The veteran manager calls for improvements on transparency and choice, among others.

One of the industry’s most-held funds, Fundsmith Equity has an enviable track record – it was almost perfect until 2021, when a combination of market forces and two badly timed sales impacted performance.

In the three years since, the fund hasn’t managed to beat the MSCI World index, a reason why earlier this year, it was included in Bestinvest’s Spot the Dog report for the first time.

Below, veteran manager Terry Smith justifies the underperformance against its “dog” status, discusses portfolio turnover and elaborates on the areas where the industry needs to improve.

Performance of fund against sector and MSCI World index over 3yrs

Source: FE Analytics

Can you describe your process?

We seek to buy good companies with a high return on capital employed, because that is the financial metric which shows they are creating value, and a source of growth to allow those high returns to be invested and compound in value. We try not to overpay and seek to hold them for the long term.

Why should investors pick your fund?

We aim to run the best fund ever, meaning the one with the highest return over the long term, adjusted for risk.

What were the best and worst calls over the past 12-18 months?

The worst was selling Amazon. We last sold it on 4 May 2023 at a share price of £83 and since then it rose a further 74% – that’s against the 26% growth of the MSCI World index in the same timeframe. At the beginning of June, the price was £145 per share.

The best was holding Meta, which went from £185 to £386, returning 108%. Since we first bought it in February 2018, the share price has risen almost 200% from £129.

Why has the fund underperformed of late?

Interest rates began rising in late 2021 and had a disproportionately large impact on stocks of the sort we own. They are high quality companies and therefore, on average, more highly rated than the market.

But the share prices fare worse than the average when rates rise, just as long-dated bonds fare worse than short-dated bonds in those periods. Also, my sales of Adobe and Amazon could have been better timed.

You bought and sold those two stocks in quick succession. Has turnover increased?

Minimising portfolio turnover remains one of our objectives. Last year it was 11.1%, just a little higher than usual and far less than the average fund manager.

In 2023, we sold our stakes in Adobe, Amazon and Estée Lauder and purchased stakes in Procter & Gamble, Marriott and Fortinet. This may seem a lot of names for what is not a lot of turnover as in some cases the size of the holding sold or bought was small.

We have held 10 of our companies for more than 10 years, five of which since inception in 2010.

What do you make of Bestinvest’s report finding Fundsmith was a ‘dog’ fund?

When Bestinvest issued its report, our main UK competitor's global fund had underperformed Fundsmith Equity by 16 percentage points over the period chosen by Bestinvest but was not rated as a "Dog”, which raises an obvious shortcoming of the methodology.

Also, one of the years included as a period of underperformance was 2021, when the fund returned 22.1%, only marginally behind the MSCI World Index that returned 22.9%. I don’t think many investors were unhappy with a 22.1% return that year.

We think investors should judge our returns over the long term, and since inception the fund is up 594% or 15.3% on an annualised basis, net of fees, compared with 11.8% for the benchmark MSCI World.

What do investors consistently get wrong?

They have too much of a home bias. Why should investors in the UK invest in the FTSE100? The UK is under 3% of global GDP. There is a whole world to choose from.

In what areas does the industry need to improve?

Firstly, transparency, for example making sure that investors can see how much they are being charged – not just in terms of management fees but also charging admin fees direct to the fund and not via the management company, and dealing costs.

Why are there ad valorem charges for some platforms which basically supply software?

Secondly, direct and clear communications explaining fund objectives and what has happened in plain language.

There are also far too many funds and too many intermediaries between the investor and the companies they invest in. Intermediaries always add costs.

What do you do outside of fund management?

I like to keep fit and practice Muay Thai. I have a history degree and still study the subject. I scuba dive.

Trustnet looks for global funds that are top decile in 2023 and over 2024 to date.

Significant holdings in tech darling Nvidia helped a handful of global equity funds to make top-decile returns last year and are keeping them at the top of the sector in 2024 as well, research by Trustnet has found.

Data from FE Analytics shows there are 16 IA Global funds that made first-decile returns in 2023 and are repeating this sector-topping performance over 2024 so far, with the majority of them holding the artificial intelligence (AI) chip giant in their top 10 holdings.

All of these funds follow the growth style of investing, which looks for companies that are expected to grow faster than the market. This style was hit hard in 2022, when interest rates were hiked, but has bounced back in the time since.

The 16 IA Global funds to have made first-quartile total returns in 2023 and over 2024 to date can be seen in the table below, ranked by their performance across the entire period. The top fund, however, is the only one without Nvidia among its largest positions.

Source: FE Analytics. Total return in sterling to 19 Jun 2024

WisdomTree Blockchain UCITS ETF invests in companies primarily involved in blockchain and cryptocurrency technologies, while excluding any that do not meet WisdomTree’s environmental, social and governance (ESG) criteria.

Stocks owned by the ETF fall into two categories: ‘blockchain enablers’, or the companies that develop building block components for blockchain ecosystems, and ‘blockchain engagers’, or companies that provide blockchain and cryptocurrency services and/or applications.

Among the top holdings are electronic trading platform Robinhood Markets, business intelligence provider MicroStrategy, cryptocurrency platform Coinbase Global and bitcoin mining data centre operators Iris Energy and Cleanspark.

While blockchain has enjoyed a strong run of late, WisdomTree expects this technology to be a long-term trend with applications in areas such as decentralised finance, Web 3.0 and the Metaverse.

“Blockchain technology is undoubtedly a revolution in the making. Wherever a transparent, immutable and digital record of information could be useful, blockchain has the potential to disrupt the status quo,” the firm said.

“The variety of applications and use cases for blockchain are becoming more apparent and can be seen across many industries. As such, the range of potential applications for the technology is far-reaching and the future looks bright for companies involved in the blockchain, even if we are at the early stages of proliferation.”

However, this is not the only tech trend that has helped some funds top the IA Global sector in both 2023 and 2024 to date. The appearance of the Polar Capital Artificial Intelligence fund in third place reflects the boost in AI stocks that followed the ‘ChatGPT moment’ in late 2022.

Since OpenAI launched ChatGPT, generative AI has been a hot theme and has underpinned much of the performance of the global equity market over the past two years.

Again, advocates of this technology do not see it as being a short-term surge, with Polar Capital Artificial Intelligence’s managers earlier this year saying: “Generative AI is a rare example of discontinuous technology change. We are at a critical turning point where an entirely new compute architecture/stack is required and, as per earlier technology cycles, prior winners are unlikely to be the future leaders.

“The large incumbents know what the technology is and what they need to do but their business models (like Search in the case of Google) are built around legacy technology. While a transition is possible, the current pace of AI progress threatens to widen the gap between leaders and laggards until it happens, not to mention the room it leaves for new entrants to gain a foothold, such as OpenAI.”

An example of a company benefitting from the rise of AI is Nvidia, which is seen as one of the major ways to take exposure to the AI theme because of its leading role in developing advanced graphics processing units (GPUs) that power AI applications. Its technology is essential for training and deploying machine learning models across various industries, making it a key player in the AI sector.

Even the funds on the above list of outperformers that are not dedicated tech strategies can credit their strong returns to this theme. Every one aside from WisdomTree Blockchain UCITS ETF have a top 10 holding in Nvidia, the latest available positioning data shows.

The stock has rocketed since 2022’s ChatGPT moment, which caused investors to flock to companies linked to the rollout of AI. A group of these companies known as the Magnificent Seven (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) have performed especially well and all of the funds (again, apart from WisdomTree Blockchain UCITS) own more than one of these stocks in their top 10.

Mark Baribeau, head of global equity at Jennison Associates and manager of the PGIM Jennison Global Equity Opportunities fund (which appears in second place in the table above), said: “In uncertain times like these, there are still companies that can manage to remain on the cutting edge by making our daily lives more efficient with new products or by helping us to work together more productively with new services. These companies, which should continue to see healthy customer demand and sales growth, offer the kind of investment opportunities we seek.

“In general, we think successful growth investing requires a selective and active approach focused on carefully weighing the long-term opportunities against the risks. There will be more market volatility in the months ahead and stock picking will become paramount, creating challenges for passive investors. Active managers can look through the short-term noise and focus on the bigger long-term opportunities by spotting secular growth trends early.”

Splitting your money across a number of potential winners is a better strategy than backing the favourite.

Investing has a lot in common with horse racing. Both are gambles, but with enough study you can make an informed decision that gives you a better chance of success.

In the horseracing world, this means lower returns, as bookmakers shorten odds to ensure they pay out less if the favourite wins.

Investing, however, does not have such a problem. You back the right horse (or in this case, fund) and the returns are expected to be even higher than if you had gone for something else.

This analogy sprung to mind this week with Royal Ascot currently running – possibly the crown jewel of the horseracing calendar.

I enjoy a flutter on the races, but my strategy with horses is much like my investing pot. I put in what I can afford to lose and I spread it out on horses in each race, always betting each-way (where you get paid for the winner but also if your horse comes second, third, or in some cases even further back).

This strategy has worked well enough – I’m never going to pay off my mortgage this way, but nor am I likely to find myself in a pile of debt. So far I’m even up on the week.

The same can be said for my ISA. I have three funds at present, putting work in to deliver top returns. But this is not where the similarities end.

Like with horse racing, form is everything and even the top managers go through some tougher times.

For example, favourites such as Terry Smith and Nick Train, who would have made investors a lot of money over the past decade, are currently experiencing blips to relative degrees.

They will undoubtedly come roaring back at some point, but right now the conditions are less favourable. It is the same as backing a horse that runs on good ground when the race day is soft.

The conditions do not suit the horse, so it cannot be expected to perform as well in the environment. The same can be said for funds.

