Even the most benign of inflationary environments can nibble away at your purchasing power, warns Hargreaves Lansdown.

Annuities have grown in popularity over the past few years as interest rates have risen on the back of rampant inflation.

And with inflation seemingly tamed, for now, and interest rates expected to start coming down over the next six months, some may consider it a good time to buy one before the yields on offer are reduced.

But retirees must remain vigilant to the potential for inflation to rise again, said Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. People who retire at 65 might live for another 20 to 30 years or more, making inflation one of the biggest enemies to their savings.

“Even the most benign of inflationary environments can nibble away at your purchasing power over that time,” she warned, while a period of double-digit inflation “can bite huge chunks out of your plans”.

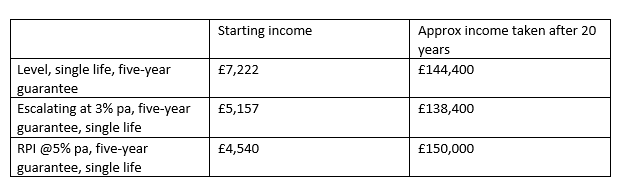

One option is to get an annuity that rises in line with inflation. Hargreaves Lansdown’s research shows that a 65-year-old with a £100,000 pension can get an RPI-linked annuity paying up to £4,540 per year.

They could also get up to £5,157 per year from an annuity that escalates at 3%, meaning the total income will rise by a fixed amount each year.

However, the same 65-year-old with a £100,000 pension can get up to £7,222 per year from a single life level annuity with a five-year guarantee – over £2,000 more per year than they would have got three years ago.

Current annuity rates versus inflation

Source: Hargreaves Lansdown

Both of the latter options are “far lower than you would get with a level annuity”, said Morrissey, but reward those that live longer. As such, retirees need to consider what is best for them.

“You will need to try and work out how long it will take for the income of your escalating annuities to catch up with the starting income from the level one,” she said.

For example, it would take 12 years for the escalating 3% annuity to catch up to the current income, meaning the 65-year-old would have to wait until they are 77 before their income hits £7,222.

“It would also take around 21 years before you had taken the same overall amount of income (approximately £144,000) that you would have taken from the level product,” she calculated.

Meanwhile, the RPI-linked annuity rising at 5% per year would take 10 years to match current payouts and 20 years before a retiree had received the same amount as the level option.

“Of course, if RPI inflation were higher you would make up ground more quickly, but lower inflation means it could take you longer. You need to think carefully about how long you are likely to live to come to the best decision for you,” Morrisey said.

Another option for retirees is to take out part of their pension, rather than their full amount, and annuitise it in slices, rather than all at once. The rest of the pot could then be invested for capital growth.

“This way you also have the benefit of securing higher annuity rates as you age and if you develop a condition where you qualify for an enhanced annuity then you could get a further boost in income that can help you fight the impact of inflation over time,” she said.

Hawksmoor’s Mackie shares his favourite funds to play the domestic market.

There is a broad opportunity set across all sections of the UK equity market, with stocks in most sectors trading cheaply compared to their history, according to Ben Mackie, portfolio manager at Hawksmoor Asset Management.

“The valuation opportunity is very broad in the UK, spanning across the market-cap spectrum,” he said. “Every kind of UK portfolio is now cheap relative to its history – unlike Japan, which has re-rated and where value has moved down the market-cap spectrum".

As such, Hawkmoor’s multi-asset portfolios have gone with a 20-30% allocation to the domestic market and to harness all the opportunities available, the managers are opting for portfolios that are “cheap, have lots of marginal safety and a real blend of styles”. They also maintained a bias to smaller companies.

