Artemis’ William Tamworth teaches some investment lessons from ‘Hollywood accounting’.

What do the following films have in common: Spider-Man (2002), Men in Black (1997) and Return of the Jedi (1983)?

I’ll give you a clue. Spider-Man took in $826m at the box office against a budget of $139m. Men in Black took in $589m against a budget of $90m. And Return of the Jedi took in $483m against a budget of $33m.

Have you worked it out yet? Yes, that’s right: none of these films ever made a profit. Anyway, moving on…

Royalty payments

Hang on! What’s that you say? How can I claim that none of these films ever made a profit when in each case their box-office takings dwarfed their production costs?

Well, if you don’t believe me, let’s ask some of the people whose royalty payments were dependent on these profits. In 2002, Spider-Man creator Stan Lee sued Marvel after the company claimed it received no profits from the film as defined by the terms in his contract.

In 2019, Men in Black screenwriter Ed Solomon referred to the film’s profit statement as “the greatest work of science fiction I have ever been involved with” after it claimed it was still in the red, 22 years after it was released.

And in 2009, the actor David Prowse – Darth Vader himself – told Equity magazine: “I get these occasional letters from Lucasfilm saying ‘we regret to inform you that as Return of the Jedi has never gone into profit, we've got nothing to send you’.”

So what is going on?

Welcome to the world of ‘Hollywood accounting’, where the lawyers and bookkeepers at the major studios and production companies use every trick at their disposal to avoid paying out royalties to the people involved in making their films.

But rather than go into detail about how profits can be understated to confuse actors, writers and directors, we’d rather talk about how profits can be overstated to confuse investors. Because we see it all the time.

Profits are not a statement of fact

Profits are often considered to be a statement of fact rather than a matter of opinion. This is not the case. When something is quantified, people tend to give it more credence. Compare the statements “it was 27oC” to “it was a warm day”. Most people are inclined to give greater weight to the former than the latter (clearly an opinion). Although profits are presented as a specific number, in reality they are a culmination of many opinions.

For example, if a customer has yet to pay for a service it has received, the company that provided this service is allowed to recognise the debt in its profits by reflecting the difference in working capital. When times are tough, customers may be encouraged to ‘buy now, pay later’ (which does not affect profits) rather than demand a discount (which does). Again, the difference is reflected in working capital.

Alternatively, imagine you’re a technology company employing developers to work on a new software release. As they are employees of the company, you would expect their salaries to be a ‘cost’ that hits profits. However, companies have the option to ‘capitalise’ some of these costs – put them onto the balance sheet. Then, when the software is released, they can amortise (gradually write off) the cost of these salaries against sales of the product over its lifetime, thereby deferring the hit to profits.

This can make a substantial difference to adjusted earnings and therefore P/E ratios. For advocates of EBITDA (which we are not) it’s even better – these costs never hit this metric.

Another issue is the use of ‘adjusting items’, which allow companies to ignore ‘non-recurring’ costs when reporting profits. The problem here lies with the definition of ‘non-recurring’ and often sees the day-to-day costs of running a business treated as one-offs and removed from the profit-and-loss statement. A large redundancy may be a legitimate one-off, but what if redundancies happen every year?

A focus on cashflows

So, what can investors do to protect themselves? One method of identifying the sort of practices mentioned above is to focus on cashflows – the amount of money coming in and going out of a business.

While not an exact comparison, think of the Hollywood films mentioned at the start of the article and how the difference between box-office takings and production costs didn’t translate into profits – when a company’s cashflow statement looks substantially different from its reported earnings, that immediately makes us suspicious.

Not foolproof

This technique doesn’t always work. Often there’s a credible explanation for why the numbers are different (and it’s worth noting that all the practices mentioned above are completely legitimate). In the past, focusing too heavily on cashflows has caused us to sell out of some companies we should have kept hold of and to miss other opportunities entirely.

And while it can help us steer clear of frauds, it isn’t foolproof: we didn’t pick up on what was going on at Patisserie Valerie, for example, as its profits and cashflows looked immaculate. In that case we were plain lucky – the shares looked too expensive for us, so we never invested.

But over the years, managing money in this way has repeatedly helped protect our investors from share prices falls when companies are struggling. Just as importantly, we have found that a predictable and growing cashflow that is allowed to compound over the long term is an underappreciated driver of returns, allowing us to take full advantage of the small-cap effect.

You can forget about Spider-Man, Darth Vader and everyone else in Hollywood for that matter – to us, cashflow is the real superstar.

William Tamworth is co-manager of the Artemis UK Smaller Companies fund and the Artemis UK Future Leaders investment trust. The views expressed above should not be taken as investment advice.

Nothing stops optimism in a positive month for markets.

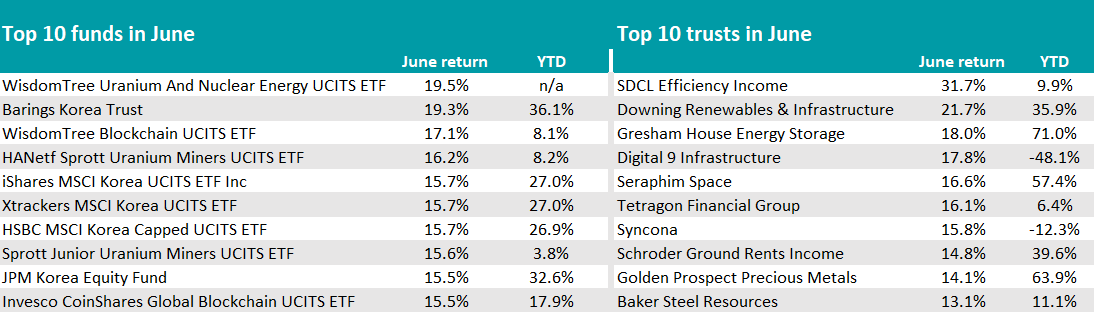

June was a positive month for investors in funds and trusts, with the majority of sectors closing the period with a positive average return.

Energy was a key theme both geopolitically (with a volatile oil price following the attacks on Iran) and in the investment world, where energy-focused investments stood out.

Grabbing centre stage was the SDCL Efficiency Income trust, with the best performance of the month (31.7%). Two more IT Renewable Energy Infrastructure strategies – Downing Renewables & Infrastructure (21.7%) and Gresham House Energy Storage (18%) – completed the top-three trusts.

A similar trend was reflected in the open-ended space by the WisdomTree Uranium And Nuclear Energy UCITS ETF, which topped the funds ranking with a 19.5% return. Exchange-traded funds (ETFs) investing in uranium miners were also high up in the list, with HANetf Sprott (16.2%) and Sprott Junior (15.6%) being the two main ones.

Source: FinXL

The other story of the month was Korea, whose equity market has delivered the strongest first-half performance in 20 years, as Fairview Investing director Ben Yearsley noted.

“The KOSPI index had a good run post the Korean election results and on hopes of an imminent US rate cut that tends to lift all of Asia and emerging markets,” he said.

With a gain of 19.34%, Barings Korea was the second-best fund overall, followed by iShares, Xtrackers and HSBC ETFs that track the country’s stocks, as well as the JPM Korea Equity fund, which returned 15.5% over the month.

The third theme this June was technology.

The third-best performance overall in the open-ended space came from the WisdomTree Blockchain UCITS ETF (17.1%), with Invesco CoinShares Global Blockchain UCITS ETF not too far off – demonstrating the prevailing sentiment was to be risk-on.

“Optimism has not been dented, but will be tested this month with the ending of the 90-day pause in US-imposed tariffs,” Yearsley warned.

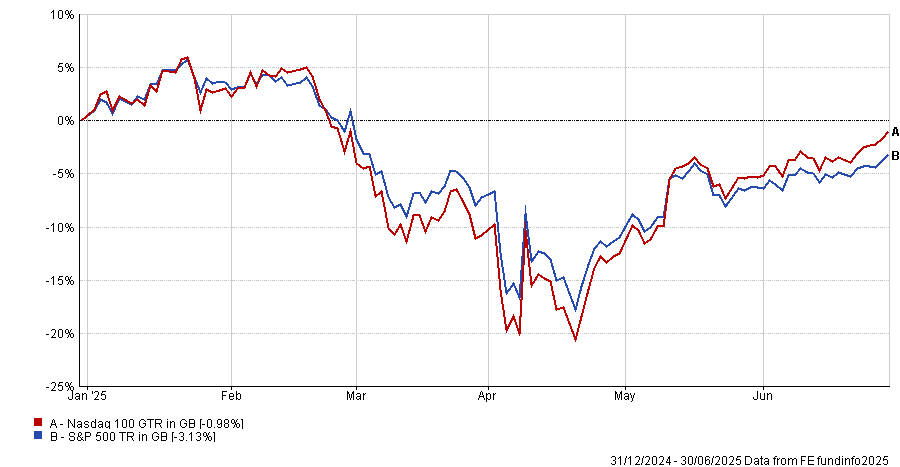

There were no signs of that fear in June, with the S&P 500 and the Nasdaq both closing the month at fresh record highs. The most notable active funds in the space were Liontrust Global Technology (11.3%) and Polar Capital Global Technology (11.1%).

The whole technology sector has staged a major rebound after a challenged first quarter, but returns for UK investors were “more than wiped out” by dollar weakness, with very few hedging their equity exposure.

For Yearsley, if the trend is for a weaker US dollar, then “investment strategies might need to be rethought”.

Performance of indices over the year to date in pound sterling

Source: FE Analytics

Commodities and natural resources funds also picked up in June, with a resurgence of names such as SVS Baker Steel Electrum and Pictet Clean Energy Transition within funds, and Golden Prospect Precious Metals and Baker Steel Resources in the investment trust universe.

At the foot of the tables last month was a cohort of funds focused on the consumer, as fears around heightened inflation due to US tariffs started to drive the narrative.

It affected European funds such as the SPDR MSCI Europe Consumer Staples UCITS ETF and IA Global funds such as the iShares S&P 500 Consumer Staples UCITS ETF, but especially US funds, as the table below shows.

Source: FinXL

“The last six months has been one of the most fascinating yet random in the last decade,” Yearsley noted.

“AI, Trump, wars, more Trump – actually Donald Trump has impacted many areas, with AI possibly the only one he’s not been involved in. Even then, China’s resurgence in the tech space has been largely down to having to innovate without the latest US chips.”

Former M&G executive to lead asset manager's multi-asset capabilities from late 2025.

Ninety One has appointed David Knee as its new head of multi-asset. With over 30 years of experience, Knee is set to take responsibility for the firm’s multi-asset teams later this year.

Knee has managed multiple multi-asset and fixed income portfolios across South Africa and the UK – most recently serving as co-deputy chief investment officer for fixed income at M&G Investments in London. He also held the position of chief investment officer for the firm in South Africa from 2016.

Domenico Ferrini, co-chief investment officer at Ninety One, said: “Multi-asset sits at the intersection of many of our specialist capabilities.

“In addition to his co-portfolio manager responsibilities, [Knee] will focus on fostering even greater collaboration across teams and strengthening the macro research process that underpins our strategies.”

Ferrini pointed to Knee’s expertise in asset allocation and fixed income selection, noting that this will be "instrumental in driving improved investment outcomes”.

Alongside Knee’s appointment, Ninety One has promoted Rehana Khan to co-head of South Africa equity and multi-asset, working with Hannes van den Berg.

Khan, who joined the firm in 2020 and previously worked with Knee at M&G Investments Southern Africa, will work with the Global Strategic Managed portfolio management team, utilising her equity expertise.

Shift reflects persistent geopolitical risks and uncertainty.

Quilter’s WealthSelect Managed Portfolio Service (MPS) has increased its allocation to fixed income and reduced equity exposure, citing ongoing risks to growth and inflation.

WealthSelect portfolio managers Stuart Clark, Bethan Dixon and Helen Bradshaw have chosen to maintain a tactical underweight to equities relative to the strategic asset allocation, despite the fact equity markets have rallied since US president Donald Trump’s so-called ‘Liberation Day’, which saw the unveiling of a host of aggressive tariffs.

Instead, the team has notably increased the MPS’ fixed income exposure, although it is maintaining an underweight position versus the strategic asset allocation, favouring a blend of fixed income, alternatives and cash.

Bradshaw said: “While markets have rallied following Trump’s ‘Liberation Day’, we remain relatively cautious in our outlook.

“The portfolios have been rebalanced to acknowledge market momentum but also to defend against the potential volatility stemming from the ever-changing geopolitical tensions, inflationary pressures and uncertainty around global trade.”

The rebalance included the addition of the Vanguard Euro Government Bond Index fund, which has been introduced to reflect the potential for divergence between European and US economic and monetary policy.

It also aims to account for a declining appetite for US government debt, both through the Vanguard fund and the iShares Green Bond Index. The latter provides exposure to predominantly European bonds whereby the proceeds are utilised to achieve a positive environmental outcome.

Within WealthSelect’s sustainable portfolios, the team added T.Rowe Price Global Impact Credit and increased its allocation to Goldman Sachs Sovereign Green Bond.

In addition, the managers have maintained the UK overweight position – opting to increase mid-cap domestic exposure via Quilter Investors UK Equity Opportunities – while trimming European equities and redirecting slightly to emerging markets and Japan.

