The AIM market breathes a sigh of relief, while sterling and equities surge.

Chancellor Rachel Reeves delivered the first Labour Budget in almost 15 years today. Financial markets responded positively, as did many fund managers.

Rathbone UK Opportunities manager Alexandra Jackson said equity markets liked the Budget, with sterling also rallying in the immediate aftermath. The chancellor has “threaded the needle of raising the taxes she needs without spooking investors”, she concluded.

Adrian Gosden, UK equities fund manager at Jupiter Asset Management, said the Budget was “tough but fair” and declared: “The UK is open for business”.

AIM stocks get a reprieve

The AIM market rallied on news that inheritance tax (IHT) relief had not been abolished altogether, even though it was halved. Abby Glennie, manager of the abrdn UK Smaller Companies fund, said that the government “did not quite throw in the hand grenade for AIM entrepreneurs and investors that many expected”.

Even so, investing in AIM stocks is now less attractive, she said. “With tax benefits halved, investors will need to be more positive on return prospects to allocate cash to AIM and this could swing allocations towards other areas.”

Capital gains tax hikes could impact investment decisions

Richard Stone, chief executive of the Association of Investment Companies, expressed disappointment at the increase in capital gains tax (CGT), coming “from a government which has put so much emphasis on investment and growth”.

“Increased tax on profits from shares is a disincentive to invest in the stock market outside an ISA or pension,” he said.

“Bringing all AIM shares and pension funds into the scope of inheritance tax will act as a disincentive to build and retain those long-term investments for the benefit of future generations.”

As a consequence of a higher CGT, multi-asset portfolios should become more appealing, according to BNY Investments’ head of retirement Richard Parkin.

“We expect the higher CGT rates will lead to more advisers looking at multi-asset funds rather than model portfolios. While CGT is still payable on these funds, using a single fund structure makes it easier for advisers to time when gains are realised,” he said.

“These higher rates of CGT and lower thresholds make it even more important to maximise tax-advantaged investments such as ISAs and pensions and it’s good to see that the tax benefits of these vehicles have largely been maintained.”

That said, Rachael Griffin, tax and financial planning expert at Quilter, pointed out that CGT is paid by only 350,000 people per year (equating to 0.65% of the adult population).

“This will not be a change that is felt throughout the nation. But while this move is aimed at boosting revenue, is likely to have the opposite effect, as it discourages investment and leads to reduced economic activity across key sectors,” she said.

"One key problem with raising CGT is that it doesn’t necessarily guarantee more tax revenue, because it results in fewer people selling their assets to avoid triggering the tax. This has the effect of locking wealth into certain asset classes, reducing the flow of capital into the economy.”

Gilts yields fell initially then rose

Yields on 10-year gilts fell initially when the Budget was announced but then shot up during yesterday afternoon, in anticipation of increased government borrowing.

Shamil Gohil, fixed income portfolio manager at Fidelity International, said: “With £20bn more of issuance pencilled in skewed to the long end, that will lead to some curve steepening.”

Capital gains tax shoots up to 18% and 24% for the basic and higher rates, from 10% and 20% respectively.

Chancellor Rachel Reeves today delivered Labour’s first Budget in 14 years, announcing £40bn of tax rises to rebuild public services and restore the stability of public finances.

The bulk of the tax hikes will fall on the shoulders of businesses, with employer national insurance contributions rising by 1.2 percentage points to 15% by April 2025. National insurance contributions will be payable on salaries over £5,000 rather than the previous threshold of £9,100. However, the Employers Allowance for National Insurance has been increased to £10,500 a year, meaning that many small businesses will be exempt.

These measures should raise £25bn annually by the end of the forecast period, the chancellor said.

Capital gains tax hiked

Capital gains tax (CGT) will increase to 18% from 10% for basic rate taxpayers and to 24% from 20% for those on the higher rate. CGT rates on property sales will remain at 18% and 24%. The UK will still have the lowest CGT of any G7 economy, Reeves said.

CGT on business assets will rise from 10% this year to 14% in 2025-26 and then 18% in 2026-27. The lifetime limit for business asset disposal relief remains £1m.

IHT relief halved for AIM shares

Shares traded on AIM will be subject to a new 20% inheritance tax (IHT) rate.

Amisha Chohan, head of small cap strategy at Quilter Cheviot, said: “While it is disappointing that AIM shares will no longer be fully exempt from inheritance tax, we are pleased the government has seen sense to retain some sort of incentive to help drive the growth of this country’s smaller companies.

“With an effective tax rate of 20%, instead of IHT’s headline rate of 40%, AIM businesses, along with their growth potential, continue to give investors a compelling offer.”

Reeves also announced that the current IHT freeze, which was due to end in 2028, will be extended to 2030.

However, inherited pensions will become subject to inheritance tax from 2027 onwards.

Business and agricultural assets worth less than £1m will not be subject to IHT, enabling small family farms to be passed down to the next generation. Assets worth more than £1m will be granted 50% relief, leading to an effective IHT rate of 20%.

EIS and VCTs extended; ISA allowance frozen

Labour has extended the Enterprise Investment Scheme (EIS) and Venture Capital Trust Scheme to 2035, meaning that investors will continue to access tax relief, including income tax, capital gains tax and the exemption of EIS shares from inheritance tax.

There were no material changes to ISAs in this Budget although the ISA allowance has been frozen until 2030. Since the ISA allowance was last changed in 2017, it has effectively fallen by £6,000 in real terms, said Chris Rudden, head of UK investment consultants at digital wealth manager Moneyfarm.

Furthermore, Reeves has confirmed that the British ISA will not go ahead.

Good news for working people on income taxes and living wage

As part of Labour’s manifesto commitment not to increase taxes on working people, Reeves has not altered income tax, value added tax (VAT) or employees’ national insurance contributions. The current freeze on income tax and national insurance thresholds, which ends in 2028-29, will not be extended. As a result, personal tax thresholds will once be uprated in line with inflation.

The national living wage is set to rise to £12.21 an hour, an increase of roughly 6.7%. In line with this, the government will move towards the introduction of a single adult wage by raising the minimum wage for 18 to 20-year-olds by over 16% to £10 an hour.

Finally, state pensions are set to benefit from the triple lock. In line with updated figures on national wage growth, the new state and basic pensions will be uprated by 4.1%, bringing about £470 into pensioners' pockets next April.

Stability and investment rules introduced

The Budget confirmed plans to make “responsible reforms” to the government’s fiscal framework, to improve certainty, transparency and accountability, by implementing two rules.

The first is the ‘stability rule’, which aims to move the current budget into balance so day-to-day spending is met by revenues. This means the government will only borrow for investment.

Meanwhile, the ‘investment rule’ will reduce net financial debt as a proportion of GDP. This marks a technical change to the way debt is measured: it will take into account not just the debt that government owes but the financial assets that are expected to generate future returns.

The Budget said this rule “keeps debt on a sustainable path while allowing the step change needed in investment”.

Reeves said both of these rules will be met in 2027-28, two years ahead of the previous target of 2029-30.

Analysis by the Office for Budget Responsibility (OBR) predicts that the current deficit will fall from £55.5bn (or 2% of GDP) this year to a surplus of £10.9bn (0.3% of GDP) by 2027-28. It will then narrow to a slightly smaller surplus of £9.9bn in 2029-30.

In her speech, Reeves also listed the latest GDP forecasts from the OBR, which said real GDP growth will be 1.1% in 2024, 2.0% in 2025, 1.8% in 2026, 1.5% in 2027, 1.5% in 2028 and 1.6% in 2029.

The body also expects consumer prices inflation to average 2.5% in 2024 and 2.6% in the following year, then 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2% in 2029.

Monetary easing is likely to boost emerging market local currency bond prices, but active investors should find plenty of idiosyncratic opportunities since easing cycles will not be synchronized.

Emerging market local bonds returned a stellar 12.7% in 2023 in US dollar terms but lost 3.7% in the first half of 2024 amid a strong dollar, concerns about fiscal discipline in Brazil and the prospect of post-election institutional deterioration in Mexico.

The asset class recovered strongly between July and September, delivering a 9% return in a single quarter despite market turbulence and the unwinding of yen-funded carry trades. While Brazil and Mexico’s issues persist, investors are shifting their focus to US events that are moving the dollar and potentially boosting local assets in emerging markets.

The US presidential race appears very tight. Kamala Harris is slightly ahead in the national polls but Donald Trump could still win, given that the results for many swing states will be a toss up, according to opinion polls.

The dollar would likely strengthen under a Trump victory and weaken otherwise due to two economic reasons: taxes and tariffs. Trump has promised to extend the corporate tax cuts he introduced during his first presidency, which increased competitiveness and attracted capital flows from corporations and resulted in a stronger dollar. Harris, on the other hand, has promised that the wealthiest Americans and largest corporations will pay their fair share.

If elected again, Trump would impose more tariffs on China and potentially on the rest of the world. A country facing higher tariffs will see its currency weakened by market forces to compensate for lower competitiveness. This was evident in the Chinese yuan during the 2018 trade wars.

We expect the US-China rivalry to continue regardless of the outcome of the election, though it is likely to be less disruptive under Harris.

Taxes and tariffs point towards a stronger dollar if Trump wins. If Harris wins, the sentiment towards emerging markets should improve amid prospects of a weaker dollar.

Can we stay in the middle of the so-called US ‘dollar smile’? Currencies strengthen when their economies are doing well and vice versa, but the US dollar also strengthens in times of crisis on safe haven flows due to its reserve currency status.

The dollar remained strong after the Covid pandemic on the back of strong US growth. A hard landing would imply dollar strength on safe haven flows.

But in our soft-landing baseline, we could move towards the middle of the smile: weaker US growth and a weaker dollar. Should this occur, it would be a game changer for sentiment towards emerging market local currency debt and we would expect double-digit returns to ensue.

Real rates remain high in emerging markets amid orderly disinflation; many major emerging market central banks hiked rates faster and more aggressively than their developed market counterparts in 2021 and 2022 after the pandemic and cut rates earlier starting in 2023. These rate cuts contributed towards the double-digit returns achieved in 2023. Many emerging market central banks paused through 2024, while others continued to cut but more cautiously, waiting for the US Federal Reserve.

Local currency bonds are also set to benefit from the easing monetary cycles overseen by most developed market central banks, which includes the Fed after September’s 50-basis points cut. The effect of these cycles is indirect, but still powerful.

Emerging market central banks have already been cutting rates since last year but some of them have paused or taken a more cautious approach in 2024. Now that the Fed has started cutting rates, several of them have resumed and may accelerate their own rate cutting cycle.

Indonesia’s central bank cut rates on the same day as the Fed, while South Africa, China, Hungary, Czechia, Mexico, Costa Rica, Dominican Republic among others followed suit soon after. Only Brazil bucked the trend with a 25bps hike.

This global easing cycle is likely to boost emerging market local currency bond prices and lower domestic borrowing costs for sovereigns and corporates.

Active investors are likely to find plenty of idiosyncratic opportunities since cycles will be much less synchronized, as not all countries have been equally successful in their fight against inflation.

Carlos de Sousa is an emerging market strategist at Vontobel. The views expressed above should not be taken as investment advice.

The self-styled ‘king of debt’ would increase the US’s already exponential deficit and his policies would be inflationary, causing bond yields to soar, fund managers said.

If Donald Trump wins the US election next week, inflation would rise, the budget deficit would increase and the Federal Reserve would probably cut rates at a slower pace than currently expected, fund managers predict.

Nicolas Trindade, who manages the AXA Global Short Duration Bond fund, said a Republican victory would be “very disruptive” for bond markets and would drive treasury yields higher, causing a rapid steeping of the yield curve that “could potentially be really painful for a lot of fixed-income investors”.

