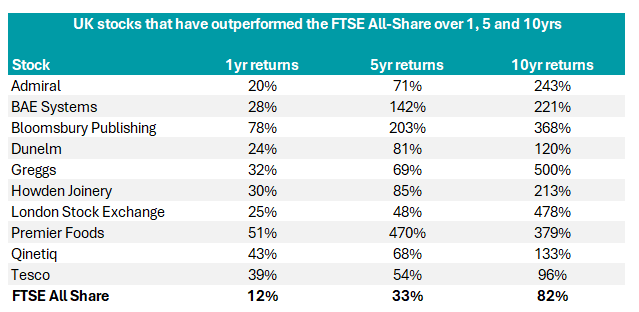

Experts suggest satellite strategies to complement core fund holdings and construct a simple portfolio.

A well-diversified portfolio isn’t born overnight. Not only does it take effort, it also takes money – it’s no use finding a long list of great fund combinations if your investible pot is limited.

When time and money are scarce, investors must work with what they have got. One option would be to invest in a one-stop-shop solution, be it a multi-manager, multi-asset or index fund – but it doesn’t have to stop there.

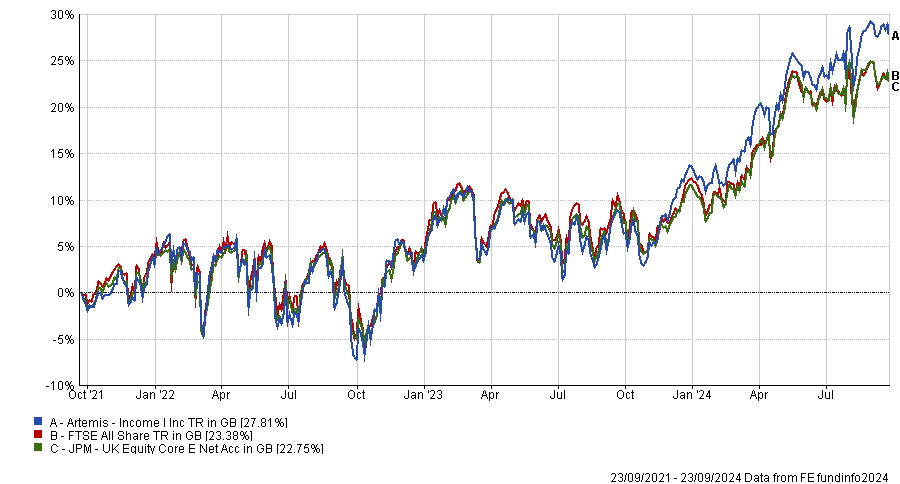

Trustnet asked experts what other options are available for investors who want to go beyond one-stop-shop funds, but keep things simple. Below, they suggested two-fund portfolios with a core/satellite approach, whereby one fund bears the brunt of the heavy lifting while the second one complements and enhances it.

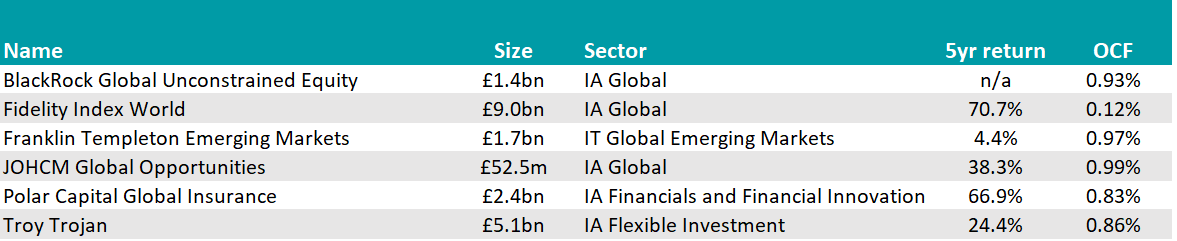

Fidelity Index World and Templeton Emerging Markets

Long-term, buy-and-hold investors might want to focus on equities rather than a multi-asset approach.

For them, a good pairing would be a core holding in a global developed market equities fund, coupled with a modest satellite position in emerging markets, according to Jason Hollands, managing director of Bestinvest.

His suggestion for global developed market equities is the Fidelity Index World fund, which tracks the MSCI World Index and has a low ongoing charges figure (OCF) of 0.12%. It provides “significant diversification across stocks at low cost,” he said.

For the satellite position in “less efficient” emerging markets, he proposed a selective approach through an actively managed portfolio such as the Templeton Emerging Markets investment trust.

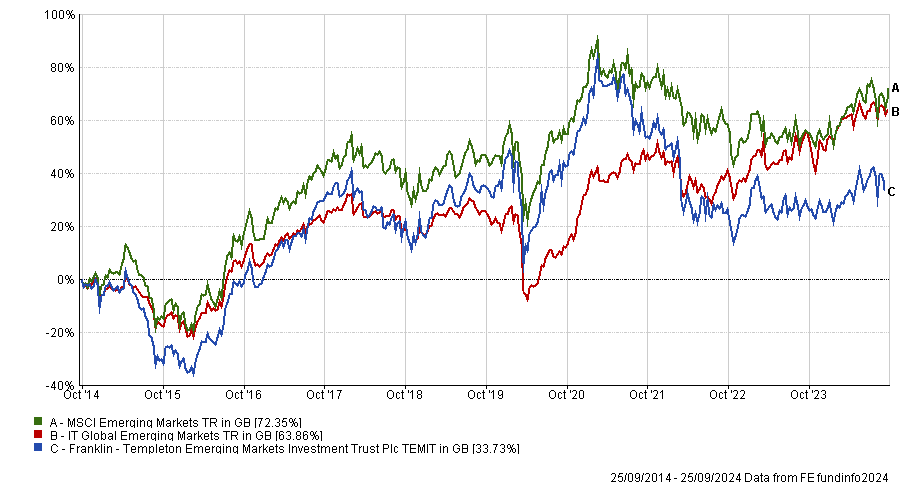

Performance of fund against sector and index over 10yrs Source: FE Analytics

Source: FE Analytics

This trust is “the grandaddy of emerging market investments”, having been launched in 1989. Since the departure of veteran investor Mark Mobius, it has been managed by Chetan Seghal and Andrew Ness, who “leverage a research team that is embedded across local markets”.

“The trust benefits from having a very pragmatic and patient philosophy, investing in companies with sustainable earnings power that are mispriced,” Hollands said.

Currently, nearly 81% of the portfolio is invested in Asia, with technology and financials being notable themes.

Polar Global Insurance and Troy Trojan

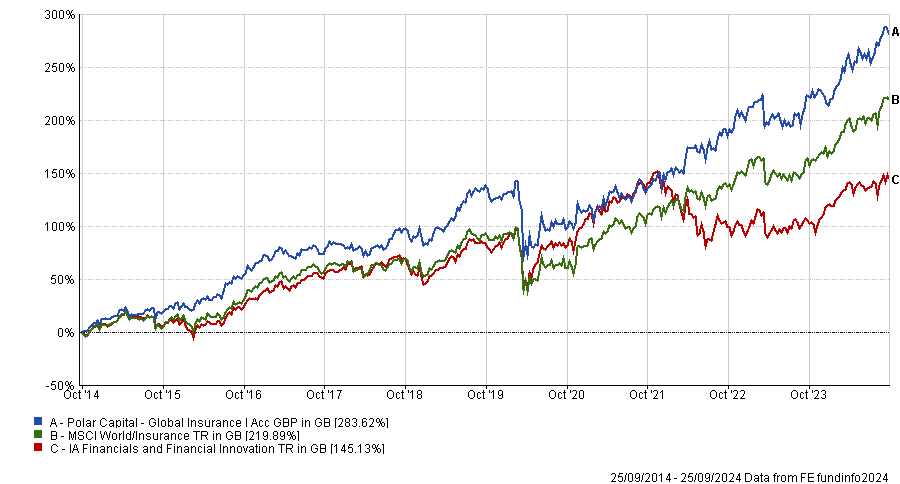

Director of Fairview Investing Ben Yearsley picked the satellite fund first – Polar Global Insurance.

“The satellite is easy. It’s one of my favourite funds, albeit a niche one; I use it for low and high risk,” he said.

“You’d be hard-pressed to find any of its stocks in most other portfolios, as it mainly focuses on reinsurance and catastrophe insurance companies.”

The £2.4bn strategy has achieved a maximum FE fundinfo Crown Rating of five and has been “very consistent over the long term”, having delivered 10% per annum over a very long period.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

For core exposure in a small portfolio, he wanted to avoid excessive volatility, so he also went with Fidelity Index World. It offers “cheap, broad-based coverage” and is suitable for higher-risk investors.

Those who would rather keep risks at a minimum might prefer Troy Trojan, managed by FE fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge. It seeks to protect wealth from inflation through exposure to quality companies, gold and inflation-linked government bonds.

JOHCM Global Opportunities and BlackRock Global Unconstrained Equity

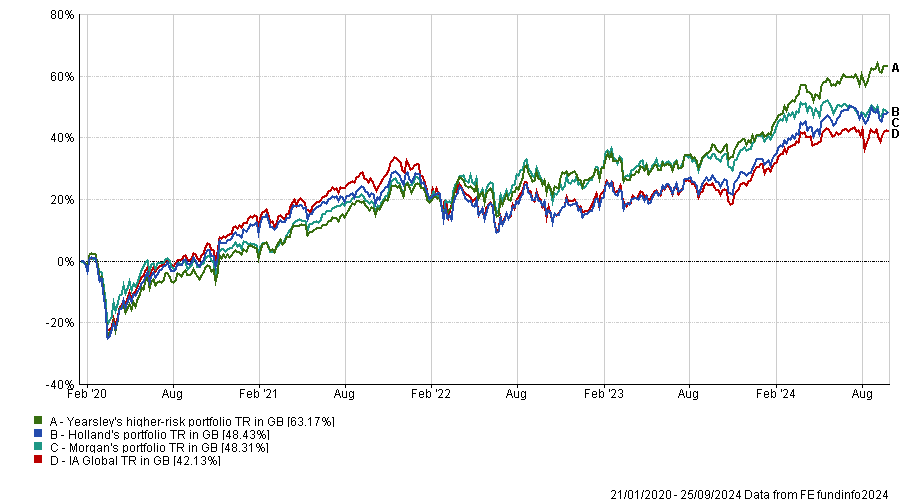

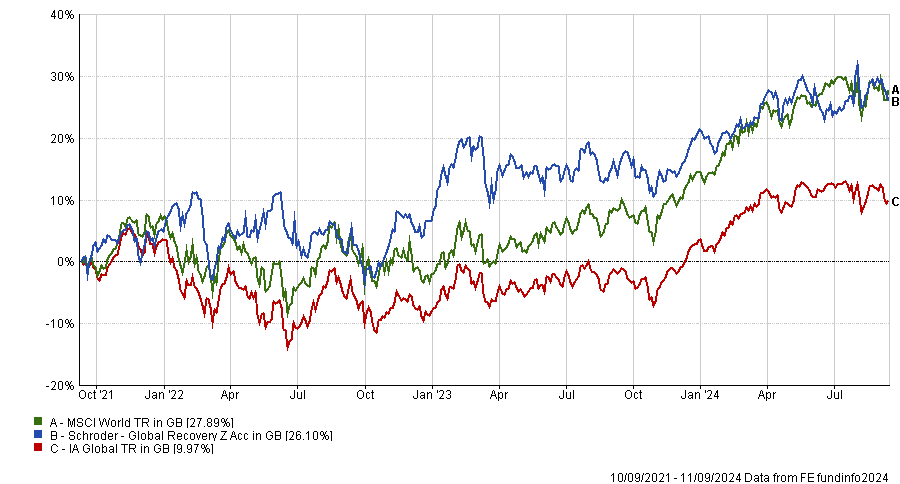

Finally, Rob Morgan, chief analyst at Charles Stanley Direct, opted for two global equity funds – JOHCM Global Opportunities for the core allocation and BlackRock Global Unconstrained Equity as the satellite.

Performance of portfolios (with 70% in core and 30% in satellite) against IA Global sector over 3yrs

Source: FE Analytics

The JOHCM fund can be considered for “part of an investor’s core allocation to global shares, especially for those wishing to keep their portfolio anchored by characteristics of quality and value”, he explained.

The fund is neither growth or value biased, instead exploring what the managers refer to as the ‘forgotten middle’ where quality, growth and value styles intersect.

“As well as a concentrated portfolio, where stock picking has a significant impact, the approach emphasises capital preservation,” Morgan said.

“If insufficient attractive opportunities are identified, the managers are prepared to hold some cash.”

This all-weather fund is paired with BlackRock Global Unconstrained Equity, a “punchy, growth-orientated option” that is likely to be “more volatile, given the very high-conviction approach”.

It is managed by Alistair Hibbert, best-known for his success in unconstrained European equity funds. The manager searches for the “growth compounders” of the coming decade and beyond, with no regard for any benchmark.