“In this environment, resilience and adaptability are key, and our portfolios are well positioned to deliver both,” Bradshaw said.

Strong inflows underscore investor momentum amid heightened NATO-driven defence spending.

The WisdomTree Europe Defence UCITS ETF has gathered $3bn in assets just three months after its launch in March this year.

It was the first ETF to focus solely on European defence and its rapid growth in assets under management reflects strong investor demand for exposure to the region’s military and strategic sectors.

The ETF’s growth coincides with a major shift in European defence policy, as NATO moves from symbolic benchmarks to enforceable spending goals backed by multi-year government commitments.

NATO’s updated guidance calls for 5% of GDP to be directed toward defence, including 3.5% for core capabilities and 1.5% for adjacent sectors such as cybersecurity and infrastructure.

Adrià Beso, head of distribution, Europe at WisdomTree, said: “The NATO summit has made it clearer than ever: European countries are stepping up their defence commitments, with increased spending now a top priority. For investors, this marks the next phase of a long-term shift.

“As governments channel more funds into the defence space, we see strong potential for sustained growth across the sector. Companies that support modern military capabilities and critical infrastructure are well-positioned to benefit, making European defence an increasingly important area for capital allocation.”

Legal & General’s Private Markets Access Fund has amassed more than £1bn in assets within 12 months and broadened pension client access.

Legal & General’s Private Markets Access Fund (PMAF) reached £1.3bn in assets under management by the end of June, one year after its launch in 2024.

The fund offers defined contribution (DC) scheme members diversified exposure to private markets. It invests across real estate, infrastructure, private credit and private equity, including assets such as affordable housing, clean energy and natural resources.

L&G launched the fund alongside a new target-date fund default range, the L&G Lifetime Advantage Funds, which makes use of PMAF to access private markets. Since its launch, L&G Lifetime Advantage range has seen inflows of more than £11bn from DC clients, including contributions from the firm’s own employee pension plan.

L&G is a founder signatory of the Mansion House Accord, aiming for at least 10% of DC default fund assets to be allocated to private markets by 2030, with a minimum 5% directed into UK-based private market investments.

Responding to pension scheme demand, L&G has also opened PMAF to defined benefit (DB) clients. The offering features a weekly-dealing structure designed to help manage pension scheme liquidity and allow prudent extraction of surplus capital under the new Pensions Bill.

Eric Adler, chief executive of asset management at L&G, said: “We are pleased to have been an early adopter in designing a solution that enables default schemes with flexible liquidity requirements to access private markets opportunities.

“As private markets continue to open up to new DC and DB members, we expect a continued focus on private markets strategies that can offer income and growth together with positive societal benefits.”

L&G has expanded its private market platform and client offering in recent years, including launches of a £500m affordable housing fund, a €600m clean power fund and a $235m nature and social outcomes strategy.

HANetf’s new defence ETF will target Indo-Pacific-listed companies, amid a regional rearmament push.

HANetf will expand its regional defence fund offerings with a new Indo-Pacific ex-China ETF set to launch in July 2025.

The ETF will provide targeted exposure to Indo-Pacific-listed firms in the defence, aerospace and security sectors. It joins the firm’s existing defence range, including the $2.6bn HANetf Future of Defence UCITS ETF and the €130m HANetf Future of European Defence UCITS ETF.

The launch comes amid rising defence spending and greater focus on military industrial policies across the Indo-Pacific. Countries such as India, Japan, South Korea and Taiwan are increasing their defence budgets and seeking greater self-reliance in arms production.

The new ETF will track the VettaFi Future of Defence Indo-Pac ex-China index, which focuses on companies domiciled in the Indo-Pacific with significant defence revenues. Top constituents include Singapore Technologies Engineering, Kawasaki Heavy Industries and Mitsubishi Heavy Industries, with the biggest geographical allocations being South Korea (45.3%), India (28.9%) and Japan (9.6%).

At the Shangri-La Dialogue in Singapore, US defence secretary Pete Hegseth encouraged Asian allies to follow Europe’s lead, citing NATO members pledging 5% of GDP to defence spending.

Among the regional defence drivers highlighted by HANetf are Japan initiating its largest military build-up since the 1950s, India directing three-quarters of its defence capital budget to domestic manufacturers and South Korea expanding its defence exports with the aim of taking 5% of the global arms market by 2027.

Hector McNeil, co-founder and co-CEO of HANetf, said: “The Indo-Pacific is fast becoming the geopolitical centre of gravity for the 21st century. From Taiwan to the Indian Ocean, rising tensions and a shift toward defence self-reliance are driving a historic rearmament cycle.

"Just as our NATO and European Defence ETFs have helped investors access the new realities of global security, this strategy offers targeted exposure to companies within the Indo-Pacific region.”

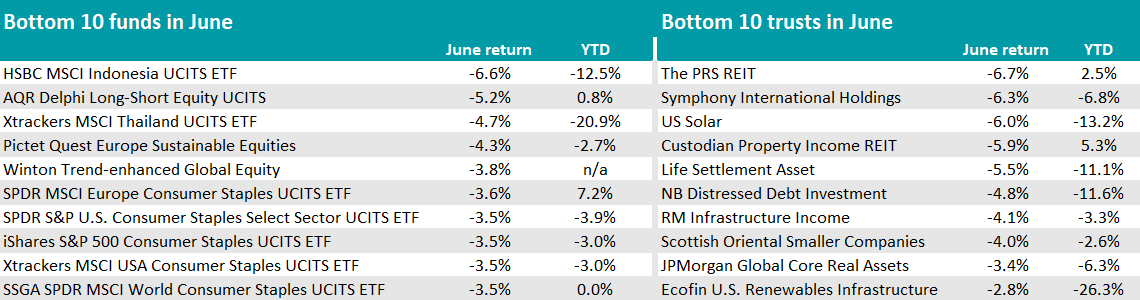

Small differences between indices can have big consequences for a portfolio if investors aren't aware of them.

Simply combining multiple index trackers in a portfolio can carry a “hidden risk” that increases volatility and impacts returns, according to Vanguard.

Blending index funds or exchange-traded funds (ETFs) is a commonly adopted strategy to build low-cost portfolios but analysis by the passive giant has identified how differences in index construction can result in material deviations in portfolio performance.

Although trackers may look the same on the surface, the ways in which index providers define and track value, growth or market capitalisation can vary significantly, Vanguard said, warning that this can lead to significant deviations from benchmark exposures – inadvertently driving up portfolio volatility and affecting returns.

Vanguard’s Andrey Kotlyarenko, equity index senior investment product manager, and William Coleman, head of the US ETF capital markets team, said: “These problems are often invisible until market volatility occurs.

“When turbulence hits, investors can start to see that their portfolios are riskier than the market or than they intended.”

CJ Cowan, portfolio manager on Quilter Investors’ Cirilium range, agreed with the broad point of the research, though he added a note of caution about tone: “While the summary is perhaps more simplistic than we might wish it to be and has more negative connotations than we would want to imply, overall, yes. If you use different index providers, it can lead to increased risk if not managed properly.”

For example, S&P, Russell and CRSP all apply different sets of financial metrics to determine whether a stock is ‘value’ or ‘growth’, Vanguard noted. While they all use price-to-book ratios to assess a company’s value factor, their models promptly diverge, with CRSP using 10 total factors, S&P six and Russell three.

As a result, the three providers categorise the style of 46% of large-cap stocks differently.

Russell and S&P also allow overlap – so the same stock could be in both a growth and a value index. CRSP will allocate each stock exclusively to one style.

The same inconsistency applies to market cap, the Vanguard research noted.

Market cap split across S&P, Russell and CRSP

Source: Vanguard calculations using FactSet data as at 1 Mar 2025

Russell and S&P use static stock counts to classify equities based on size, with the Russell 1000 covering 94% of total market capitalisation and the S&P 500 covering 87.5%. The latter also applies a profitability screen which excludes companies and depends on a committee to have the final say as to whether a company merits inclusion.

Meanwhile, CRSP defines large-cap as the top 85% of the market by capitalisation.

Although Quilter’s Cirilium passive range does not use style or market cap ETFs, the firm has found that the index divergence displayed above also spills into regional classifications, particularly in emerging markets, according to Cowan.

“MSCI includes South Korea in its emerging market equity index, FTSE does not, which has led to a noticeable performance difference,” he said. “In this instance we would want to make sure we hold an exact match and indeed this is a change we recently made in our own funds in buying the Amundi MSCI Emerging Markets II ETF.”

While the FTSE Emerging index has zero exposure to South Korean companies, the MSCI Emerging Markets index has a 9.6% weighting to the country with Samsung Electronics being the fourth largest constituent.

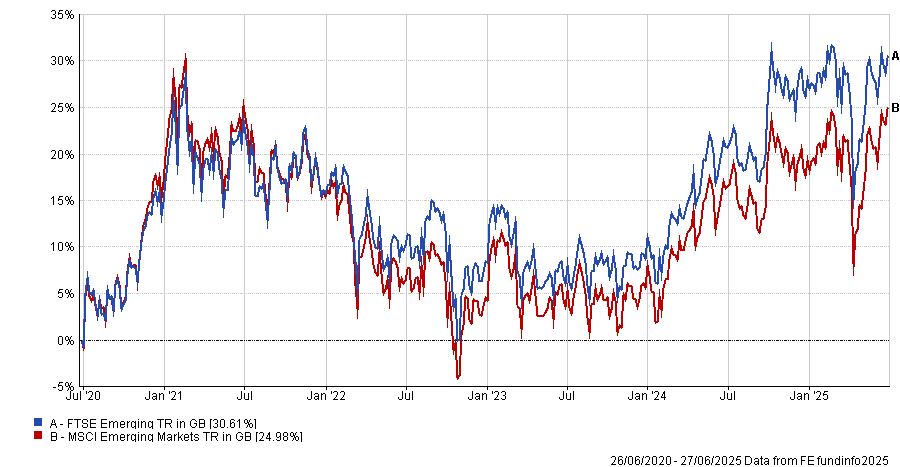

Performance of indices over 5yrs

Source: FE Analytics

FE Analytics shows the MSCI Emerging Markets index has outperformed the FTSE Emerging index by almost five percentage points over the past five years, albeit with more volatility and a higher maximum drawdown.

The impact of any of the above variations means picking two index funds with similar names may result in an investor inadvertently doubling up on certain holdings or introducing style drift into the portfolio. This, in turn, may also heighten risk and impact the portfolio’s performance.

Looking under the bonnet

This doesn’t mean mixing funds is a bad idea – only that it requires advisers and investors to review the underlying index methodologies in close detail.

Vanguard's Kotlyarenko and Coleman said: “Understanding the nuances of index construction methodologies and how well funds align with each other can help reduce unintended active risk.

“The fund name or classification is only the start of the story. A small-cap fund following one index provider may include a surprising number of companies that a different provider considers to be large-cap.”

One potential solution may be to stick with a single index provider where possible, Vanguard suggested – a move which would keep exposures consistent, simplify rebalancing and reduce the chance of overlap or misalignment.

Cowan agreed that “within an asset class you should use the same index provider for your strategic asset allocation” to avoid doubling up or missing out on exposures.

However, within actively managed portfolios, there can be benefits to working with multiple index providers, according to Tom Buffham, portfolio manager at RBC Brewin Dolphin.

“The main advantage of using multiple providers is being able to reduce the cost to clients by choosing the provider that is most competitive in any specific asset class or region,” he said.

“Additionally, there may be more targeted strategies, such as small-caps, that we want to incorporate in portfolios.”

The dual-purpose savings scheme is leading savers to make poor financial decisions and squandering billions in public money.

The Lifetime ISA (LISA) has come under fire from MPs, with a Treasury Select Committee report warning that the product’s design may be leading consumers to make poor financial decisions.

The LISA was introduced in 2017 and allows under-40s to save up to £4,000 per year towards their first home or retirement, receiving a 25% government bonus on contributions.

The dual-purpose product has been criticised by MPs for instead potentially diverting savers from more suitable products.

For example, the committee said that cash LISAs may benefit first-time buyers but are ill-suited for retirement saving, as they are unable to invest in higher-risk but potentially higher-return products such as bonds and equities.

In addition, the report warned that the LISA may have been mis-sold to benefit claimants, as funds held in these products can reduce an individual’s eligibility for Universal Credit or Housing Benefit. As such, the committee has asked the Treasury to measure and publish how people on different income brackets are using the product.

The LISA’s 25% withdrawal penalty also came under fire. The charge not only claws back the government-issued bonus but also takes 6.25% of the saver’s own money – meaning they are worse off when making an unplanned withdrawal.

According to the committee, there were nearly twice as many unauthorised withdrawals in 2023-24 (99,650) as home purchases (56,900).

Public spend is also of concern to MPs, with the Office for Budget Responsibility estimating the LISA will cost the Treasury around £3bn over the next five years for 1.3 million open accounts.

Dame Meg Hillier, chair of the Treasury Select Committee, said: “The committee is firmly behind the objectives of the Lifetime ISA, which are to help those who need it onto the property ladder and to help people save for retirement from an early age. The question is whether the Lifetime ISA is the best way to spend billions of pounds over several years to achieve those goals.”