Both presidential candidates have made spending pledges that would increase the US government’s deficit, although Trump – who once called himself the ‘king of debt’ – is expected to ramp up borrowing more than Kamala Harris.

FE fundinfo Alpha Manager Trindade believes Trump would extend a series of tax cuts that are due to expire, creating a tailwind for growth but adding inflationary pressure. Tariffs on imports from China, Europe and elsewhere, as well as a clamp down on immigration, would also cause prices to rise in the US.

The scale of Trump’s potential victory would be a critical factor, according to Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable Asset Management. “A Republican sweep is the worst outcome for bonds,” he said.

“President Trump’s policies with lower taxes, more deregulation, tighter immigration policies and the likely implementation of broad-based tariffs will lead to higher inflation expectations, a significant increase in budget deficits, but also increased policy uncertainty. Markets would likely price a shallower Fed rate cut cycle and a higher term premium to account for the additional uncertainty.”

If Congress is divided, however, Trump would have less leeway to implement his policies and the market reaction would be more muted, Olszyna-Marzys explained.

Global government bonds have been selling off rapidly during the past six weeks – not just in anticipation of a Trump presidency but also in reaction to strong US economic data, said Ashok Bhatia, co-chief investment officer for fixed income at Neuberger Berman.

“Bond yields have surged because, after a weak August, September saw a string of US releases deliver upside surprises, including a blockbuster payrolls report and warmer-than-expected retail sales and inflation,” he explained.

Bhatia thinks “this could be just the beginning of a surprisingly sustained move higher in yields”.

He expects the Fed to cut rates by 0.25% next week and in December, but it could then potentially take a pause during the first quarter of next year. “It is hard to imagine the Fed next year mechanically delivering rate cut after rate cut in the face of 2.5% GDP growth and increasingly stubborn inflation.”

A Fed pause could spark fears of a return to rate hikes and have an outsized impact on the yield curve, the co-CIO said.

“The recent sell-off has taken yields back only to the levels of late July, just before a very weak US payrolls report and the unwind of the yen carry trade created a big bid for bonds. It would not be surprising to see the US five-year yield add another 50 basis points from here, taking us back to the mid-2024 highs.”

Arif Husain, head of fixed income at T. Rowe Price, also expects yields to continue rising. “The 10-year treasury yield will test the 5% threshold in the next six months”, he predicted, up from 4.3% on 29 October.

“Ongoing issuance by the US Treasury to fund the government’s deficit spending is flooding the market with new supply,” Husain explained. “The Federal Reserve’s quantitative tightening has taken a large, reliable buyer of treasuries out of the market, further skewing the balance of supply and demand in favour of higher yields.”

Managers are preparing for this eventuality by shortening duration. David Roberts, co- manager of the Nedgroup Investments Global Strategic Bond fund, has started selling down the US, shortening interest rate exposure. The fund is underweight US bonds and “closer to the election, I may go further – possibly to zero or, whisper it… short”.

In client portfolios where Neuberger Berman has the most freedom, Bhatia and his colleagues have reduced duration to around 3.5 years; just over half the duration of the major investment grade benchmarks.

“Moreover, with US investment grade corporate bond spreads as tight as they have been for almost 20 years, we are also cautious on corporate credit, where a move back to 4.5% in the five-year yield could cause a disorderly exit,” he said.

“Investors who need exposure would be better off looking at structured products such as investment grade collateralised debt obligations or mortgage-backed securities, where spreads still offer a thicker cushion.”

Trindade also expects short-dated bonds to weather the oncoming storm better. He is keeping duration at two years in his AXA Global Short Duration Bond fund, which has a 5% yield, meaning that it could withstand a rise in yields of 250 basis points before posting a negative total return.

“If we see treasury yields rising further, then we'll have plenty of space in the strategy to add duration at better levels,” he continued. About 20% of the portfolio matures each year and in a rising rate environment, the proceeds can be reinvested into bonds with higher yields.

With emerging markets strengthening, Trustnet asks the experts for their favourite funds for this asset class.

Funds managed by Artemis, Lazard and GQG Partners are among those that investors could look to if they think emerging markets are poised for a rebound, fund pickers have said.

As Trustnet examined yesterday, a strong economic backdrop, stimulus in China, attractive valuations and a weaker dollar are some of the reasons why investors are starting to feel more confident in their outlook for emerging markets.

Below, we look at five funds the experts are tipping for investors looking to buy into emerging markets.

Artemis SmartGARP Global Emerging Markets Equity

We start with FE Investments, where emerging markets fund analyst Tahia Tahmin picked out Raheel Altaf’s £1bn Artemis SmartGARP Global Emerging Markets Equity fund.

She said the approach taken by the £1bn fund is not a conventional one but has proven to be successful with the fund outperforming over one, three and five years, as well as since its launch in 2015.

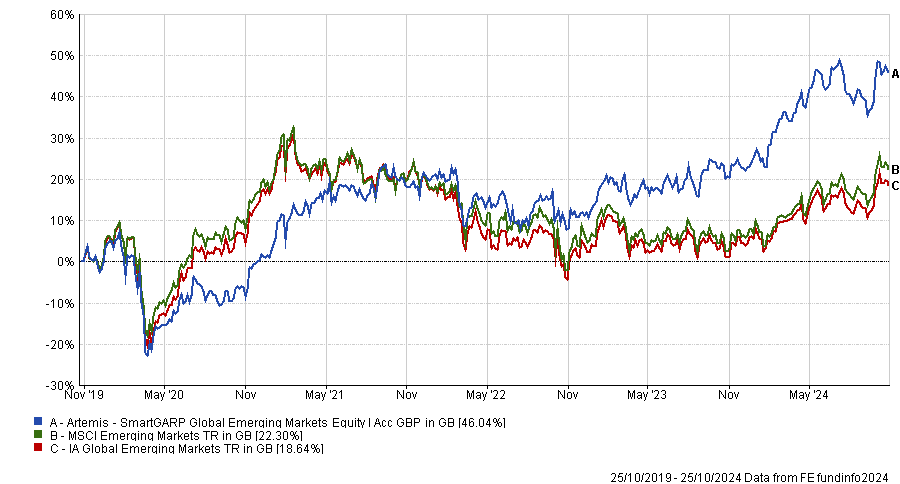

Performance of Artemis SmartGARP Global Emerging Markets Equity vs sector and index over 5yrs

Source: FE Analytics

“The manager incorporates both a systematic process from his quantitative tool SmartGARP to screen for stocks and eliminate the potential for any behavioural biases, as well as applying a qualitative layer to the process, which allows the manager to factor in top-down risks and carry out sanity-checks on all investment decisions,” Tahmin explained.

In looking for stocks that are growing faster than the market but trading on lower valuations, the fund ends up with a value tilt. Top holdings at present include Taiwan Semiconductor Manufacturing Company (TSMC), Tencent Holdings, Kia Motors and Petróleo Brasileiro.

GQG Partners Emerging Markets Equity

Darius McDermott, managing director at FundCalibre, thinks investors need to watch the strength of the US dollar and the impact of China’s stimulus package as both factors will influence the performance of emerging market equities from here.

To cope with this uncertain environment, McDermott highlighted the $3bn GQG Partners Emerging Markets Equity fund. It is run by Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, all of whom hold FE fundinfo Alpha Manager status.

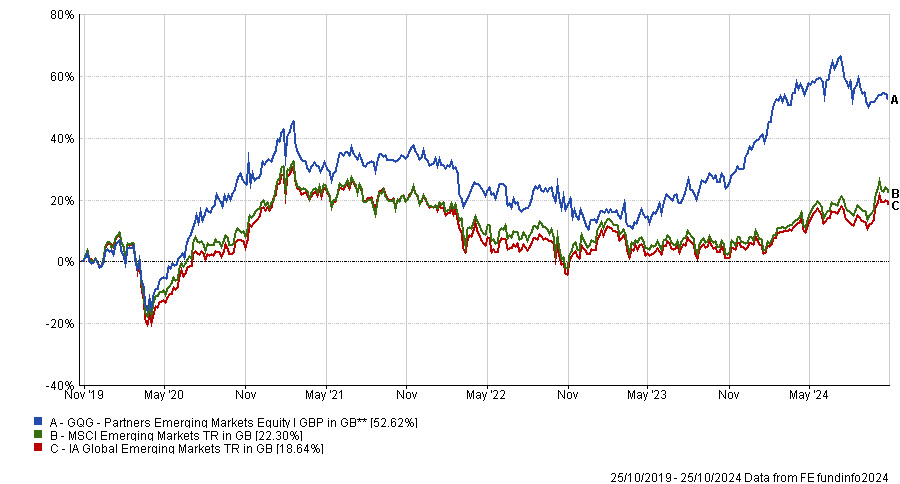

Performance of GQG Partners Emerging Markets Equity vs sector and index over 5yrs

Source: FE Analytics

“This fund benefits from inherent flexibility, allowing it to quickly adapt to market opportunities,” he explained. “Moreover, it is managed by a highly experienced team that has delivered stellar returns for investors since its launch.”

GQG Partners Emerging Markets Equity’s process seeks out companies with attributes such as stable financial and solid balance sheets, profitability, efficiency, sustainable businesses and liquidity, giving it a quality-growth bias. Top holdings include TSMC, Petróleo Brasileiro, TotalEnergies and Adani Enterprises.

Invesco Emerging Markets ex China

McDermott also suggested the Invesco Emerging Markets ex China fund for investors who want an emerging markets fund without exposure to China. This could be for several reasons, including scepticism about the outlook for China or because they already own a dedicated Chinese equity strategy.

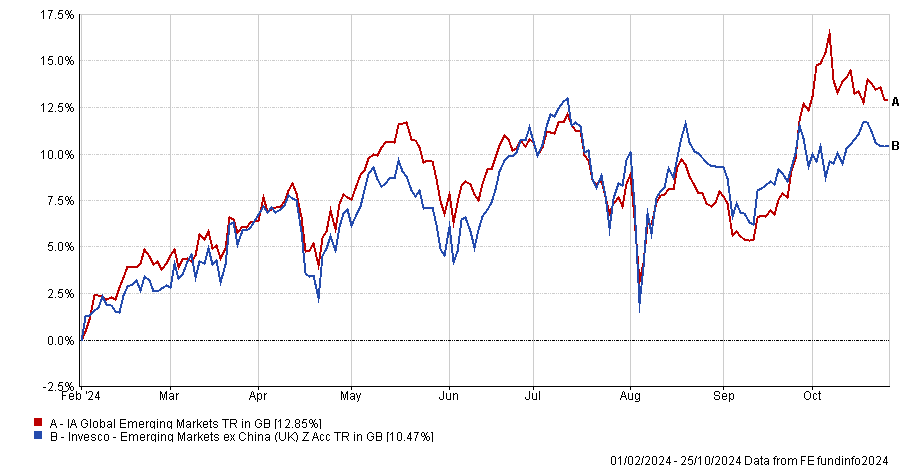

Performance of Invesco Emerging Markets ex China vs sector since launch

Source: FE Analytics

Managed by James McDermottroe and FE Alpha Manager Charles Bond, the £240m fund has a contrarian approach that looks for companies in unloved parts of the market. It’s another fund with TSMC in its top 10, which sits alongside the likes of Samsung, HDFC Bank and Naspers.

“The process adopts a value focus, with returns largely driven from stock selection. It is still relatively early days, but performance since launch has been very promising,” McDermott said.

Lazard Emerging Markets

Rob Morgan, chief analyst at Charles Stanley Direct, pointed out that the long-term opportunities of emerging markets are currently offset by high valuations in the Indian market and political and economic uncertainties in China.

“To balance the opportunities and the risks we favour an active approach that combines elements of quality and value to navigate this disparate sector. As such Lazard Emerging Markets is a good fit,” he said.