These quality growth managers surged during the low interest rate environment when their style of stock picking came to the fore. Now, with higher rates, the conditions are much more difficult.

If conditions turn, however, they should be back on form. But it is always worth having other bets on, just in case.

Picking a value fund, which should be coming into its own under these conditions, is one way to go.

Another is to back passives. They’re consistent, if unspectacular, but the same can be said about plenty of horses who have excellent results.

Either way, selecting a few good options with a fighting chance to win big in the future is a ‘safer bet’ than putting it all on the favourite. Particularly at the moment.

Nvidia is not yet a quality name and it’s fine to wait for that to change before investing, Vontobel manager argues.

The stellar performance that chipmaker Nvidia has achieved over the past two years, with its share price growing by 500%, has favoured investors who jumped on the artificial intelligence (AI) bandwagon and left everyone else wondering whether they are too late to the party.

Earlier this week, it surpassed Microsoft and Apple to become the world’s most valuable company, with a $3.34trn market capitalisation, making the question even more present in investors' minds.

But there are a number of unknowns around Nvidia according to Markus Hansen, portfolio manager at Vontobel’s quality growth boutique, who said that historically in the technology sector, it has been much more beneficial to sit back and wait for the fog to clear around a stock.

“We don't own Nvidia. It’s great business that’s doing great and it might become a quality business one day, once it figures out what its long-term growth is. But there's an element where the predictability is unknown,” he said.

“Today, I just can't predict what the earnings numbers are going to be, so how can I understand how it's going to be valued in the future?”

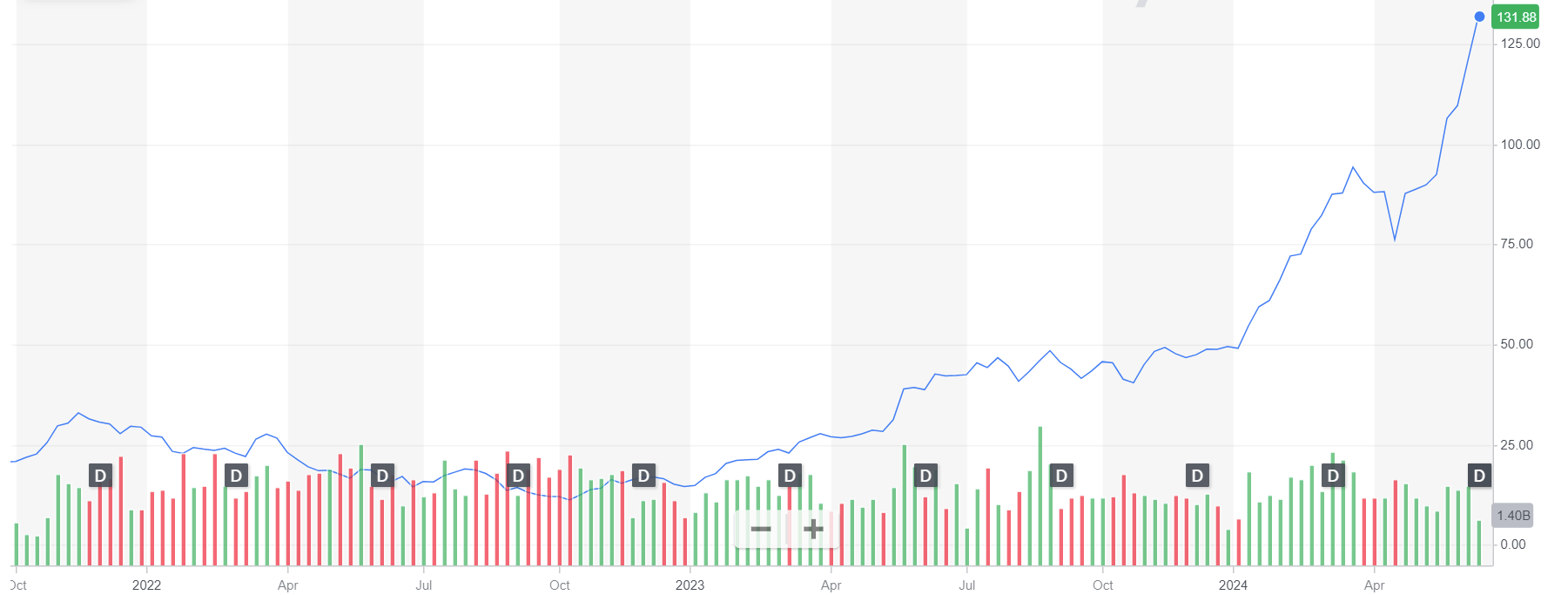

Performance of stock over 2yrs

Source: Yahoo! Finance

Nvidia’s track record has been erratic. In the early 2000s, its graphics processing units (GPU) chips were needed in gaming consoles, then when consoles started selling off because gaming was moving online, it lost money for a couple of years.

Nvidia’s fortunes improved with the rise of Bitcoin mining, which required its high-end GPUs. When that faded out, Nvidia hit a new driver – artificial intelligence (AI).

“Now, could you have predicted that? The simple answer is no. Three years ago, people thought that sales would be in the $30bn range for 2025, now they're predicting $110bn. That's a massive difference. That's unpredictable,” Hansen said.

“And that’s where the risk is. As we get into 2026, competition might come out, or we might understand what AI is. We're still too early to understand what is real from AI and what isn't.”

The biggest buyers of Nvidia's products currently are hyperscalers, who "hate relying on just one supplier and much prefer having two or three or developing their own chips", he said.

For instance, Apple did not want to be tied to chipmaker Qualcomm, so it started creating its own chips.

Demand for semiconductors, which has risen due to the boom in large language models, could fall if small language models prove more successful instead.

“You don’t need a language model that’s capable of crunching 10 million bits of data to get your calendar appointments sorted. If that’s what people will be using language models for – or for other similar, smaller tasks – we might not see as large a demand for computing power as people are predicting today,” he said.

That is why generally in technology, “being late doesn't mean you've missed the boat”, said Hansen. This has happened before, with Amazon and Cisco Systems, he said.

Amazon came to the market in 1997 as an online bookseller. Anyone who bought it at or around its initial public offering (IPO) would have initially made five times their money, but then it fell below the IPO price, not recovering until 2007.

Performance of stock between 1997 and 2008

Source: Yahoo! Finance

“The bulk of Amazon's returns came if you bought it 13 years after it came to the market,” noted the manager.

Similarly, Cisco Systems, which makes routing equipment, was a darling of the stock market from 1997 to 2000 as the internet was being built.

“The stock went up, came back down, then went sideways for forever because it wasn't clear whether everyone could make money from doing that,” he said.

“So we're not rushing to chase these fad names, even though they have great growth. My gut is, Nvidia will be a similar story.”

Hansen owns other stocks where he thinks the AI applications are much clearer today and which have predictable earnings streams that Nvidia, such as Microsoft, Google and to some extent, Amazon.

What convinced the manager about Microsoft is its small language model Copilot, which integrates with the Office package and helps users summarise, produce slides or use formulas on Excel.

“What you maybe spent half an hour on, Copilot can do in a few minutes. For me, that's great, that's productivity, there’s nothing to predict. As for Google, it has Gemini in development,” he said.

“Other companies are developing in the same direction too, such as Wolters Kluwer and RELX, whose legal AI assistant can quicken the job of teams of paralegals.”

QuotedData’s James Carthew weighs up the relative merits of Polar Capital Global Financials and Augmentum Fintech.

One of the great rules of investing is don’t buy something that you don’t understand. Fortunately, most businesses are reasonably straightforward, but one sector that is riddled with complexity is financials, especially when it comes to the banks, insurance and life assurance companies that make up the majority of it.

Unfortunately, financials are also the second-largest sector in global equity indices (based on the MSCI All Country World Index, a neutral weighting in the sector would be more than 16% of your portfolio), so it isn’t something that can be ignored.

In addition, if you restricted yourself to investing in UK financials, just 10 stocks account for over 90% of the market cap of the MSCI UK Financials index and HSBC accounts for well over a third of that.

There is a clear need to diversify your exposure, but that makes the stock selection decision even harder. Therefore, there is an excellent case for accessing the sector through a globally diversified fund managed by an expert team.

In the investment companies world, two trusts are focused on this sector – Polar Capital Global Financials trust and Augmentum Fintech. However, they target very different parts of it; the Polar trust is designed to offer broad-based exposure, while Augmentum is focused on the hopefully fast-growing new entrants to the industry, many of which are still unquoted companies.

Augmentum’s approach comes with considerable additional share price volatility. In net asset value (NAV) terms, it has made money for investors, but it currently trades on a discount of more than 37%. That discount could close and the NAV could continue to climb as more of its holdings exit to initial public offerings (IPOs) or trade sales, but this is probably not the fund in which you would choose to put a significant proportion of your portfolio.

Polar Capital Global Financials was listed in July 2013. Part of the pitch was that the outlook for the UK financials sector looked pretty dire and this was a way of globalising your exposure. It was designed to be a trust to which an investor could entrust all their financials exposure.

From its launch up to end May 2024, the trust has generated a 154% return on its NAV. An investment in the best of the UK banks – HSBC – made around half that. Buying Barclays would have made hardly any money at all.

The managers at Polar Capital see plenty of reasons why the trust might do well from here. They have picked out five themes that they think will help the trust beat its benchmark.

The first of these is backing asset managers that specialise in alternative asset classes such as private equity, infrastructure and credit. These companies are managing a growing proportion of investors’ funds and that trend is forecast to continue for some years yet. The profit margins that these businesses earn is attractive, often incorporating performance fees. The best of them are also consolidating a highly fragmented market.