Time for a change?

The report has prompted a wave of reaction from the industry, with advisers and policy experts calling for urgent reform.

Tom Selby, director of public policy at AJ Bell, said the LISA is a “fantastic” savings and investment product when used correctly, but added that it features design flaws which “need to be ironed out”.

He said: “Even the best-laid plans often go awry and it is unfair to punish people with an exit charge that goes beyond simply recovering the government-funded bonus.”

Selby suggested reverting to the system in use during the pandemic, when the penalty only matched the original bonus received on the amount.

Rachael Griffin, tax and financial planning expert at Quilter, pointed out that the LISA’s £450,000 property price cap no longer reflects the reality of the UK housing market.

“Many who have saved diligently find they cannot use their LISA for the property they need without facing a financial penalty,” she said. “This undermines confidence in the product and adds to its complexity.”

The ISA framework more broadly needs to be reformed and simplified to encourage more of a “culture of investment”, according to Richard Stone, chief executive of the Association of Investment Companies (AIC).

“This is vital to help ensure increased financial resilience and wealth, as well as making sure the regime delivers value for money for taxpayers,” he said.

“We share many of the concerns raised in the Treasury committee’s report and agree that the dual purpose of the LISA could lead consumers to make poor asset allocation decisions.”

Redwheel’s Ian Lance explains how the growth of multi-manager hedge funds is reshaping market dynamics.

The gap between the cheapest and most expensive stocks is close to its widest level for fifty years (see Chart 1). While passive investing has played a role in this market distortion, there is another force reshaping markets that receives far less attention: the growth of multi-manager hedge funds, commonly known as ‘pod shops’.

Chart 1: MSCI World value vs growth, average valuation premium

Source: Morgan Stanley, 30 Apr 2025. Past performance is not a guide to the future.

These pod shops operate as platforms that allocate capital to many independent portfolio managers, each running their own strategies with a sector or event-driven focus. The parent fund enforces strict risk controls such as tight stop-loss limits and intraday monitoring, while maintaining market neutrality to allow the parent fund to gear up the strategies.

This structure is designed to deliver consistent, low volatility returns regardless of broader market moves, making pod shops especially attractive to institutional investors seeking stable performance in a low-return world.

Their scale is unprecedented. Citadel and Millenium, the two largest firms, manage $65bn and $73bn1, respectively. Citadel employs around 3,000 employees, less than half of which are investment professionals, whilst Millennium has over 6,000 employees, around half of which are investment professionals2. The collective headcount of pod shops has tripled since 2015, underscoring their meteoric rise3.

But it is their leverage that magnifies their influence beyond what their AUM suggest. Data from the Office of Financial Research (OFR) illustrates that the gross leverage of multi-strategy funds including pod shops has risen from 4x a decade ago to 12x today, while their net leverage has risen from 2x to around 4.5x today4. Combined with high turnover and tight risk controls, pod shops now account for over 30% of US equity trading volume5. They have become the marginal price-setters in the stocks they trade, their flows and reactions shaping intraday and event-driven volatility.

Impact on valuations

Here is where it gets interesting for long term investors: Pod shops operate on short-term horizons. Many penalise managers for holding positions longer than a set period (often 30 days), pushing towards rapid turnover and event-driven trading. This creates a powerful incentive to focus on catalyst events – earnings releases, guidance updates, analyst estimate revisions and regulatory news – that move prices immediately.

Valuation becomes almost completely irrelevant. Their focus is momentum and trend, not whether a company is cheap or expensive relative to intrinsic worth. We can see this trend in action when a pod starts shorting a high-quality company on the basis that the next quarter will disappoint.

The earnings frenzy

Pod shops respond to corporate events within minutes of news releases. Their structure of multiple independent teams, each armed with sophisticated data and analytics, allows instant repositioning. Risk controls further incentivise rapid moves as pods that are slow to react risk underperforming and losing capital allocations.

This has created a market where responses to earnings surprises are both faster and more violent than in the past. Stocks beating expectations see immediate, sharp rallies as pods pile in, while disappointments trigger precipitous drops as pods race to exit or short positions. The effect is most pronounced in the most liquid, widely followed stocks where pod shop activity is most concentrated.

For long-term investors, this creates both frustration and opportunity. It can be alarming to watch companies plummet on a small quarterly earnings miss despite already trading at very low valuations. This sense of frustration was echoed by US value investor Harris Kupperman6 in a recent blog: “I’m genuinely amazed at how these pods will short high-quality, rapidly growing businesses … just because the next quarter will be weak.”

The value investor’s opportunity

If you believe that share prices will eventually be driven by fundamentals and move towards intrinsic value, pod shop influence creates an opportunity. As prices are driven further from intrinsic value, future return potential for valuation-driven investors increases.

The momentum oriented, valuation-agnostic approach provides us with an opportunity to buy quality companies at very low valuations – the very essence of value investing. Recent takeovers and the surge in share buybacks suggests that we may have reached valuation floors, prompting other market participants to step in and exploit these anomalies. This dynamic may presage a better environment for value investing generally.

The rise of pod shops represents a fundamental shift in markets. When combined with passive investing's growth, we're witnessing unprecedented concentration of capital in strategies completely indifferent to valuation.

While valuation may no longer matter to the market's biggest hedge funds, it still matters for long-term wealth creation. For patient investors willing to buy quality businesses at reasonable prices, the current environment may prove rewarding.

Ian Lance is a partner and fund manager in the Redwheel value & income team. The views expressed above should not be taken an investment advice.

1 Source: corporate websites. April, 2025

2 Source: Rupak’s Substack. April, 2025

3 Source: GSAM. April, 2024

4 Source: Rupak’s Substack. April, 2025

5 Source: NSPGroup. March, 2024

6 Harris Kupperman is the founder of Praetorian Capital Management LLC, an investment manager focused on using inflecting trends to guide stock selection and event-driven strategies. Mr. Kupperman is also the author of Praetorian Capital’s public blog, Kuppy’s Korner

With US dominance fading, 2025's second half may reward portfolios that embrace alternatives and local exposures, asset managers say.

The second half of 2025 is about to test the resilience of investment portfolios. After a volatile start to the year marked by tariff shocks, uneven growth and policy uncertainty, leading asset managers are calling time on the old investment playbook.

HSBC Asset Management, Fidelity and Goldman Sachs Asset Management all foresee an investment environment defined by fragmentation, fading US exceptionalism and the growing need to diversify.

For Xavier Baraton, global chief investment officer at HSBC Asset Management, investment conditions are changing “in fundamental ways”, with volatility becoming “a defining feature of the current macro regime”.

“We are moving from a world of unipolar economic leadership to an environment where no single nation holds sway over the global order. Investors must be prepared to adapt tactically and lean into diversification to drive returns and manage risk,” he said.

Fidelity International echoed that theme and Henk-Jan Rikkerink, global head of multi-asset, real estate and systematic, urged investors to “actively rewire their allocations in line with structural moves”, as traditional safe havens such as US equities and treasuries “can no longer shoulder global portfolios alone”.

A combination of policy unpredictability, high valuations, weakening growth and shifting capital flows is challenging the longstanding assumption that US assets offer both safety and superior returns.

Fidelity expects US GDP growth to fall to around 1% this year, as tariffs push inflation up to an estimated 3.5%. This stagflationary risk, where prices rise even as growth slows, is seen as a particular threat to the appeal of US equities and treasuries.

“The first six months of this year have shown us how quickly narratives can change,” said Rikkerink, who added that the US dollar’s role as a global hedge is also starting to erode.

Goldman Sachs and Fidelity highlighted rising concerns around the US fiscal position and, although the region still offers depth and innovation (particularly in artificial intelligence and technology), the case for broadening out is growing stronger.

Regional shifts

One of the main regions that deserves attention, according to all three managers, is Europe (the region was already highlighted as an unintended beneficiary of US policies).

Goldman Sachs pointed to the increased fund flows into European equities in the first half of the year, which were driven by more than just US pessimism.

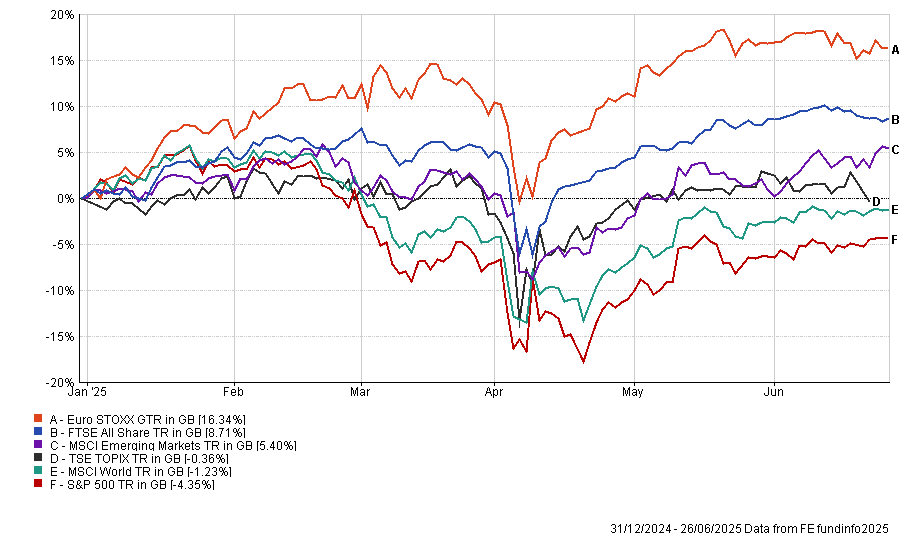

Performance of indices in the past six months

Source: Goldman Sachs, Bloomberg.

Positive drivers include stronger fiscal policy, especially in defence and infrastructure, as well as better valuations and lower concentration risk. Information asymmetry in European markets – due to lower analyst coverage and slower news diffusion – was also seen as a potential advantage for active managers.

However, as the US “catches down” to other developed markets, “the most dynamic opportunities are increasingly found in Asia and emerging markets”, according to HSBC’s Baraton.

In particular, China’s advance in artificial intelligence was highlighted as one of the key forces propelling the rest of the region (indeed, emerging markets managers have been waking up to the opportunity in China, as Trustnet recently reported).

But it’s not just equities. Fidelity noted that hard and local currency emerging market bonds (particularly in Brazil and Mexico) offer high yields and “have become more attractive as the dollar depreciates”. A number of managers, including Fidelity’s Mike Riddell, have been vocal about this opportunity since as early as April.

Asset class adjustments

Beyond geographies, fund managers are rethinking the asset classes traditionally used for diversification. HSBC and Fidelity both flagged the diminishing appeal of US treasuries as a hedge, citing high issuance, rate volatility and fiscal concerns. The response has been a turn toward European duration, higher-quality corporate credit and hard currency emerging market debt.

Alternatives are also moving closer to the core of portfolio construction. HSBC recommends infrastructure and private credit as sources of stable income and diversification. Goldman Sachs believes private markets will continue to benefit from investor demand and sees further opportunity in secondary market innovations that provide liquidity and rebalancing flexibility. Hedge funds are also back in favour as potential beneficiaries of volatility and uncorrelated alpha.

Private assets including real estate offer further diversification potential, according to Fidelity, as Rikkerink singled out European real estate as one underappreciated option.

“Investors may find alternative opportunities in real estate, especially through higher-income-yielding European markets which can protect against inflation and through the value-add of 'greening' previously unsustainable buildings,” he said.

A less central US

While agreeing US centrality in global portfolios is no longer guaranteed, all three houses are all still invested in the US, particularly in high-quality businesses with strong margins and balance sheets.

“There is no wholesale rejection of US assets,” the Goldman Sachs outlook read. But “improving prospects in other regions, coupled with concerns about US trade policy, fiscal trajectory and institutional integrity, are prompting investors to diversify”.

As Fidelity noted, decades of rising exposure to US assets have created portfolio concentrations that may no longer be justified. Rewiring those allocations – whether through geography, asset class or currency – has now become a priority.

“Diversification has always been important but now it is imperative for portfolios that have become increasingly reliant on US assets over the past 25 years,” Rikkerink concluded.

“Capital outflows and a dollar depreciation mean index weightings will look very different in the future. Those who get ahead of these structural trends may stand to benefit as portfolios rebalance.”

Ninety One’s Alessandro Dicorrado explains why people are missing the point by waiting for international investors to return to the UK.

The UK market does not need global investors to return to be an attractive investment opportunity as it has many unrecognised strengths already, according to Alessandro Dicorrado, manager of the Ninety One UK Special Situations fund.

The UK market is rallying this year, with the FTSE 100 hitting record highs and the FTSE All Share outpacing the US and many other developed markets, as seen in the chart below.

Dan Coatsworth, investment analyst at AJ Bell, said this is “exactly what’s needed to raise the UK market's profile among international investors”.

Performance of developed equity markets in 2025

Source: FE Analytics. Total return in pounds sterling

But for Dicorrado, hoping that international investors will come back is missing the point. “Do I want a revival in the UK? Not really. I don’t think you need anyone to come back”, he said.

Domestic investors have been turning away from the UK for some time. UK equity funds have shed £8bn in net outflows over the past year, according to data from the Investment Association, continuing a trend that has been in play since 2016.