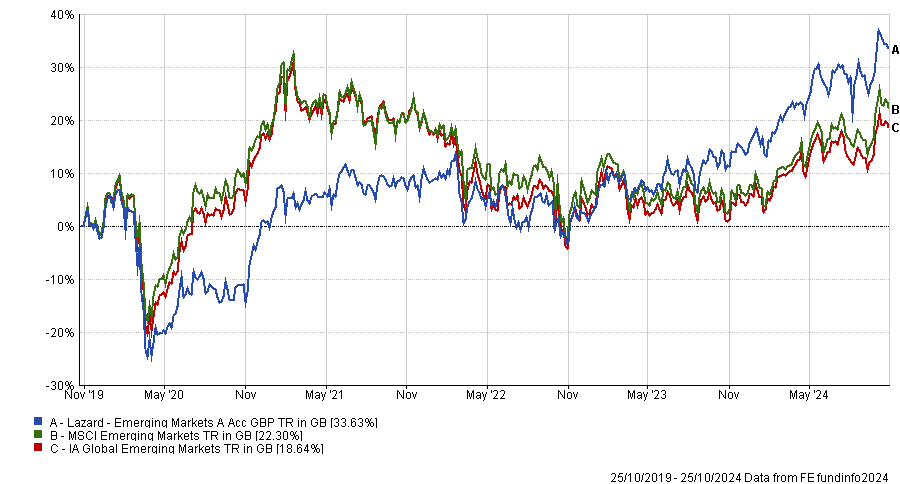

Performance of Lazard Emerging Markets vs sector and index over 5yrs

Source: FE Analytics

“The fund adopts a patient and strict ‘value’ approach, buying into shares in unloved companies at a significant discount to their true worth. However, James Donald’s philosophy could be better summed up as ‘quality at a discount’.

Morgan said the fund should appeal to those who believe an active manager can add value by prioritising quality and avoiding problem companies or those most adversely impacted by the political or regulatory landscape.

Lazard Emerging Markets’ largest holdings include TSMC, China Construction Bank, Alibaba and Indus Towers.

HC Sephira GEM Long-Only

Simon Evan‑Cook, manager of Downing Fox multi-asset funds, told Trustnet yesterday that active managers he invests with are optimistic about benign economic conditions, good companies and cheap valuations in emerging markets.

One lesser-known fund that Evan-Cook uses to play this space is HC Sephira GEM Long-Only fund, which is managed by Jason Mitra, the founder and chief investment officer of Sephira Investment Advisors.

“He runs a highly active strategy investing in high-quality businesses. He also focuses heavily on risk management of the portfolio, as he is aware that even the highest quality companies in emerging markets can face risks above and beyond those of more established markets,” he added.

“This can result in higher turnover, but we believe this is no bad thing if the manager can demonstrate that trading is adding value above its costs.”

HC Sephira GEM Long-Only uses a bottom-up approach that looks for high-quality, undervalued companies in the overlooked areas of emerging markets. Top holdings include DiDi Global, TSMC, Star Health and Allied Insurance.

Experts discuss if investors have become too short-termist with their investments.

Markets have always moved rather quickly, but for some experts, the biggest challenge facing the market is investors' obsession with short-term results.

Certainly, no stock can rise forever and for investors hoping to make the most of their money, it is crucial to know when to get out to avoid a potential downturn in performance. However, for many experts, making investment decisions on the back of short-term price movements is a dangerous game and is one too many investors have begun to play.

Louise Kernohan, co-manager of the £1.4bn BNY Mellon Global Equity fund, said: “I think often stocks are moving away from fundamentals and valuations and being carried by momentum. I think it is the case that markets have become too fixated on the short term.”

As a result, investors have begun to lose sight of the long-term potential of companies and have let short-term performance dictate their evaluation of strong businesses with significant growth potential.

In such a market, there are a range of opportunities for the more adventurous investors who are willing to maintain faith in even the most ‘out of favour’ stocks.

Ben Needham, co-manager of the Ninety One UK Equity range, said: “Rome wasn't built in a day, a better tomorrow will not come without pain for today, and that’s for companies, that’s for society, that’s for everything.”

He admitted that investing in out-of-favour stocks can be like waiting for a bus, “you wait 10 minutes, you wait another 20 minutes, and you just walk off because you get bored, and then the bus comes, and you wish you had waited that extra five minutes”, meaning investors must have patience.

CMC Markets

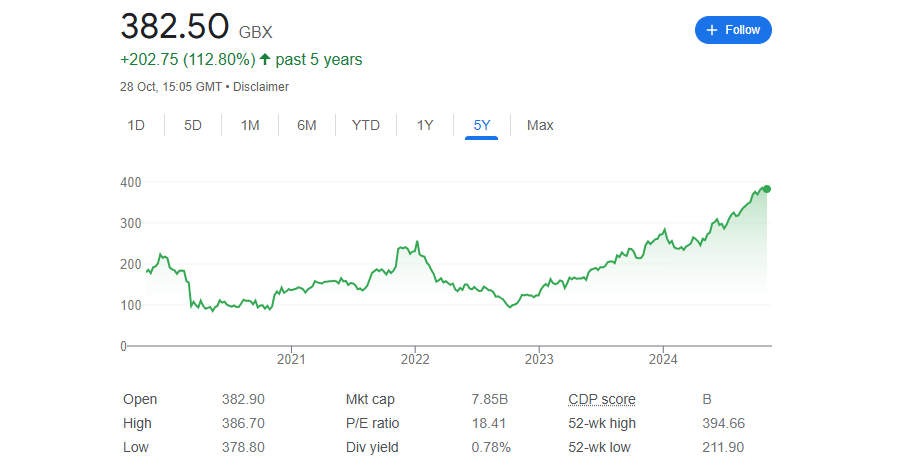

Thomas Moore, manager of the £156.7m abrdn Equity Income Trust, agreed with this long-term approach and highlighted the online trading platform CMC markets as a great example of a stock that rewarded long-term investors who maintained faith.

The firm has struggled in recent years, with shares declining from £5.36 in April 2021 to a low of just 99p in December 2023. This coincided with a poor year for the firm when it reported net operating income had declined by £2m.

Share price of CMC Markets over 5yrs

Source: Google Finance

Despite this, Moore remains convinced of the stock's value and potential for a long-term resurgence and currently holds the share as the eighth largest position in the portfolio.

Indeed, the stock has enjoyed a resurgence this year, with the share price rising to £3.25. Moore attributed this turnaround to the long-term investment approach of chief executive officer Peter Cruddas.

“Yes, there have been wobbles and profit warnings that have tested investors' patience but the fact that he then goes on to deliver what he said he was going to, got people quite excited."

Marks and Spencer

Similarly, Ian Lance, co-manager of the £798m Temple Bar Investment Trust, advocated for a long-term approach. Too many investors decide to remove companies from their portfolios due to short-term trends, regardless of how cheap the valuations are, he said.

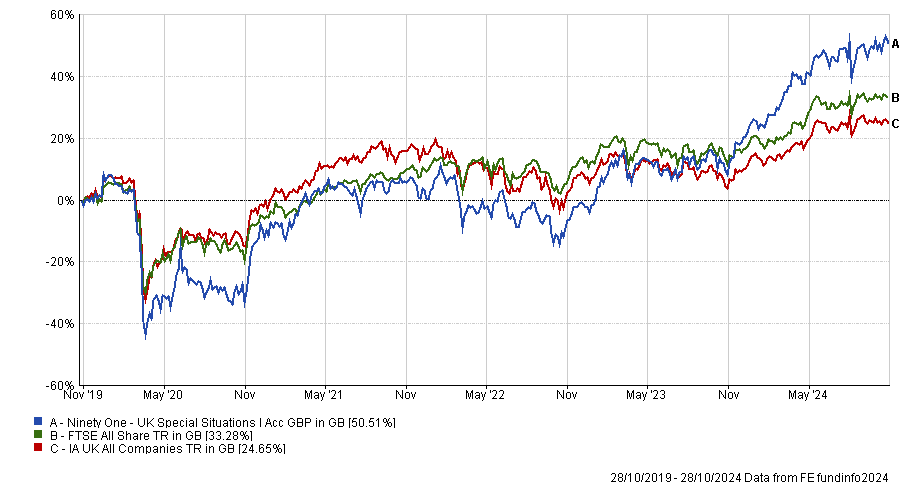

This offers opportunities for investors with a more long-term approach to thrive. As an example, he drew attention to Marks & Spencer(M&S).

When the trust initially brought M&S, Lance said the firm paid no dividends making it particularly unpopular for many income investors. Moreover, the stock has had a turbulent five years, with the share price falling below a pound in 2020 and 2022, coinciding with the pandemic and the Liz Truss’ mini-Budget.

Share price of Marks & Spencer over 5yrs

Source: Google Finance

Despite this, Lance maintained faith in the stock, which is currently the 10th largest position in the portfolio, which has paid off this year, with shares up to £3.83, surpassing its former five-year peak of £2.56.

Lance attributed this turnaround to a change in leadership, which identified the problems with the company and started fixing them. As a result, the outlook was now much brighter, rewarding investors who had stuck with M&S when it was unpopular.

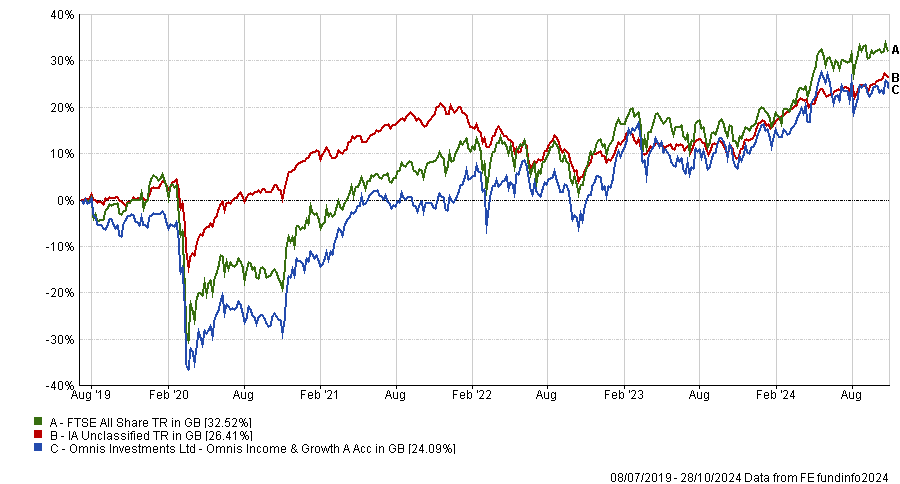

Omnis awards £573m mandate to Ninety One following Whitmore’s departure from Jupiter.

Omnis Investments has chosen Alessandro Dicorrado, head of value at Ninety One, to replace veteran stock picker Ben Whitmore at the head of the £573m Omnis Income and Growth fund, effective from December 2024.

The decision follows Whitmore’s departure from Jupiter Asset Management, which previously held the Omnis mandate.

Over Whitmore’s tenure, which began in July 2019, the fund returned 24%, underperforming the FTSE All Share, as the chart below shows.

Performance of fund vs sector and index since July 2019

Source: FE Analytics

Dicorrado and seven of his colleagues will deploy the same investment approach as the Ninety One UK Special Situations fund, with some adjustments specified by Omnis, which has specific volatility and tracking error parameters designed to better cater for their clients.

The managing team will focus on mispriced UK companies that demonstrate sustainable earnings recovery, growth or cash return potential.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

The Omnis fund’s objective remains unchanged – to achieve a return consisting of both income and capital growth exceeding that of the FTSE All Share Total Return index, after fees and expenses, over a five-year rolling period.

Omnis’ chief investment officer Andrew Summers said he was “impressed” by the “clarity and rigour” of Dicorrado’s investment approach, which has enabled the team to “consistently identify compelling investment opportunities”.