Next is reinsurance companies. A series of natural disasters have eaten into the capital that is made available to reinsure risks. That in turn helps drive up the cost of reinsurance and the profit potential of these companies. An environment of higher interest rates has also helped these businesses earn much higher returns on their capital base.

Given its worldwide remit, Polar Capital Global Financials is able to take advantage of the superior growth potential of financials operating in emerging markets. The managers are selective about which companies and in what markets, but the earnings growth achievable from selling financial products into often previously untapped markets is considerable. Polar Capital is also looking to profit from corporate governance reforms in Korea that are designed to boost returns to investors.

The managers have spotted a growing opportunity in smaller and medium-sized financial companies which have been left behind recently and are looking cheaper than usual. The large caps in the sector have noticed this too and mergers and acquisitions activity is picking up.

That also feeds through into the revenues for investment banks. The trust’s managers are being selective about which banks they back. On average, valuations look attractive, but some banks are more fully valued than they were, and others (especially smaller US regional banks) have exposure to possible problem areas, such as loans secured against office space. They are optimistic about investment banking revenues, however, and so this is reflected in the portfolio.

Currently, you could buy shares in Polar Capital Global Financials on an 8% discount to NAV. However, it operates with a liquidity opportunity that in 2025 and every five years thereafter lets you cash in shares at a price close to NAV. That suggests that the discount will narrow from here.

James Carthew is head of investment companies at QuotedData. The views expressed above should not be taken as investment advice.

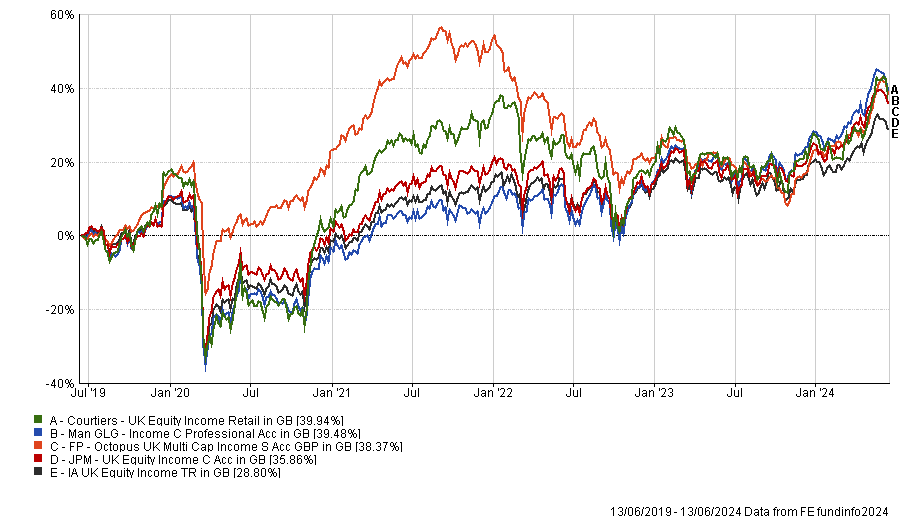

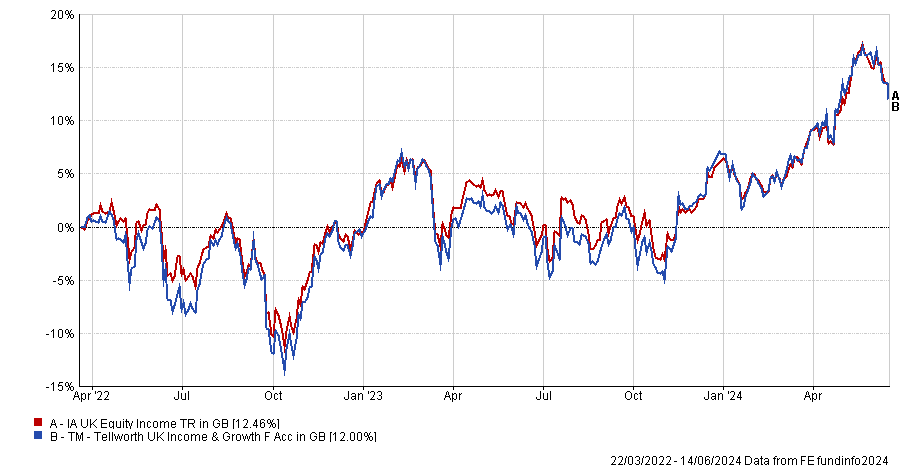

Wealth managers and financial advisers expect the UK’s economy and stock market to improve and anticipate rate cuts at some point this year.

Most private investors and high-net-worth individuals prioritise income when investing, according to a survey by Rathbones. Wealth managers, financial advisers and financial planners contacted by Rathbones in May 2024 said 88% of their clients are investing for income rather than growth, partly due to the recent cost-of-living crisis.

Advisers and wealth managers highlighted the UK as a key market for equity income. Most professional investors (79%) expect significant dividend growth during the next 12 months and a further 12% predict modest dividend growth.

Almost 60% of wealth managers and advisers think UK economic growth will rise above expectations and 29% believe it will rise in line with expectations over the next 12 months.

Two-thirds (65%) of respondents believe the Bank of England will cut interest rates this year, providing further stimulus for economic growth. Only one-third (34%) expect the US Federal Reserve to do likewise, although about 40% anticipate US rates cuts in the first quarter of next year.

Alan Dobbie, manager of the Rathbone Income fund, said: “Whilst the relative cheapness of the FTSE All-Share has been apparent for some time, it is only more recently that a plethora of catalysts have fallen into place to unlock this substantial valuation discount.

“Better than expected economic data, renewed merger and acquisition interest, increased share buybacks and imminent interest rate cuts are all likely to play a role in restoring the fortunes of the UK market.

“More importantly, meaningful pension and planning reforms, designed to catapult the UK out of its growth funk, have moved right up the political agenda. If politicians can follow words with action, then investors are absolutely right to be getting excited about the prospects for the UK market.”

Experts are mixed on whether there will be any rate cuts this year.

The Bank of England (BoE) has held rates again at 5.25%, making it almost 12 months since its last rate rise. There just two dissenting voices this time around, who proposed lowering rates by 25 basis points, while seven members of the Monetary Policy Committee (MPC) were happy to wait.

This is despite inflation dropping back to the Bank’s 2% target last month, according to data from the Office for National Statistics released this week, and GDP growing more strongly than expected.

A statement released on behalf of the MPC read: “Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term in line with the MPC’s remit.”

Official Bank rate

Source: Bank of England

Lindsay James, investment strategist at Quilter Investors, said that although inflation hitting 2% was a “significant milestone”, it was not enough to allow the Bank of England to declare job done.

“While it will come as a bitter blow to the Conservative party, this decision is no real surprise given month-on-month figures suggest inflation is unlikely to remain at 2% for long. It is instead expected to rise again later this year and ultimately settle between 2% and 3%,” she added.

As such, those hoping for interest rate cuts may have to temper their expectations. She suggested the first may not arrive until the November meeting.

The main roadblock to rate cuts appears to be the labour market, with policymakers noting it is “difficult to gauge”, but remains “relatively tight by historical standards”.

James said: “With the Labour Force Participation Rate still trending down and at the lowest level since 2015, a worker shortage is one crucial inflationary factor that will need addressing by the incoming government.

“Given the Bank’s focus on sustainably returning inflation to the target in the medium term, it could be some time yet before we see a cut.”

Not all were as pessimistic, however. Julian Howard, chief multi-asset investment strategist at GAM, said: “The path appears increasingly clear for some easing at the August meeting.”

He was particularly interested in the UK's energy bills, which are easing, with price reductions finally being passed on to consumers after months of “lumpier” price movements.

Risks remain, such as the upcoming general election, and he noted the Bank will be “keen to avoid a policy error” by cutting too soon.

Andrew Summers, chief investment officer at Omnis Investments, agreed that rate cuts are still “on the horizon” and also suggested they could start in August, although he noted that the most probable date is November.

Yet others were even more circumspect, with Nicholas Hyett, investment manager at Wealth Club, suggesting markets no longer expect the Bank to cut rates at all in 2024.

“At the beginning of the year four cuts were being priced in. It’s amazing the difference six months can make,” he said.

High street banks continue to offer disappointing rates.

The savings market has been volatile this year, but savers can still profit from advantageous rates if they know where to look.

With inflation reaching 2% and the Bank of England’s Base rate expected to drop by the end of the year, savings rates could have followed the downward trend, but instead they have barely nudged so far.

Since the start of December 2023, the average easy access savings rate has fallen from 3.18% to 3.12%, while for ISA accounts it remained at 3.31% – the same level as six months ago, data from Moneyfactscompare shows. In the last month, the rate has risen for non-ISA accounts but the ISA version fell month-on-month.

Similarly, notice account averages have budged a few basis points – from 4.44% to 4.26% since December 2023 for non-ISA accounts and from 4.25% to just 4.14% for ISA rates.

Rachel Springall, finance expert at Moneyfactscompare, said savers may feel relieved that rates have not fallen too much over the past six months. However, they should still make sure they aren’t missing out on returns.

“The top rate tables continue to be dominated by challenger banks and building societies. With the average rate on easy access accounts around 3%, there will be many savers out there getting a poor return,” she said.

“Consumers would be wise to review their rate if they have not done so over the past six to 12 months. Loyalty does not always pay, and potentially, more interest could be earned from the more unfamiliar brands.

“The Cash ISA market has also seen a flurry of activity over the past six months, but variable rates are slightly down month-on-month. This should not deter savers from reaping the benefits of investing cash in an ISA wrapper, to protect any interest earned from tax.”