Over the past five years, the FTSE All Share is up 39.4% in price performance terms, underperforming the S&P 500’s 83% rise. However, these indices track the capital value of the stock markets, not the total return they generate, which makes the UK look worse than it is.

When dividends are included, things become a lot different, he said. FE Analytics shows the total return of the FTSE All Share was 66.9%, which is much closer to the S&P 500’s 93%.

“One thing I think people don’t quite appreciate is how big of a component dividends are in your total returns,” Dicorrado said.

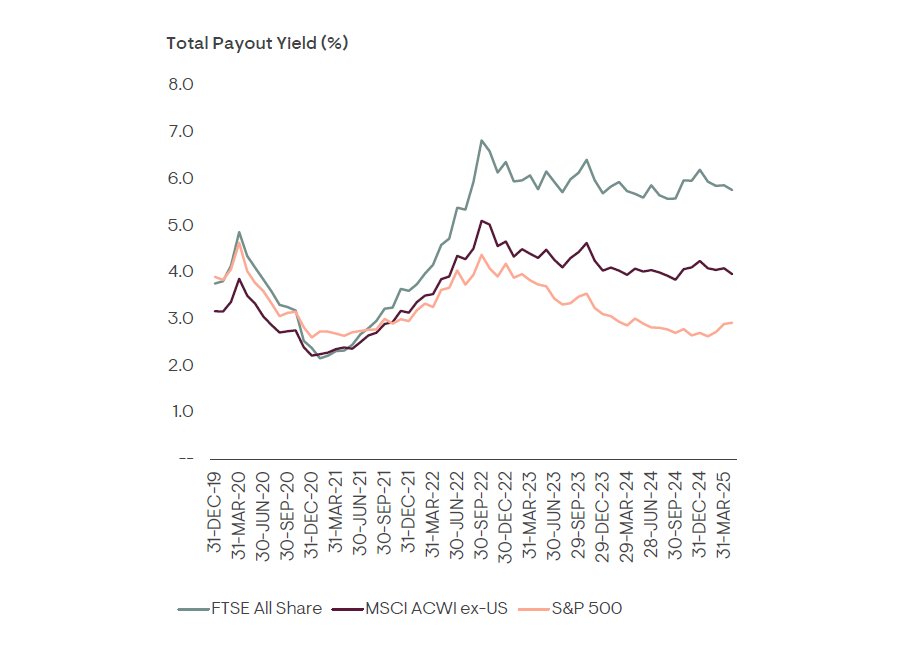

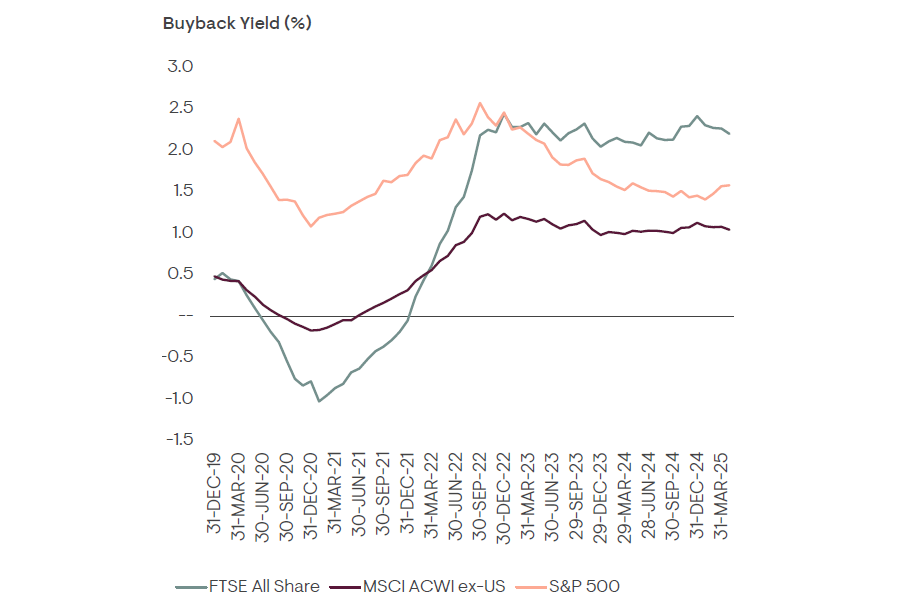

Since 2020, the average payout yield on the FTSE All Share has risen to around 6%, outpacing the S&P 500, as demonstrated by the chart below.

Total payout yield of major equity markets since 2020.

Source: Ninety One

Starting with 6% dividend yield gives UK investors a head start over many other equity markets, he explained. While the FTSE All Share may have grown less impressively than the S&P 500, the high starting yield means UK companies have “far less work to do” to achieve comparable total returns.

“You have to think about buying a stock over the long term. Some of your returns will be from growth, but in the UK, most of it will come from the dividend,” he added.

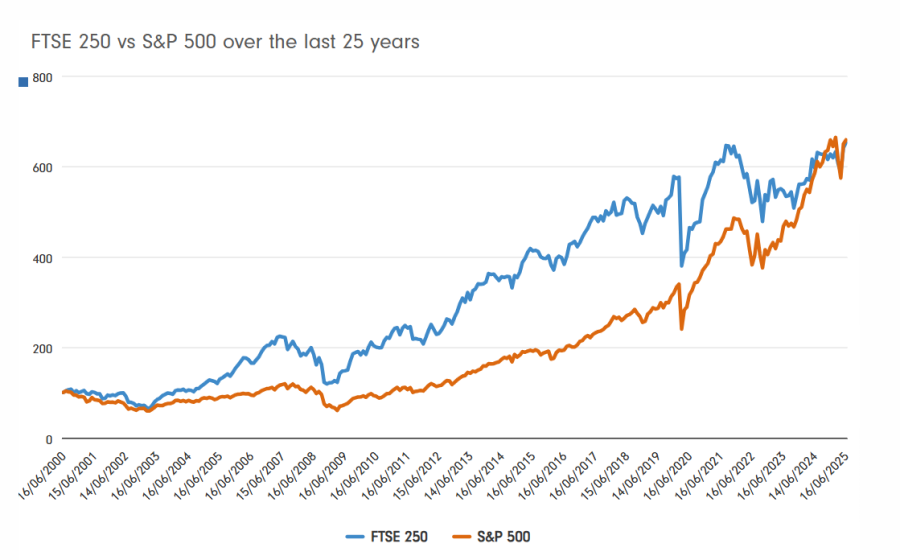

He is not the only investor to draw attention to this. Recent research from Fidelity International indicated that an investor who put a lump sum of £100 in the FTSE 250 25 years ago would have outperformed someone doing the same in the S&P 500, due to the influence of dividends.

Source: Fidelity International

Dicorrado said: “If the strong, good companies on the market continue to do even just okay, you’ll see it in earnings growth, you'll see it in payouts and you’ll see it in your return.”

This is part of the reason why the UK did not need a revival: the returns are already attractive and, by waiting for international interest, investors are missing out, he argued.

Additionally, interest from global investors would narrow the valuation gap between the UK and its competitors, creating a new set of challenges.

This is because cheap stocks encourage share buybacks, he said. While the UK has always been a high dividend-paying market, historically it was not big on share buybacks and UK businesses used to “waste a lot of money” before the pandemic.

Nowadays, UK businesses are much more careful with capital than they used to be. Instead of sitting on excess capital or buying other companies, more UK businesses are considering buying back their stocks and investing internally, with the buyback yield on the average FTSE All Share company rising to around 2.5% over the past five years.

Share buyback yield of developed markets since 2020

Source: Ninety One

This process of share buybacks is primarily a “function of valuation”, he explained.

“If you buy back stock at a cheap valuation, you're compounding the per-share earnings of whatever investor remains. It’s like the end investor buying more of the stock, except the business is doing it for them.”

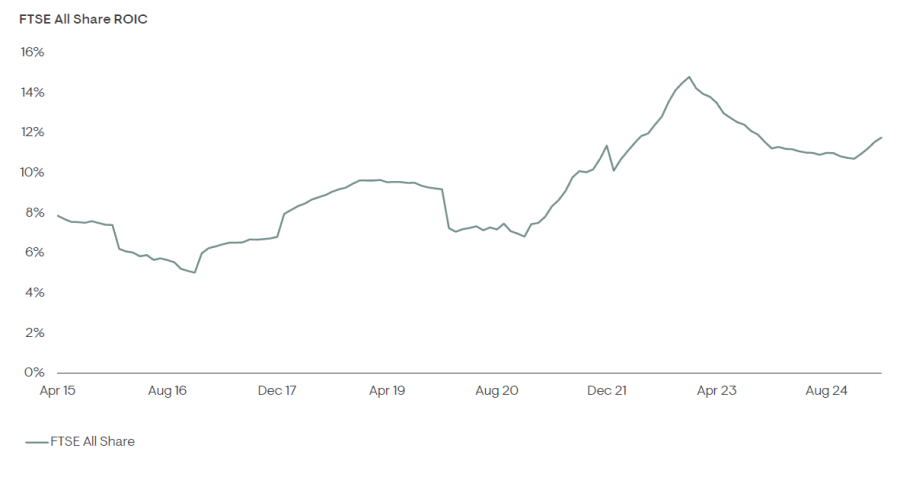

Internal investment has also made UK businesses much stronger and tightly run, with the return on investor capital (ROIC) of the FTSE All Share doubling in the past decade.

FTSE All Share ROIC since 2015.

Source: Ninety One.

“We got consumer staples in the UK that are cheaper than consumer staples in the US and we’ve got industrials and capital goods that are cheaper than in Europe.”

If international investors do come back, he explained, these stocks will likely rerate upwards, which would boost returns, but it would also make share buybacks far less compelling.

“We don’t want the market to die, of course, but we want it to remain cheap,” Dicorrado said. “So I don’t think you need that [international interest] to make the call to invest in the UK.”

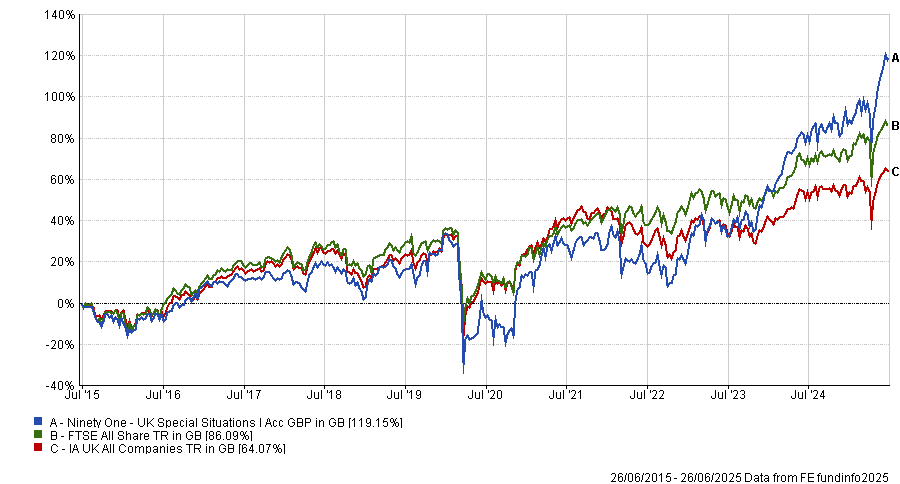

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics. Total return in pounds sterling

Ninety One UK Special Situations has delivered top-quartile returns in the IA UK All Companies sector over the past one, three, five and 10 years, while outperforming the FTSE All Share over all these periods.