Ninety One managing director Tom Peberdy added: “By seeking to understand why conventional wisdom is wrong through fundamental research, the team is able to deliver a differentiated, concentrated, high-conviction portfolio.”

The presidential election is reshaping the role of US treasuries.

The US presidential election has so far only promised economic uncertainty, giving international bond investors little comfort for the long-term outlook.

This begs the question of whether US treasuries are in danger of becoming uninvestable.

One thing is for certain: US treasuries have a risk premium attached. The US is the highest yielding G7 government bond market after the UK, with 1% extra yield than Canada. That’s what happens when you have a debt-to-GDP ratio that makes the Italians look fiscally conservative.

But with little policy certainty and at least one presidential candidate who has threatened to upend established fiscal institutions, there an argument brewing that investors should avoid US treasuries.

Politicians and strategists alike will tell you how important Uncle Sam is to the global economy, given the dollar remains the world’s reserve currency. Protectionist, inflationary policies are a good way to threaten that position, not least when elected representatives espouse Bitcoin investment as the best hope for deficit reduction.

American politicians and American voters need to tread carefully – there are increasing alternatives for global investors.

US treasuries may have been the cornerstone in global bond portfolios for decades, however if their risk/reward profile diminishes, investors no longer need to own any US assets.

Longer term, I believe in the power of fiscal and monetary policy working in tandem to deliver growth. Shorter term, politics can spook markets, as evidenced by Liz Truss’ unfunded budget in the UK. More recently in France, rising debt and decade-high borrowing costs led to political volatility.

The same thing is happening on the other side of the Atlantic. Since Joe Biden’s poor performance in his debate against Donald Trump in June, long-dated bonds have plunged in value relative to short-dated ones. Few investors want to risk lending long to the US. Understandably so.

Shorter-dated bonds seem okay for now, with the Federal Reserve set to continue cutting rates. I currently own no US dollar bonds with maturities longer than seven years.

And it’s not just pure economics that worries investors. At least one leading candidate seems seriously to be considering removing the independence of the central bank, sacking the head of the financial regulator, introducing restrictive trade practices and maintaining a debt-to-GDP ratio above 125%

The Nedgroup Investments Global Strategic Bond fund is underweight the US bond market and closer to the election, I may go further – possibly to zero or, whisper it… short!

I’ve started selling down the US, shortening interest rate exposure. Canada may be too expensive, but from Germany to Australia there are value-driven reasons to diversify away from the US market, quite apart from the political rationale.

A few years ago, Chinese sovereign debt was included in global bond indices for the first time. Today, China’s bonds represent a high-single-digits portion of the global market. At the moment, it’s a step too far for many global bond managers, me included.

Some investors already do buy China of course. The US needs to be careful. International capital is finite. The more reasons investors are given to look elsewhere, the less money flows to Washington.

Otherwise, the US government’s borrowing costs will rise further and with a $2trn and rising deficit, higher interest costs are not what the American public needs to see.

David Roberts is co-portfolio manager of the Nedgroup Investments Global Strategic Bond fund. The views expressed above should not be taken as investment advice.

Is it time for politicians to leave their egos at the door, and accept that the market will move without them?

The outcome of the US election is the source of much speculation among market commentators, but the results are less important than investors may think, according to experts.

There are just three weeks to go until the US picks its next president, with either Democrat Kamala Harris or Republican Donald Trump bidding win both the Senate and the House of Representatives.

But Mark Sherlock, manager of the $1.2bn Federated Hermes US SMID Cap fund, and Kirsty Gibson, manager of the £689m Baillie Gifford US Growth Trust, said it is irrelevant.

Sherlock said: “There is a lot of chat in the news, understandably so, about who might win. My observation would be that typically, there’s not much that stops the North American capitalist juggernaut either way”.

Below Trustnet breaks down how markets are likely to react to either Harris or Trump taking over the Oval Office.

The US economy under Democrats and Republicans

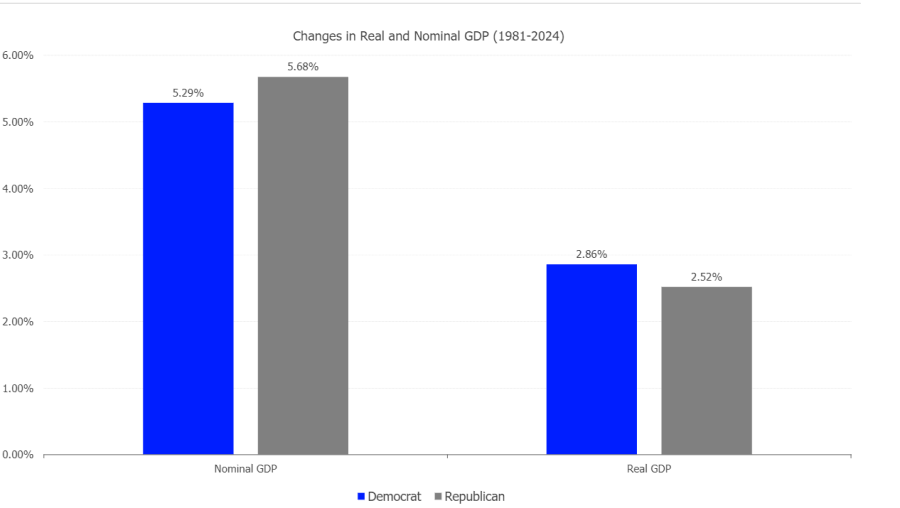

Indeed, the US economy has enjoyed remarkable resilience regardless of which party has come into power, despite their often very differing fiscal policies.

According to research conducted by the London Stock Exchange earlier this year, historical GDP growth has been broadly similar regardless of which party has been in power. Under a Democratic president, real GDP has risen by 2.9% since 1984. In the same period, GDP climbed by an average of 2.5% under Republican presidents.

Average changes in real and nominal GDP, 1981-2024

Source: London Stock Exchange. FTSE Russell/LSEG. Data as of 31st of August 2024.

In an election year candidates will usually campaign on the platform of a strong economy because that is the pledge that wins votes, said Sherlock. This time around, both candidates seem to lack a clear economy policy making it a comparatively “issueless” election .

He added: “Really, when you boil it all down, everyone wants a strong domestic economy, and both candidates will be supportive of that”.

Markets and presidencies

Of course, it is worth remembering that the economy and the market are not the same thing. Gibson said: “Even if we assume the president influences the economy completely, which is debatable in itself, it is not the singular factor driving the market forward.”

Indeed, market developments and mega trends have often had a more notable impact on the performance of the US market than which side of the political spectrum comes to power.

For example, while Gibson noted that the average return for the S&P 500 under Republican presidents was 5% per year, compared to 11% per year under Democratic candidates, these numbers are distorted.

This discrepancy is largely the result of wider market circumstances rather than the political or fiscal leanings of any one candidate.

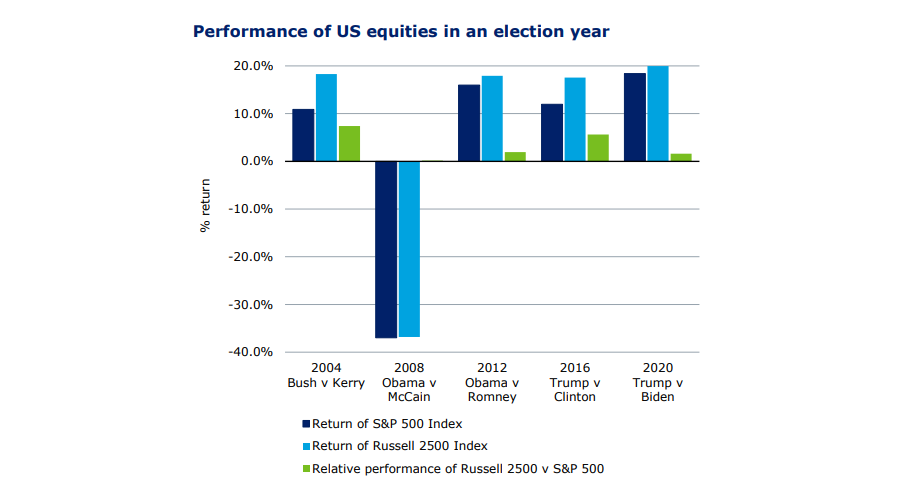

Performance of US Equities in an election year

Source: Federated Hermes. Bloomberg as of 31 August 2024. Returns in USD

For example, in four out of five elections since 2004, the US indices enjoyed broadly similar rises in value during election years. The only exception to this was 2008 when US equities fell by more than 30% because of the global financial crisis.

Similarly, Republican George W. Bush’s numbers looked far worse because the dot-com bubble burst almost immediately after his election. By contrast, Democrat Joe Biden enjoyed much better numbers as he was able to enjoy the massive recovery in US equities following the pandemic period.

Furthermore, even a division between Congress and the presidency is not proven to affect the future of the US economy.

For example, in 2014, during Barack Obama’s second term, despite Congress being controlled by Republicans, the S&P 500 rose by 20% in sterling terms that year. By contrast, during Bush’s second term when Congress was controlled by Democrats, the S&P 500 was up 16.7%.

“When we look back in 20 years, I don’t think the discussion will be about whether Harris or Trump won the election. It is going to be more to do with who put in place the infrastructure necessary to take on board trends such as the AI [artificial intelligence] paradigm shift.” Gibson concluded.

Sherlock added: “While there may be a move to the left or a move to the right on particular policies with a short-term effect, really the capitalist juggernaut will keep on trucking.”

Experts share their views among a flurry of launches of equally-weighted strategies.

Investors who have become wary of their traditional (market-cap weighted) S&P 500 exposure could rejoice this October at the abundance of launches of S&P 500 equally-weighted index funds.

In the past month only, Trustnet reported of two new strategies that have come to market, the Legal & General S&P 500 US Equal Weight and the HSBC S&P 500 Equal Weight Equity index fund. On top of that, the Invesco MSCI World Equal Weight UCITS exchange-traded fund (ETF) was launched in Europe at the start of September.

These strategies work differently compared to a more common market-cap weighted index tracker. While the latter attributes larger index positions to larger companies, equal-weighted S&P 500 trackers have a neutral weighting of 0.2% in each of the stocks in the S&P 500.

Because the index is typically rebalanced every quarter, no single company will make a meaningful contribution to returns, but investors are still getting directional exposure to the broad US market.

The aim is clear – to offer an investment vehicle for cheap and broad US exposure while avoiding the concentration risk in the top seven companies that make up one third of the whole 500-strong index, commonly referred to as the Magnificent Seven – Nvidia, Apple, Microsoft, Alphabet (Google), Amazon, Meta Platforms (Facebook) and Tesla.

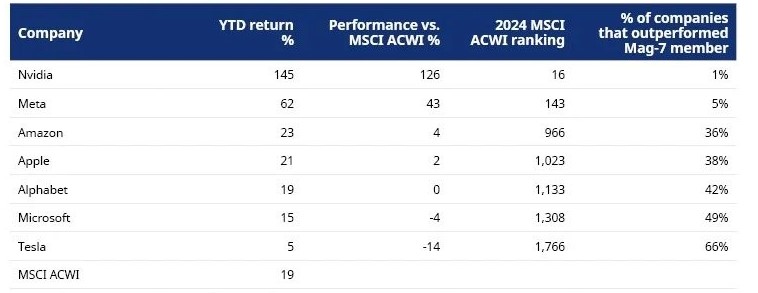

Their dominance might just be starting to wane, and investors would be right to look elsewhere, according to Duncan Lamont, head of strategic research at Schroders.

This year “a significant proportion” of global companies have outperformed most of the Magnificent Seven, as is shown in the chart below.

Magnificent Seven performance against MSCI ACWI companies

Source: LSEG Datastream, MSCI, Schroders. Data to 30 September 2024, in US dollars.