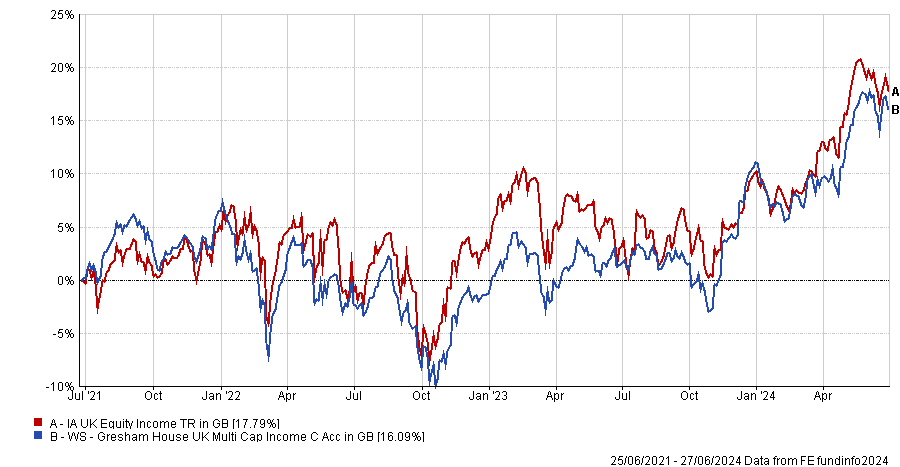

The first fund Mackie highlighted was WS Gresham House UK Multi Cap Income.

“That's a significant position for us. It’s less value-orientated and more looking to buy good-quality businesses,” he said.

Performance of sectors over 3yrs

Source: FE Analytics

It is run by FE fundinfo Alpha Manager Brendan Gulston and Ken Wotton, who focus on profitable small and mid-cap companies that generate high cash levels.

RSMR analysts praised the fund’s underlying income stream, which is “well diversified across industries”, and the “stable and resilient” dividend. It is currently yielding 3.8%.

Mackie balanced out this fund’s open-ended, multi-cap quality approach with several mid and small-cap strategies in different styles.

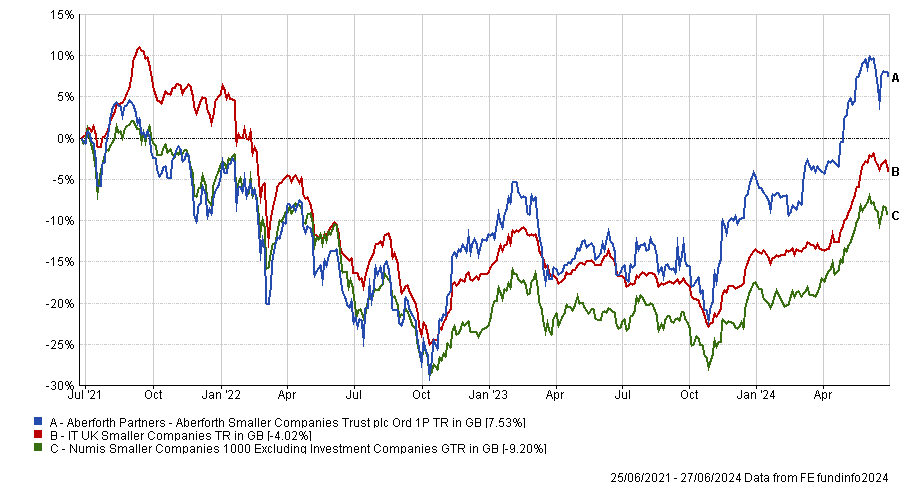

“While good opportunities are spread across the whole market, small-caps is where we're seeing most value,” he explained.

The asset class has been “a painful place to be” in recent years, with the average UK small-cap fund and trust dropping approximately 30% between October 2021 and October 2023, as shown in the chart below.

Performance of sectors over 3yrs

Source: FE Analytics

But the manager maintained his conviction in this space and his first pick here was Aberforth Smaller Companies.

The Aberforth team has “a traditional value approach”, complementing the Gresham House fund.

The trust is trading at a wider-than-usual 10% discount and was recently picked by Tillit’s Sheridan Admans as an ideal strategy to dip your toes back into smaller companies.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

To counter the negative momentum in small caps, Mackie chose two other trusts whose managers build meaningful positions in companies and drive change from within to generate extra value.

“We have some specialist investment trusts that take influential stakes in companies and are very happy to roll their sleeves up and engage,” he said.

Hawksmoor uses Odyssean, which is managed by Stuart Widdowson and Ed Wielechowski, and Wotton’s Strategic Equity Capital. Both have a FE fundinfo Crown Rating of five – the highest score.

Odyssean is a £214.9m strategy and the second-best performer in the IT UK Smaller Companies sector over the past five years.

The trust is proving popular with fund selectors and was recommended by Numis, 7IM, Winterflood and Blyth-Richmond Investment Managers. Several fund pickers said the trust was worth buying even at a premium.

With Strategic Equity Capital, Mackie repeated his conviction in Gresham House’s Wotton.

“Effectively, what we’re doing is looking for talented managers – those who align with us culturally, are talented stock pickers and stick to the process,” he said.