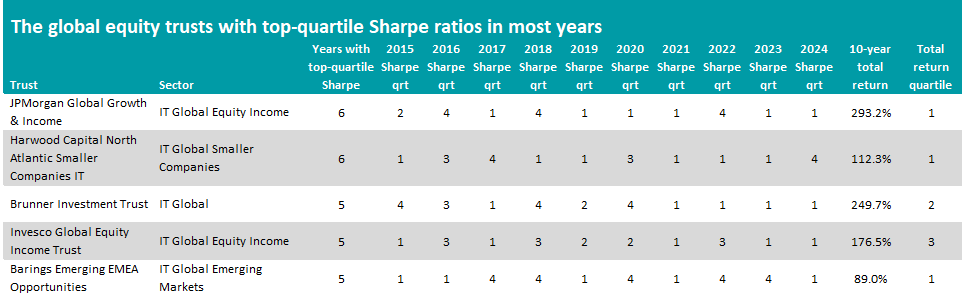

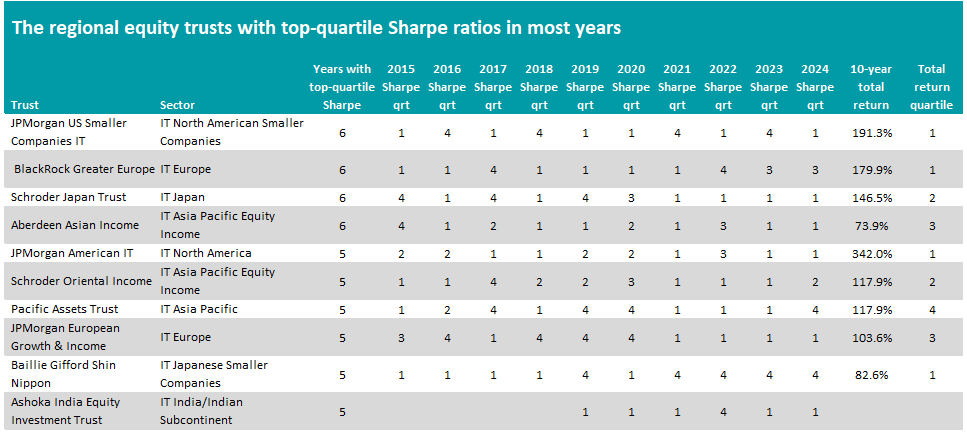

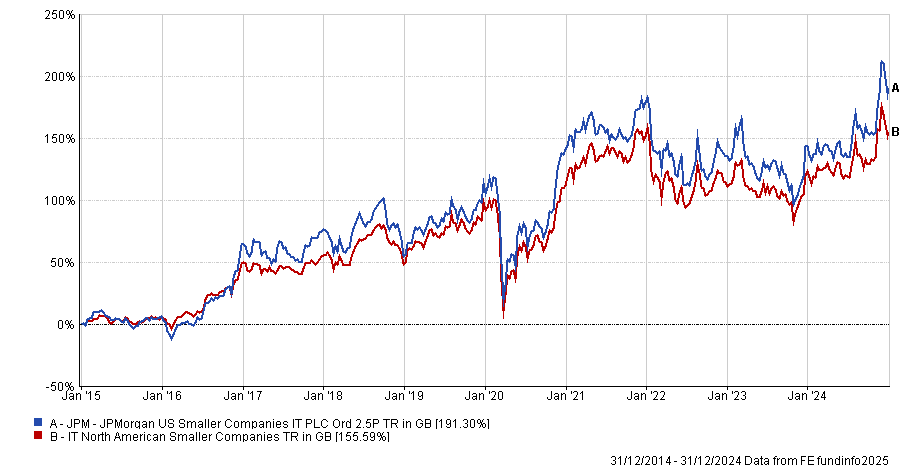

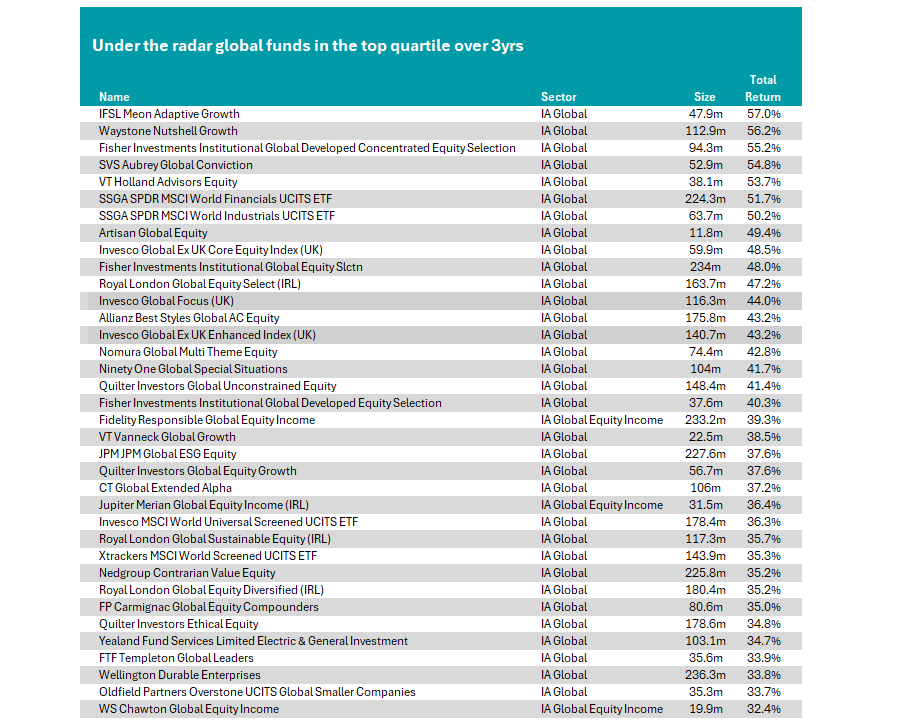

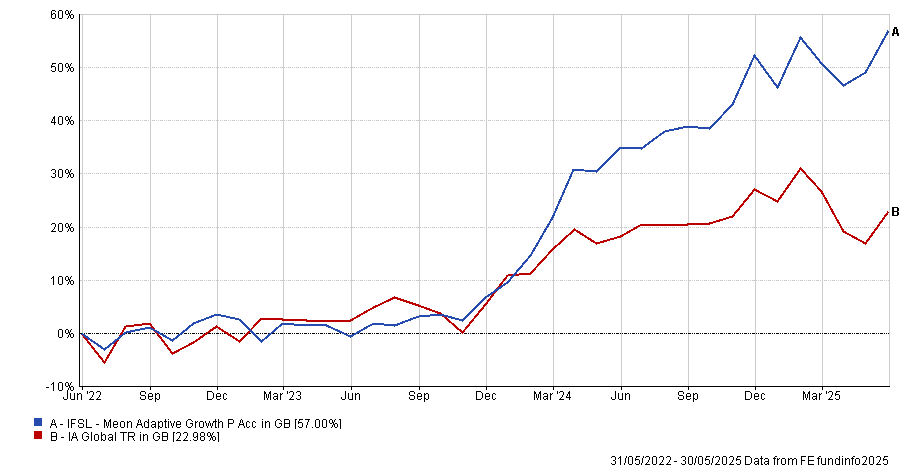

Trustnet finds five global investment trusts with strong risk-adjusted returns year in, year out.

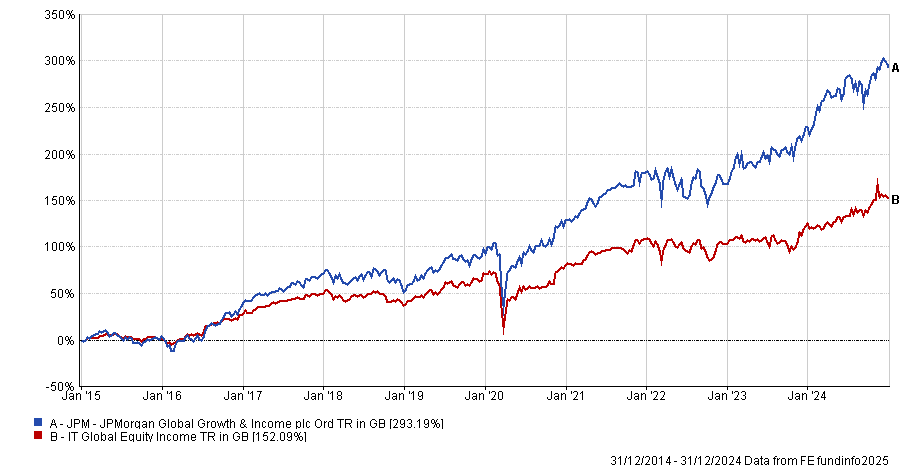

JPMorgan Global Growth & Income and Brunner Investment Trust are some of the global investment trusts with some of the highest Sharpe ratios of their sectors over the past decade, Trustnet research shows.

The Sharpe ratio – which calculates the excess return earned per unit of volatility – can be used by investors to assess whether an investment’s returns are worth the level of risk. A higher Sharpe ratio means an investment has a higher return for each unit of risk.

In this article, Trustnet examines the IT Global, IT Global Equity Income and IT Global Emerging Markets sectors for investment trusts that have made a top-quartile Sharpe ratio in at least five of the full calendar years of the past decade.

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

JPMorgan Global Growth & Income is at the top of the table as it has generated a first-quartile Sharpe ratio in six of the past 10 full calendar years. It also made a 293.2% total return over this time, putting it in the top quartile of the IT Global Equity Income sector.

Managed by Helge Skibeli, Timothy Woodhouse and James Cook, the trust is designed to be a core holding that provides exposure to companies with superior quality of earnings and faster growth, without being expensive.

At present, the portfolio is split between ‘high-growth cyclicals’, such as tech stocks with exposure to the artificial intelligence theme, and ‘low-growth defensives’, which includes overlooked areas such as defensive infrastructure, healthcare and defensive consumer.

Analysts at Kepler said: “In our view, JPMorgan Global Growth & Income’s outperformance of its benchmark, the MSCI ACWI index, in every calendar year since 2019 is particularly impressive, given the varying market environments over this period.

“We think it is worth noting that this outperformance was driven by stock selection rather than sector or country allocation, highlighting the managers’ stock-picking skills.”

Performance of JPMorgan Global Growth & Income vs sector over 10yrs to end of 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

JPMorgan Global Growth & Income has absorbed three investment trusts since 2022 and is expected to combine with Henderson International Income Trust in July 2025. The managers and strategy will remain unchanged.

Harwood Capital's North Atlantic Smaller Companies is the only other trust to make a top-quartile Sharpe ratio in six of the past 10 full calendar years. This came with a total return of 112.3% over the decade in question.

It resides in the IT Global Smaller Companies sector but, as its name suggests, invests in businesses based in countries bordering the North Atlantic Ocean.

Manager Christopher Mills can invest in both quoted and unquoted companies, with the sustainability and growth of long-term cash flow being key considerations for any investment.

Last month, Mills said: “The trust has for a number of years maintained substantial cash balances. However, given the collapse in the value of UK equities due to mass redemptions and the panic that is spreading across equity markets courtesy of president Trump, I believe now is the right time to start to deploy our liquidity into companies where we either understand the financial impact of a potential global trade war or where there is little or no impact.

“Obviously, calling a bottom in markets is never easy and we will cautiously deploy our liquid reserves.”

Brunner Investment Trust is in third place with a top-quartile Sharpe ratio in five of the 10 years and a first-quartile total return of 249.7%. Residing in the IT Global sector, it is managed by Allianz’s Christian Schneider.

The trust aims to “thrive in all market conditions” by balancing quality, value and growth when seeking best-in-class businesses. Key to the approach is buying and selling at the right valuations; the management team try to invest before a stock reaches its full potential but sell before it looks overdone.

Kepler said: “Brunner looks well placed to navigate varying market environments, thanks to its strategy of balancing quality, growth and value factors, resulting in a versatile portfolio.

“This adaptability is underpinned by a strong track record, with Brunner being one of the best-performing strategies in the AIC Global sector over the past five years.”

Analysts added that this strong performance is not solely down to the diversification across factors, as stocks added in the past 12 months have been strong contributors and also demonstrate successful stock selection.

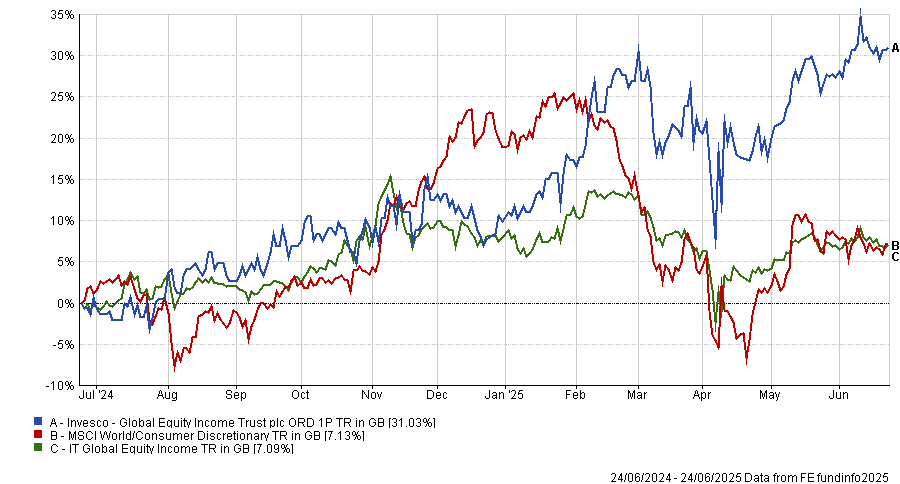

Invesco Global Equity Income is the only other trust on the shortlist to make a return of more than 150% over the 10 years examined in this research.

Managers Stephen Anness and Joe Dowling invest in high-quality companies trading at attractive valuations and often buy them following a period of weakness.

They also divide the portfolio into three buckets: companies that can grow their dividend over time, those with low yields but strong growth potential and those with short-term challenges but a chance to restore their dividend.

In a recent update, the managers highlighted how they attempt to build an ‘all-weather’ portfolio, rather than one that bets on specific economic or market outcomes.

“We choose not to second guess these outcomes, rather focusing our time and energy on building a diversified portfolio of high-quality businesses, trading at attractive valuations from the bottom-up,” they said.

“Diversification is key in this market as we can’t rely on one definitive economic outcome. We will continue to work through the economic implications at an individual business level, but with the focus entirely on building a robust portfolio that can perform through different environments.”

JPM US specialist Katie Magee explains why recent trends in US mega caps are unlikely to repeat.

The US has been a hard place to be, but investors should not be too quick in writing the market off entirely – although they might have to look outside of current darlings like tech stocks.