“Don’t get me wrong, many of the Magnificent Seven are fantastic companies,” he said. “The theme here is one of broadening out. Whereas last year, returns outside of the Magnificent Seven were mediocre in comparison, this year there has been a wealth of often overlooked opportunities,” he said.

“There are opportunities away from the mega-caps, but portfolios have a shrinking allocation to them. Historically, periods of high index concentration have foreshadowed periods when the bigger companies went on to underperform the average company.”

Greg Hirt, global multi asset chief investment officer at Allianz Global investors, agreed with Lamont that the earnings growth gap between the Magnificent Seven and the remaining 493 companies “is expected to narrow”.

Concerns over their “outsized” influence make the equal-weighted approach in the US stock market “compelling, offering diversification that reduces single-stock risks”.

“It is true that US equities, mainly driven by growth stocks, appear quite richly valued. But given that we prefer value compared to growth and equal-weighted versus market-capitalisation weighted, broad equities in general do not appear overly rich,” he said.

“In the US, we have seen that high valuations can last longer than anticipated. We think technical conditions are still supportive of equity markets and we see potential for further gains.”

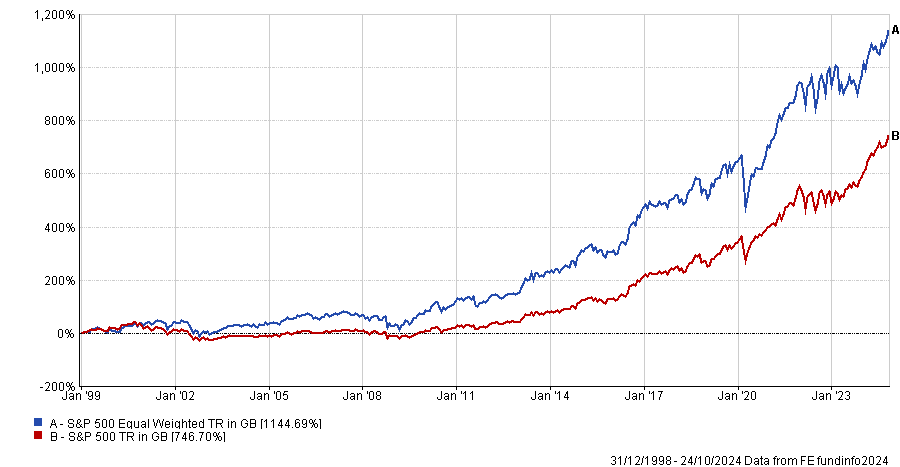

In addition to the short-term reasons for backing an equally weighted tracker, there are long-term ones too. The equal-weighted version of the S&P 500 has outperformed the typical market-cap weighted version historically.

This is highlighted by the charts below, showing the returns of the two types of indices over the past five years (positive means equal-weighted outperforming) and 20 years (the S&P 500 Equal Weighted index was launched in 1999), respectively.

Five-year outperformance of equal-weighted S&P 500 versus market-cap weighted

Source: LSEG Datastream, S&P, Schroders. Data as 31 December 1989 to 31 October 2023.

Performance of indices over 20yrs

Source: FE Analytics

So what are the options for investors who are growing increasingly uncomfortable with their exposure to US mega caps?

Jason Hollands, managing director of Bestinvest, said the Xtrackers S&P 500 Equal Weight UCITS ETF is worth considering – especially for its ongoing charges figure (OCF) of only 0.20%.

However, an alternative option to an equal-weighted tracker for those worried about overvaluation in parts of the US market and seeking exposure to a broad basket of US equities, would be the Invesco FTSE RAFI US 1000 ETF.

This ETF has outperformed the equally-weighted S&P 500 over one, three, five and 10 years and it provides “wider exposure to include mid-cap names”.

It is a factor fund that owns the 1,000 largest US companies – double the number of the S&P 500 – whose position size is determined by four fundamental factors: sales and cash flow (both averaged over the prior five years), book value at the review date and total dividend distributions averaged over the past five years, Hollands explained.

“These factors give a slight value tilt that favours more defensive companies. Unlike an equally weighted index fund, where position sizes are tiny, the largest holding in this ETF [currently Apple is 2.4% of the portfolio] can make a more meaningful contribution,” he said.

The ongoing costs are at 0.39%, however, “much higher” than the 0.20% which is typical for the S&P 500 equally weighted ETFs.

An alternative is to eschew passive funds altogether and pick active managers who do not have overweight positions to the Magnificent Seven.

Lamont said: “The proportion of assets managed passively around the world has never been higher. The reasons for this are well known and understandable. But it is worth investors at least pausing to reflect on what that really means in today’s market.

“There are tremendous opportunities across global stock markets today but passive portfolios have rarely had so little exposure to them. Individual decisions may be understandable but I do worry that the precise timing of the influx may be inopportune.”

With some decent returns in 2024, experts ask whether it’s time to return to emerging market equities.

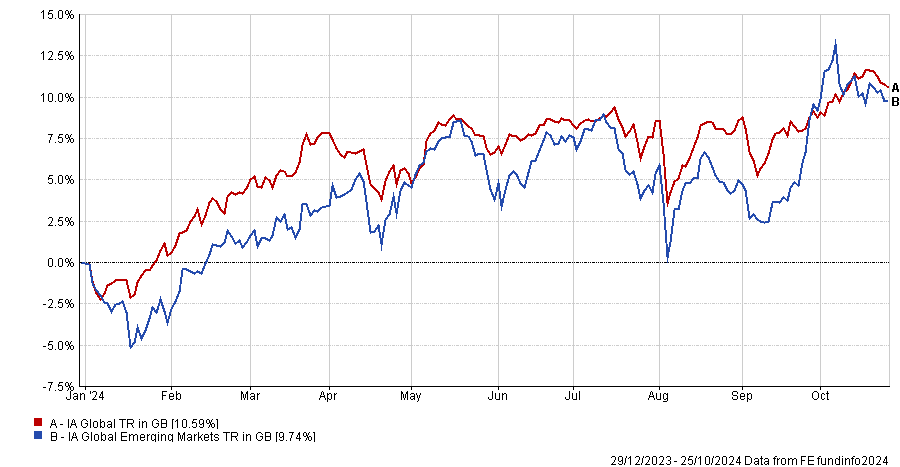

Emerging market funds are catching up with their developed market rivals over 2024 so far, leading to renewed confidence that the asset class could be on the brink of ending a long spell of underperformance.

The average fund in the IA Global Emerging Markets sector has made a 9.7% total return since the start of the year, putting it within spitting distance of the IA Global peer group’s 10.6% average returns.

This is in contrast to 2023, when the average global emerging markets fund made 4.3% and was more than 8 percentage points behind the IA Global sector, which was buoyed by the strong gains made by US-listed artificial intelligence stocks.

Performance of sectors over 2024 to date

Source: FE Analytics

Simon Evan‑Cook, manager of Downing Fox multi-asset funds, said: “We don’t do top-down allocation at Downing Fox, but if we did we’d probably have a larger allocation to emerging markets currently. A lot of that has to do with the positive views coming from the active managers we use: they’re seeing benign economic conditions paired with good companies available at cheap valuations.

“But I also have a soft spot for previously loved asset classes that have been out of favour for a decade and emerging market equities certainly fit that bill.”

Indeed, FE Analytics shows the MSCI Emerging Markets index has made an 81.8% total return over the past 10 years – putting it significantly behind the 227.6% return from the developed markets-focused MSCI World. What’s more, the MSCI Emerging Markets index has underperformed the MSCI World in eight of the past 10 calendar years (the exceptions being 2016 and 2017).

As Evan‑Cook noted, these have left them at more attractive valuations than the developed world, especially the US where a decade of outperformance from tech stocks has left some of the growthier parts of the market looking stretched.

He also gave “benign” economic growth as a reason for renewed optimism on emerging markets. China recently cheered investors with promises of fiscal and monetary stimulus to boost the world’s second-largest economy.

In its latest World Economic Outlook last week, the International Monetary Fund said it forecasts emerging market GDP to grow by 4.2% in both 2024 and 2025, with the fastest expansion expected from India (growing 7% then 6.5%) and China (4.8% then 4.5%).

The developed world, on the other hand, is tipped for GDP growth of just 1.8% in each of 2024 and 2025. The US economy is forecast to grow 2.8% this year and 2.2% next year; the UK just 1.1% and 1.5% in the two years (but still outpacing the likes of Germany, France, Italy and Japan).

Guido Giammattei, emerging markets equity manager at RBC Global Asset Management, said: “Returns in emerging market equities have tended over the past 35 years to excel in relative terms when earnings and GDP in emerging markets increase faster than in developed markets, and vice versa.

“This relationship broke down in 2023, as relatively fast emerging-market growth did not lead to equity-market outperformance. One reason for this breakdown was likely that the influence of AI-related stocks in developed markets, particularly the US, had an outsized impact on index returns. We would expect the relationship between emerging market and developed market equities to re-establish itself in the coming years as market compositions return to a more ‘normal’ state.”

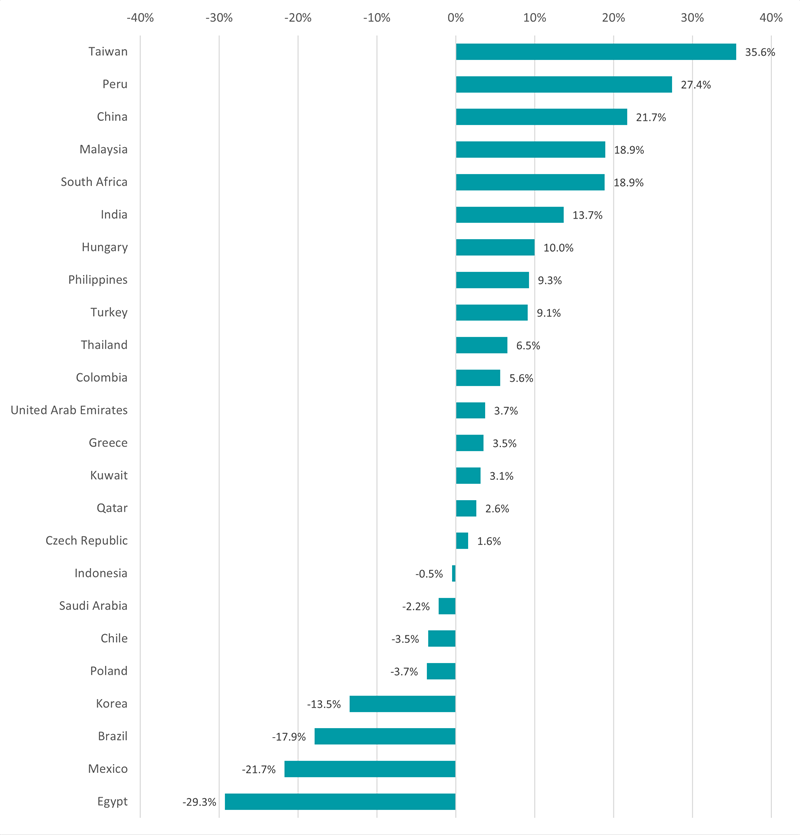

Performance of emerging market countries in 2024

Source: FinXL

Tahia Tahmin, emerging markets fund analyst at FE Investments, added: “Given the current macroeconomic environment with global growth remaining resilient and inflation generally getting close to target ranges, the outlook is favourable for emerging markets assets, which should benefit from a weaker dollar.

“Asia in particular is expected to be a major driver of growth, with China remaining the focus point as investors patiently await further details of fiscal measures to encourage consumer spending and stabilise the property market.”

However, she said investors should remain cautious for a more volatile market environment on the back of continued geopolitical risk and uncertainty surrounding upcoming elections.