“This is a pure stock-picking fund with a very defined approach and style in the hands of an accomplished manager,” said Morgan.

“It makes for a good complement to a broader equities fund or a tracker.”

Source: FE Analytics

The long/short equity fund is betting against the US consumer, electric vehicles and snack companies.

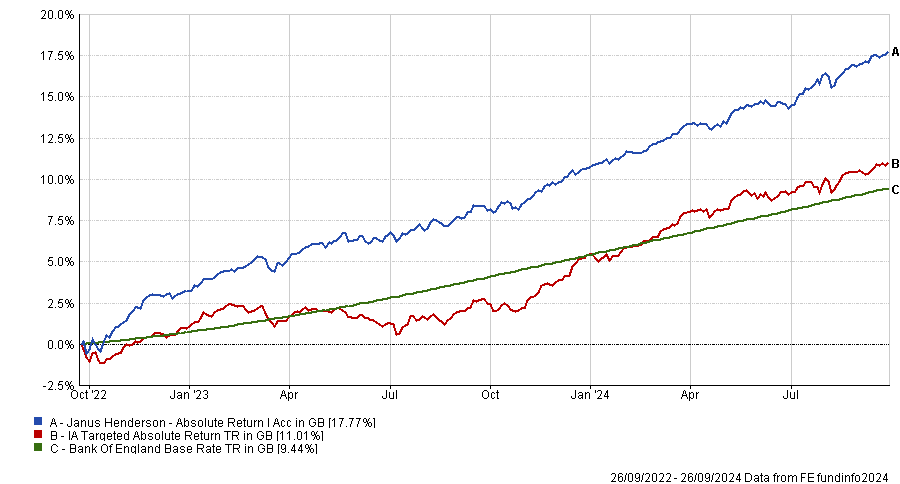

The Janus Henderson Absolute Return fund has gone 23 consecutive months with no drawdowns, the longest unbroken streak since its inception in April 2009.

Manager Luke Newman said his colleagues have promised him a birthday cake once he gets to two years. The £912m fund’s stellar returns also earned Newman and co-manager Ben Wallace an FE fundinfo Alpha Manager of the Year award in the absolute return category in May.

Newman attributes the fund’s success to a conducive environment for stock-picking on both the long and short side. Below, he explains why the fund is net short the US and how he is using pairs trades to benefit from the rising popularity of obesity drugs.

Describe your investment strategy

We are an equity long/short strategy within the absolute return sector, investing in developed market, large- and mega-cap equities. Over the long term, we've delivered equity-like performance with the volatility of sovereign fixed income. That's become the calling card of the strategy.

We run two separate investment books: a core book, which looks longer term on both the long and the short side; and then a tactical book, which is more trading-orientated and can react quickly to protect against downside risk and capitalise on shorter-term disruptions.

How has Janus Henderson Absolute Return performed recently?

We've delivered a run of 23 months without a drawdown. It's a new record for us and we've been running the strategy for 20 years.

Performance of fund vs sector and benchmark over 2yrs

Source: FE Analytics

The big change during this time has been moving back to an environment where money has a cost. We've emerged from a period of near zero interest rates into an environment that feels more normal for equity investing.

The increase in dispersion between share prices is being driven by underlying company fundamentals more than macro headlines. That rationality is great news for stock-pickers, especially those able to benefit on the short side.

How much of your performance came from the short book this summer?

In down months for the broader market, we would expect more returns from the short book and that's exactly what happened through the summer, especially given we were positioned net short US companies.

But areas of the long book were still contributing. Earlier this year, we tilted the portfolio towards defensive, longer duration assets, particularly in Europe and the UK. Sectors such as utilities and real estate investment trusts (REITs) came into the portfolio and performed well this summer.

How long have you been net short US stocks?

Through the quantitative easing (QE) years, we were consistently net long the US. A lot of liquidity was injected into the US economy, which outperformed.

But that is unwinding. The levels of financial leverage at a household and corporate level, plus the much higher relative valuations of US assets, convinced us to take profits through the summer of 2022 and introduce some net shorts. We didn’t feel comfortable with the lofty valuations within the technology, consumer and industrial sectors. Our focus was on the US consumer, going short companies in retail, housing and consumer goods.

How have you been playing the tech sector?

In 2022, technology in the US was the first area we moved to short. That was due to valuation regime change with higher interest rates, as well as the normalisation of trading patterns after lockdowns when we were all sat at home replacing hardware and signing up to new subscriptions. There was a pronounced sell-off and we were able to protect capital through our short positions.

Since 2023 there has been much more stock-specific dispersion within technology. Businesses such as Microsoft, Oracle and Alphabet have been able to adapt to a higher cost of borrowing. In many cases, they have huge net cash positions, so high rates are actually a positive.

The contrast would be in the short book, where you have businesses such as electric vehicle manufacturers that have seen challenges in terms of demand, pricing, leverage and the higher cost of debt.

Do you have any exposure to obesity drugs?

We’ve been close to Novo Nordisk during the 20 years we’ve been running the strategy. We're always interested in companies whose challenges are on the supply side rather than generating demand; that is usually an advantageous position to be in.

The second and third derivatives of obesity drugs are interesting when you think about the lifestyle changes we are likely to see as adoption increases. We are shorting quick service restaurants in the US.

We're long Coca-Cola, which has no snacking exposure, and short a beverage and snack competitor; that’s a pairs trade which has worked well.

How do you use pairs trades?

During the QE years of low interest rates and high correlations, pair trading strategies were really challenged. You simply didn't have the dispersion at a single stock level to make them worthwhile.

Over the past two years, pairs trading – going long and short two different companies in the same region or industry to isolate macro risks – has become an important part of our strategy again.

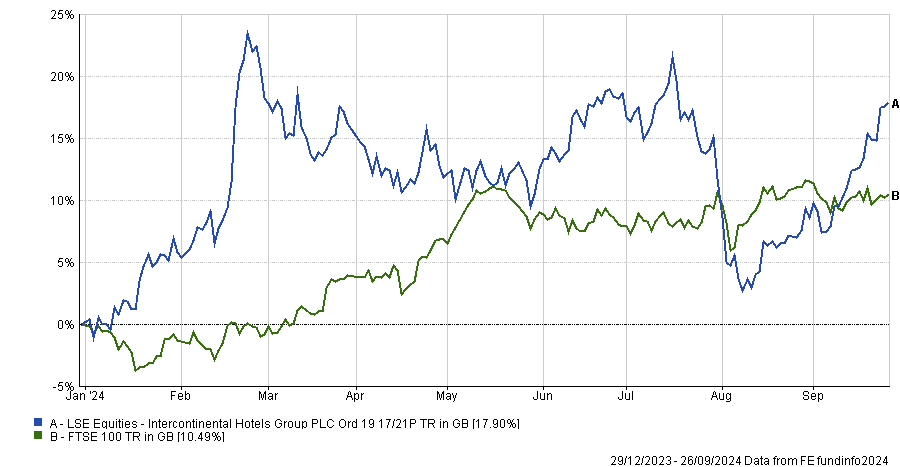

An example would be long InterContinental Hotels versus shorts in US hotel groups. InterContinental Hotels was trading at a material discount at the start of this year because it is London listed and has more Chinese exposure than US competitors. We benefitted from the normalisation of the relationship between those valuations.

Performance of Intercontinental Hotels this year vs FTSE 100

Source: FE Analytics

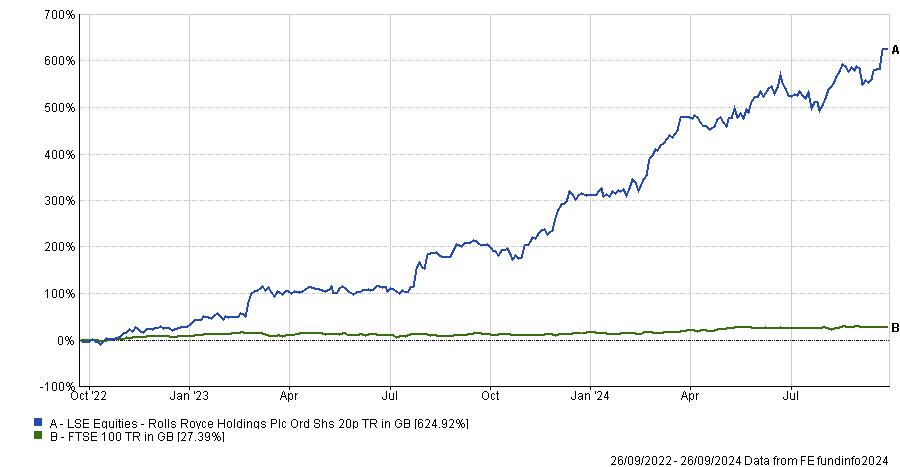

What has been your best performing position recently?

Rolls-Royce, the aircraft engine manufacturer. We met the new management team early last year and understood the opportunity. The share price was implying that the business would need to raise equity, whereas it became clear to us that Rolls-Royce – with a dynamic new management team – would be in a strong position to recover from travel disruption and resume dividends.

Performance of Rolls-Royce vs FTSE 100 over 2yrs

Source: FE Analytics

What positions detracted from returns in the past year?

We haven't had a significant detractor over that period because of the low level of risk in the strategy. We usually have a long list of very small detractors because we operate with a stop loss in the tactical book. We stay in liquid positions and if the fundamentals change or a share price’s reaction to an announcement differs from our expectations, we close that position. Similarly, if any position moves 10% against us, we close it.

What do you enjoy doing outside investing?

I ran the Marathon du Médoc last year, which is a perfect way of combining two passions – running and wine.

Age is an underappreciated but essential facet of diversity.

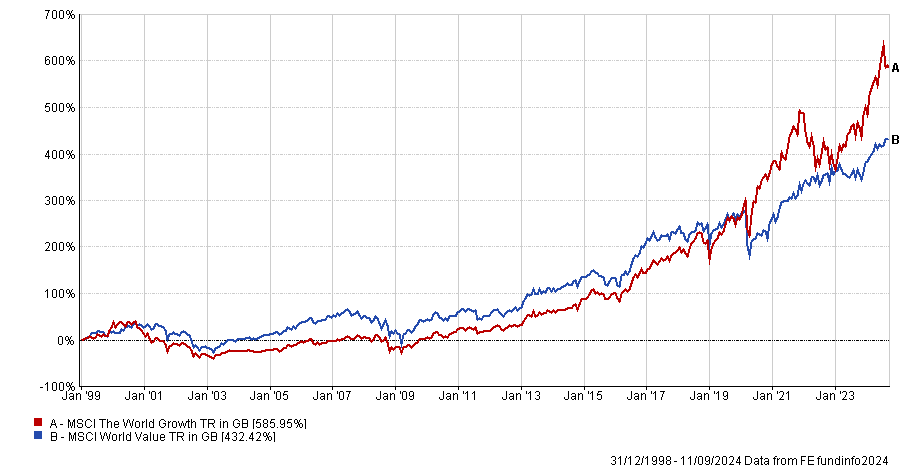

Everything from my youth seems to be making a comeback: Oasis, the Spice Girls, Sex and the City, Top Gun, a Labour landslide, inflation and pre-financial crisis economic conditions. Fund managers, who are getting bored of reading central bank tea leaves, are yearning for the latter.

Luke Newman, who manages the Janus Henderson Absolute Return fund, said the biggest change in equity investing during the past two years has been “moving back to an environment where money now has a cost”.

“In terms of financing rates, the discount rate, interest rates, the cost of money, they're much more normal in a historical context” than during the post-financial crisis years of quantitative easing, he said. As a result, dispersion between share prices is increasing and is being driven by company fundamentals, more so than macro headlines. This is “great news for stock pickers”, he concluded.

If we are returning to a landscape more akin to the pre-2008 normality, surely it would be wise to entrust our savings to fund managers who have a track record from that era.

In some ways I am preaching to the choir. Most fund selectors look for experienced managers. But I want to make the specific point that some of that investment experience should have been garnered before the global financial crisis irrevocably altered our industry and ushered in a wave of central bank intervention.

I began my career in financial journalism back in 2002, interviewing UK pension funds back when they all still had a massive home bias. Then I moved to New York where I had a ringside seat to watch the financial crisis unfolding… but did I read the writing on the wall? Let’s just say that if you’ve watched The Big Short, you will have noticed that a plucky young English journalist was, well, nowhere to be seen. This still rankles. “Why didn’t you spot the financial crisis coming?” my father asked me over lunch last week. If I had, the lunch would’ve been a lot more lavish.

Which leads me to believe that we’re looking for fund managers who racked up much more pre-financial crisis experience than I did; in other words, somebody older than me. Late forties and above. When I interview fund managers in this age group, I do tend to afford them a greater degree of respect. And we tend to get each other’s jokes.

There are downsides to old hats, however. The longer you do something, the more patterns, prejudices and bias can set in.