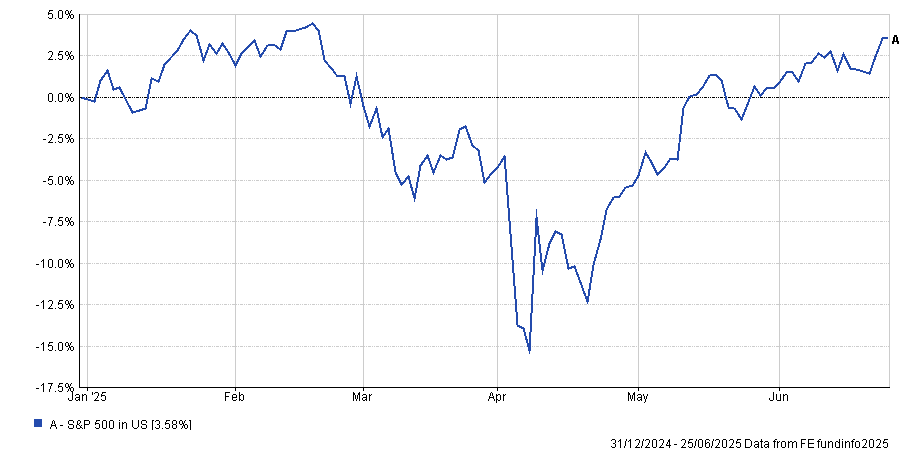

The extreme policy volatility has caused the S&P 500 to fall by as much as 15.3% in dollar terms during April, with some investors beginning to reconsider their allocations in favour of other regions, such as Europe and the UK.

Nevertheless, letting recent volatility distract them from the long-term potential of the US market is a mistake, according to Katie Magee, US equity specialist at JP Morgan Asset Management.

The US can generally rally from a downturn, and while April’s volatility was dramatic, the S&P 500 recovered most of the ‘Liberation Day’ losses within a month, as demonstrated by the chart below.

Performance of the S&P 500 year to date

Source: FE Analytics. Data in US dollars.

As analysts from Brewin Dolphin noted earlier this week, underperformance does not mean the US is no longer attractive.

However, recent volatility does mean the opportunity set is changing, according to Magee.

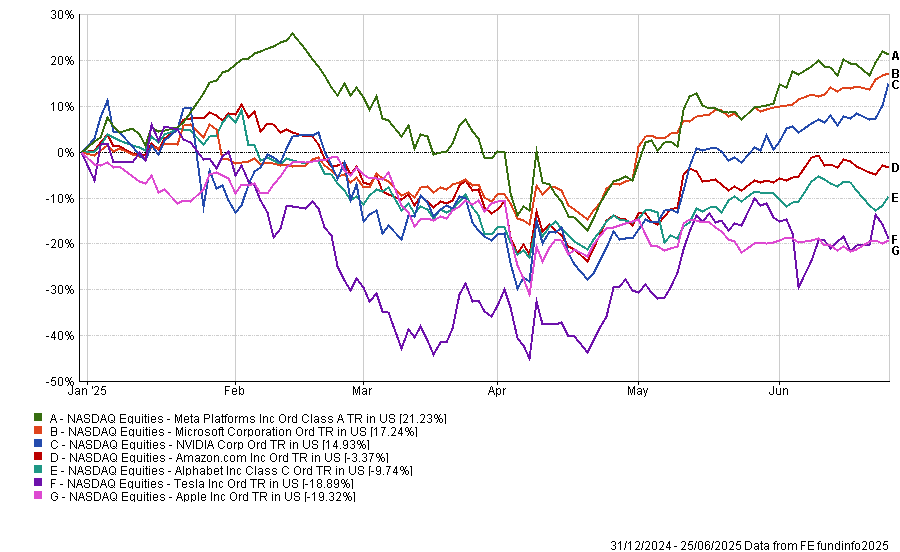

While artificial intelligence (AI) is still a transformational development, AI companies will struggle to generate the returns they used to. This trend is already starting, with four of the ‘Magnificent Seven’ (Apple, Nvidia, Microsoft, Tesla, Meta, Alphabet and Amazon), down so far this year.

Performance of the Magnificent Seven year to date

Source: FE Analytics. Data in US dollars

“I don’t think the dynamics we’ve seen over the last couple of years are going to repeat themselves.”

Instead of these handful of mega-cap tech stocks being the main driver of performance, investors should expect the market to broaden out and earnings growth to moderate, she said.

For example, Magee is a strategist on the JPM America Equity and JPM US Select Equity Plus funds, which posted top-quartile returns in the IA North America sector over the past five years due to stock selection across multiple sectors, including technology. However, the funds have struggled to maintain these strong returns this year as market have been volatile, with both sliding into the bottom quartile of the peer group.

Magee explained that as part of their active approach, they have been gradually reducing their tech allocation taking profits from stocks that have performed well, and redistributing this capital to other areas within the portfolio, such as financials.

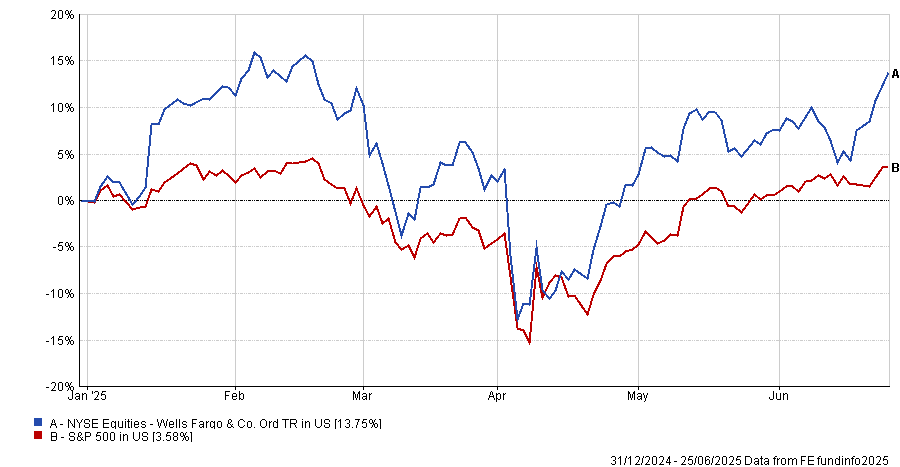

JPM US Select Equity Plus has US bank Wells Fargo as the ninth largest position and it is performing well. So far this year, Wells Fargo is up 13.8%, a 10-percentage-point outperformance compared to the S&P 500. This follows earnings reports coming in above expectations and the Federal Reserve ending a cap on its assets, which has been in place since 2018.

Performance of stock vs the S&P 500 YTD

Source: FE Analytics. Data in US dollars

However, banks in general are looking more appealing, Magee said. Larger banks are benefitting from a wave of structural change, including the push for deregulation and an interest rate environment that, while still unclear, looked more broadly supportive.

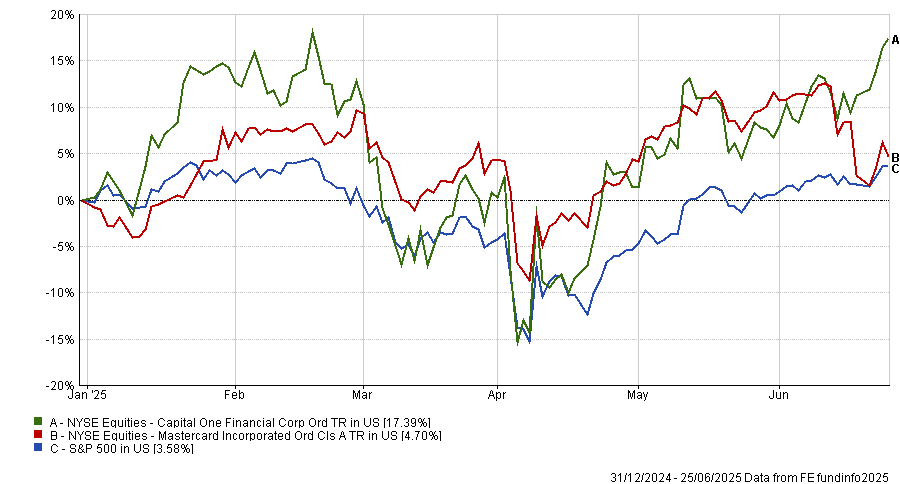

Elsewhere in financials, “as payments move away from being cash-based,” insurance and digital payment companies looked appealing. MasterCard and Capital One are good examples, which are already in their portfolios and have outperformed the S&P 500 so far this year.

Performance of stocks vs the S&P 500

Source: FE Analytics. Data in US dollars

Other recent opportunities that have caught the team's eye include the consumer space, with “off-price retailers and affordable restaurants” standing out.

She argued that these will be “less affected by tariffs” than some other US businesses and consumers have more emphasis on value for money, which is broadly supportive of higher spending.

Additionally, the US consumer was in a strong position and still drove most of the US gross domestic product (GDP), she argued. “We’d seen real wage growth be pretty reasonable for the US, consumer inflation had dropped from its peaks and unemployment rates were low. From our perspective, those themes remain in place,” she concluded.

“It’s not just been mega-cap tech driving performance this year and that’s been good. There are opportunities to be found across the board.”

New fund targets premium yield and long-term growth for income investors.

Aegon Asset Management has launched the UK-domiciled Aegon Global Income fund to invest in a high-conviction portfolio of companies expected to sustainably grow their dividends over time.

Managers Mark Peden, Douglas Scott and Robin Black will mirror the strategy of their $1bn Irish-domiciled Aegon Global Equity Income fund. The UK version aims to provide an income equivalent to 130% of the yield of the MSCI AC World index over a seven-year period.

“The launch of the Aegon Global Income fund is a direct response to client demand for a UK-domiciled version of our successful global equity income strategy,” said Peden.

It will target companies with strong cash flows, stable balance sheets and consistent earnings, capable of growing dividends sustainably, while avoiding areas of the market where high yields are judged to come with significant risks.

“With global dividends reaching record highs for four consecutive years and the dividend universe expanding to include global tech giants and other non-traditional players, we believe this is a golden age for income investing and our disciplined, time-tested process is well-positioned to deliver both premium yield and long-term growth,” said Peden.

ESG factors are also integrated into the investment process.

Trustnet’s Gary Jackson asks if the market has got too used to Donald Trump backing down.

TACO, or Trump Always Chickens Out, is the kind of acronym that markets shouldn’t take seriously but have been in 2025. With the 90-day tariff pause from Liberation Day set to expire on 8 July, the question now might not be whether Trump will make another threat but whether this time he might actually follow through.

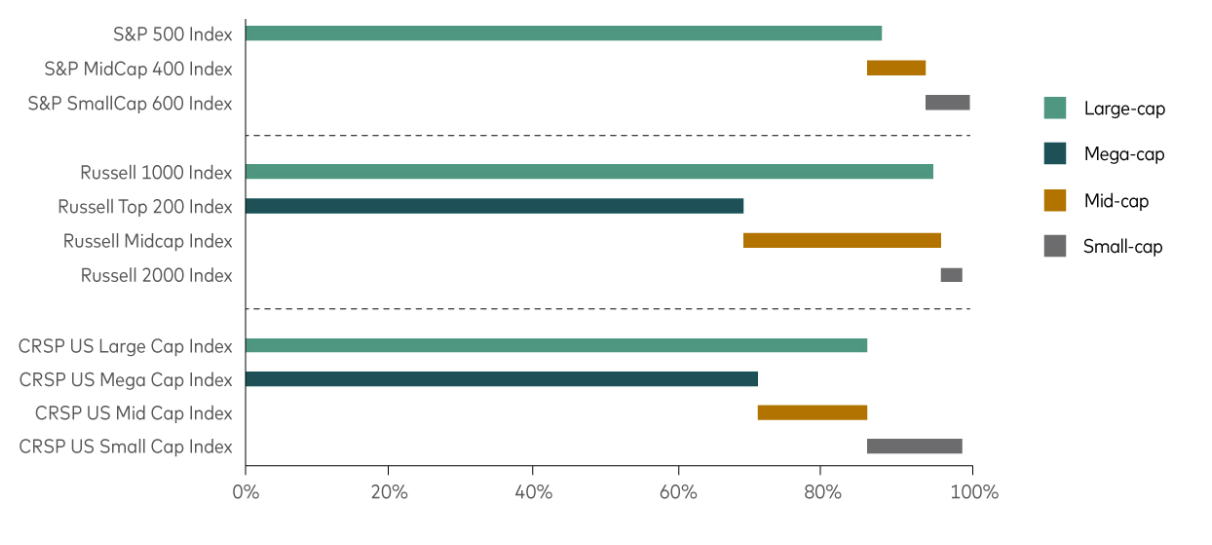

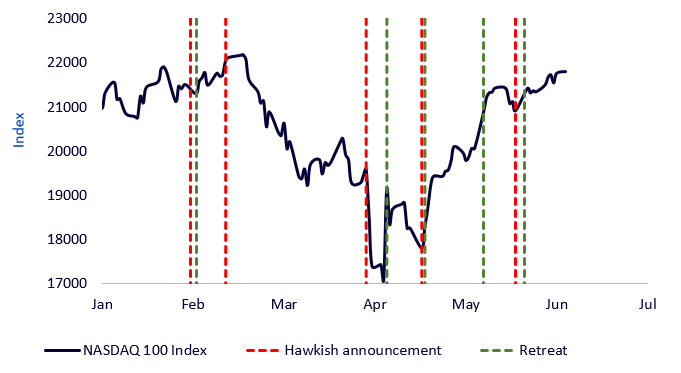

Coined by FT columnist Robert Armstrong, TACO has become a shorthand for a trading pattern that’s shaped much of this year: a Trump policy threat sparks fear, markets tumble, the US president pulls back and then markets rebound. The Nasdaq 100 has become the main stage for this drama.