Rob Morgan, chief analyst at Charles Stanley Direct, sees emerging markets as “an essential component of a long-term growth portfolio”, thanks to favourable demographic trends and some dynamic companies.

However, his enthusiasm for the asset class is currently tempered by high valuations in the Indian market and political and economic uncertainties in China. These are the two largest countries in the MSCI Emerging Markets index and, as the chart above shows, among the strongest performers this year.

Darius McDermott, managing director at Chelsea Financial Services, agrees that investors need to keep a close eye on potential headwinds when considering buying emerging market funds today.

For him, the strength of the US and the impact of China’s stimulus package are the critical factors to watch from here.

Should the dollar weaken further, emerging market companies would benefit as they tend to borrow in dollars but conduct business in their local currencies, which effectively reduces the burden of their interest payments and allows them to borrow at lower costs.

But the impact of China’s stimulus plans could be significant for the asset class, given the fact that the country accounts for around 28% of the MSCI Emerging Markets index.

“From a stock market perspective China has been a laggard for many years – until recently that is. Following the announcement of a huge stimulus package the market took off and is now up nicely year to date,” McDermott finished.

“It does remain to be seen if this is the start of a strong bull market or a bounce from very low levels, so you do need to take a view on this when investing in global emerging markets.”

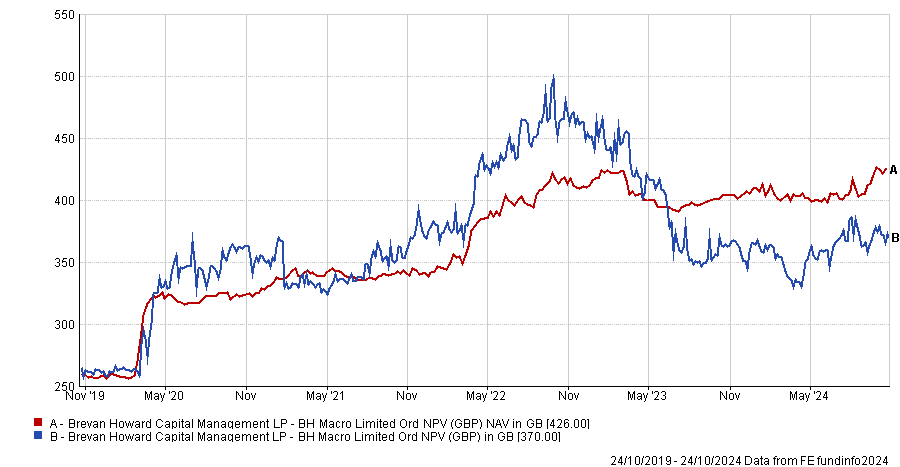

The trust provides investors with access to Brevan Howard’s hedge fund and is trading on a double-digit discount.

The BH Macro investment trust offers UK-based private investors access to one of the world’s largest hedge funds: Brevan Howard. With a market capitalisation of £1.3bn, it was trading at a 12.2% discount on 25 October, potentially making this an opportune time to consider investing.

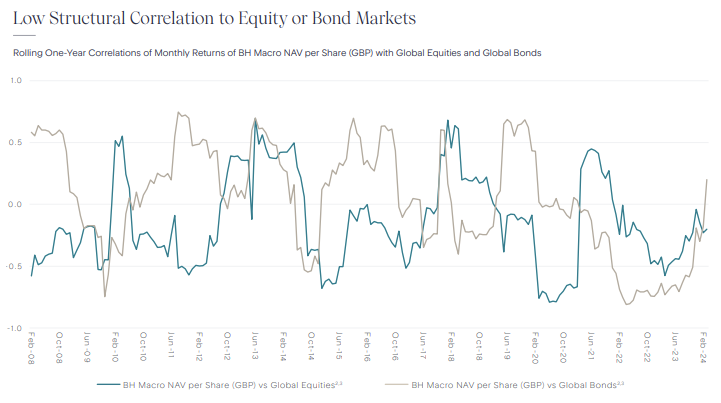

One of the trust’s main selling points is the diversification it offers by being uncorrelated to equities and fixed income.

Chris Clothier, co-manager of the Capital Gearing Trust, said BH Macro “tends to perform best when other asset classes are struggling, so in periods of high equity market volatility, it has historically performed very well”.

Source: BH Macro

The portfolio is comprised of multiple different trades executed by 155 traders and portfolio managers across equity, bond, currency and commodity markets as well as digital assets.

Brevan Howard structures ‘convex’ trades, where the upside potential significantly outweighs the downside, using options and stop losses. A risk management overlay ensures that the overall portfolio has balanced exposures.

Clothier described BH Macro as a “structurally long volatility trust”. Its traders buy options which perform well when volatility spikes. When markets are steady, “you tend to be bleeding option premiums [but] the traders at Brevan Howard are sufficiently skilful that when markets are calm, they don’t appear to lose much money and to make a bit of money most of the time”, he explained.

“So what you tend to see is periods of quite dull performance and then periodic surges of very good performance, probably just when you need them, because the rest of your portfolio might not be doing so well.”

One drawback is that Brevan Howard’s strategy is “not hugely transparent”, Clothier noted. The hedge fund shares risk data showing its exposures but that data is often retrospective and the portfolio can shift positioning quite suddenly.

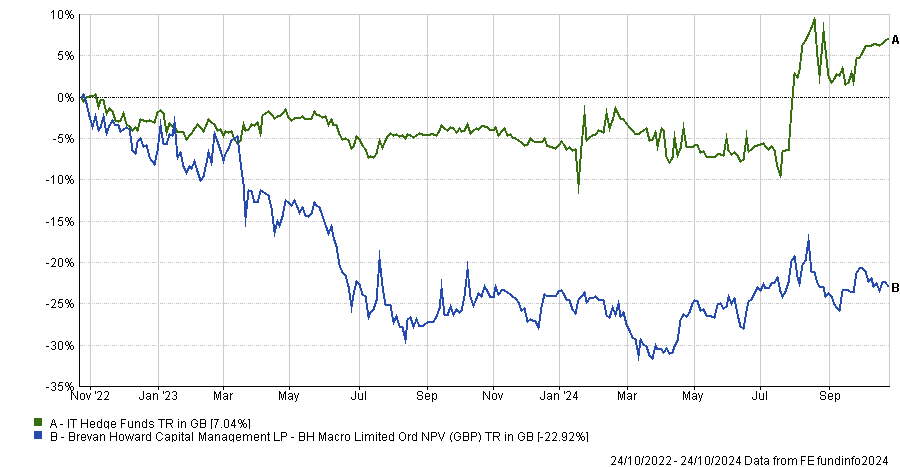

Performance has been impressive over the long term, especially during periods of equity market stress, but “mediocre” and “disappointing” for the past two years, said James Yardley, senior research analyst at Chelsea Financial Services.

BH Macro achieved an 8.8% annualised net asset value (NAV) per share return from inception on 9 March 2007 until 31 December 2023, net of fees, with just 8% volatility.

Its share price volatility was 13.6%, still lower than the S&P 500’s annualised volatility of 18% over the same period.

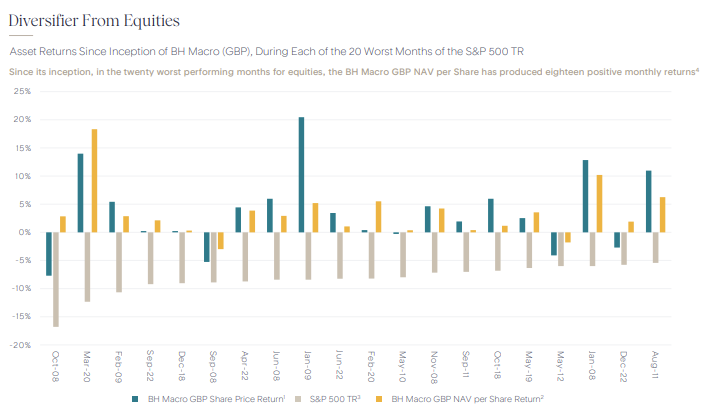

William Heathcoat Amory, managing partner at Kepler Partners, said: “In each of the S&P 500’s 20 months of worst performance since 2007, BH Macro has significantly outperformed the index, delivering a positive sterling share price return in all but five of those months, with an average monthly share price return of 3.7% net of fees.”

Source: BH Macro

Yardley added: “In 2021 and 2022, as higher inflation caused panic in the bond and stock market, BH Macro delivered very strong returns. This helped shield many investors' portfolios from falls they were suffering from their other holdings. In other words, this trust has a track record of doing its job and being there for you when you most need it.”

In 2022, BH Macro’s NAV and share price both rose more than 21% net of fees. By comparison, the MSCI All Country World Index lost 8% in sterling terms that year.

Strong performance propelled BH Macro’s share price to a 22% premium by September 2022. The trust responded to high demand from investors by issuing new shares in February 2023 raising £315m.

The timing proved unfortunate because in April 2023 the trust’s largest shareholder, Rathbones, merged with another large shareholder, Investec.

Fears that Rathbones and Investec would hold more than 30% of BH Macro after the merger and would become forced sellers caused the trust’s share price to fall to an 18% discount by 30 April 2024. This represented a 20% loss for investors who had bought the new shares at a 2% premium.

Total return of trust vs sector over 2yrs

Source: FE Analytics

Yardley said the double-digit discount “exacerbated the drawdown and volatility of the trust” but pointed out that “the underlying NAV performance has not actually been nearly as bad as the share price”.

BH Macro’s share price vs NAV over 5yrs

Source: FE Analytics

The equity raise also preceded a period of poor investment performance. The trust’s NAV fell 7.1% between March and May 2023 after an interest rate trade went against Brevan Howard, according to Investec analysts Alan Brierley and Ben Newell.

Clothier said BH Macro was positioned for a much weaker US economy and had not expected markets to remain so calm.

A third reason for the discount is fees. The trust pays a 1.5% management fee, a 50 basis points administrative fee and a 20% performance fee. Yardley said BH Macro’s high fees are “out of kilter with current market pricing”.

Given Brevan Howard’s reputation and the trust’s long-term track record, “you can certainly make the case that it's worth it and a double-digit discount certainly makes the high fees easier to stomach,” he added.

Clothier concurred. “We don’t love paying high fees […] we stomach them through gritted teeth”, he said, adding that the trust’s long-term track record of 8.8% per annum is after fees.

Some investors are taking advantage of the discount. Capital Gearing started buying BH Macro in February 2024 and the trust is now one of its largest positions, worth 1.1% of the multi-asset portfolio.

BH Macro’s discount has narrowed since then, not least because the trust has been buying back its own shares.

Heathcoat Amory said that “given the role BH Macro plays in a portfolio – as a potential diversifying counterweight to an otherwise equity-focussed portfolio – there is never a bad time to buy BH Macro, other than when it is on a significant premium to NAV”.

“Now that it is trading on a significant discount, this could prove an attractive entry point to the flagship strategy of one of the most successful hedge funds of all time. In terms of being a strong diversifier to equities, I would say there are no real equals,” he concluded.

Hargreaves Lansdown’s Victoria Hasler highlights the warning signs that an investment opportunity might not be as good as you’re being told.

Close to 30,000 people have fallen for investment scams over the past year but the chances of being taken in by fraudsters can be lowered by watching out for several vital clues, according to Hargreaves Lansdown.

Data from Action Fraud shows 27,225 cases of investment fraud were reported in the UK between September 2023 and September 2024, with losses reaching £524.7m. A typical investment scam revolves around criminals contacting people out of the blue and convincing them to invest in schemes or products that are worthless or do not exist.

Victoria Hasler, head of fund research at Hargreaves Lansdown, said: “Remember how your granny always told you that if something seems too good to be true then it probably is? You’d do well to apply this advice to investments too.

“Advertisements promising enticingly high returns, or guaranteed returns, or straight-line returns make us very nervous. Why? Because they could be scams.”