To guard against this very thing, Mick Dillon and Bertie Thomson from Brown Advisory invite their colleagues to point out their blind spots at their offsite meetings every year. Mick admitted to a tendency to cleave to stereotypes that were valid in the past but are no longer true, such as semiconductors being a cyclical industry.

In the same vein, GQG Partners set out to hire a cohort of younger analysts who did not share the same prejudices as the rest of the team, whose fingers had previously been burned in the energy sector, for instance.

Most people now subscribe to the benefits of a diverse team but age is a facet of diversity that may not have been afforded the appreciation it deserves, and investment teams arguably need people of all ages to reach the best decisions.

So next time you have a big birthday, celebrate in style. Ageing is a privilege and it may just make you better at your job.

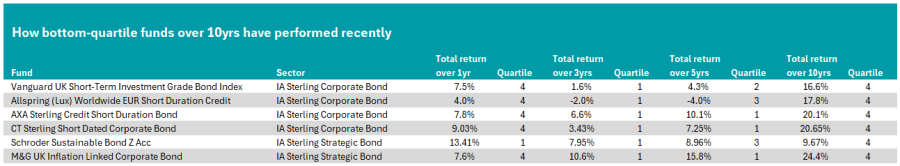

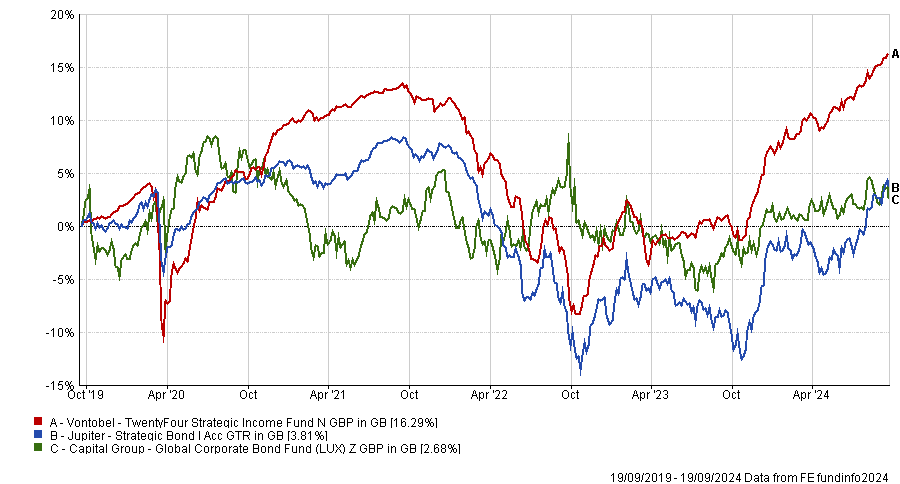

Trustnet looks at the UK fixed-income funds which rallied after weak long-term performance to produce top-quartile efforts.

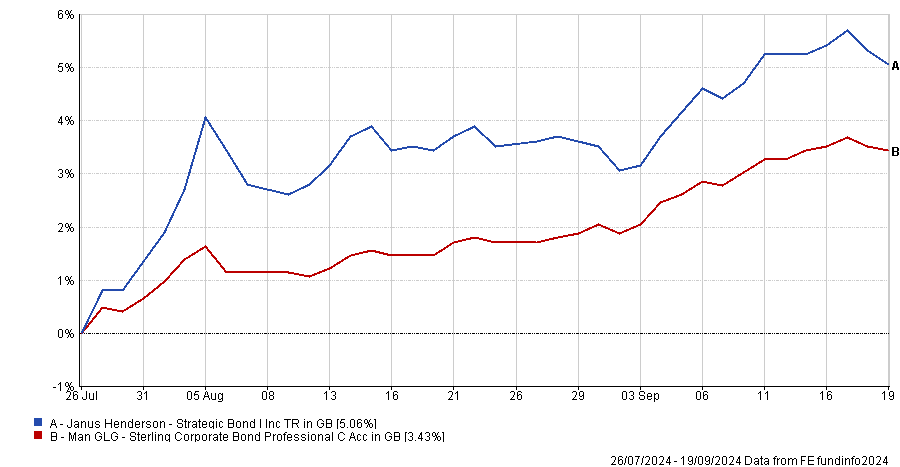

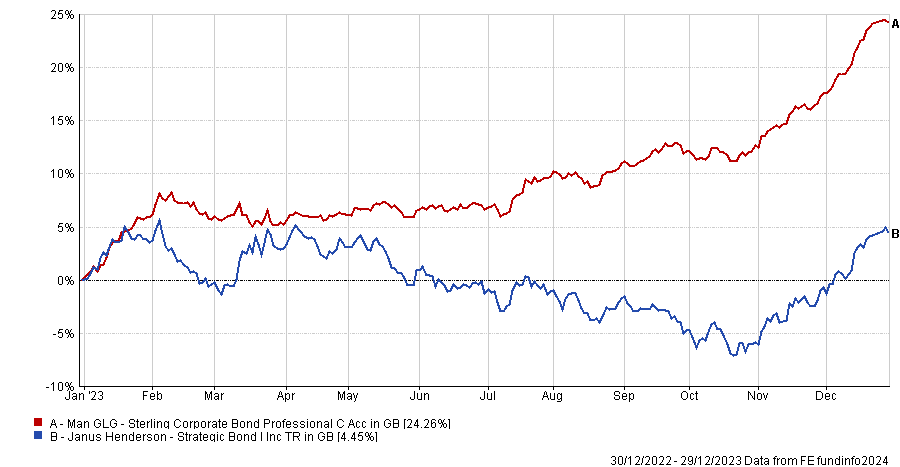

The past three years have seen a reversal of fortunes for fixed income funds. Central banks’ decisions to slash interest rates this year bode well for the asset class, as lower interest rates should enable bonds to deliver higher total returns.

Several fixed-income strategies have proven impressive amidst these turbulent market circumstances, with some even recovering from weak long-term performance to produce stellar numbers more recently.

As part of an ongoing series, Trustnet looks at the funds that have rallied from bottom-quartile performance over 10 years to top-quartile performance over three.

Below, we look at fixed-income funds across the IA Sterling Corporate Bond and IA Sterling Strategic Bond sectors.

How bottom quartile funds over 10yrs have performed recently

Source: FE Analytics

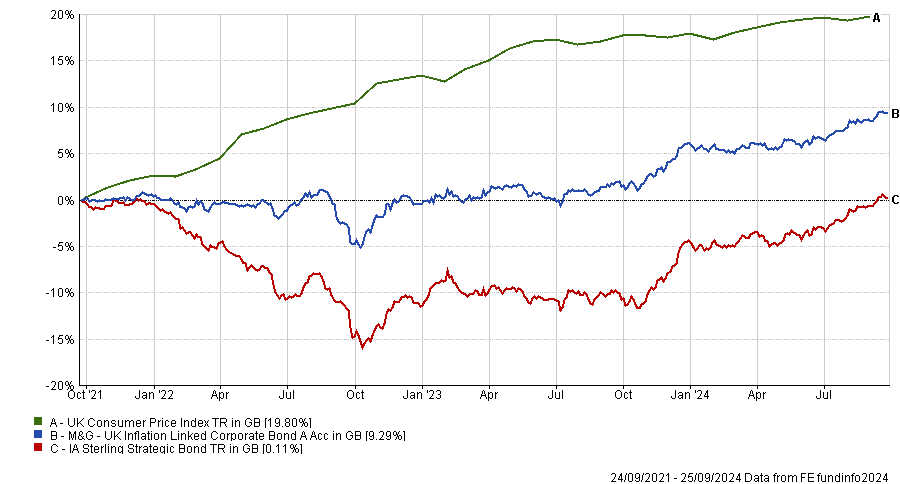

In the IA Sterling Strategic Bond sector, just two funds meet our criteria of moving from bottom to top-quartile performance over the past three years.

Of those two, the most interesting is the £813m M&G UK Inflation Linked Corporate Bond fund, managed by Ben Lord and Matthew Russell.

The portfolio has an FE fundinfo Crown Rating of five. It has rallied from the bottom 10 funds in its sector, returning 24.4% over 10 years, to a top-five performance of 10.6% over three years. Additionally, the fund delivered a top-quartile effort over the past five years, rising by 15.8% in total.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Unlike more conventional corporate bond funds, this strategy came into its own when inflation spiked in 2022. Given its low sensitivity to movements in interest rates, it was not hampered by rate hikes that year. Therefore, the fund boasted a particularly strong 2022 compared to peers, falling by just 0.4% that year.

The fund invests directly in high-quality, inflation-linked corporate bonds, as well as gaining indirect exposure by combining inflation-linked government bonds with derivatives. It also holds floating rate notes.

Analysts at Square Mile, who have given the fund an AA rating, said “there are very few funds of this ilk” giving investors “rare access” to inflation-linked corporate bonds.

“We believe that the fund is both intelligently structured and capably managed to navigate inflation, credit and interest rate markets to the benefit of investors seeking inflation-protected returns over three to five-year time horizons,” they concluded.

The fund’s shorter-term record has failed to impress, however, dropping to the bottom quartile versus peers over the past year.

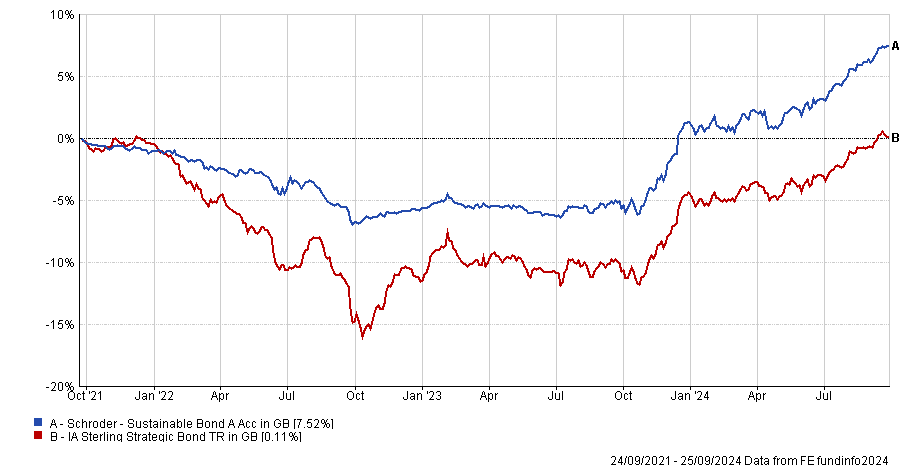

Another example of a strategic bond fund which rallied over three years was the four Crown-rated £67.1m Schroder Sustainable Bond strategy.

It was the second-worst performer in the whole sector over 10 years, but it produced a top-quartile effort over three years, up 8%, and remained in the top-quartile for the past year.

Performance of fund vs sector over 3yrs

Source: FE Analytics

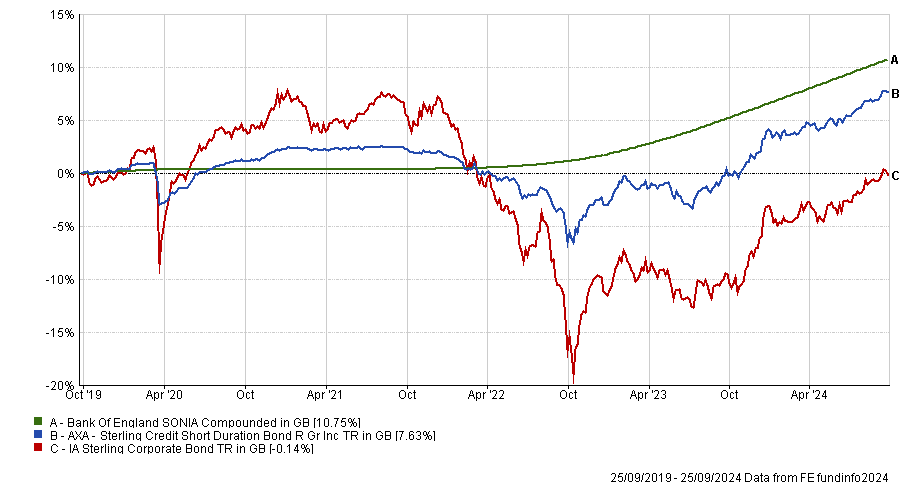

Turning to the IA Sterling Corporate bond sector, a further four funds match our criteria here.

First is the £895m AXA Sterling Credit Short Duration bond, led by FE fundinfo Alpha Manager Nicolas Trindade.

The portfolio has enjoyed an impressive turnaround, rising from the seventh-worst track record in the peer group over 10 years, to the third-best result of 6.6% over three years. Its five-year performance is also impressive, with the fund up by 10.1%, making it the fourth-best in the sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund's defensive strategy has enabled it to weather difficult market circumstances and recover much better than competitors in the corporate bond peer group.