Mobeen Tahir, director of macroeconomic research & tactical solutions at WisdomTree, said: “It describes president Trump’s pattern of making bold policy announcements, like imposing tariffs or threatening the US Federal Reserve, only to retract and soften later. This, of course, has resulted in significant market volatility.

“For investors in the Nasdaq 100, TACO has created a rollercoaster ride. For those inclined to trade tactically around these sharp market fluctuations, there have been plenty of opportunities to take views in either direction.”

The rhythm has been pretty consistent, almost to the point of a policy threat on Monday, a softening on Wednesday and a rally by Friday. Tahir explained that a typical reaction of the Nasdaq 100 to the US administration’s announcements has been “negative in response to the hawkish announcements and positive following the subsequent retreats.”

The Nasdaq and the TACO trade

Source: WisdomTree, PBS News, ABC News, Bloomberg, as of 10 Jun 2025

There’s no shortage of examples. In February, Trump signed an executive order slapping tariffs on Mexico, Canada and China. The Nasdaq 100 dropped. Two days later, he paused tariffs on Mexico and Canada. Markets bounced.

In April, he revived reciprocal tariffs – his Liberation Day – and the index sold off again. A week later, a 90-day pause was announced. Cue the rally.

May brought threats against the EU and Apple, and once again, markets whipsawed before those threats were delayed.

US policy announcements and Nasdaq reaction

Source: WisdomTree

Of course, it’s worth asking: is this really Trump backing down or was there never a real intention to follow through? Maybe these aren’t policy reversals, but strategic bluffs or strongarm negotiating tactics.

Regardless if it’s chickening out or The Art of the Deal, the market has learned to trade them like clockwork. And that’s where the risk lies.

“One hypothesis is that the TACO trade may be over because markets have become immune to new hawkish announcements from president Trump, knowing they will eventually be reversed or at least dialled down,” Tahir said.

“If markets anticipate this pattern, new tariff threats no longer deliver a shock effect.”

The danger, though, is that this perceived ‘immunity’ is not genuine resilience. Rather, it could just be a new habit. Markets are no longer pricing the threat but a pattern, and if that pattern breaks, the fallout could be significant.

So the question now isn’t whether Trump has bluffed before or backed down, because he has. The question is what happens when he doesn’t. What if one of these threats sticks? What if a 50% tariff on EU goods actually goes into effect?

Or if he acts on his past threat to fire Jerome Powell as Fed chair? What if companies like Apple, already walking a tightrope on global supply chains, face punitive tariffs for failing to move manufacturing back to the US?

Tahir summed it up: “What if president Trump announces a hawkish measure and does not retreat? What if he delivers a surprise that truly catches markets off guard?”

The scenarios might seem outlandish, but they’re just past threats that didn’t materialise. That’s what makes them dangerous: they’ve been seen as noise, not risk.

The Nasdaq 100, in particular, has become the lightning rod for this behaviour. Its high concentration of growth stocks, global revenue exposure and sensitivity to rate expectations make it vulnerable to shocks that challenge the TACO assumption of policy reversals.

None of this means that Trump will follow through next time. He may well continue to use threats as leverage without enacting them. But markets might not be properly hedging the possibility that he won’t. And when everyone’s on the same side of a bet, being wrong is rarely a trivial matter.

The TACO trade has worked because it’s been predictable. But when patterns become too predictable, markets stop preparing for the alternative. If 8 July arrives without a walk-back – if the tariff suspension expires and the bluff turns real – it won’t be just another dip to buy. It will be a lesson in just how fragile those expectations really were.

Gary Jackson is head of editorial at FE fundinfo. The views expressed above should not be taken as investment advice.

Chelsea’s Darius McDermott selects a defensive portfolio for uncertain times.

Excitement has its place in investing but perhaps not when markets are as unpredictable as they are today. With wars ongoing, chaotic tariff policies and artificial intelligence (AI) upending industries, many investors are ditching risk in favour of reliability.

“Appetite is growing for boring, predictable funds that can weather the storm,” said Darius McDermott, managing director at Chelsea Financial Services. “They are not built to shoot the lights out – their goal is to deliver consistent, incremental returns.”

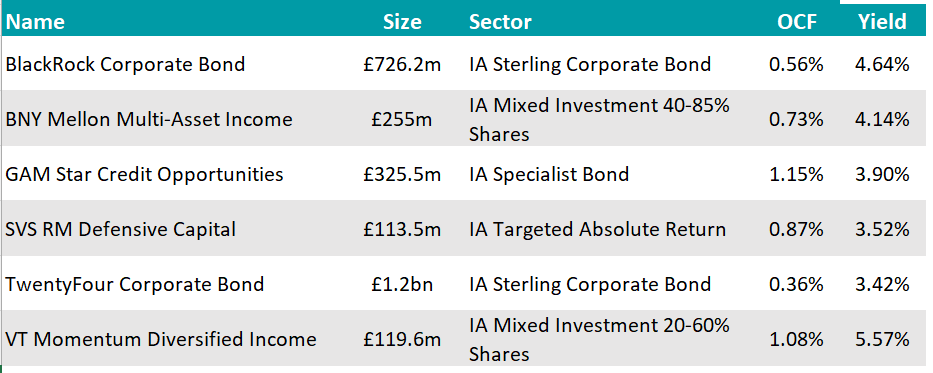

For defensive investors and for those that have an investment horizon of five years or less, McDermott believes a carefully constructed, lower-volatility portfolio is the answer. Below, he put one together that can serve as an example, focusing on multi-asset, absolute return and fixed income strategies designed to smooth the ride through market turmoil.

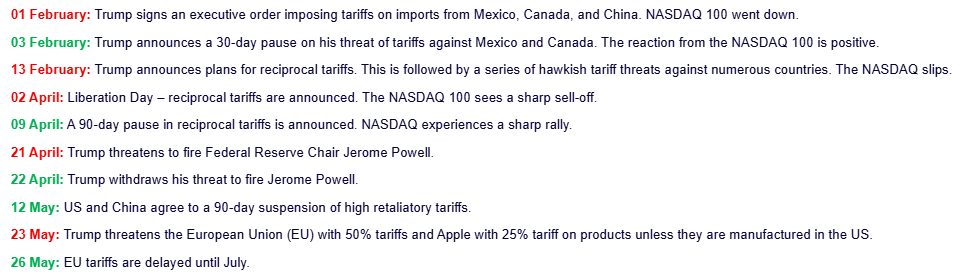

His first port of call was multi-asset funds that “bring genuine diversification”, such as BNY Mellon Multi-Asset Income and VT Momentum Diversified Income – a split of the two should make up 40% of the portfolio.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The BNY Mellon strategy draws on Newton’s global research to deliver “a stable and growing income” alongside long-term capital growth.

The managing team (with Paul Flood as lead manager and Bhavin Shah as deputy) invests without any benchmark restrictions and are rated by RSMR and Square Mile analysts.

McDermott highlighted the fund’s strong performance record since its launch in 2015 – to today, the fund has outperformed the IA Mixed Investment 40-85% Shares sector average by 24 percentage points.

VT Momentum Diversified Income is also a “well-diversified” global fund focussing on income though a “common-sense approach that has helped it deliver better returns and lower volatility relative to peers”, according to the fund picker.

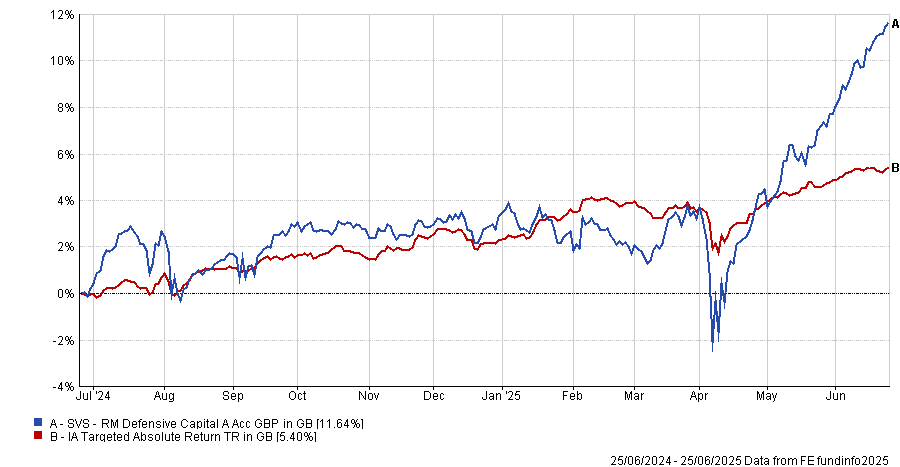

Next up was absolute return, which was given 15% of the overall allocation. Here, the choice was SVS RM Defensive Capital, an all-weather strategy with a focus on lower volatility and minimising downside risk.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Managed by Niall O’Connor, the portfolio combines bonds, equities and commodities and tends to have a value bias by avoiding expensive areas of the market, which makes it “another dull but more predictable option,” according to McDermott.

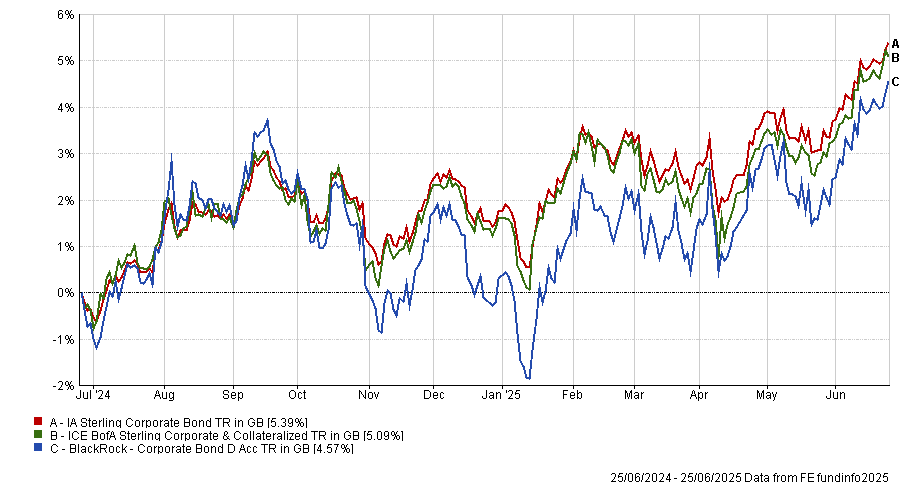

The rest of the portfolio was dedicated to fixed income, with the managing director first including a corporate-bond fund, BlackRock Corporate Bond, which should make up 15% of the overall portfolio.

He praised its flexibility and “proven ability to exploit inefficiencies in fixed income”.

Since Ben Edwards has been in charge from 2015, the strategy has delivered “excellent returns”, with its 30% upside over the past 10 years putting it in the first quartile of performance against the IA Sterling Corporate Bond average of 27.5% – all the while taking “significantly less risk than the rest of the sector”, McDermott noted.

This result hasn’t been achieved over more recent times frames, however, with the vehicle dropping to the third quartile of performance over the past five and three years, and to the last over the past 12 months, as shown in the chart below.

Performance of fund against index and sector over 1yr

Source: FE Analytics

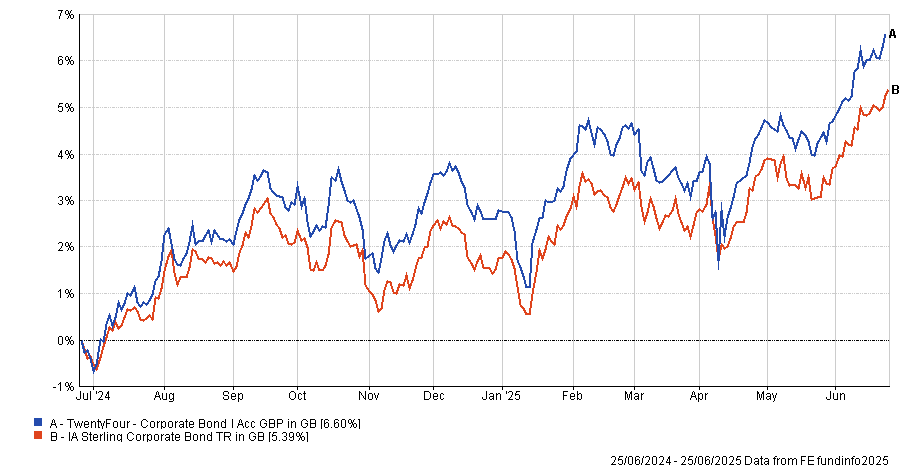

To continue in the same area, TwentyFour Corporate Bond also deserved a place and another 15% of the budget.