“Ultimately, these portfolios will move around and we're not trying to second-guess their positioning. It's more about how they think and whether they are genuinely skilful.”

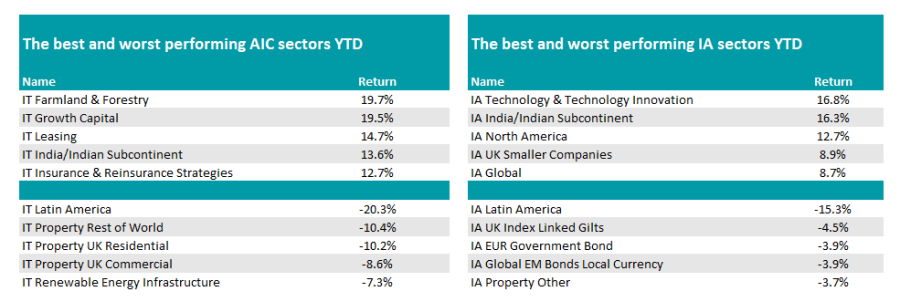

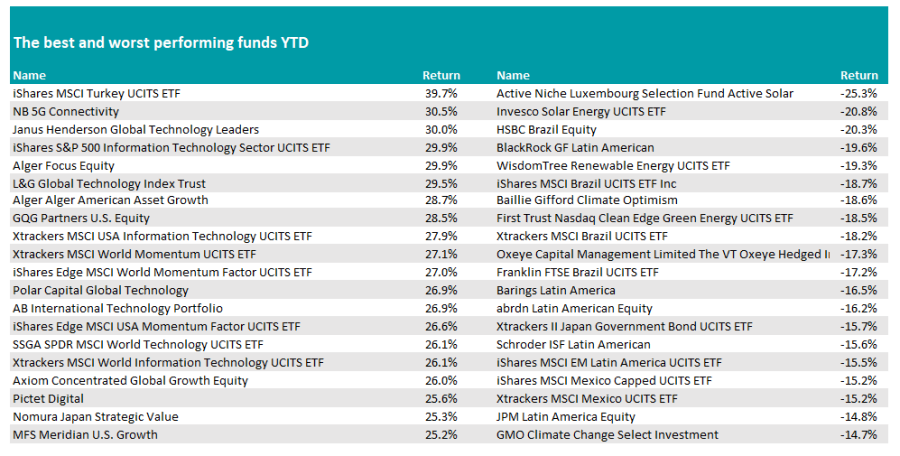

Trustnet looks at the funds and investment trusts that have flourished and floundered so far this year.

Technology stocks, Indian equities and UK smaller companies have all enjoyed a strong year so far, while Latin American companies and government bond investors have struggled, according to data from FE Analytics.

The first half of 2024 has been dominated by macroeconomics and in particular central banks, who have had to wait a lot longer than was initially expected to cut interest rates.

Indeed, as it stands, only the European Central Bank (ECB) has managed to drop rates so far, with the Federal Reserve and Bank of England both remaining in wait-and-see mode.

This has impacted many asset classes but in particular bonds, where investors had hoped that rate reductions would lead to capital gains for government bonds.

It resulted in both IA UK Index Linked Gilts and IA EUR Government Bond sitting among the worst five performing Investment Association (IA) sectors over the past six months.

Yet it was not all bad news for assets that usually do better when rates fall.

Tech stocks (which should benefit from lower rates as they reduce the discount put on their future growth figures) have continued to soar on the back of the artificial intelligence (AI) boom, with IA Technology & Technology Innovation the top-performing sector of the year so far.

Source: FE Analytics

Here, the average fund has made 16.8% in 2024. The market continues to be dominated by the Magnificent Seven, with Nvidia briefly climbing to become the world’s largest company last month, before it slipped back and returned the crown to fellow tech giant Microsoft.

As such, eight of the top 20 funds over the past six months had a technology focus, with the likes of Janus Henderson Global Technology Leaders, iShares S&P 500 Information Technology Sector UCITS ETF and L&G Global Technology Index Trust among the top 10 funds so far in 2024.

This small basket of stocks also helped to propel the IA North America and IA Global sectors to among the top five best-performing peer groups in the first half of the year.

While much of the global equity market’s performance has become more concentrated in recent months, other areas also shone.

Indian funds continued their meteoric rise, with the average fund in the IA India/Indian Subcontinent sector up 16.3%, just behind the tech sector.