In fact, the distance between high-street and challenger banks has increased. Today, the average rate paid by the former is 2.01% – an increase of 0.57% year-on-year from 1.44%, but it compares to a year-on-year rise of 0.91% across the entire easy-access market.

“It is very unpredictable to know where interest rates are going, so as variable rates can fall as well as rise, some savers may want to take advantage of a fixed rate bond or ISA for a guaranteed return if they are concerned interest rates will fall in the months to come,” Springall added.

“Whichever savings account consumers choose, it’s important they are aware of any restrictive criteria, keep on top of the best rates across the savings spectrum and proactively switch.”

Age is also a factor in how investors may react to the elections.

Four in 10 UK investors intend to tweak their portfolios following the UK general election, according to research from St. James’s Place (SJP).

Experience is an important factor in how investors plan to react to the elections. For instance, 62% of investors who began investing in the past year are likely to modify their portfolios, while only 19% of those who have been investing for more than a decade are looking to make changes.

Age also plays a role. Most young people (81% of 25 to 34-year-olds) plan to adjust their portfolios and only 12% intend to do nothing. In contrast, 74% of the 45-54 age group and 85% of investors over 55 won’t take any action at all.

Among investors planning to make changes, a quarter intend to increase their exposure to equities, while 22% will add more bonds. In terms of geographies, 24% of investors want to reduce their UK investments to diversify internationally, while 13% are considering topping up their allocation to the domestic equity market.

SJP’s research also shows that investors planning to make changes are twice as likely to add contributions rather than withdraw funds.

Joe Wiggins, investment research director at SJP, said: "It is encouraging to see that very few respondents were looking to react to current events by withdrawing their investments, but it is important to remember that timing the market also applies to adjusting our asset allocation. High profile events can often tempt us into injudicious trading decisions, and this is something we should look to guard against.

“Successful long-term investing is founded upon building a diversified portfolio spread across asset classes and geographies and tailored to meet our return and risk objectives. If we get this right, we should be well-positioned to meet our goals irrespective of short-term events.”

Meanwhile, 19% of UK investors reported waning confidence in the domestic equity market, while 13% said their confidence in their own investments had decreased due to the election.

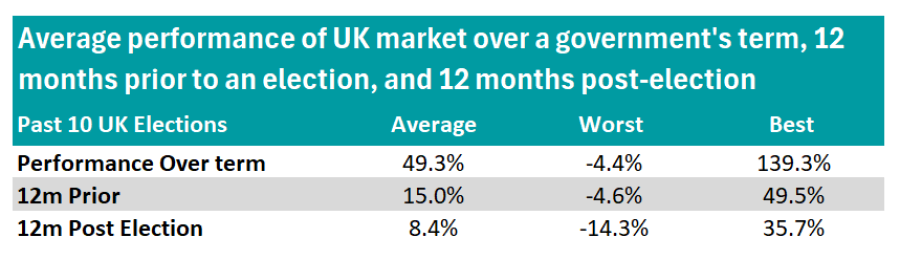

Yet, SJP’s analysis of UK market performance data spanning the past 10 UK elections, going back to 1987, shows there is no clear trend between election outcomes and market performance.

Source: SJP

On average, the performance prior to, immediately post, and over the duration of each government’s term was positive, though with a very wide range. Only one government had a negative absolute return over its term, which coincided with the dotcom crash.

In fact, SJP’s research suggests that major external shocks such as the 1987 stock market crash, the bursting of the dot-com bubble in 2000, and the financial crisis in 2007 have more of an impact in the short term than any political party.

“Our research into market behaviour shows that political events such as general elections have limited impact over the long-term. Therefore, while any period of political change can cause investors to worry, it is important not to become overly distracted by short-term noise,” Wiggins concluded.

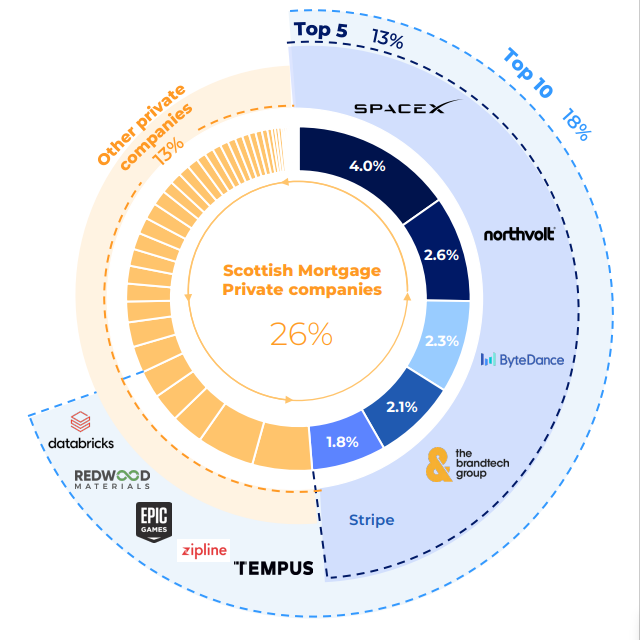

Private equity investment trusts could deliver returns in the mid-to-high teens if their discounts of around 30% normalise, Barwon Investment Partners asserts.

Private equity investment trusts are trading on wide discounts and should benefit once interest rates come down – potentially giving investors strong returns should they be willing to bite the bullet and invest now, according to experts.

Bob Liu, portfolio manager of the Barwon Global Listed Private Equity fund, said UK-listed private equity investment trusts offer the “most compelling risk/reward across the global listed private equity universe”.

If their discounts of 30% or more normalise, even trusts with average investment performance should deliver returns in the mid-to-high teens, he said.

Current discounts reflect the headwinds that private equity investment trusts have faced in recent years, said Ben Conway, chief investment officer of Hawksmoor Investment Management.

“They are getting a bit of bad press at the moment because the realisation market, by which I mean the environment for them selling their assets, is pretty rubbish”.

During the recent rate hiking cycle, investors grew sceptical about the valuations of unlisted companies owned by investment trusts, said Victoria Clapham, an investment manager at private client firm Manorbridge Investment Management.

To ease investors’ concerns, several trusts including Scottish Mortgage (which she owns) arranged for their assets to be valued more regularly by independent auditors and communicated more up-to-date valuations to their shareholders.

With interest rates poised to fall, worries about private companies’ debt should abate and companies will be able to refinance at lower levels.

There is a longer-term trend of companies staying private for longer, so investment trusts remain a good way to gain access to high growth companies whose returns are “going from strength to strength”, she added.

Manorbridge, which runs bespoke portfolios for private clients, has held 3i Group, Pantheon International and Oakley Capital Investments for several years and enjoyed strong returns. “The proof has been in the pudding”, she said.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Clapham has been trimming exposure to 3i because it is trading at a high premium and the portfolio is concentrated in the European discount retailer Action. For clients with cash to invest, she is still buying shares in Oakley Capital and Pantheon International, whose management teams she described as “outstanding”. “I’m quite happy to have 5-7% in private equity at the moment,” she said.

Pantheon and Oakley both focus on mid-market businesses. Pantheon’s portfolio is split between direct investments and funds, while Oakley Capital invests in “exciting” high growth areas such as technology and education, she said.

Conway, who also likes Oakley Capital, said its founder and managing partner Peter Dubens owns a significant stake in the trust, which provides alignment of interests.

All the management teams running private equity investment trusts are impressive and investors are “spoilt for choice”, he added.

Liu agreed. “If they were listed anywhere else in the world, the institutional-grade professionalism with which these trusts are managed would receive a much larger following,” he said.

Liu has been adding to his position in NB Private Equity Partners and said ICG Enterprise Trust is especially good value. “I just can’t believe that it trades at 65 cents on the dollar,” he said.

Barwon started investing in Pantheon International and HarbourVest Global Private Equity two years ago because of their discounts, which now stand at approximately 33% and 42%, respectively. The manager also holds Hg Capital, Princess Private Equity and Patria Private Equity.

Where trusts differ most is the quality of their boards, Conway argued. “Some boards have got your back more than others.”

He particularly admires John Singer, chairman of Pantheon International, who has instigated an ambitious programme of share buybacks. “He’s basically thrown down the gauntlet and said to all listed private equity investment trusts, ‘are you for shareholders or are you not?’ And you can buy back shares if you want to, you can treat these trusts for the benefit of shareholders.”

Further up the risk spectrum, Manorbridge invests in venture capital and fintech for clients with a high risk appetite and long horizon. It uses Molten Ventures and Augmentum Fintech to gain exposure to “higher growth areas that are difficult to get access to in listed markets”, Clapham said.

“Everyone’s so excited about US tech, but here are two great UK investment trusts with exposure to fantastic smaller UK companies that could be the next Nvidia, the next Apple,” she said.

Molten Ventures’ chief executive officer Martin Davis has committed to using 10% of the £100m the trust expects to receive in company exits this year to buy back shares. “The share price has been ticking up, which is nice because that whole area has been in the doldrums,” she added. Augmentum’s chief executive officer Tim Levene is also a “great manager”.