It held up well in 2021 and 2022, falling by just 0.1% and 4.2%, respectively. Both years were challenging for other bond funds, with no fixed-income portfolio in the peer group enjoying positive returns in 2022, while just 10 funds rose in value in 2021.

Square Mile analysts gave the fund an AA rating, noting that while its focus on short-dated bonds means returns are lower, the portfolio successfully protects capital in line with its stated objectives.

“Whilst this fund is never likely to excite, it is also unlikely to produce any nasty surprises for investors,” analysts at Square Mile concluded.

Several other funds in the Sterling Corporate bond sector rebounded from struggling long-term performance and enjoyed first-quartile three-year returns. These included the £1.3bn Vanguard UK Short-term Investment Grade Bond Index, the £177.6m Allspring (Lux) Worldwide - EUR Short Duration Credit fund, and the £87.4m CT Sterling Short-dated Corporate Bond fund.

Alternative investments must beat cash by a wide margin and have half the volatility of equities to make it into Schroders’ model portfolios.

An ongoing debate for investors, asset allocators and managers of model portfolios is whether they really need alternative investments.

With fixed income and money market funds delivering a decent yield and offering diversification away from equities, alternative investments – which often charge high fees – look less appealing.

As Rob Starkey, who co-manages Schroders’ range of model portfolios, said: “It’s a very expensive position if it’s not keeping up [with] or outperforming cash.”

This is why Schroder Investment Solutions has a dual mandate for alternative investment strategies. The minimum return target is cash plus 2% after fees (using the ICE BofA Sterling 3-Month Government Bill index as a proxy for cash) and this is the portfolio’s primary benchmark. Secondly, beta should be half that of the MSCI All Country World Index.

Taken together, these goals underscore that alternative investments should be return enhancing and/or risk diversifying.

This strategy has worked in recent times. During the volatile months of July and August 2024, Schroders Investment Solutions’ alternatives portfolio provided a less volatile and higher return outcome than global equities. Performance for the two-month period was circa 1.2% net of fees versus 0.3% for the MSCI ACWI.

One reason that investors and multi-asset fund managers such as Starkey may want to add alternatives now is inflation; in particular, where it will settle in the future.

Even though inflation is coming down, Schroders’ long-term view is that it will be higher than in the past due to the ‘three ‘D’s’ of demographics, decarbonisation and deglobalisation – to which Starkey added a fourth factor, debt.

Equities and bonds tend to become more correlated during periods of higher inflation, a relationship that becomes more pronounced when inflation reaches the 3% level, creating a role within portfolios for alternative investments.

The highest allocation to alternatives within Schroders’ model portfolios, which it manages on behalf of financial advisers, is currently 14.5%. This varies depending on the level of risk, with the allocation increasing with each step up the ladder, although the most aggressive strategy is invested solely in equities.

The alternatives bucket includes absolute return, macro, multi-strategy, volatility/arbitrage, trend-following and 130/30 extension strategies, alongside commodities and real estate.

Schroders also holds equity dispersion strategies that aim to profit from the difference between the S&P 500 index’s volatility and that of its constituent stocks.

The firm’s model portfolios invest in the Landseeram European Equity Focus Long/Short fund, Jupiter Strategic Absolute Return Bond, Brevan Howard’s BH Macro strategy and Schroder GAIA Contour Tech Equity, among others.

Schroders also holds catastrophe bonds or CAT bonds, which insurers use to transfer the risk of extreme events to investors, and which are “excellent diversifiers” because their returns are not related to the stock market, Starkey said.

The commodities allocation is split between the L&G Multi Strategy Enhanced Commodity ETF, which provides broad exposure to the sector, and a market neutral strategy that aims to benefit from the difference between the spot price and futures contracts. By being market neutral in this sense, the latter dampens the portfolio’s exposure to the volatility of commodity prices.

Early adopters could get the most out of the recovery and subsequent elevation of a smaller company’s share price.

Meno’s Paradox first appeared in the Socratic dialogues. It represents sophistry at its most adroit and Plato at his most exquisite. Yet the concept is perhaps best expressed not in an ancient Greek elenchus but in a 1972 episode of Steptoe and Son, a sitcom about two bickering rag-and-bone men.

The scene in question features the title characters quarrelling over who should write an article for their parish magazine. Steptoe Snr contemptuously brands his offspring incapable of spelling ‘chrysanthemum’, to which Steptoe Jnr defiantly replies: “I can look it up in the dictionary.”

The father is quick to seize on this fallacy. “How can you look it up,” he says, “if you can’t spell it?”

Investors may face a similar puzzle at a time when the case for diversification is back in the spotlight. Recent volatility around leading technology stocks has re-emphasised the merits of looking further afield in the investment universe – but exactly what are we looking for?

One possibility is UK smaller companies. Widely unloved for several years, they could now finally emerge from the shadows for numerous reasons – including a cut in interest rates, attractive valuations and a history of outperformance relative to their larger counterparts.

Crucially, though, these stocks are not just underappreciated – they are also under-researched. Most are covered by barely a handful of analysts, and some are covered by just one or even none.

This sounds like Meno’s Paradox in full effect. How can investors who want to optimise risk and return across their portfolios seek out these opportunities if little or no information about them is available in the first place?

The solution is logical enough. As Steptoe Jnr tells his sneering parent in response to the chrysanthemum gibe: “I shall get someone else to spell it for me!” This is where market knowledge, high-level engagement and informed stock-picking enter the reckoning.

Eyeballing and early adopters

The task of identifying a stock’s appeal usually falls to investment analysts. These supremely diligent souls work for fund brokers, financial advisory firms and major investment banks.

Their basic function is to guide buy and sell decisions. They do so by sifting through a wealth of data – including company statements, price moves, currency adjustments and yield fluctuations – to assess a specific stock or other asset.

The number of equity analysts likely to be eyeballing a given business can vary substantially. As our own surveys have shown, a company’s market capitalisation is a key factor in this regard.

A FTSE 100 constituent is likely to be monitored by around 20 analysts. The figure for a FTSE 250 business is around 10, while the figure for a micro-cap firm – that is, a company with a market value of less than £200 million – is just one.

The tail-off is normally a product of liquidity and trading volumes. An investment bank, for example, may take the view that there is insufficient viability in exploring smaller-cap stocks.

This can give an edge to investment teams that conduct their own research. It can also favour fund managers whose track records in this sphere make them a go-to port of call for specialist brokers capable of unearthing hidden gems.

But why might it pay to be first? The answer is that many of these smaller companies, despite having sound business models and a capacity for long-term growth, remain significantly undervalued.

This means investors who spot potential before the broader market cottons on may reap the greatest rewards over time. Not least in the current environment, early adopters could get the most out of the recovery and subsequent elevation of a smaller company’s share price.

Digging deeper

Of course, quantitative investment analysis might reveal only part of the story. As active managers, we believe direct engagement with companies is essential.

Meeting executives in the smaller-cap space can be hugely instructive. Their grasp of a business’ workings and prospects is often much more detailed and intimate than that of a large-cap organisation’s senior management.

We feel it is especially important to understand the dynamic between a chief executive officer and a chief financial officer. Is the latter strong enough to stand up to the former? Do they have a truly shared vision? Is their strategy realistic?

Equally, the people who run the ship need to recognise that we expect the best for a company. We are not merely interested onlookers. We are there to maximise our investment and benefit shareholders and other stakeholders by helping the business survive and thrive.

All this information – gleaned both from analysis and from engagement – is ultimately used to select stocks. It should equip us with a more fully formed picture of which to buy, which to hold and which to sell.

Naturally, much the same approach might be applied across a variety of assets and regions. In-depth research, strong relationships and an on-the-ground presence can deliver a competitive advantage in many investment settings.

Yet we would argue the effect is more powerful in some arenas than in others. In the realm of UK smaller companies – a sector that continues to suffer from an undeservedly low profile and which might be disproportionately vulnerable to economic downturns – it can produce a degree of insight not easily acquired by would-be market participants.

The lesson: this is a corner of the investment universe that may demand not only long-overdue attention but demonstrable expertise. All things considered, you do not need to be an ancient Greek philosopher to see the wisdom in that.

Eustace Santa Barbara is co-manager of the IFSL Marlborough Special Situations, UK Micro-Cap Growth and Nano-Cap Growth funds. The views expressed above should not be taken as investment advice.

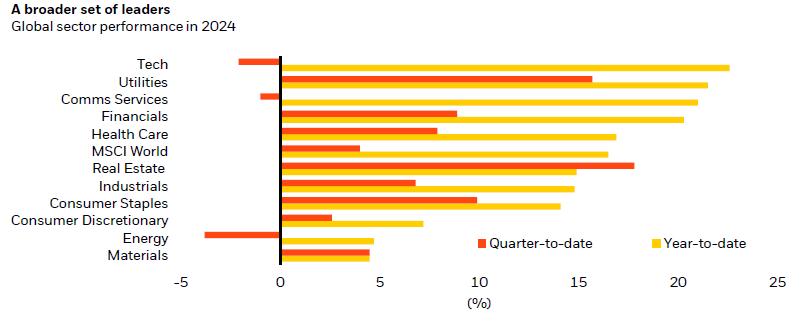

BlackRock is bullish on the prospects for infrastructure, housing and healthcare during the final quarter of this year.

Infrastructure, housebuilders, small- and mid-cap stocks and dividend-payers should all benefit from interest rate cuts during the remainder of 2024, according to BlackRock. The manager also has a favourable outlook for the healthcare sector.

Yet the turbulence characterising the summer months has not completely dissipated, said Helen Jewell, chief investment officer of BlackRock fundamental equities, EMEA.

During the “tumultuous” third quarter, investors rotated from cyclical stocks into more defensive names such as financials and utilities, which “rose up the performance rankings as global market leadership extended beyond tech.”

Source: BlackRock Investment Institute, data to 17 Sept 2024

She expects this dynamic to continue. “Worries around recession and AI may result in more volatility and further broadening in market leadership as investors seek to diversify portfolios,” she said.

Below, she highlights the sectors she expects to prosper during the remainder of this year.

Rate-cut beneficiaries

Areas that suffered during the rapid rate-hiking cycle and were weighed down by borrowing costs and mortgage rates, such as construction and housing, are poised for a reversal of fortunes.

“Some recent earnings calls in these sectors highlighted green shoots of activity in both the US and parts of Europe, including areas such as the Nordics where construction was severely impacted by higher rates,” Jewell said.

In the UK, housebuilders have the additional tailwind of supportive government policy.

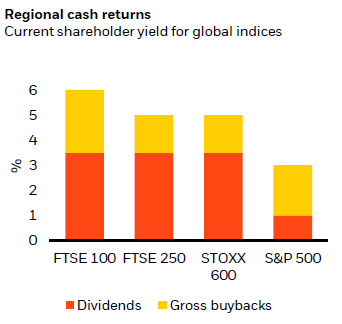

Companies that offer stable sources of income are likely to become more popular amongst investors as bond yields decline. “This is another reason we believe the UK is worth a look – the FTSE 100 has a current shareholder yield (dividends plus buybacks) of 6%, versus 3% for the S&P 500,” she noted.

Source: Goldman Sachs Global Investment Research, BlackRock, Sept 2024

Across Europe, small- and mid-caps remain attractive given their propensity to benefit from falling rates as well as their cheap valuations, she added.

Infrastructure

Infrastructure stocks are slated to be another winner in an environment of moderating inflation and rate cuts. Because these companies are capital intensive and “a significant amount of equity value is driven by long-term cash flows”, their valuations are inversely correlated to bond yields.

With valuations currently languishing at levels comparable to the 2008 global financial crisis, this is an attractive entry point for investors, she said.

Over the longer-term, the ‘four D’s’ of decarbonisation, deglobalisation, demographics and digitalisation should bolster the sector further.

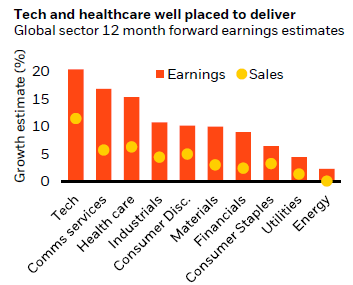

Earnings resilience

With market volatility still on the horizon, BlackRock is sticking with companies that have long-term earnings resilience. This includes large technology and semiconductor companies profiting from increased AI spending, as well as more cyclical areas, such as construction and industrials, that should benefit from decarbonisation.

“This emphasizes the importance of selectivity. There's a clear divide between those companies that have exposure to energy efficiency, electrification, data centre demand and automation, and those that don’t – and are therefore more vulnerable to an economic slowdown,” Jewell explained.

Healthcare

The healthcare sector is going through a period of rapid innovation in the fields of obesity medication, atrial fibrillation treatments and oncology drugs. Obesity drugs could be worth more than $100bn in sales in the US by 2030, Jewell noted.