The country has been the beneficiary of investors turning away from China, which has been under pressure for the past two years, with India becoming something of an emerging market darling of late.

The recent general election result, in which prime minister Narendra Modi won in a less convincing style than expected, did little to dissuade investors. However, no India funds appeared in the top 20 funds of the year so far, as the below table shows.

Source: FE Analytics

China was not the only emerging market region navigating difficult waters. The IA Latin America sector was the worst performer over the first six months of the year, down 15.3%.

Part of the fall could be the sector giving up its gains over the past two years. In 2022 the average Latin America fund made 16.4% while in 2023 it made 23.2%.

Another potential reason is the disappointing performance of Brazil, where president Luiz Inácio Lula da Silva’s plan to reduce spending, along with a surprise cut to rates from a divided central bank, has caused turmoil in markets.

Yet Brazil’s underperformance does come as a surprise, considering the market is often viewed as a barometer for commodities, which have performed well in 2024 so far.

Four Brazil funds and six broader Latin America funds appeared in the 20 worst performers list, which also featured several funds investing in specific renewable energy sectors, such as Active Niche Luxembourg Selection Fund Active Solar and Invesco Solar Energy UCITS ETF, which have been the two worst performers of the year so far.

Renewable energy companies tend to be highly leveraged and the postponement of interest rate cuts is likely to have hurt performance.

There were some positives closer to home, where UK small-caps have flourished. The IA UK Smaller Companies sector was the fourth-best performer over the year-to-date, up 8.9%.

The sector has been under the cosh for the past few years as interest rates have risen, but has come back to the fore this year as investors forecast lower rates. It has also been given a lift from both the Conservative and Labour parties, who have committed to encouraging cash into UK companies, with proposals ranging from a UK ISA to encouraging pension funds to invest more in domestic stocks.

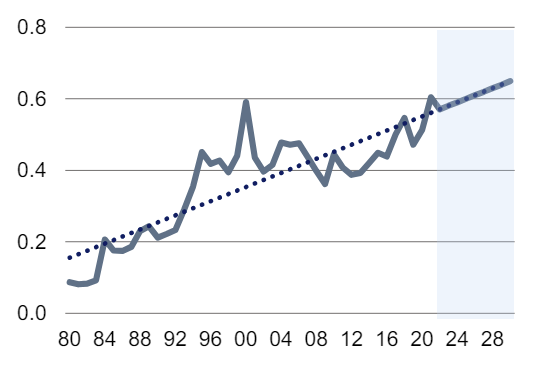

Turning to investment trusts, they have been a real mixed bag so far this year, with some niche sectors such as IT Farmland & Forestry, IT Growth Capital and IT Leasing leading the way, while property has been the main area investors would have wanted to avoid.

Source: FE Analytics

In terms of individual trusts, technology and UK smaller companies investment companies dominate the top 20, while on the downside, trusts investing in real estate and renewable energy have dropped off, as have a number of venture capital trusts.

Japan’s Canon is muscling into the chips industry.

The availability of semiconductors has been a primary force in markets over the past few years and so far, just a handful of companies have been able to benefit from this trend.

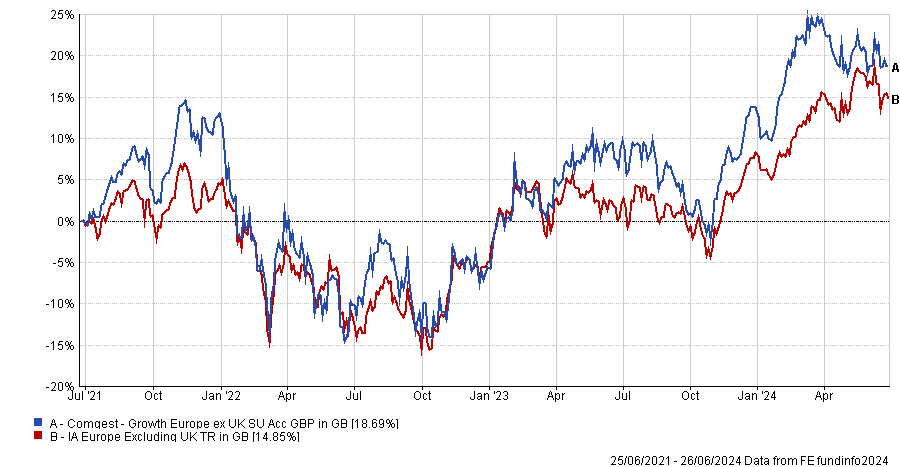

While Nvidia is the clear winner on the global stage, the European semiconductor darling has been ASML – a company that has an 8.2% weighting in the Comgest Growth Europe ex UK fund, co-managed by James Hanford.