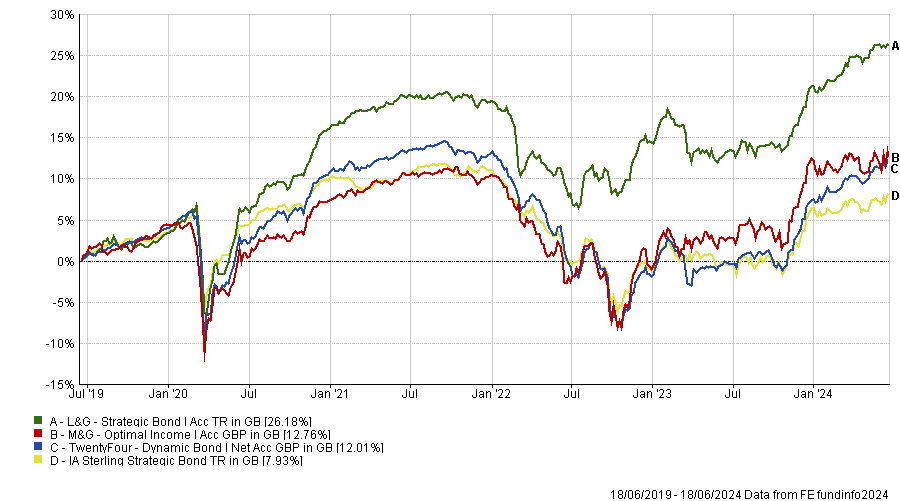

Experts recommend L&G Strategic Bond, M&G Optimal Income and TwentyFour Dynamic Bond.

Retired investors usually have a bond ballast in their portfolios to deliver income, stable returns, capital preservation and diversification against more volatile assets.

Conventional wisdom used to be that investors should shift gradually from equities into bonds as they approached retirement age, but the experience of 2022 when both equities and bonds were hurt by rapidly rising interest rates and inflation has left many investors and advisers with a sense of trepidation.

Chris Metcalfe, chief investment officer at IBOSS Asset Management, warned that “one of the key dangers in investing is trying to fight the last war”. “The extremely volatile and largely negative bond period between the end of 2021 and October 2023 has led many advisers and retail clients to question the validity of holding bonds in their ‘at retirement’ portfolios.

“However, we believe the backdrop for bonds, especially for active managers, is more positive than it has been for the best part of two decades,” he said.

Edward Allen, private client investment director at Tyndall Investment Management, was more circumspect. “Perhaps we are past interest rate rises, but history would teach us not to be complacent. As such, for those investors looking for income and security, short-dated bonds and/or floating rate exposure would seem more appropriate. Returns will likely be low, but they should be predictable,” he said.

When selecting funds, Metcalfe recommended focusing on total returns rather than prioritising yield to the detriment of the overall risk/return profile – even for retired investors who rely on the income generated by their portfolios.

“We saw many managers suffer extreme drawdowns in the pandemic sell-off and the market lows of early October 2022. It was often the managers who either had explicitly high target yields or that gravitated to those bonds offering what, on paper, looked like attractive outcomes,” he recalled.

“We recommend a broad church of fixed-income investments offering an acceptable mix of capital appreciation as well as capital preservation, and an attractive but not excessively risky income yield. Whilst we expect inflation to stay elevated, higher volatility brings opportunities for active managers to harvest alpha even if interest rates don’t move down quickly.”

With yields for gilts and US treasuries still above 4%, the risk/return profile of sovereign bonds looks attractive, he continued. “Given these starting points in yields, there is also significantly less risk of capital losses.”

Metcalfe also thinks that corporate bonds, high yield and emerging market debt have a role to play within a diversified portfolio. “Emerging market debt, particularly the blended currency sector, can help reduce overall correlations by adding an additional diverse source of potential alpha,” he explained.

Below, fund selectors suggest six bond funds for retired investors.

TwentyFour Dynamic Bond

The £1.5bn TwentyFour Dynamic Bond fund “suffered in the bust”, Allen said, “but this left some of the assets where TwentyFour has particular expertise, specifically asset-backed and collateralised bonds, at screamingly cheap prices”.

“The fund has roughly 25% of its assets in US treasuries and has a suitably glass half-full attitude to portfolio allocation; they take risk where they see suitable rewards and avoid it where they do not,” he explained.

“This is therefore not the fund for retirees focussed on short-term capital preservation, but is worthy of consideration for those willing to absorb volatility and pay up for active navigation of shark-infested waters. It has a healthy mark-to-market yield of 7.8% so a running return expectation of perhaps 7% after fees.”

L&G Strategic Bond and M&G Optimal Income

Metcalfe tipped the £592m L&G Strategic Bond fund, managed by FE fundinfo Alpha Managers Colin Reedie and Matthew Rees since 2019. “It takes a very active stance on both duration and credit quality and has made several important strategic moves which have added value to clients whilst being mindful not to take excessive risks,” he said. For instance, the fund is relatively overweight high yield on a tactical basis.

L&G Strategic Bond is the fourth-best performing fund in the IA Sterling Strategic Bond sector over five years to 18 June 2024 and has also delivered top-quartile performance over one and three years.

M&G Optimal Income, managed by Alpha Manager Richard Woolnough, is also nimble in its approach, Metcalfe said.

“For several years, we considered this fund too large to invest in, whilst maintaining our belief in the M&G team. At its current size of £1.4bn and with the superb track record the team possesses, we feel that it offers an excellent cornerstone investment for a client looking for solid fixed-income credentials,” he concluded.

The strategy has retained the large assets it had previously funnelled into the UK-based fund, but moved much of the money overseas following the Brexit vote in 2016.

Performance of funds vs sector over 5yrs

Source: FE Analytics

T. Rowe Price Global Impact Short Duration

In an environment where interest rates could stay higher for longer, short-dated bonds have a key role in providing a strong yield of 5-6% while minimising credit and interest rates risks, said Ben Faulkner, director of marketing and communications at EQ Investors.

As such, EQ has invested in the T. Rowe Price Global Impact Short Duration fund, which was launched earlier this year and is helmed by Matt Lawton, who developed T. Rowe Price’s impact bond franchise.

“T. Rowe Price impressed us with the expertise they have built in selecting businesses and projects that are making measurable positive social and environmental impact. This recently-launched fund is bridging a gap for investors than want to marry impact and short-dated bonds,” Faulkner said.

“We also like the fact that the fund invests across all regions and has a wider reach than most peers restricted to bonds issued in sterling.”

Passive fixed income funds

For investors who prefer index trackers, Henry Cobbe, head of research at Elston Consulting, said there is “plenty of solid yield available in high-quality, low-cost index bond funds” such as the Fidelity Index UK Gilt and BlackRock Corporate Bond funds. “Higher yields now make for a more interesting entry point,” he added.

Cobbe warned, however, that “bonds alone are not enough”.

“For someone aged 65 with average life expectancy, a bond fund isn’t enough to ensure portfolio durability. Over that term, the biggest risk is inflation and it’s harder for nominal bonds to keep pace with inflation. Most retirees will need a multi-asset retirement portfolio to last the course.”

The fund managers lost confidence in the social impact these companies would make.

Edinburgh-based Baillie Gifford is known for its out-and-out growth style of investing, but there are nuances among some of its portfolios.

Baillie Gifford Positive Change, for example, requires companies to jump through environmental, social and governance hoops before they are allowed entry into the portfolio.

The Positive Change team is split in half, with an investment division and an impact team. The former looks at the potential growth and returns a business can make, while the latter focuses on its impact on the wider world and whether the company is making a positive difference to people.

It was this part of the equation that led to the team selling out of Google parent company Alphabet in 2021.

Thaia Ngyuyen, co-manager of the £2bn Baillie Gifford Positive Change fund, said: “At the time, we felt that our original impact hypothesis for Alphabet had largely played out, with billions of people around the world gaining access to information through its products and services.

“However, the company’s progress in scaling its ‘other bets’ had been underwhelming and we had concerns about aspects of Alphabet’s business practices which we had been unable to address through our engagement.”

Upon re-examining the case for Alphabet, the team had “less conviction” in Alphabet’s ability to be an agent of positive change, even though it remained a strong proposition from a return-generation perspective.

Another stock on the chopping block was Chinese e-commerce firm Alibaba, which was also sold in 2022 due to concerns about its ability to meet the firm’s impact objectives.

“For Alibaba, the combination of regulatory intervention and internal issues dampened our belief that the company could drive positive change in Chinese society,” said Ngyuyen.

But the impact side of the equation is not always the trigger for selling out of positions. Vegan alternative food provider Beyond Meat was axed in the same year by the other part of the team: the investment division.

“With Beyond Meat, while we still believe in the long-term prospects of the plant-based meat market and admire the ambition of Ethan Brown, Beyond Meat’s founder and CEO, some operational missteps reduced our assessment of its probability of success,” Ngyuyen said.

There are lots of companies however that do fit the fund’s criteria, such as Nu Bank, which sits in the fund’s social inclusion bucket. Baillie Gifford first invested in 2021 at the stock’s initial public offering.

It is the world’s largest digital bank serving more than 100 million customers in Latin America although it mainly operates in Brazil.

“Brazil is a peculiar market, home to a few banks with an oligopolist structure and earning very high fees,” said Nguyen.

“Two-thirds of the population in the region are ignored by the traditional banks and charged high fees for things we take for granted here, such as text message alerts or bank withdrawals.”

Nu is an online-only bank, with customers using an app to keep track of their finances. It has no physical branches, meaning costs are lower – something it passes on to customers. Indeed, Nguyen noted that in some cases it charges nothing for services that would otherwise cost a lot more with traditional banks.

“Its products are really loved by the customers, with a net promoter score of 90, which is unheard of for any bank in the world,” she said.

“At the same time, it provides services for people who were previously ignored by the traditional banks. Some 6 million people have access to credit cards for the first time.”

Another example is Remitly, a US company providing remittance for immigrants. The firm fits the fund’s ‘base of the pyramid’ theme for companies providing products and services to the 4 billion people who live on less than $3,000 per year.

“It is estimated that the total global payments from immigrants in high-income countries to their families and friends in low and middle-income countries is higher than the total foreign direct investment and overseas aid to those countries combined. So you can imagine the importance of sending that amount of money,” said Nguyen.