Below, we look at these four clues in more detail to see how they can help investors avoid being taken in by investment scams.

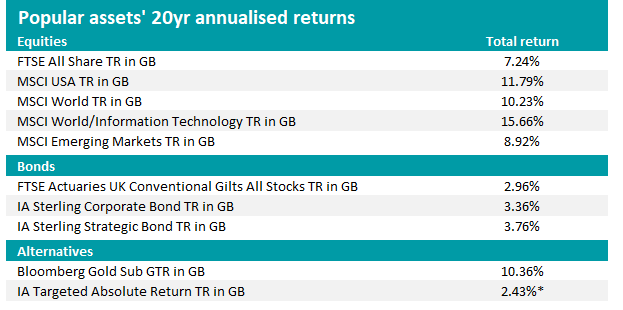

Clue 1: Investments promising returns that are higher than historical averages

The first thing to keep in mind, according to Hasler, is to be cautious when someone tells that they can get returns much higher than the historical average over the long run.

The below table shows the long-term annualised returns for some well-known assets to show the ballpark performance that investors can expect, keeping in mind that they will vary from year to year.

Source: FE Analytics to 30 Sep 2024. * 10yr annualised return

“If you are shown an investment and told it can achieve much higher returns than these then you might want to ask yourself why. We’re not saying that it’s impossible to get more than history might suggest, but a higher return is usually compensation for more risk,” Hasler said.

“You should also not panic if your investments return a lot more or less than these returns in any given year. Remember these are averages over 20-year periods and for any one year the returns are likely to be higher or lower than this.”

When presented with an investment opportunity, people should ask where exactly their money will be invested and then consult data like the above table to see if the promised returns seem realistic or not.

Clue 2: Investments with promised or guaranteed returns

“In this world nothing can be said to be certain, except death and taxes. So said Benjamin Franklin. He was referring to the American Constitution, but he could easily have been talking about investments,” Hasler continued.

“This one is easy – if anyone is absolutely, iron-clad guaranteeing you a return from anything other than cash, my advice would be to politely decline and run in the opposite direction as quickly as you can."

She pointed out that investments are not guaranteed; they compensate an investor for taking risk, but risk is always present. Even government bonds – seen as one of the safest assets – can (and occasionally do) default.

The closest to a risk-free investment is cash, but the returns on this are very low and, if savings are above the Financial Services Compensation Scheme’s £85,000 limit, remain at risk in the rare event of a bank collapse.

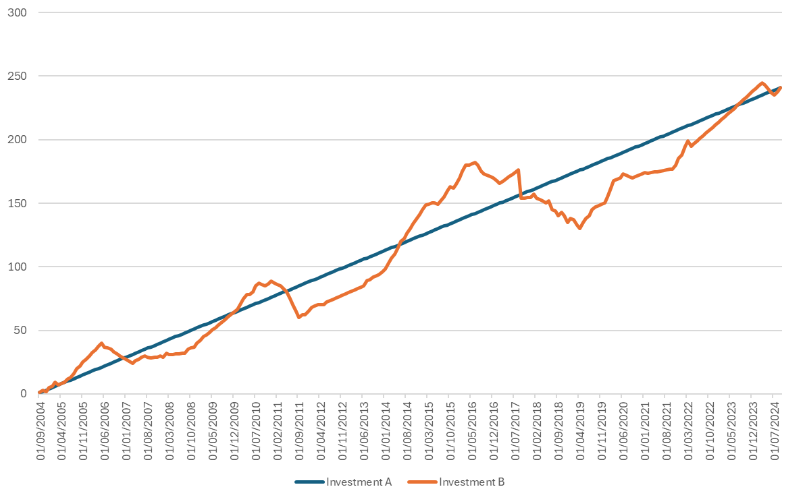

Clue 3: A journey that is too smooth

Hasler’s third clue to a scam is the promise that an investment has gone up in a smooth line. While investors hope that their investments will rise over the long run, this is never going to be in a straight line.

“Take a look at the historical return graph for the investment you are considering. Is the line going up in a straight or almost straight trajectory? Markets experience ups and downs, and your investments will too,” she said.

“If the return profile looks too good to be true, then it probably is. In the below illustrative chart, investment A may look attractive, but the path of investment B is a lot more realistic.”

Two hypothetical investments

Source: Hargreaves Lansdown

Clue 4: Bamboozingly complicated investments

The final guideline to avoiding potential investment scams is to not invest in something “horribly complicated” when there is a simple alternative.

Hasler said scammers often present very complicated investment strategies in the hope this will make them appear clever. However, if they cannot explain it in everyday language, then investors should avoid it.

“The problem is that if you don’t understand an investment, then it’s very difficult to tell if it is legitimate or a scam,” she concluded. “Does this rule mean that you could occasionally miss out on some good investments? Yes. Does it mean you also miss some horrible blow ups and scams? You bet.”

For those wise enough to take a long-term view, who do their research, buy shrewdly, diversify to reduce risk and are prepared to be patient, AIM is rich in opportunity.

Next year the AIM market turns 30, but if there is a party will anyone turn up? Despondency and concern from the investment community about smaller companies has seldom felt greater in the many years I have been managing money.

Worries about the general outlook for the UK are now compounded by specific concerns for some AIM investors that the tax exemptions might be removed or reduced in the coming Budget.

We can talk more about tax shortly, but first why AIM matters, and why a sensible Chancellor will do everything possible to ensure the health of this market.

AIM – formerly the Alternative Investment Market and a sub-market of the London Stock Exchange – was launched in June 1995 with just 10 companies. What makes it distinctive is the lower regulatory burden on companies listed there. This puts more onus on the investor to conduct detailed due diligence but it gives young, growing companies a route to capital without overburdening them with crippling compliance and legal costs.

From inception to September this year, AIM had helped more than 4,000 companies raise over £135bn, with nearly £87bn of that as follow-on capital to help them grow further.

And many have done. Take specialist insurer Hiscox. In the early 1990s Lloyds of London was running out of capital. The ‘names’ who had traditionally provided capital with unlimited liability had experienced severe losses.

What was needed was a new structure supported by companies with limited liability. But they themselves needed capital. AIM provided this and we invested in several. It has been very worthwhile, with some being taken over and others, like Hiscox, growing phenomenally.

London’s status at the heart of the global reinsurance industry owes much to AIM and the role it played in rejuvenating the industry.

Today there is a need for a new generation of alternative energy companies. With little in the way of trading records these early-stage businesses have relied on AIM to raise the capital they need. ITM and former AIM stock Ceres, for instance, have both raised money on multiple occasions to finance their development. I believe that one day we will look back and appreciate AIM’s vital contribution in the journey to renewables.

The London Stock Exchange has tried to put a number on AIM’s value to the UK. Last year, research it commissioned from Grant Thornton found that in 2023 alone, UK companies admitted to AIM contributed £68bn to the UK economy through direct, supply-chain and induced impact. They have paid £5.4bn to the Exchequer.

Hiscox and Ceres are now on the main market. Other familiar names have followed that path, like Asos and Melrose. But many significant companies remain on AIM. Jet2 is now a £3bn company – bigger than any FTSE 250 business. And 28 companies on AIM are now worth over £500m.

One example is laboratory instrument business Judges Scientific – admitted in 2005 and now with a market capitalisation of £630m. I stupidly thought it was too expensive a few years ago. On admission the shares were about a pound. Today they are nearer £100.

But I have enjoyed other successes, too. I have held defence technology company Cohort for many years – it was admitted in 2006 with shares at £1.48. Today they are nearer £9.

There are downsides for investors too, of course. It can take patience, waiting for a company to really build the foundations for success. Many fail. Patisserie Valerie left a bitter taste in the mouth for many investors when it collapsed following a fraud in 2019. This year alone 14 companies have been admitted, but another 72 have been cancelled – de-registered, bought out or folded.

Few move from AIM to the main markets but to be fair, not every company aspires to do so. For companies with a degree of family ownership, for example, the business property relief that comes with being on AIM, protecting the investment from inheritance tax (IHT) on death, can make it a sensible long-term home.

And that brings us to the thorny issue of tax. It has been estimated that if the IHT relief was withdrawn it could lead to a 30% drop in share prices.

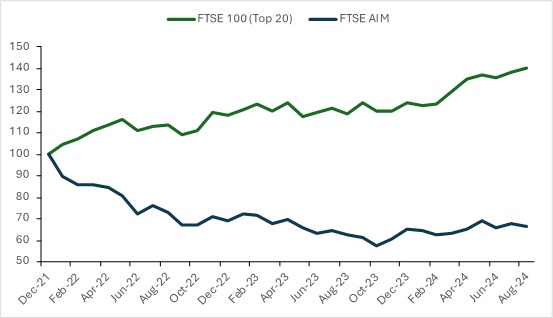

To me, much of that risk looks priced in already. Stand a mirror on the horizontal axis of a chart showing the returns of the top 20 companies in the FTSE 100 since the beginning of 2022 and you will see in the reflection a line going almost exactly the opposite way. That’s AIM. The FTSE is up 39.9% since then; AIM is down 33.6%.

FTSE 100 vs AIM

Source: Janus Henderson Investors

Total capital raised by AIM companies fell by more than 70% last year on the market’s 20-year historic average. And the number of companies on AIM has fallen from 819 at the end of 2020 to 695 companies, valued at £72bn today. So where next for AIM?

This market still plays a huge part in the economic life of the UK. I cannot see that changing without dire consequences.

Investors can easily wander into an echo chamber of gloom and depress each other out of an opportunity. I have the advantage of getting out to meet the managers of many AIM-listed companies and so often come away enthused by the progress they are making.

An economy is driven not by Budget pronouncements but by innovation and hard work. My visits and meetings suggest the current climate of gloom is misplaced.

Falling interest rates should help trigger consumer spending and encourage corporate investment that delivers growth. It might also encourage investors to switch from cash to equities.

For those wise enough to take a long-term view, who do their research, buy shrewdly, diversify to reduce risk and are prepared to be patient, AIM is rich in opportunity – perhaps as much as at any time since its launch.

We may get to realise some of that opportunity the other side of the Budget, if it proves less contentious than the market currently fears. It does not take much to change the mood. By the time AIM hits 30, I hope we will have something to celebrate.

James Henderson is co-manager of the Henderson Opportunities Trust, Lowland Investment Company and Law Debenture. The views expressed above should not be taken as investment advice.

Ben Needham and Anna Farmbrough outline their picks for the most underappreciated stocks in the UK market.

With just two months to go until the end of 2024, this year looks set to be another disappointing one for anyone invested in UK equities.

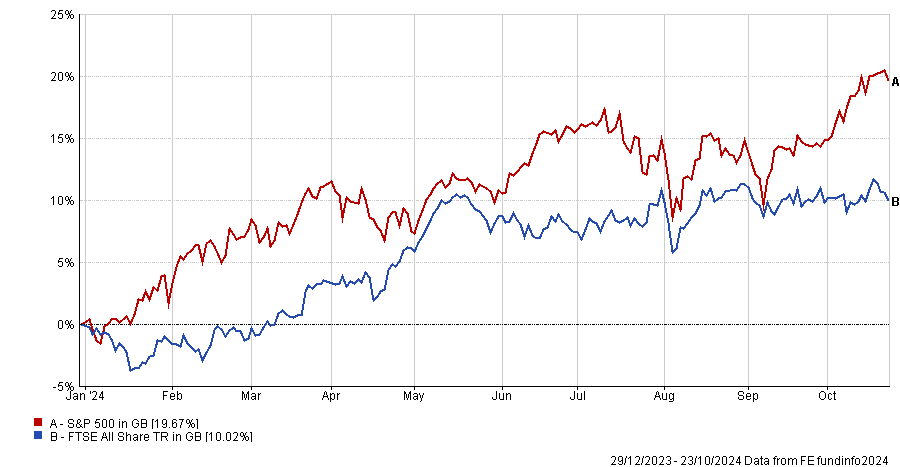

Despite optimism that domestic stocks could finally be in line for a rebound, this has failed to materialise. Although the FTSE All Share index is up 10% year to date, this is a below-par return compared with markets such as the US, where the S&P 500 is up 20.6%.