For McDermott, manager Chris Bowie has built “one of the most dependable funds in the space”, aiming to deliver high income with minimal volatility. It is currently in the IA Sterling Corporate Bond's first or second quartile over one, three, five and 10 years, making a top-quartile 31% total return over the past decade.

Square Mile analysts appreciate its approach of mixing “a healthy degree of interest rate risk, which could prove to be an attractive diversifier in a balanced portfolio, as well as exposing investors to credit risk and the extra returns above government bonds which this should generate over time”.

Performance of fund against index and sector over 1yr

Source: FE Analytics

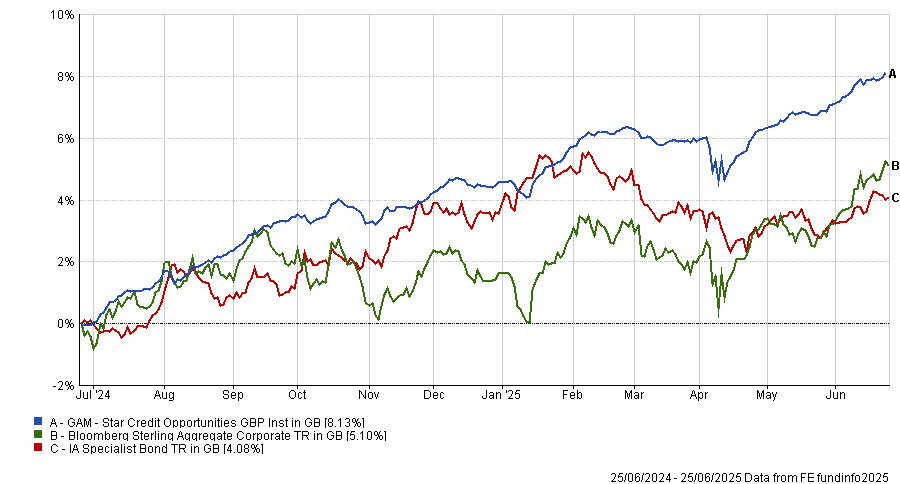

Finally, while it carries slightly more risk, GAM Star Credit Opportunities was McDermott’s last pick, which offers “an attractive option for income seekers” and accounts for the final 15% the portfolio.

“By focusing on the strongest companies further down the capital structure, the fund generates a high yield while maintaining quality,” he said.

It is co-run by FE fundinfo Alpha Manager Anthony Smouha, who follows the philosophy that investment-grade companies rarely default and by extension their higher-yielding junior debt rarely defaults.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The fund has a strong bias towards financials such as banks and insurers. For RSMR analysts, its low sensitivity to changing interest rates is compelling.

They said: “The simple approach of investing in quality companies via junior credit and using the capital structure to derive higher returns has been a cornerstone of the investment approach for a long time and has led to attractive returns for investors willing to tolerate some volatility at times of market stress.”

Despite the slightly higher volatility, the fund achieved a first-quartile performance against its IA Specialist Bond peers across all main timeframes.

Source: FE Analytics

AJ Bell’s James Flintoft assess both the opportunities and the risks of investing in China.

A decade ago, China launched an industrial strategy to upgrade to a high-tech industrial base called ‘Made in China 2025.’ Little did they know it would be finalised in a year when their main economic rival would attempt to definitively pivot towards protectionism.

It could be that the authorities anticipated the struggles they would experience in shifting economic growth from a reliance on the property sector and the uncomfortable comparisons that would bring with Japan’s lost decades.

For equity investors, the reforms to the property sector have had a profound impact, compounded by the first trade war and a crackdown on the freedom of technology companies.

The main Chinese equity indices are lower over the past five years to the end of May. Onshore/offshore, A, B and H share indices have at times lost more than 40% of their value in sterling terms, and some over 55%.

Amid so much negative sentiment in early 2024, index valuations, as measured by the forward P/E, dropped to 20-30% of their post-global financial crisis (GFC) averages¹.

In the second half of the year, government initiatives unleashed an almighty rebound, with some indices rising over 30% in a matter of days. Expectations of earnings upgrades compounded upon the low starting valuation. The rally cooled as the year end approached, however 2025 has seen a similarly dramatic performance, albeit this time with differentiation.

January’s release of the DeepSeek R1 AI model was a defining moment, challenging the prevailing wisdom that US companies would dominate in AI. This set in motion another ferocious rise in large cap H shares.

In times of divergence in markets, strategic asset allocation decisions, such as benchmark selection, can show up in unexpected ways for those unaware of the nuances.

Any equity region has several indices available. At its most obvious, this can be the intended coverage of the index in terms of region, think pan-European versus Europe ex-UK. However, the difference often lies within the index provider methodology, where free-float adjustment, inclusion criteria and country classification can have an impact on the profile of the index.

China and the wider region have important and often ignored issues here. The broadest definition of China (Greater China) includes Hong Kong and Taiwan. Over the past three years it has paid to invest in the MSCI Greater China index, or strategies that manage around it, because it has a large allocation to TSMC and hence rode the dominant tech/AI theme in wider markets.

If on the other hand you specifically targeted A shares, you missed out on this trend and the 2025 H share rally too.

The MSCI Greater China index meanwhile has had the H share gains this year eroded by exposure to the wider tech sector, namely TSMC and its close association with the US AI champions.

That is where slightly broader China indices come in handy, such as MSCI China. This index does not include Hong Kong and Taiwan, but does target an A share component, alongside H shares, P chips and Red chips. A shares are capped by index inclusion criteria and inclusion ratios.

Failing to assess the underlying positions of a passive or active holding with respect to these differences may have seen a few investors surprised with how their portfolios have performed this year.

Turning to where we stand today, there has been a re-rating, meaning valuations across China equity indices sit much closer to the post-GFC averages. In other words, the easy money has been made, especially when you consider the relative performance to US equities.

China is still on the cheap end of the spectrum when looking across other regions. The shift in narrative around AI and the benefits of Made in China 2025, which now means manufacturing in China is not all about cost, could be felt for some time.

Of course, other factors explain some of the valuation discount. The elephant in the room is Taiwan. Most are aware of the invasion risk, but it is unpredictable.

There are different approaches to these types of risk. Perma-bears can be very well appraised of the minutiae of risks but can frustratingly miss out on opportunities whilst holding the intellectual high ground. Others, meanwhile, may continue investing without fully appreciating their exposure, until it matters.

We prefer a more nuanced approach: recognising both the opportunities in China and the risks that may require careful management. That’s why in 2025 we moved our asset allocation to an Emerging Markets ex-China model, with dedicated allocations to China that allow quick and efficient changes to exposure should we need it.

For many this was a pressing issue when China accounted for over 40% of the MSCI Emerging Market index back in 2020, but it remains an obvious risk management improvement that allocators can make to their processes.

¹Between 01/01/2010 and 31/12/2023.

James Flintoft is head of investment solutions at AJ Bell. The views expressed above should not be taken as investment advice.

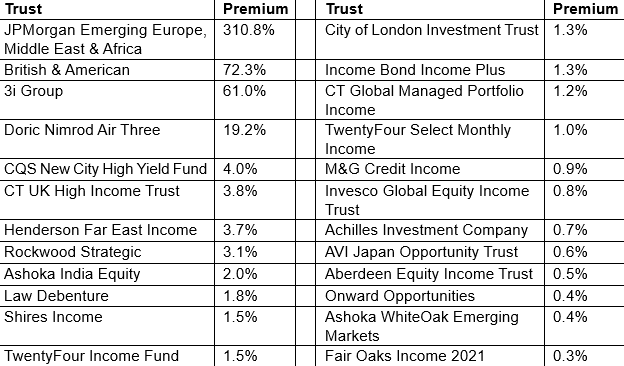

More trusts are moving above NAV as investors reward income, reliability and unique holdings.

More investment trusts are trading above their net asset value (NAV) this year compared to 2024, as investors grow more willing to pay extra for dependable income, a proven track record or access to rare opportunities.

According to data from AJ Bell and the Association of Investment Companies (AIC), 24 investment trusts now trade at a premium, compared with 19 this time last year – still a far cry from the 88 premium-rated trusts in 2015, but a noticeable shift in sentiment after years of discount dominance.

For Dan Coatsworth, investment analyst at AJ Bell, investors are showing greater willingness to pay up for certain strategies.

He said: “Trusts currently commanding a premium rating are ones that either specialise in income, have a track record of beating the market or provide access to unique, unusual or scarce assets.”

Investment trusts trading on a premium to NAV

Source: AJ Bell, AIC. Data as of 23 Jun 2025

One of the most consistent themes among premium-rated trusts is income, which has been driven by falling interest rates and the repercussions on the cash market.

“Rates are starting to come down on cash savings accounts and that’s driving more income-hungry individuals back into equities and bonds in search of better yields,” said Coatsworth.

“Furthermore, the investment trust structure also enables a smooth ride with dividends as trusts can keep money in reserve to top up income payments in harder times.”

Some of the most prominent examples include CQS New City High Yield, CT UK High Income and Invesco Global Equity Income.

The latter in particular shows how sharply investor sentiment has turned, as it traded at about 12% discount in 2023 and 2024 and has now jumped to slightly above NAV – a status it hasn’t seen for four years.

That shift also partly reflects a 2024 restructuring that merged several Invesco Select strategies into a single, more focused vehicle, said Coatsworth.

Performance of trust against index and sector over 1yr

Source: FE Analytics

Some investors are also willing to pay a premium for reliability. In a volatile global environment, “they are happy to pay up for names that can demonstrate success wasn’t simply down to one lucky year”.

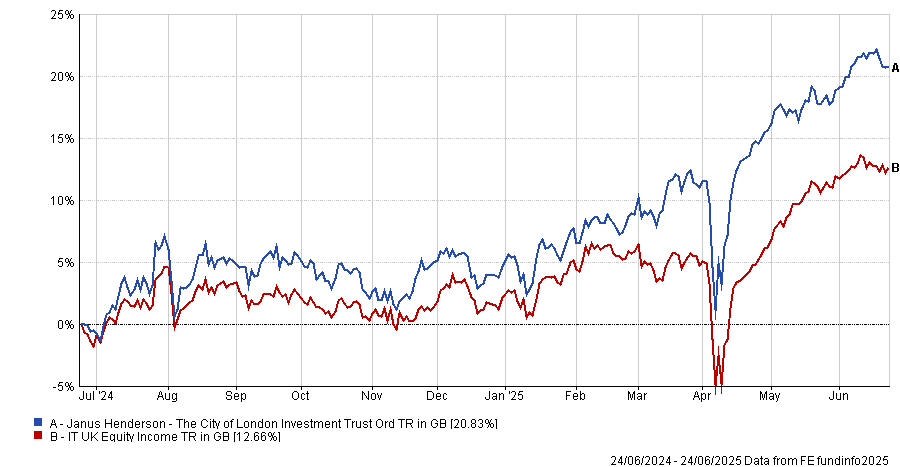

One example is the City of London Investment Trust, which is back on a premium after falling to a discount last year. Its appeal, according to Coatsworth, lies in both its strong yield and long-term track record of outperformance.

Over the past 20 years, City of London has delivered a 418% total return versus 283% from the broader UK stock market, but the strategy also achieved first-quartile returns in 2024, as the chart below shows.

Performance of trust against sector over 1yr

Source: FE Analytics

Its return to favour also reflects a broader recovery in sentiment toward UK equities, which have outperformed many global markets so far in 2025. This was an advantage because the trust is “effectively a ‘best ideas of the FTSE 100’ vehicle, which benefited from owning many of this year’s best-performing UK stocks”.

A smaller group of trusts are trading at a premium because they offer something that’s otherwise hard to access.

Private-equity trust 3i Group is a case in point. Its shares are priced more than 60% above NAV, largely due to its exposure to Dutch discount retailer Action, a private company that has become a rare source of fast growth in European retail.

“Action is growing fast and has all the hallmarks of Amazon in its early days,” Coatsworth said. “Its products are considerably cheaper than those of competitors and it constantly reinvests money back into the business.”

3i owns a 57.9% stake in Action and, for investors, buying the trust is effectively a long-term bet on the retailer’s continued expansion.

But there are other names in more unusual territory, such as the JPMorgan Emerging Europe, Middle East & Africa, which currently trades on an extraordinary 310% premium, up from 167% of January last year.

The trust, previously known as JPMorgan Russian, drastically wrote down its Russian holdings after the 2022 invasion of Ukraine, while some remain frozen. For Coatsworth, its premium rating indicates that some investors may be speculating on a potential thaw in geopolitical tensions.

“There is a suggestion that investors have recently been piling into the trust as a bet on Donald Trump ending the war in Ukraine and that Russian assets will be unfrozen,” he said.

In a recent update, the board of the trust said it believes that this premium “arises because of the uncertainty of what value if any should be attributed to the Russian assets and should not be interpreted as an indication that investors are more likely to derive any value from these assets”.

Despite the general uptick in investment trust premiums, Coatsworth noted that overall premiums remain far below historical levels. At the end of May 2015, nearly a third of investment trusts traded above NAV. Today, only 24 out of 435 trusts – about 5.5% – carry a premium.