“Remittance plays a very important role for tens of millions of people worldwide in terms of socio-economic development.”

The global remittance market is large with more than $500bn being sent annually, she suggested. Yet traditional services from incumbent players typically involve people having to physically give money to a cashier, which is then sent on, with families overseas having to wait for months to receive it.

“Everything can be done very quickly over the app. It offers one of the best global services for remittance with lower cost, convenience and peace of mind,” said Nguyen.

William Blair expects sector outperformance to become more widespread in the US, while Japan stands out as a market poised for growth and strong returns, as corporate governance reforms take root.

While the European Central Bank was the first to cut rates this month, investors continue to play the waiting game for the rest of the major central banks to cut rates this year. In the background, global equities have been performing well – with healthy levels of economic growth and inflation.

We believe that the normalization of the post-pandemic global economy will result in both a broader distribution of growth and a shift of leadership from some of the recent mega-cap winners. This trend has become particularly prominent due to investors' flight to safety, as it has given way to the search for growth.

In the months ahead we foresee continued broad growth, particularly from the US, slightly less in Europe, and the potential for accelerated strength in Japan. All in, we believe developed markets will continue to grow by 2%-plus on a sustainable basis, with some countries clearly dominating the charge.

The US: Widespread sector outperformance expected

The US seems to have achieved a soft landing, with corporate earnings having turned out better than anticipated in the first quarter.

The S&P 500 index saw record highs in February of this year, rising above 5,000. Not surprisingly, the “Magnificent 7” stocks (otherwise known as Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla) continued showing off as top performers in the index, but tech was not the only sector to outperform. In fact, nearly three quarters of companies making up the S&P 500 managed to report earnings above expectations.

So, what does this mean in terms of U.S. market strength in the coming quarters? As impressive as it is to see certain tech companies dominate the index, we expect this will moderate. We anticipate sector outperformance will become more widespread, as the growth gap between the Magnificent 7 and the rest of the S&P 500 ultimately narrows.

Europe: Resilience shines through

Europe has demonstrated economic resilience over the past quarter, partly due to easing inflationary pressures and economic indicators show it is not the end of Europe's growth story.

While growth in the region appeared to have bottomed at the end of last year, we expect improvement in the coming quarters. Further bright spots in Europe have been indicated by the outpacing of corporate earnings, as well as the upward trend of manufacturing purchasing managers indices. These components characterise a market that has shown resilience, and one that we believe will continue to do so.

China: Promise amid challenges

Despite recent efforts to stimulate the Chinese economy, it still faces challenges in the near term. We expect this year's market performance to largely hinge on the economy's ability to recover whilst simultaneously increasing consumer confidence, stabilising the property market and improving youth unemployment numbers.

Ongoing geopolitical risks, however, are likely to affect stock prices. And while geopolitical tensions have somewhat eased in recent months, we anticipate chatter around policy to increase as the US election approaches, thereby potentially impacting the market.

Against this backdrop, we find Chinese equities are attractively valued compared to their own long-term averages and emerging market valuations more broadly. While China has historically traded at about a 4.5% discount compared to emerging markets, it is currently trading at about a 20% discount.

We believe now more than ever, it is crucial to consider the importance of active management within Chinese equities to benefit from the country's growth trajectory.

Japan: Among the strongest markets

Investors were fully optimistic about Japan's macroeconomic outlook and structural tailwinds earlier this year, as it proved to be one of the stronger markets in the first quarter.

From a macroeconomic perspective, Japan is now experiencing positive inflation at a sustainable level, marking a significant shift in the country's economy. The outcome of the ‘shunto’ wage negotiations in recent weeks resulted in Japan's largest wage increase since 1991, at approximately 5.3%. This surge in real wages is expected to fuel consumption growth, mirroring trends observed in the US and Europe.

Further painting the picture of continued strength in Japan is a revision to the country's corporate governance code. While the country has traditionally lagged in corporate governance metrics, a change to the corporate governance code is expected to address issues such as board independence and board diversity. The revision, which is currently underway, may lead to better capital allocation decisions and, we believe, improved returns for investors.

In terms of structural tailwinds, several factors are expected to drive improvements in corporate performance. One example is a new program implemented by the Tokyo Stock Exchange. The program targets listed companies with low price-to-book ratios and low returns on equity, challenging them improve their efficiency or potentially face delisting from the exchange.

This should prompt companies to hyperfocus on profitability and core business strengths – ultimately leading to stronger corporate performance for Japanese companies, whilst also positioning Japan as a leading market poised for growth, compared to others across the globe.

Ken McAtamney is a partner, portfolio manager and head of the global equity team at William Blair Investment Management. The views expressed above should not be taken as investment advice.

More bonds on the market means limited performance potential going forward.

There is an “extraordinary” new wave of bonds coming to the market and investors are lapping it up, but this bond “euphoria” might come with a hefty price tag in the form of higher risks. That’s according to Christian Hantel, manager of the $919m Vontobel Global Corporate Bond fund.

Fixed income managers have been taken by surprise by the current levels of bond supply. With interest rates as high as they are today, it's costly for corporates to issue new bonds, as they need to reward investors more than when money was cheaper.

However, companies are just going on with their funding, seemingly not caring how they will repay the debt, said the manager. Still, this issuance is being taken up “quite well” by investors, who have continued to increment their fixed income allocation.

To some extent, this leaves companies in a riskier position going forward both from a fundamentals and a valuation perspective, Hantel explained.

“As a bond portfolio manager, you need to be sure that you always buy the right risks. This means companies that you know well and are on a good trajectory, be it through stable or improving credit metrics. When new companies come to market, you need to first get familiar with them and how they treat bondholders. That's the first challenge,” he said.

“The second challenge is with the pricing. When there's so many bonds coming to market and demand is so strong, they tend to be priced at the very low end of the of the range, leaving very little extra spread and limiting the performance potential in the corporate bond portfolio”.

This phenomenon is typical for when there's too much euphoria in the market, the manager said, which is the case now even more than it was earlier in the year.

At the beginning of 2024, investors were piling into the fixed income market and appeared willing to buy almost irrespective of price. But back then, premiums were higher, whereas now they have been dropping, which is having a negative impact on future returns.

“During recent bond issuance price talks, institutional investors have been pulling their orders out of the book more frequently because they think it is not creating value,” Hantel said.

“This gives a message to the syndicate teams that the deals are coming too tight and we won’t participate anymore. As institutional investors, we must avoid buying securities that will underperform after launch, so we pay a lot of attention to these dynamics and use discipline by setting a spread limit.”

On a positive note, corporates are using the proceeds of their funding quite conservatively. In Europe, for instance, there aren’t too many mergers and acquisitions or leveraged transactions, the manager explained.

In fact, the bonds that come to market are being used for refinancing maturing bonds and general corporate purposes, such as funding their capital expenditure needs and investments.

One of the questions worth asking is how long demand will stay this elevated and what could go wrong from here on. It’s a difficult prediction to make, but disruption could come in different forms, said the manager.

Firstly, demand could wane in response of an unpredictable macro event, say for example further tension in the Middle East, which could have an impact on risk appetite.

A second option is higher volatility in fixed income markets from uncertain monetary policies – especially if the divergence between the Federal Reserve and the European Central Bank should exacerbate, or if inflation surprises again to the upside – although this is not the base case.

“Whatever the catalyst might be, it's already remarkable that corporate bond spreads have not been impacted by uncertainty or volatility so far,” the manager concluded.

Returns are about to broaden out across sectors and geographies.

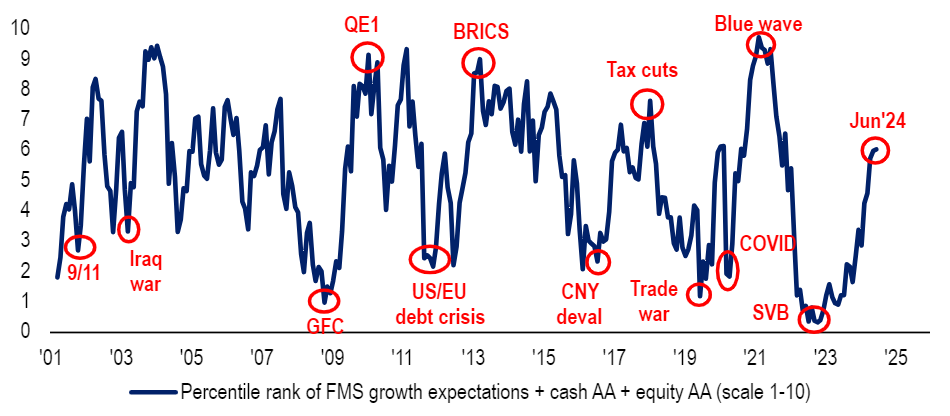

What to do with US mega caps is one of the main preoccupations for many investors today, who worry whether their exceptional performance over the past 18 months can continue going forward.

Even for investors who believe in the AI narrative, it would now be prudent to take profits and explore other markets, according to Hugh Gimber, global market strategist at JPMorgan Asset Management. That's especially true for passive investors.

“Within the US, investors who have been sat passively are seeing portfolios being dragged more and more into a handful of names and more and more towards growth,” Gimber said, referring to the Magnificent Seven stocks (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla).

“We think now is a good time to rebalance some of that out and explore the less appreciated parts of the US market.”

The skyrocketing returns achieved by the Magnificent Seven are linked to the excitement around artificial intelligence (AI), but it’s worth cashing in on some of those gains whether or not you believe the hype is justified, according to Gimber.

He thinks the US equity market’s returns will broaden out for two main reasons.