Ageing populations are boosting demand for healthcare, underpinning earnings for the sector and making it more resilient to market cycles and periods of geopolitical tension. Many healthcare companies already deliver stable income streams to their shareholders and long-term demographic trends are supportive of this dynamic.

All that said, many companies within the healthcare sector, such as vaccine makers, have had a tough couple of years since supply/demand dynamics were warped by the Covid pandemic.

The sector is now going through a cyclical recovery. As a result, “healthcare earnings are expected to lead most sectors over the next 12 months, while the sector is available at a 5% discount global stocks,” Jewell pointed out.

Source: BlackRock Investment Institute, Sept 2024

The new manager will replace T. Rowe Price in November.

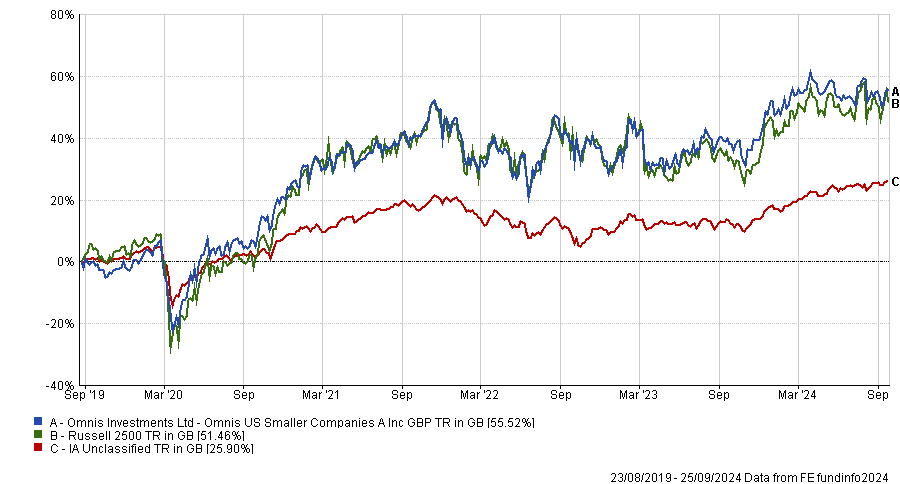

Janus Henderson Investors’ Jonathan Coleman has been appointed to run the £183m Omnis US Smaller Companies fund from November onwards.

The manager, who is part of the US small- and mid-cap growth team at Janus Henderson, will replace T. Rowe Price’s Curt Organt and Matt Mahon, who have run the fund since 2019 and 2023, respectively.

The move follows “a change in personnel at T. Rowe Price”, which triggered “a strategic review of the incumbent manager”, Omnis Investments announced.

During Organt’s tenure, the fund has beaten its benchmark, the Russell 2500, by four percentage points, as shown in the chart below.

Performance of fund against sector and index since August 2019

Source: FE Analytics

Coleman, who has more than three decades of investment experience, said his team has a “strong track record in identifying high-quality, smaller US companies with strong growth potential”.

Omnis reassured investors that there will be no alternations to the fund’s strategy, investment objectives or philosophy. It will continue to focus on US early-stage companies with competitive advantages, a high return on capital and robust cash flow generation. The new team will “carefully consider” the price paid for stocks, relative to intrinsic value, Omnis stated.

Andrew Summers, Omnis’ chief investment officer, said he was “impressed” with the new team’s “disciplined investment process, which combines a focus on fundamental research with a strong emphasis on valuations”.

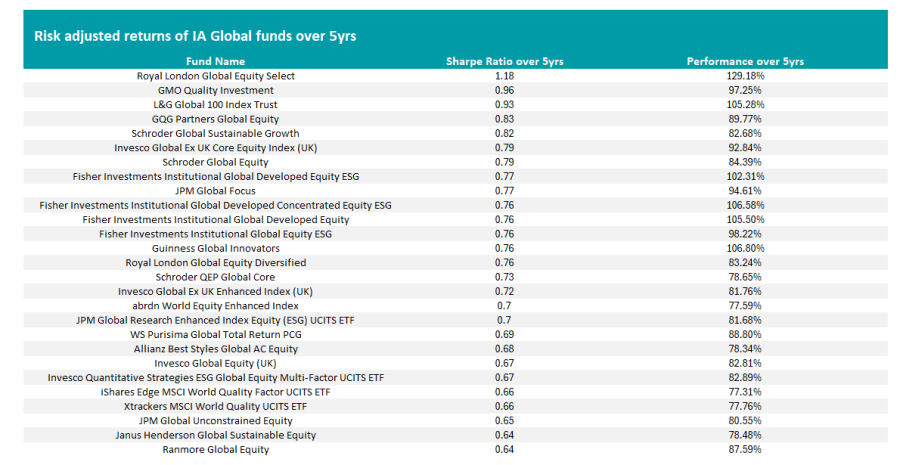

Trustnet looks at the funds achieving top decile Sharpe ratios and returns over half a decade.

Global markets have experienced a turbulent five years, facing challenges such as a global pandemic, recession, and various geo-political conflicts. During times like this it can pay off to take some risks, but can also go catastrophically wrong.

As such, getting the best returns for the risk taken can become a key factor for investors when deciding which funds to buy.

In the first part of a new series, Trustnet looks at the funds in different sectors that have made the best risk-adjusted returns over the past five years using the Sharpe ratio, which factors in volatility and total return.

We do this by looking at funds ranking within the top 10% for five-year returns and Sharpe ratio – which measures the amount of excess return generated by a fund per unit of risk.

There are two ways funds can achieve a strong Sharpe ratio – either by taking less risk for reasonable returns, or by taking on more risk for supranormal gains.

Below, we look at the best funds for risk-adjusted returns over five years in the 412-strong IA Global peer group.

Risk-adjusted returns of IA Global funds over 5yrs

Source: FE Analytics. Total return in Sterling. Figures accurate up to 31 August 2024.

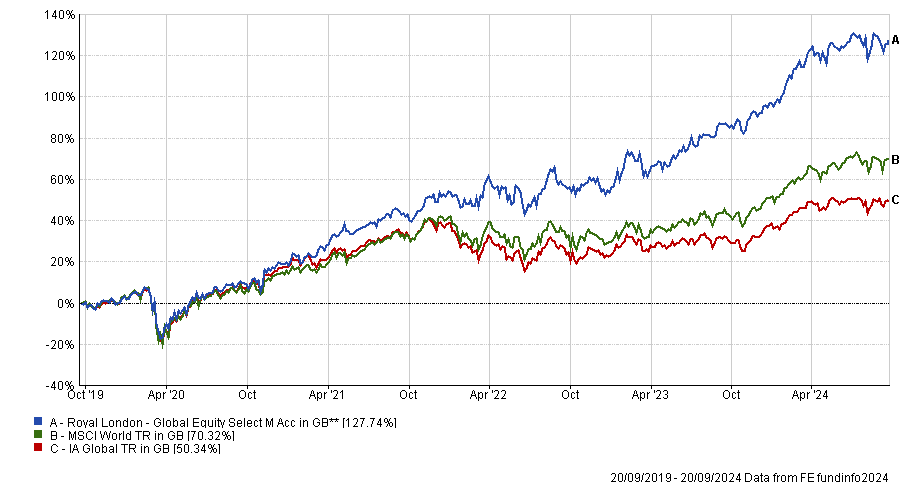

Heading the table is the £621m Royal London Global Equity Select fund, led by FE Fundinfo Alpha Manager Mike Fox. Over five years, it has achieved the best five-year returns among its peers of 129.2% with third-decile volatility of 12.3%. This has led to it achieving one of the highest Sharpe scores in the sector at 1.2.

Performance of fund vs the sector and benchmark over 5yrs

Source: FE Analytics

However, the fund is currently hard closed to new investors. Additionally, Royal London’s head of equities Peter Ruffer departed the firm earlier this year, which may affect the fund’s future performance.

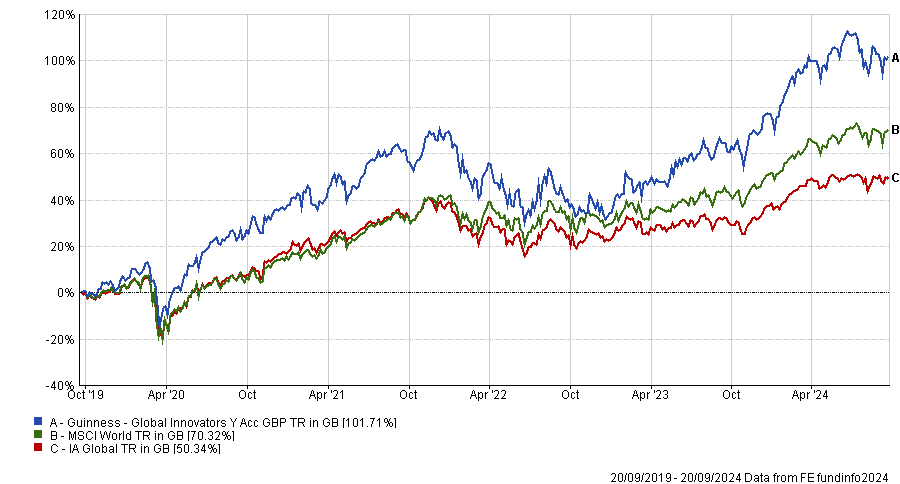

Next up is the £833m Guinness Global Innovators portfolio, managed by Ian Mortimer and Matthew Page, which enjoyed the second-highest five-year returns of 106.8%.

It was however, a comparatively more aggressive strategy than Royal London’s portfolio, with the fund ranking in the eighth decile for volatility over the past five years.

This combination of high risks and high returns means the fund achieved a total Sharpe ratio of 0.76 over five years.

Performance of fund vs sector and benchmark 5yrs

Source: FE Analytics

The portfolio’s broader performance has also been impressive, with top 25% results over 10 years, and the past year. It did, however, drop into the second quartile over three years.

Several other funds achieved returns of above 100%, while also ranking in the top decile for Sharpe ratio across the past five years.

These included the £51.7m Fisher Investments Institutional Global Developed Equity ESG, the £1.7bn L&G Global 100 Index Trust, and the £5.9m Fisher Investments Institutional Global Developed Concentrated Equity ESG.

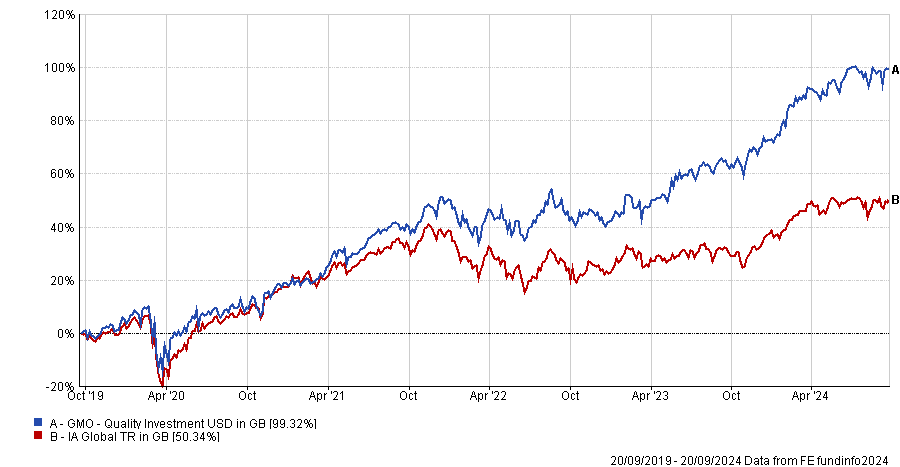

Another popular portfolio in the IA Global sector that achieved top-decile risk-adjusted returns was the £2.9bn GMO Quality Investment fund, which has an FE fundinfo Crown Rating of five.

With the second-highest five-year Sharpe ratio of 0.93 and top-decile returns of 97.3%, it is one of the consistently best-performing portfolios in the sector, with strong 10-, five-, three- and one-year records.

Performance of fund vs the sector over 5yrs

Source: FE Analytics

Its 10-year record was particularly exceptional, with the fund up by 347.2%, a second-place performance in the peer group overall, 37 percentage points better than the third-place portfolio.

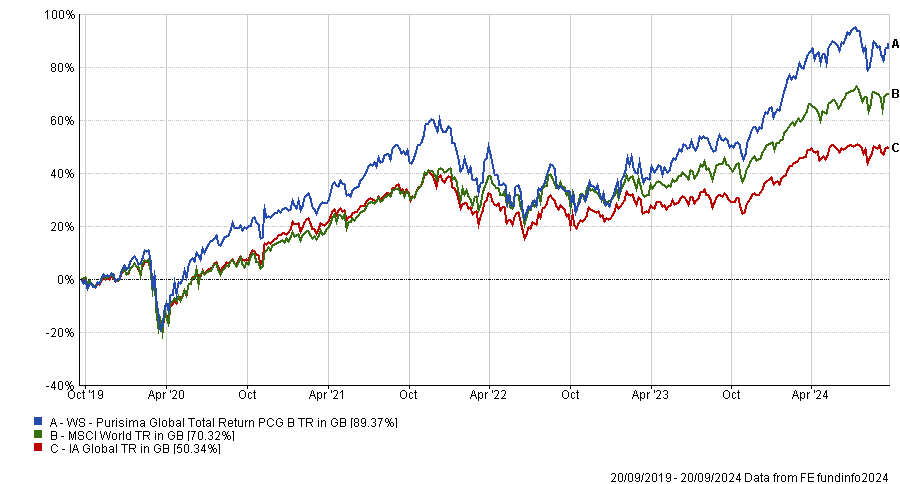

Many other larger funds secured top-decile risk-adjusted returns over five years, most notably the £10bn WS Purisima Global Total Return fund.