When pitted against European, emerging market, Japanese, US and global indices, the FTSE All Share is the second worst over 12 months and third worst year-to-date.

But this is not just a new phenomenon. Over 10 years, the UK’s main index is the second worst among this list with a gain of 89%, beating on the MSCI Emerging Markets index and almost four times less than S&P 500.

For this reason, Anna Farmbrough, co-manager of the Ninety One UK Equity Income and UK Alpha funds, said “we can understand why clients have given up” on investing in domestic stocks.

Performance of indices year-to-date

Source: FE Analytics

However, there are always opportunities to be found, according to co-manager Ben Needham, who said the depth and scale of the UK’s underperformance for much of the past decade has left myriad underappreciated stocks waiting for someone to take a chance on them. Below the managers outline their three favourites.

JD Wetherspoons

Firstly, the managers identified JD Wetherspoons as one of their favourite stocks, despite a decline in share price of 14% YTD. It is one of the managers’ core holdings, occupying the 10th position in the portfolio.

Needham said one of the reasons it is attractive is because of its price advantage compared to other hospitality businesses. Rather than competing with other hospitality venues, Wetherspoons now sees supermarkets as its main competitor in terms of price. Consequently, Wetherspoons has developed a significant price advantage over other pubs on the market.

Farmbrough added: "We think this is very realistic because people have gone from drinking outdoors to drinking at home, so their direct competition has changed". This makes it a very “safe” bet in difficult economic circumstances.

Share price of Wetherspoons YTD

Source: Google Finance

Moreover, Farmbrough credited the company for its longer-term emphasis on reinvestment, primarily through how it treats employees. For example, the firm pays its employees better than almost all of its competitors, leading to much higher tenures. Indeed, an internal report from the firm last year stated that it had paid out £520m in free shares and bonuses between 2006 and 2023.

Farmbrough noted, if it stopped paying its employees bonuses and paid them in line with other pubs, “profits would increase by 50% overnight” indicating how much the firm puts into its workforce.

AJ Bell

Another favourite for the Ninety One team is the leading savings and investment platform AJ Bell. While they noted that the platform is hardly underappreciated, with shares up 56% YTD, Needham and Farmbrough felt its true long-term potential has yet to be fully recognised.

Share price of AJ Bell YTD

Source: Google Finance

The biggest advantage of the firm is its value proposition and ability to cater to both traditional consumers and financial advisors, giving it a broad customer base. “It looks after the customer as an asset manager, which no one ever talks about,” Needham said.

Moreover, the team described it as a great example of a capital-light UK stock – or one that was poised for sustained long-term growth with very limited investment needed. This allows it to provide consistent income while also allowing capital to appreciate over time.

With earnings per share growing at more than 20% per annum but still trading at a price-to-earnings ratio of 23.7x, Farmbrough and Needham described it as one of the “bedrocks of our portfolio”.

Wise

Finally, the team identified cross-border payment company Wise as another underappreciated industry leader. It has had a challenging year, with share price down 11% in 2024 so far, with particularly large slides downwards in April and June. Despite these outflows, Farmbrough and Needham felt the stock had significant potential to disrupt the cross-border payment market.

Share price of Wise PLC YTD

Source: Google Finance

Traditionally, cross-border payments are made through a ‘correspondent banking model' in which to transfer money internationally it passes through multiple different banks, each of which takes a “cut of the pot”.

By contrast, Wise allow investors to transfer money more cheaply and quickly than many competitors because it has direct links with local banks.

Moreover, the firm has been expanding its services with new products such as the Wise platform API, which lets customers do cross-border transfers as if they were traditional banking customers.

Needham said: “So that disrupts by saying ‘we are going to have a cheaper fee than you because we are not using this correspondent banking model’. But don't worry, you can plug yourself into its infrastructure, and it will solve this problem for you at the same time, which we think is genius. The value proposition is phenomenal for the customer and we wish more customers had heard about it."

The enlarged strategy will be called Invesco Asia Dragon Trust.

The Invesco Asia trust and Asia Dragon, managed by abrdn, have announced a proposed merger this morning. If the move meets investors’ approval from both sides, the newly created vehicle will be called Invesco Asia Dragon Trust and, with £800m of assets under management (AUM), is set to become the largest in the IT Asia Pacific Equity Income sector.

The new strategy will retain the investment approach of Invesco Asia, as well as its managers Fiona Yang and Ian Hargreaves, who employ a total-return mindset applied to undervalued Asian companies with the goal to provide capital growth and “enhanced” dividends.

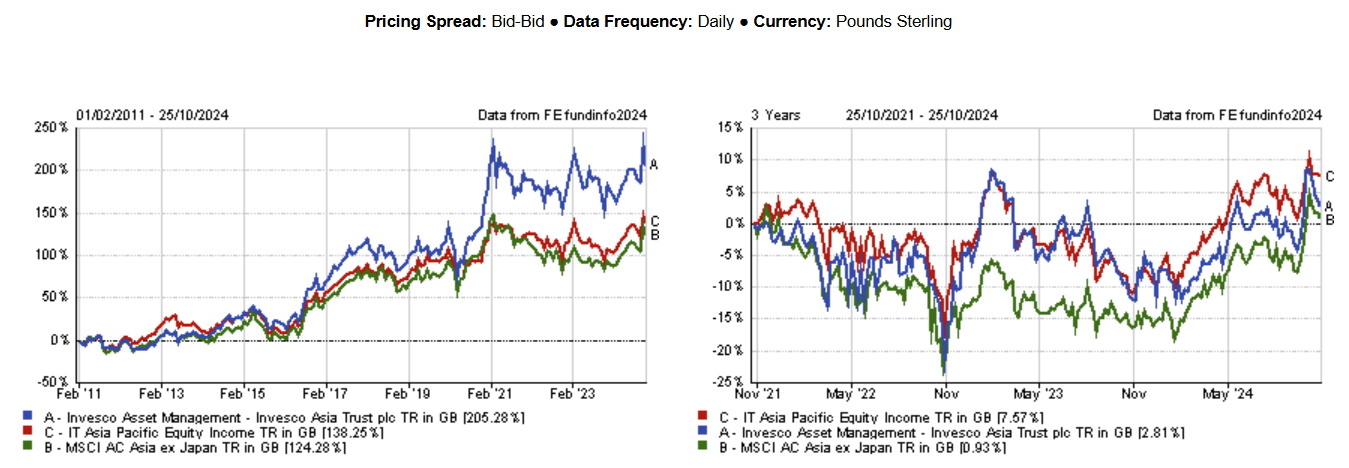

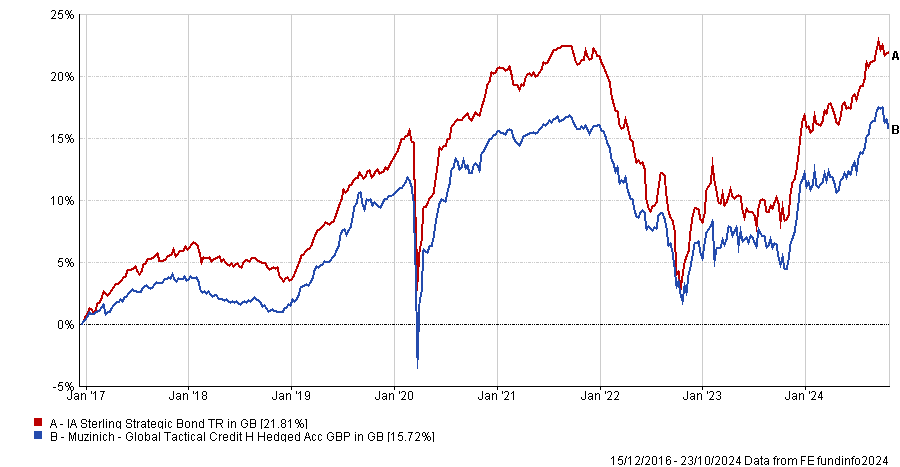

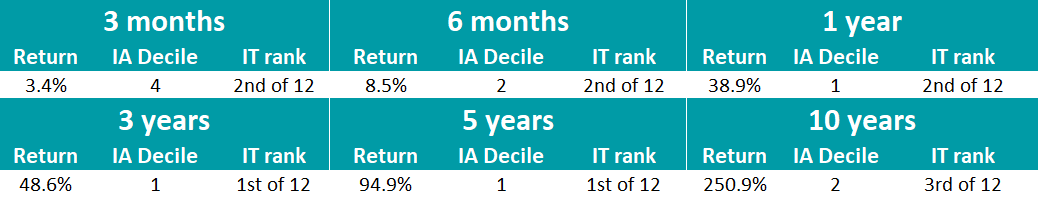

During Hargeaves’ tenure, which began in February 2011, Invesco Asia has returned 205%, 67 percentage points ahead of its peers. It remained in the first quartile of its sector over the past 10 and five years, but fell below its peers over more recent time frames, as the chart below shows.

The new vehicle will benefit from a lower fee of 0.75% for investments below £125m, 0.6% below £450m and 0.5% thereafter, from the current 0.75% below £250m and 0.65% thereafter.

Performance of trust against sector and index over manager’s tenure and 3yrs

Source: FE Analytics

Deutsche Numis analysts Ewan Lovett-Turner and Gavin Trodd said it is “somewhat unusual” to see the smaller vehicle, acting as the consolidator, but this “reflects that Invesco Asia has the better performance track record after a strong run for its value style between mid-2020 and late 2023”.

Asia Dragon's performance has been “disappointing” for years, they said, with a strategic review triggered in May 2024 after an approach by Ashoka WhiteOak Emerging Markets.

Shareholders in Asia Dragon will have a 25% cash exit opportunity at a 2% discount to formula asset value (FAV), while the combined entity will put in place a three-yearly unconditional tender offer for up to 100% of share capital.

“The board of Invesco Asia is seeking to make this the go-to Asian trust, with a premium rating to grow organically and through further combinations. To achieve this, it will need to raise its profile,” the analysts said.

“Invesco used to have a large stable of investment companies, but this is down to four now. The three-yearly exit is a useful addition, but the fund might need to be more active in buying back shares, given it has consistently traded wider than the 10% target, and it needs to seek to reduce the stake held by City of London holding [30% of Dragon’s and 20% of Invesco] for the discount to narrow meaningfully.”

Winterflood’s Shavar Halberstadt said the proposed transaction is “very much in line with sector trends”, with entrenched discounts and “subpar performance” driving boards to consider combinations, increasing scale and “presumably manager quality” in the process.

Yang and Hargreaves said the move comes “at an exciting moment to invest in Asia”, as valuation disparities across the region offer “abundant opportunities” for the active investor.

For the chairman of Asia Dragon, James Will, the concluded review process was “full and robust”.

He said: “The combination of the two trusts was the most attractive outcome for shareholders, providing a partial capital return alongside the continuation of shareholders' investment in a trust that has delivered strong long-term performance managed by a highly regarded team at Invesco.”

The veteran fund manager is to join as chair of his new firm’s investment committee.

Former Artemis fund manager Simon Edelsten has returned from retirement to join new fund house Goshawk Asset Management.

He joins as the new investment committee chair, leading a team including previous Artemis colleague Alex Illingworth.

It comes after Goshawk officially acquired the Vermeer Global Fund last month, which will be renamed to the Goshawk Global Fund. The fund, which has assets under management of £70m has kept the former management team of Tim Gregory, James Roswell, and Charlie Fricker.