First, a colossal amount of infrastructure is required to enable the AI architects to deliver, leading to increased demand for clean energy, power distribution and the minerals used to produce chips.

“There is no AI revolution without the background infrastructure to support it,” he said.

“ There's no way today that grids in the US, the UK or elsewhere can cope with the kind of power demands that we see ahead. Electricity demand was already set to rapidly accelerate thanks to the energy transition and now you have this additional wave of demand.”

Second, the elevated earnings expectations for AI applications require much higher demand and many more AI consumers to justify them.

“That could be healthcare, manufacturing, financial services – but you do need a broadening out of earnings upgrades to justify the pricing that you see in some of the mega caps,” Gimber said.

If the AI-fuelled bull run continues (as BlackRock strategists and portfolio managers expect), so will these other sectors – therefore it would be worth rebalancing portfolios in their direction.

On the other hand, if the hype around AI dissipates, there could be a catch-down scenario within the S&P 500, where the valuations of mega caps fall to catch down with the rest of the market, Gimber warned.

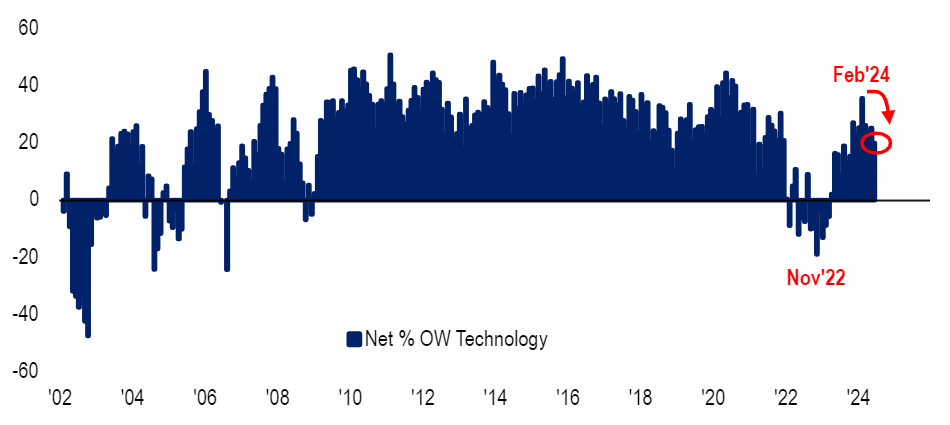

Many other asset managers are trimming their overweight exposures to US tech on concerns that the Magnificent Seven trade has become too crowded, according to the latest Bank of America Global Fund Manager survey. Fund managers’ average allocation to tech stocks currently stands at a net 20% overweight, which is its lowest since October 2023 and has come down from a net 36% overweight in February 2024. It is below the long-term average of a net 22% overweight.

A similar rotation and broadening of returns is also likely to happen regionally, according to Gimber, who urged investors to look past the recent leaders to find stronger opportunities elsewhere.

“The discounts on offer in places like Europe and the UK now look too wide”, the strategist observed. The UK is trading on a roughly 45% discount to the US today – the widest level in over 35 years – and Europe (excluding the UK) at around a 30% discount, again a multi-decade record.

In some sectors the discount might be justified, he said, but not at these levels.

US financials for example have “arguably stronger” balance sheets and better returns on equity, so they do deserve to trade at a premium, according to the strategist, but the average discount for UK financials over the past 30 years is around 10% and today it stands at 45%.

There is a similar opportunity in the rest of Europe too, where every sector is trading at a larger-than-average discount relative to its US counterpart.

“This is where stock pickers have some pretty good opportunities to be picking off companies of frankly a similar quality but that are priced at much lower levels just because they're located in a less popular neighbourhood,” Gimber said.

“When you add onto that a broadening economic momentum and higher interest rates as growth holds up, you should start to see more cyclical parts of the market that are better tapped into the real economy also coming to the fore.”

Experts hold out little hope for a UK rate cut, despite positive CPI reading.

Inflation has fallen to 2% for the first time in three years, reaching the target set by the Bank of England (BoE) and sparking hopes for upcoming rate cuts.

However, experts agree that the Bank of England is unlikely to act when it meets tomorrow.

The gauge may not remain at 2% for long, as core inflation, which strips out volatile food and energy prices, remained sticky. Much of the fall today has in fact been driven by the energy price cap and falling food prices, which will be a diminishing factor in future months, according to Lindsay James, investment strategist at Quilter Investors.

“This is not job done and victory declared for the Bank of England. The cost of living crisis persists and with wage inflation beginning to slow and prices in many areas of the economy still increasing faster than the headline rate, many won’t feel better off purely because inflation has hit 2%,” she said.

“This milestone being reached also does not mean a rate cut is coming tomorrow – much to the chagrin of the Conservative party. Sticky core inflation seems likely to continue giving the BoE pause for thought. As such, the tail end of the summer seems far more likely timing for the first rate cut.”

Consumers are starting to see prices drop in certain areas, such as fridge-freezers, pets and books, but there’s no escaping the fact that many prices are still rising, said Laura Suter, director of personal finance at AJ Bell.

“The cumulative effect of all the price rises, plus the big impact of increases in rent or mortgage costs and the higher personal tax burden over the past few years, mean it’s unlikely many people are feeling the benefit of inflation hitting target just yet.

“The future path for inflation – and so rates – will be impacted by whoever becomes prime minister and how their fiscal policy shapes up. It’s highly likely the Bank will want to wait to see the outcome of the election and the final economic plans before making that first cut. With no meeting in July, that means all eyes are now firmly on the August MPC meeting for our first potential cut to rates.”

But with prices still growing too quickly in the services sector, Zara Nokes, global market analyst at JPMorgan Asset Management, believes that even an August cut is unlikely.

“Today’s inflation news puts the final nail in the coffin for any hopes of a rate cut from the Bank of England tomorrow,” she said.

“Services inflation is still running too hot, coming in at 5.7% year on year – significantly above the Bank of England’s latest projection of 5.3%. If this stickiness in domestic price pressures continues, alongside ongoing resilience in economic activity, an August rate cut could well be off the table too.”

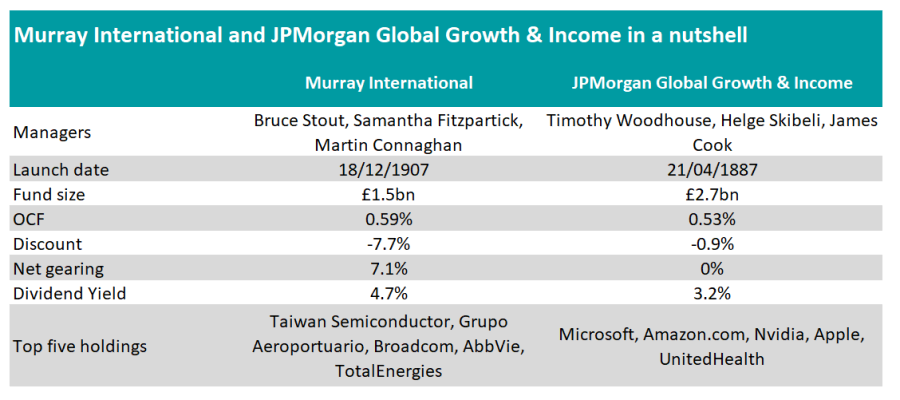

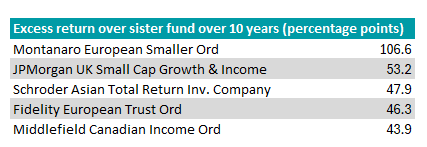

Experts discuss the differences between the two global equity income trusts and share their preference.

Murray International and JPMorgan Global Growth & Income have built a strong following over the years and are, as such, the two largest investment trusts in the IT Global Equity Income sector.

However, the two trusts built their reputations under very different circumstances.

Murray International is managed by abrdn’s Bruce Stout, who will retire at the end of this month and is being replaced by Martin Connaghan and Samantha Fitzpatrick. Stout made a name for himself during the global financial crisis, when the trust outperformed its peers and the broader market by focusing on high-quality companies and valuations.

Since 2014, however, Murray International’s performance has been subdued, placing it in the bottom quartile of its sector over the past 10 years.

JPMorgan Global Growth & Income has established its reputation through consistency; it has outperformed its benchmark in nine of the past 10 calendar years and is by far the best-performing global equity income investment trust of the past decade. This strength has enabled the trust to absorb several competitors in recent years, such as Scottish Investment Trust, JPMorgan Elect and JPMorgan Multi-Asset Growth & Income, and to issue new shares at a premium.

Performance of trusts over 20yrs and 10yrs vs sector and benchmark

Source: FE Analytics

These contrasting experiences imply a different approach to investing: Murray International operates as a conventional income portfolio, while JPMorgan Global Growth & Income takes a more flexible approach. In the event of an income shortfall, the trust’s capital reserves are used to top up the dividend – a practice that enables JPMorgan to invest in companies with a lower yield but greater prospects for long-term capital growth.

David Johnson, analyst at QuotedData, said: “Because of their different approaches to dividends, JPMorgan Global Growth & Income is able to invest in a much broader range of lower-yielding companies such as tech firms. Therefore, it has been able to offer investors exposure to non-dividend payers while still offering a 4%-ish yield.

“Murray International, on the other hand, has a more conventional income portfolio, investing in high-dividend payers. This means that it has historically had a strong bias to value stocks, while JPMorgan Global Growth & Income has been much more malleable, currently having a growth-stock bias, including a large allocation to US technology.”

He warned, however, that JPMorgan Global Growth & Income’s flexibility to invest broadly may make the constituents of its portfolio – and therefore its performance – less predictable.