The aggressive strategy paired top-decile performance of 88.8% with seventh-quartile volatility, which indicates that, despite taking on more risks than average, it made smart use of those risks. This higher risk strategy resulted in a five-year Sharpe ratio for the fund of 0.69.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

More broadly, it has enjoyed top-quartile performances over both one-, three- and 10-year periods. It’s 10-year performance was particularly notable, with the portfolio up by 247.7%, the 12th best result sector.

Other large funds to gain top-decile Sharpe ratios and returns over the past five years include the £5.9bn Royal London Global Equity Diversified and the £5.6bn JPM Global Focus portfolios.

The firm has hired a new head of investment solutions and head of asset allocation.

Scottish Widows has made four senior appointments in its investment team, reporting to chief investment officer, Kevin Doran.

Matt Brennan and Mark Gillan join from Valu-Trac investment Management as head of asset allocation and research, and head of operations, respectively.

Mobius Life’s Mithesh Varsani will come on board in January 2025 as head of investment solutions.

Finally, Heather Coulson will take on a new role as head of implementation and portfolio management in January. She moved to Scottish Widows earlier this year from abrdn and is currently deputy head of the investment office.

Brennan has almost a decade of industry experience and previously worked at AJ Bell and Brown Shipley. He will join Scottish Widows in November. Gillan will join the firm in January 2025, following a career overseeing a range of investment funds at organisations such as AJ Bell and Winterflood.

Experts discuss where the line is between conviction and key-person risk.

Having conviction in a manager is often one of the reasons why fund selectors and investors choose one fund over another.

But loading up a portfolio with strategies run by the same manager is usually not recommended, as it may lower diversification and increase the so-called key-person risk – the potential negative impact on performance due to the departure or unavailability of a manager. The extreme would be ending up ‘worshipping’ a fund manager.

Below, experts discuss where to draw the line between conviction and worship in a manager, whether investors should avoid owning more than one fund run by the same team or manager and if there are cases that are worth making an exception.

Dennehy Wealth’s Richardson: We actively avoid placing too much reliance on any single fund manager

The strongest disapproval for the practice came from Joe Richardson, discretionary investment manager at Dennehy Wealth, who “actively avoids placing too much reliance on any single fund manager or team”.

“Fund manager worship can be a very dangerous thing,” he said. “Most managers are very impressive with strong conviction in their approach but we should all be aware of a media frenzy surrounding any fund manager – history shows that can backfire and Woodford is a prime example of how things can go wrong.”

Indeed, in 2019 the once-renowned Neil Woodford came under fire for his illiquid holdings and shortly afterwards his eponymous fund house – Woodford Investment Management – collapsed.

“No one manager is infallible”, said Richardson, who instead focuses more on funds with a “solid” investment process and that stay disciplined in the execution, regardless of any one individual’s reputation.

EQ Investors’ Cheung: Owning multiple funds from the same asset management company is fine

Broadly agreeing with Richardson, EQ Investors’ investment analyst Andrew Cheung stressed the importance of the process over the manager, but allowed the ownership of funds by the same asset management house.

“Owning multiple funds from the same asset management company is fine, but not from the same individual manager,” he said.

“It is important to avoid group think and embrace a diverse range of opinions and strategies. It is the investment process that gives investors clarity as to their investment approach given the changing market conditions and their investment mindset.”

Progeny’s Sparke: We only make one exception to our rule

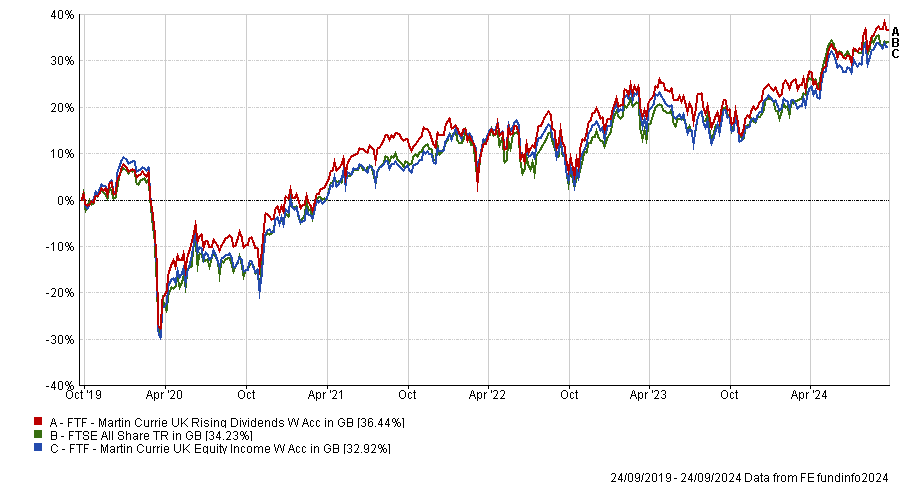

Tom Sparke, portfolio manager at Progeny Asset Management, was the first to admit he allows exceptions. While historically he has not tended to use two funds from the same manager or team, there is one exception within Progeny’s UK exposure – the Martin Currie UK Equity Income and Rising Dividend funds, both co-managed by Will Bradwell and FE fundinfo Alpha Managers Ben Russon and Joanne Rands.

Both however are “relatively small holdings” for Progeny, and are used to “nuance the exposure we gain from their overall position”.

Performance of funds against index over 5yrs

Source: FE Analytics

“In my experience, a manager or team will generally have a style that we would look to complement with another of a different style, rather than another manager from within the same house,” Sparke said.

“It may be more prevalent in strategies with a more systematic approach, meaning the same strategy could be replicated in the US, UK or Europe.”

A good example of this would be Jupiter Merian’s systematic team, who run numerous strategies in various regions.

Elston Consulting’s Qiao: A single-team approach makes more sense for multi-asset funds

For Jackie Qiao, head of fund research at Elston Consulting, key-person risk becomes a lesser concern when two things are in place. First, the success of the fund is more about the team's overall capability and consistency rather than just one person's influence. Secondly, the investment process is “robust and disciplined”.

That said, there are some qualifiers. For example, if using multiple funds run by the same team, the considerations are different for security selection funds compared to asset allocation funds.

In the first case, it can make sense if the investment philosophy and approach are similar, according to Qiao.

“For example, a team looking at UK small-cap and UK small-cap value have a lot of overlap,” she said. “But if security selection strategies are very different (say UK small-cap versus UK large-cap) it seems less likely that there is overlap and we could question if the same team can do both.”

For asset-allocation funds, it’s more about multi-asset capabilities. For example at Elston, Qiao uses the VT Avastra Global Fixed Income, VT Avastra Global Alternatives and VT Avastra Global Equity funds – all three are funds-of-funds managed by Paul Denley and Richard Morrison, who offer “broad diversification and dynamic asset allocation management”.

In this instance, having a consistent approach across asset classes from the same team makes sense to ensure consistency of outlook, Qiao said.

“It would be odd to have an equity fund positioned for rate hikes and a bond fund positioned for rate cuts, so a single team-based approach for asset allocation funds makes more sense than for security selection funds,” she concluded.

Fund managers think the pro-growth chancellor should avoid damaging the AIM market.

Ahead of the autumn Budget on Wednesday 30 October 2024, speculation is rife about which taxes chancellor Rachel Reeves will enact. One idea that has been greeted by an outcry is removing inheritance tax relief from shares listed on the Alternative Investment Market (AIM).

Business relief, which allows investors to pass on business assets to their beneficiaries free from inheritance tax when they die, currently covers AIM-listed shares, which is why they have become an important part of intergenerational wealth planning for many financial advisers, wealth managers and their clients.

Peel Hunt predicted in an interview with the Financial Times that if business relief were removed and financial advisers encouraged clients to sell their shares, the valuations of AIM-listed companies could fall by a third.

Victoria Stevens, a fund manager in the Liontrust Economic Advantage team, thinks abolishing business relief would be an own goal for the chancellor, flying in the face of her pro-growth mission.

“The government has explicitly set out an agenda to promote economic growth in the UK by supporting investment into the engine of that growth – the companies right across the country which employ local workforces, innovate to develop new products and services and already pay back a substantial amount in tax,” she pointed out.

“The UK’s junior stock market was set up for the very purpose of supporting these growth businesses and it would be a contradictory and painfully ill-judged move to withdraw this important incentive at the very moment when such companies would otherwise, finally, be looking forward to the prospect of a strong revival in their hard-hit share prices with the improving economic backdrop.”

Jessica Franks, head of investment products at Octopus Investments, agreed. “Providing investors with business relief on qualifying shares in unquoted and AIM-listed companies should be seen as one of the big success stories of the past 20 years or so. It has encouraged suitable investors to take more risk with some of their capital, investing it in growing businesses for the long term,” she said.

The risk/reward characteristics of enterprise investment schemes (EIS), venture capital trusts (VCTs) and AIM stocks would all change without tax relief, Franks said, “making them unsuitable for many existing investors and significantly reducing critical support for UK capital markets”.

“AIM has never existed without business relief, so concern around the impact of its removal is understandable,” Franks concluded.

For Stevens, however, any short-term negative sentiment stemming from taxation concerns would be a buying opportunity. “Given the absolute and relative underperformance of the AIM market since early 2022, a great many of our holdings are already trading at extreme discounts to their long run average valuation and yet nonetheless continue to exhibit strong fundamentals and growth prospects,” she said.

“We are therefore ready to take full advantage of any shorter-term sentiment-driven impact on share prices if there is a level of indiscriminate selling.”

Meanwhile, demand for AIM-listed shares is holding up, according to Puma Investments. It recently launched its Puma AIM VCT – the first new AIM VCT to be launched for 17 years – in response to “strong demand from the financial adviser and wealth management community”, a spokesperson said.

Octopus AIM VCTs also launched a £30m fundraise this week.

The performance of AIM VCTs in general has been “lacklustre” during the past few years but there are reasons for optimism going forward, said Nicholas Hyett, investment manager at Wealth Club.

First, “a lot of the pain is now in the rear view mirror” and valuations are consequently low, “creating scope for a recovery if sentiment turns”. Second, if Reeves decides against taxation changes, Hyett thinks “a flurry of new listings could reinvigorate the market”.

“Finally, the pain suffered by the highest risk AIM companies mean AIM VCT portfolios are now weighted towards the more mature investments they made years ago,” he concluded.

“For contrarian investors, the appeal of backing an unloved market (AIM) within an unloved country (UK), may prove an enticing prospect. An AIM VCT provides access to this theme with 30% income tax relief and tax-free returns.”

The broad market volatility in early August was the start of something, T. Rowe Price argues. The wind has changed and volatility could become the norm.

Thin summer liquidity conditions, coupled with crowded leveraged positions, set the kindling for a potential market shock. In early August, all it took was a spark – the Bank of Japan’s (BoJ) move to tighten monetary policy – to ignite an extraordinary volatility shock.

However, while the yen carry trade certainly played a part, it is more a convenient ex-post narrative to explain the price action than a true driver of the volatility. The scapegoating of the yen carry trade ignores the start of a bigger and deeper trend.

When talking with clients in 2023, I sometimes referred to the BoJ as the San Andreas fault of finance. That was early, but I believe that we have just seen the first shift in that fault, and there is more to come.

BoJ loosens yield curve control

The BoJ has started gradually hiking rates and loosened its yield curve control policy, which uses Japanese government bond (JGB) purchases to essentially cap yields. The BoJ moved the upper bound of its benchmark rate to 0.1% in March from -0.1% – where it had been since early 2016 – and raised rates again at the end of July, bringing the upper bound to 0.25%.

At its June policy meeting, the BoJ said it will start to ‘significantly’ scale back its asset purchases from its current ¥6trn monthly pace over the next one to two years. It took a step further in July by saying it would slowly reduce the buying pace, aiming to halve its current monthly amount by early 2026.

But the massive amount of JGB issuance needed to fund the country’s deficit means the central bank likely will not stop its purchases or let its balance sheet run off by not reinvesting the principal from maturing bonds, as the Federal Reserve has been doing since June 2022.