Its shares have been less volatile than Murray International’s, but that may be because JPMorgan Global Growth & Income tends to trade fairly close to NAV, Johnson added.

According to FE Analytics, JPMorgan Global Growth & Income is currently trading on a 1.3% premium and has had a volatility of 15.4% over the past five years. By comparison, Murray International’s trades on a 7.7% discount and it has experienced a volatility of 19% over the same period.

Although the aforementioned factors may seem to favour JPMorgan Global Growth & Income, investors should note that it currently has a lower yield of 3.2%, compared to Murray International’s yield of 4.7%.

Moreover, the fact that JPMorgan Global Growth & Income tends to trade close to NAV or even at a premium means it is particularly exposed to derating risk, according to Mick Gilligan, head of managed portfolio services at Killik & Co.

“Because of the derating risk (the discount was as wide as 15% back in 2016) investors should take an extra-long term view with this one,” he cautioned.

Which trust should you pick?

Albeit belonging to the same sector, the two investment trusts are distinct propositions that cater to different types of investors.

For instance, JPMorgan Global Growth & Income has a stronger track record of providing a balanced combination of capital growth and income. Therefore, it would be a more suitable option for investors seeking a blend of these two elements.

Gilligan added: “JPMorgan Global Growth & Income has more of a growth bias and should be attractive to investors that believe interest rates have peaked and are likely to decline in the months ahead.”

Conversely, Murray International is likely to be a better fit for investors who prefer a value-focused approach and a more conventional income strategy, where dividends directly reflect portfolio income generation, according to Emma Bird, head of investment trusts research at Winterflood.

“In addition, Murray International trades on a considerably wider discount, so is more likely to appeal to investors looking for a value opportunity,” she added.

Source: FE Analytics

Nonetheless, Bird’s preference is for the JPMorgan investment trust, due to its “impressive long-term performance record”, which she expects to continue.

“With a market cap of £2.7bn, the fund offers a large, liquid, low-cost vehicle, with an ongoing charges ratio of just 0.50%, the lowest in the Global Equity Income peer group,” Bird said.

“In our opinion, the fund’s enhanced dividend policy, which targets an annual payment of at least 4% of the previous year-end NAV, makes good use of the investment trust structure, and the fund currently provides an historical yield of 3.4%.”

Johnson favours JPMorgan Global Growth & Income as well. He also mentioned sector peer Invesco Global Equity Income, which he said now follows a very similar approach, following a recent restructuring.

However, Gilligan picked Murray International, which is his preferred trust in the sector. His choice is primarily due to the larger discount, but also partly because value stocks look particularly cheap relative to growth stocks.

“Murray International has a value style and so is better suited to investors that are less optimistic about the path of interest rates. It is also attractive for investors that need a growing income, given its record of dividend increases and scope to continue them,” he concluded.

Brian Kersmanc, portfolio manager at GQG Partners, explains why a high turnover trumps long holding periods.

Legendary investor Warren Buffett famously said that his favourite holding period is forever.

Some of the best-known fund managers, including Nick Train, Terry Smith and Stonehage Fleming’s Gerrit Smit, buy stocks with the intention of holding them for the very long term and make minimal changes to their portfolios. Many fund managers invest with at least a five-year view.

The rationale behind buy-and-hold investing is that, although it may not always be smooth sailing, the best companies will eventually prevail due to their strong fundamentals.

Yet FE fundinfo Alpha Manager Brian Kersmanc, a portfolio manager at GQG Partners, does not believe this is the optimal way to invest.

“We embrace turnover in our portfolios and think of it in terms of optimisation,” he said.

“At the beginning of a game, the manager of a sports team puts the players on the field that they believe are going to execute well over the course of the next several quarters.

“However, conditions evolve during the game, so maybe they will need to change who they have on the field.”

Kersmanc cited several turning points during the past five years that would have been difficult, if not impossible, to predict, such as the Covid pandemic, the war in Ukraine, the rapid deterioration in trade relations between the US and China, as well as the return of inflation.

He said: “Let's face it, there's no way I could have foreseen those events, so why should we act in a way where we absolutely want to set a five-year view that we’re going to anchor and never change? Our portfolio moves as much as the information flow changes.”

As a result, the investment team at GQG Partners is comfortable making bold moves to identify better opportunities or ensure capital preservation.

“If we see a risk percolating on the horizon, we will trim positions very aggressively,” Kersmanc added. “If the risk doesn't come to fruition, we're more than happy to get back in.”

For instance, GQG Partners rotated out of technology in late 2021 and moved into energy across its portfolios, a decision that proved to be rewarding.

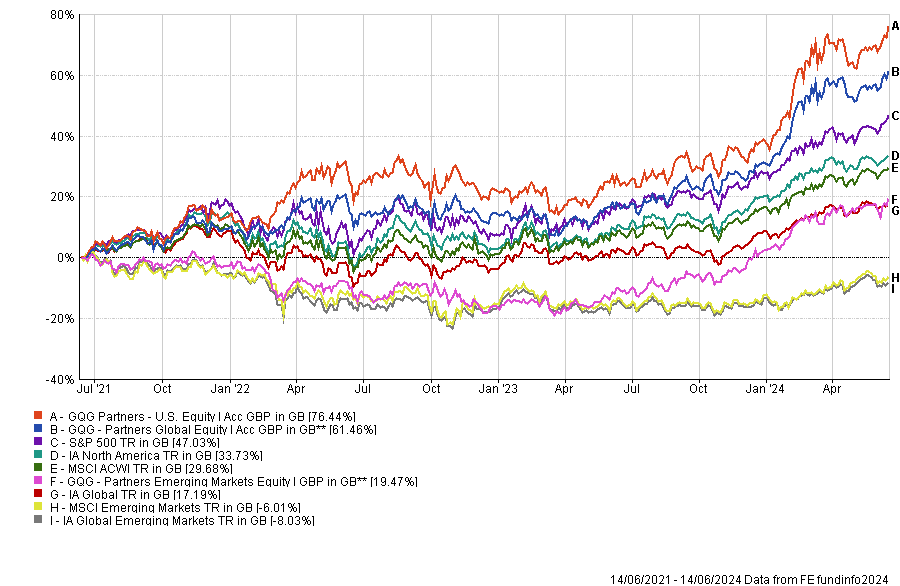

As a result, the GQG Partners Global Equity, GQG Partners U.S. Equity and GQG Partners Emerging Markets Equity are comfortably ahead of their respective sectors and benchmarks over three years.

Performance of funds over 3yrs vs sectors and benchmarks

Source: FE Analytics

Kersmanc said: “We made a pretty big call that the quality of a lot of energy companies was improving pretty substantially and they were underappreciated at that point in time.

“In fact, we noticed back in 2019 through our screening process that energy companies’ balance sheets, cash flow generation and return on capital have been getting a lot better. The rate of change has really picked up. They are exhibiting higher quality characteristics.

“By the way, these are businesses that were once considered exceptionally high quality.”

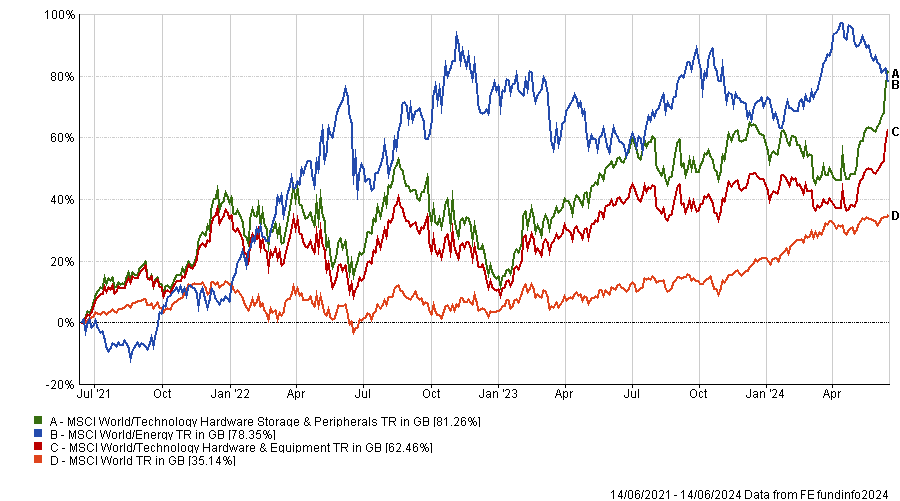

Performance of indices over 3yrs

Source: FE Analytics

An example he cited is the US oil company ExxonMobil, which years ago was considered a blue chip stock that everyone held in their pension funds.

“Perception is changing over time, the views on what quality is can ebb and flow,” Kersmanc added. “For example, software companies were considered to have cyclical capital structures 10 years ago.”

Performance of stock over 3yrs vs index

Source: FE Analytics

Last year, GQG Partners reengaged with tech companies because their cycle had rolled over.

Yet, in spite of the recent artificial intelligence (AI) frenzy, Kersmanc focuses on where he sees returns now rather than on jam tomorrow.

“Of all areas where AI has the potential to be helpful, one where we're seeing real returns right now is the digital advertising space. That's where the earnings are,” he said.

“What AI is doing is giving customers better search results and the content that's being delivered to them is causing the eyeballs to be stickier on the platforms. That has value. The companies are getting better at identifying what users want to see in terms of advertisements.

“For the rest of it, we'll see like how valuable it turns out to be over time.”

GQG Partners recently won the FE Fundinfo Alpha Manager of the Year award for emerging market equities.

It was Warren Buffett who said ‘price is what you pay; value is what you get’. When we look at the UK equity market today, this phrase couldn’t be truer.