Domestic investors could return

Not surprisingly, JGB yields have been rising. In late August, a 30-year JGB hedged to the dollar provided a yield greater than 7%. To put this into context, the 30-year US treasury yield was roughly 4%.

One would need to stretch far down the credit ratings scale to low investment grade or even high yield to match the dollar-hedged JGB yield in the US credit markets. In a world of massive debt issuance, where different issues compete for a limited amount of funds, yield matters.

At some point, higher Japanese yields could attract the country’s huge life insurance and pension investors back into JGBs from other high-quality government bonds, including treasuries and bunds. In effect, this would rearrange demand in the global market. I believe an overweight allocation to JGBs would benefit from this shift.

A corresponding underweight position in treasuries would benefit from upward pressure on treasury yields as Japanese institutional investors move out of the US and back into Japan. Other factors – including the country’s deteriorating fiscal situation and the accompanying elevated levels of new treasury issuance – also lead me to expect higher US yields on the longer-term horizon.

Inflation may mean more tightening

This approach is not without risk. Japanese inflation could wind up higher than expected in the second half of the year in the event of continued weakness in the Japanese yen or unexpectedly strong wage growth. This could lead the BoJ to raise rates again at its October meeting and slow its asset purchases further.

Weakness in the Japanese yen could, all else being equal, lead the BoJ toward more rapid tightening. But cuts from other developed market central banks would offset this to some degree.

Earlier in 2024, the yen hit its weakest point against the dollar since the mid-1980s and its lowest versus the euro since the introduction of the eurozone currency in 1998. But with the Fed seemingly eager to lower rates and the ECB having already started to loosen policy, the BoJ will not be under as much pressure to make Japan’s rates more competitive.

Astute investors should be aware

Overall, while the yen carry trade was again a convenient explanation, I sense the broad market volatility in early August was the start of something, as opposed to the end. BoJ tightening and the impact it will have on the flow of global capital is far from simple, but it will have a large influence over the next few years.

However, in the context of other megatrends, such as unsustainable fiscal expansion in a number of developed countries, volatility should not be a shock – it should be more the norm. Put a different way, there were several tailwinds that had existed for investors since the global financial crisis.

Like it or not, the wind has changed, and the next few years could be tougher. The shifting global capital flows resulting from the BoJ’s tightening is one of those changes, and astute investors should be aware of the impacts.

Arif Husain is head of fixed income at T. Rowe Price. The views expressed above should not be taken as investment advice.

Following the FCA’s rule change on cost disclosure, the multi-asset manager plans to buy more investment trusts.

Multi-asset managers are taking a fresh look at investment trusts now that they are no longer reporting misleadingly high costs.

The price tags attached to investment companies had been artificially inflated for some years until last week, when the Financial Conduct Authority (FCA) intervened, validating an industry-wide campaign to exempt trusts from European Union legislation.

After an investor buys shares in an investment company, they pay no further charges (unlike open-ended funds where costs are subtracted from performance on an ongoing basis). But the way trusts had been obliged to disclose an ongoing charges figure was confusing for investors and made it appear as if costs detracted from share price performance, which they do not, as Gravis managing director William MacLeod told Trustnet.

This also had a knock-on effect on the costs disclosed by multi-asset funds that hold investment trusts, such as the BNY Multi-Asset Income or Multi-Asset Diversified Return funds, managed by Paul Flood.

“The assumptions for calculating costs have now come back a long way, with the FCA’s new guidance on cost disclosure,” Flood said.

“It’s a temporary solution, but it does provide more clarity and removes an obstacle for investment in that area. As we go through the next year or so, that should be a key positive for the whole investment company universe.”

For the past couple of months, the manager has been increasing his allocation to renewable energy investment trusts – something he plans to do more of, now that cost hurdles have been removed.

This would have been difficult previously. If Flood in his fund wanted a 30% allocation to alternative investment trusts which published, for example, an ongoing charges figure (OCF) of 1%, he would have to add 30 basis points (the 1% charge multiplied by the 30% allocation) onto his own fund’s OCF, “effectively double counting costs,” he explained.

This made a “material” difference given that advisors are keenly focused on consumer duty and whether they're getting value for money.

“Value for money is the right thing to be looking at, but that's not what was happening here. There was an artificial inflation of the costs,” Flood explained.

He has been adding to investment trusts focusing on renewable energy infrastructure, including Greencoat Renewables, Greencoat UK Wind and Gresham House Energy Storage.

“We quite like the renewable infrastructure place, where you've got very strong free cash flow, inflation-linked revenue streams and large discounts which have gone up with interest rates,” he said.

The Greencoat trusts invest in real assets with inflation-linked revenue streams and “now is a reasonable time to start putting on more inflation protection,” he said.

On top of that, discount have widened and sentiment in the area has been “fairly negative” over the past year. So much so that Flood sold out of “a large allocation” at the end of 2022 and the start of 2023.

“We feel now is the time to be to move it back in that direction,” he said.

For battery storage it's not the inflation linkage attracting Flood, but rather the potential upside if things start to go their way. “There’s a lot more upside to these names, which are a bit more growth orientated,” he said.

ESO, the electricity system operator for Great Britain, is not using batteries but gas as a backup energy facilitator, and the manager thinks that is going to change.

“We've seen comments come out around ESO’s focus on making sure that the energy system works at the lowest possible cost, but also lowest carbon footprint. That should be a positive tailwind for the space in the next two to three years,” he concluded.

Gravis managing director William MacLeod explains the “seismic” overhaul of cost disclosure rules.

Investment trusts have faced a lot of selling pressure in recent years, partly due to “opaque and misleading” cost disclosure regulation. That headwind was removed last week when the Financial Conduct Authority (FCA) exempted trusts from European rules.

The UK Regulator’s interpretation of the EU rules was making trusts look artificially more expensive by requiring them to publish costs as an ongoing charges figure. This is misleading because costs do not detract from share price performance as it does for open-ended funds, Gravis managing director William MacLeod explained.

“Costs were captured and paid by the company within the NAV [net asset value] and then published again,” he said.

“In the hands of the investor, a valuation statement coming from a wealth manager would show all of those charges as if they were being deducted from the value of the investor’s holding, which they are not.”

Unlike open-ended funds (where investors receive returns minus fees, which are deducted on an ongoing basis) after an investor purchases shares in an investment trust, there are no further charges.

In conversation with Trustnet, MacLeod proposed a new disclosure framework, the Statement of Operating Expenses, and explained how the previous regulation muddied the waters.

Can you explain the cost difference between investing in funds and trusts?

Let’s say today, you buy £1 worth of a trust that seemingly has an ongoing charges figure (OCF) of 1%. In 12 months’ time, if that share price hasn't moved, your share price is still £1 – the value hasn't changed. Whereas if you bought a unit trust today for £1 and there was a 1% charge, in 12 months’ time (if performance was flat), it would be worth £0.99 because 1% would have been removed from its value as a charge to the investor.

This was our contention – we had no problem at all with going an extra mile to talk about the company expenses, but let's not present it in such a way that it looks like it's a detractor from the value of the investor’s holding.

What other problems did this cause?

If investors only make decisions based upon cost, which they often do (a bit myopically), and something looks synthetically expensive, they may well avoid it and miss out on the returns they were hoping to achieve.

Not only did trusts look more expensive themselves, but other strategies with trusts in their portfolios, such as funds-of-funds or model portfolios, also appeared to be more expensive.

The authorised corporate directors of those portfolios have been grabbing the ongoing charges from investment companies, calculating them pro-rata, and then adding them to an Excel spreadsheet called the European MiFID template (EMT). Therefore their own funds had this additional synthetic charge.

Practically, how large were the synthetic costs added to trusts?

At Gravis, we have a UK Infrastructure Income fund that invests in the UK-listed infrastructure sector through investment trusts and listed companies.

There are two share classes, both of which are capped, so no investor pays more than 0.75% or 0.65%. However, the published figure for those two share classes has been 1.62% and 1.52% – an extreme difference.

What happens now after the FCA exemption?

Investment companies no longer have to publish an ongoing charge or the reduction in yield calculation in their key information documents (KIDs), so the cost of owning an investment company will be a blank figure – effectively zero.

Once all those trusts put a blank in their KIDs, their portfolio costs will drop to the accurate figure rather than the synthetic figure.

My expectation is that it will probably take until the end of October for everyone to update their materials, for the zero to penetrate the system and for that then to be reflected on what's published elsewhere.

The database for costs, the EMT, is updated monthly, so to may take a few weeks to be cleansed.

What legislation will apply then?

Following the announcement made on Thursday last week, investment companies will fall within the UK retail disclosure framework for consumer composite investments (CCI), whereas industry participants have been calling for the exclusion of investment companies from CCI.

The issue with CCI is that it is premised on what is returnable to the investor in the event of wind up. If you have an investment company, nothing is necessarily returnable because it's a company – you get back whatever can be salvaged from the decline of that business.

We must be very sure that in the excitement of the news on Thursday, we aren't just rolling on our backs and having our tummies tickled. There's a lot at stake here and we must ensure that we don't slip back into a regime where we are required to disclose costs which aren't actually applied to the investor.

What is your proposal for showing costs and what information would you include?

The proposal we came up with is a document which is easy to understand called the Statement of Operating Expenses or SOE.

As an investor, I want to know at a glance that the board is being paid an appropriate sum of money to manage the operations of that company. I also want to know that a renewable energy company doesn't have a private jet – that would also appear in the SOE.

The regulation that we've just come out of was completely opaque and utterly misleading, and what we're hoping to do is to have something which is completely transparent and totally clear for everybody, be they really sophisticated investors or people who are just saving for their long-term future.

Might some sectors benefit more than others from this change?

Yes, renewables and infrastructure companies will benefit, and listed companies will benefit too. That’s because, given a bit of time and settling as people absorb the effects of this, they should be able to raise additional capital.

When investment companies are trading at a discount, it's impossible to convince investors to buy shares that are more expensive than their value. When trading at a premium to NAV, you can offer shares to new investors or existing investors in the gap between the NAV and the price, which is a good way to raise capital.

The hope and expectation is that with base rates coming down, the macro environment improving and a true cost being published, investment trusts should return back to par, and hopefully beyond that up to a premium. At that point, they can start capital raising from the wider market.

That means that they can raise capital to deploy into areas such as renewables and infrastructure that the government would like to see further investment going into – and it comes at zero cost to the government.

This is Schroders’ fourth LTAF and is focused on the UK wealth market, whereas previous LTAFs have catered to defined contribution pension funds.

Schroders Capital is launching its first long-term asset fund (LTAF) for private clients in the UK. The Schroders Capital Global Private Equity LTAF will be a feeder fund into an existing strategy, the $1.8bn Schroders Capital Semi-Liquid Global Private Equity Fund, which was launched in September 2019.

The fund invests in small and mid-market buyouts in the US and Europe, as well as growth companies in Asia, with a focus on the technology and healthcare sectors. It is managed by Benjamin Alt, head of global private equity portfolios at Schroders Capital.

Alt said the new LTAF will give private investors “access to the most attractive segments of private equity markets globally through a well-established fund with a proven track record”.

“Private equity enables investors to access different parts of the economic ecosystem, bringing the potential for robust investment performance and the benefits of diversification,” he explained.

The new feeder fund sits under the umbrella of the Schroders Capital Wealth Solutions LTAF, which has just received regulatory approval and has been designed as an open-ended investment company (OEIC) to cater to the UK wealth market.

This is Schroders’ fourth LTAF launch and it differs from the others, which target defined contribution pension funds and are structured as authorised contractual schemes.

James Lowe, director, private markets at Schroders, said: “For the UK wealth community, LTAFs will provide another access point to private markets and we expect this LTAF to be a complementary tool to existing private markets structures – like investment trusts – offering new flexibility in how UK investors will be able to meet their objectives via private market investments.”

Earlier this month, Schroders Capital also received regulatory approval from the Financial Conduct Authority to launch its first LTAF investing in UK venture capital. This fund will offer defined contribution pension funds and other institutional investors exposure to UK-based early-stage technology and life sciences companies.

RBC Brewin Dolphin believes a high allocation to equities will enable retirees to keep growing their pension pots ahead of inflation.

The traditional approach to investing in the 10 years or so before retirement – encapsulated by lifestyle pension funds – is to shift from equities into bonds and cash to de-risk. That may still be appropriate for those who want to buy an annuity or take a cash lump sum, but many people would prefer to keep growing their pension pots, according to RBC Brewin Dolphin.

Therefore, it makes sense to have a high equity allocation during your 60s and 70s to grow capital, beat inflation and fund later-life spending, said senior investment manager Rob Burgeman.

“When you get to 60, you’re far too young to take no risk because actuarially you’re going to live longer,” he observed.

Below, Burgeman suggests a pension portfolio for someone in their 60s.

Asset allocation

In the years leading up to retirement, he recommends taking the equity allocation down from 90-100% to 70-75% over a couple of years.

Retirement is not the cliff-edge it once was, given that many people opt for a phased retirement – leaving full-time work earlier, perhaps, but continuing to work part-time during their 60s.

They may need to draw down from their pension fund to supplement their income until the state pension kicks in at the age of 67, which might necessitate a move into fixed income during one’s early 60s to boost yield.

But once people can use their state pension to meet many of their everyday spending needs, they may rely less on income from their personal pension savings and decide to switch back into equities for long-term growth.

The appropriate pension strategy for someone in their 60s will also hinge upon whether they intend to take 25% of the pot as a tax-free lump sum. De-risking ahead of this “crystallisation event” would make sense because otherwise, if equity markets fall sharply and decimate the pension pot’s value in a short time, that 25% will suddenly be worth a lot less.

“Pulling up at the edge of the cliff with the wheels smoking isn’t really a great basis for an investment strategy. You don’t want to find that Russian tanks have rolled into Ukraine or that Covid has struck the week before you’re about to take your tax-free cash,” he noted.

After someone retires, their capacity for loss will be diminished, so “you do need to turn the gas down a bit”. Burgeman suggested allocating 60-75% to equities and the remainder to bonds and alternatives. Equities “do the heavy lifting” and allow the pot to at least keep pace with inflation, he explained.

Historically, a balanced portfolio has grown by 4% a year in real terms, meaning that the beneficiary could take an income worth 4% a year and leave enough in the pot for the capital to continue growing.

Burgeman proposed holding one or two years’ worth of spending requirements in cash so if a financial crisis occurs, the person can stop drawing down from their pension to allow their investments time to recover.

Equity funds

RBC Brewin Dolphin uses a mix of passive and active strategies in clients’ portfolios. “Active costs more so I think you have a right to expect some excess performance,” he said.

In the US, it is hard for active equity managers to beat the S&P 500 index so a cheap tracker could be a better option. Some enhanced index strategies such as JPMorgan US Research Enhanced Index Equity have added value over time with minimal benchmark drift, he said.

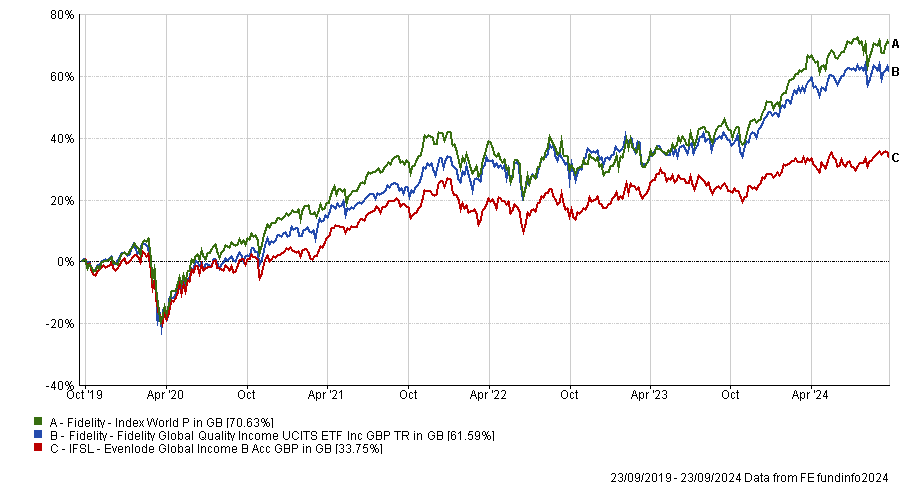

A global tracker such as Fidelity Index World is “not rocket science but it will do a job for you without costing an arm and a leg”.

For lower volatility and an income tilt, Fidelity International’s Quality Income series of exchange-traded funds are closely aligned to global indices but have more muted peaks and troughs.

He also suggested pairing a tracker with a fund such as Evenlode Global Income to boost yield. It has struggled in relative terms during the past 12-18 months because global indices have been propelled upwards by their large weightings to tech stocks, which are not Evenlode’s hunting ground (apart from Microsoft, which is one of its top 10 holdings). Evenlode also owns Unilever, L’Oreal and Procter & Gamble; “it’s a nice list of blue chip names”, Burgeman said.

Performance of funds over 5yrs

Source: FE Analytics

Bonds

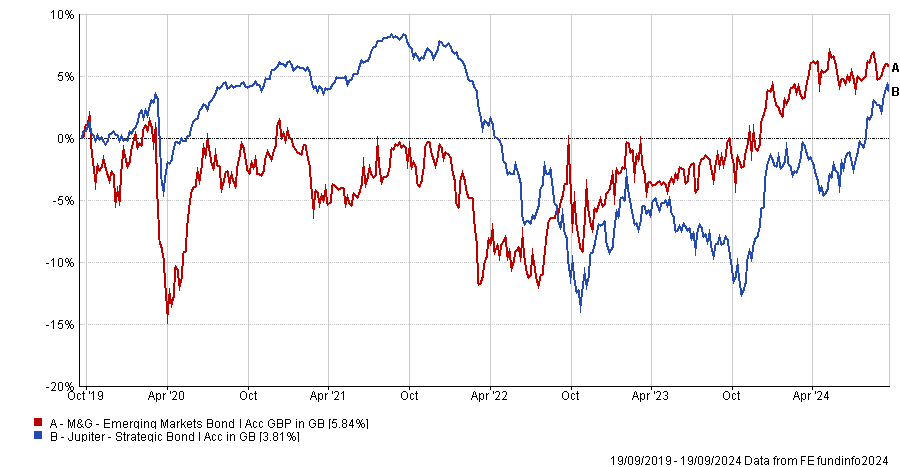

With yields at their current elevated levels, Burgeman thinks bonds will return to their traditional role of providing “ballast” to portfolios.

Investing in individual gilts directly has its merits because investors can achieve a fixed return between now and whatever year they choose.

For a strategic bond fund that can allocate across government, inflation-linked and corporate bonds, he chose Robeco Global Credits, which only holds investment-grade bonds. The majority of the fund’s assets are corporate bonds, which have a higher return than government bonds.

Another option is Jupiter Strategic Bond, with the experienced Ariel Bezalel, an FE fundinfo Alpha Manager, at the helm.

Alternative investments, commodities and diversifiers

Burgeman suggested a 3-5% allocation to gold as an insurance policy.

“Gold’s not going to give you an income in retirement and last time I checked, they don’t take it down at Tesco’s, but it does have a role to play in portfolios because when the really nasty stuff happens, gold tends to do rather well. It did very well over Covid [and] over the Ukraine period when everything else didn’t,” he said.

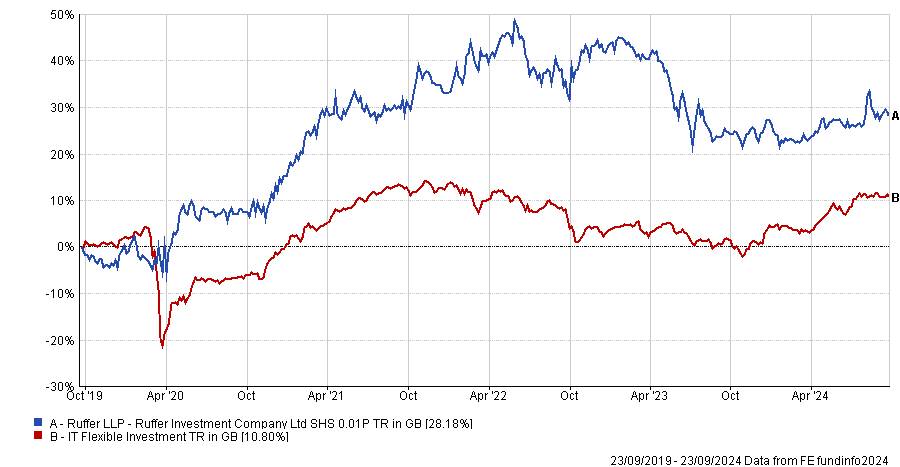

Multi-asset strategies can also provide diversification against equities and bonds.

“Do you go for disaster insurance with someone like Ruffer? The trouble with Ruffer is, you do give up quite a lot in terms of upside potential, but it’s certainly one which has a role to play in preserving value and perhaps that’s what’s important in this field.”

Performance of trust vs sector over 5yrs

Source: FE Analytics

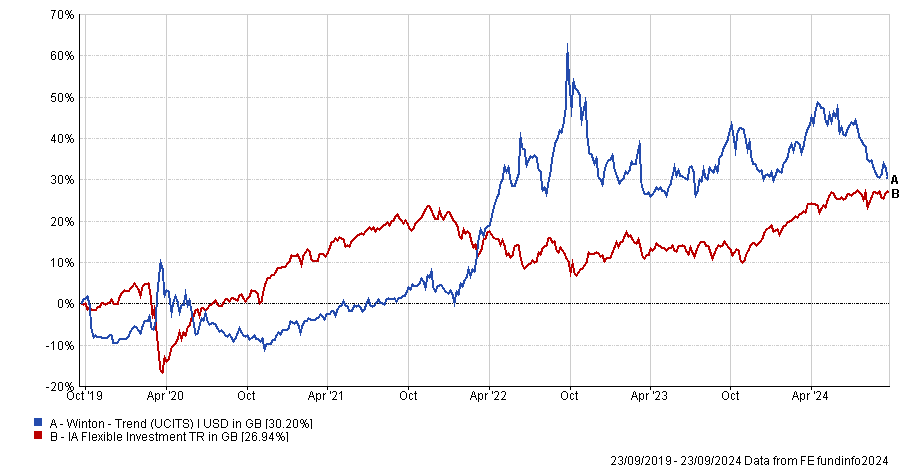

Another suggestion is Winton Trend, an algorithmic trading strategy following medium-term price trends across commodities, currencies, equity indices and fixed income. It delivers “steady, cautious growth”, although it can get caught out by a sudden shift in sentiment and can follow markets downwards, he warned.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Property funds such as Schroder Global Cities Real Estate can deliver a decent yield with inflation protection, he added.

Guinness’ CIO believes China will become a tech powerhouse as it shifts from copying the West to designing its own products.

China is on the cusp of developing its own domestic technology, which could rival the best international competitors. Innovation in the tech sector is a major reason why the Guinness Asian Equity Income fund has gone overweight China – a contrarian position, given many other managers’ bearish views of the struggling Chinese economy.

China relies mostly on repurposed technology and machinery at present but it has the potential for innovation that could catapult its economy to the next level, said Edmund Harriss, chief investment officer of Guinness Global Investors.

For instance, Chinese companies can produce semiconductor chips to levels matching Taiwan and Korea, exceeding expertise in the US, even if Chinese companies still have to use repurposed infrastructure.

“China is catching up and it is keeping pace,” he said. “There’s only so much technology you can steal; at some point, you have to develop your own.”

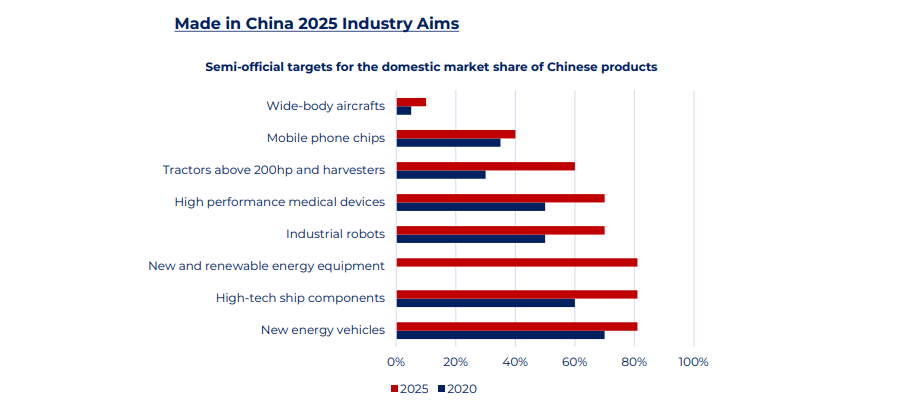

The semiconductor industry has prospered under the Made in China government initiative introduced in 2015, aiming to modernise China’s industrial capacity and end the region’s reliance on international technology. As part of this strategy, China is focussing on the ‘industries of the future’, including medical devices and renewable energy sources.

Made in China 2025 industry aims

Source: Made in China 2025, Industrial Policies: Issues for Congress, Congressional Research Service (2023)

“These are areas where China’s limited labour force, with a high set of skills, can now be repurposed and combined with capital, to take China from a middle to a higher income economy over the next 10-15 years,” he explained.

China represents 34.4% of the £186.8m Guinness Asian Equity Income fund, its second-largest overweight position. The Guinness team’s bullish outlook for the tech sector, which it perceives as an underappreciated opportunity, is a major part of the investment thesis.

The fund focusses on companies that have generated profits over the long-term (eight years) with strong dividend growth and a decent yield. Guinness has found several Chinese companies that meet its criteria, including medical technology specialist China Medical Systems.