Comgest’s investment process requires managers to challenge each other on their positions and Hanford takes pride in being able to play devil’s advocate for ASML’s position as the fund’s top holding.

While he remains confident in the company’s strong competitive advantage, he is having to defend it against a new technology application from Japan.

As time goes by, new competitors are bound to disrupt some of the certainties in the chips space and one company with a good chance of doing precisely that is the Japanese optical, imaging and industrial product maker, Canon.

“Canon has been quite vocal about a technology called nano imprint. Currently, it is used to make CDs through a stamp, but Canon is looking into applying it for semiconductor-making as well,” the manager explained.

“The company has a whole research department engaged in this. I've spoken to a lot of people in Japan and Taiwan about these efforts in nano imprint and for now I'm not concerned about Canon from a competitive standpoint against ASML. But we’re keeping an eye open and always pushing ourselves to find where we could be wrong.”

Performance of stock over 1yr

Source: Google Finance

While Canon might be onto something that may come to fruition in the long term, the biggest threat to ASML’s investment case today doesn’t stem from Japan, but from China.

In January and April 2024, the US asked its allies to stop selling high-end semiconductors to China, which has hit ASML.

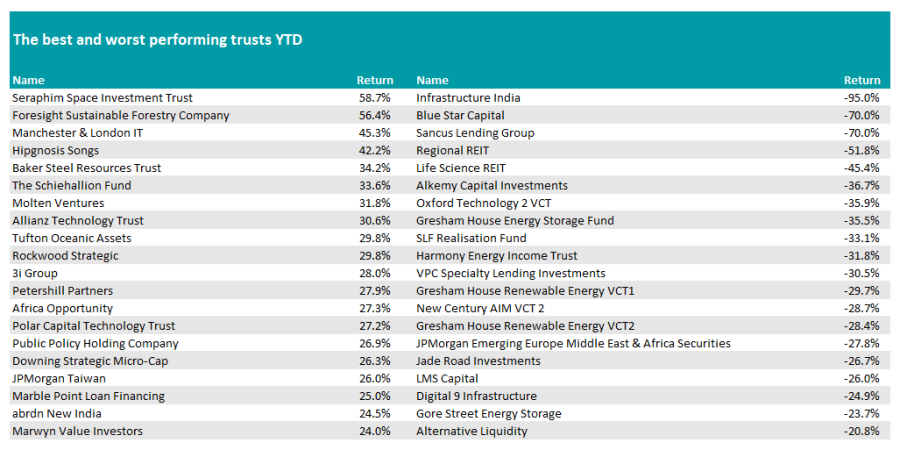

“The revenue of the semiconductor industry as a percentage of global GDP has only been going up in the past 50 years and is now at 0.7%. As human beings, we want better, including better electronics, which require chips, so demand isn’t a problem,” Hanford noted.

“The key problem is that it’s an extremely geo-sensitive industry. Overall, this is a good thing for ASML, because it's creating excess demand, but in the short term, restrictions by the US on what ASML could ship to China is definitely the main risk.”

Semiconductors sales relative to global nominal GDP (in % of GDP)

Source: Deutsche Bank Research, IMF, WSTS.

Comgest Growth Europe ex UK has been co-managed by FE fundinfo Alpha Managers Alistair Wittet and Franz Weis since 2014, joined by Hanford in 2023.

Square Mile Research analysts rate the fund for its distinct bias to quality growth companies and its managers’ stock selection skills.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The team's edge is their company analysis, and, as such, we would expect longterm returns to be primarily driven by stock contribution, although sector and country allocation can also have an influence at times,” they said.

“The performance can be highly variable and we would anticipate this fund to do well when the growth style is in favour, as well as when investors are focusing on company fundamentals. More broadly, we believe this is a solid longterm offering for investors seeking exposure to some of the region's leading companies.”

Perhaps big premiums for are a thing of the past but a shrinking in discounts seems likely.

It is unlikely that July’s general election will move the dial for the UK stock market – the outcome is seemingly well-known and, anyway, both main political parties seem to be business-friendly.

Still, many column inches have been used up debating whether the FTSE will prefer a Conservative victory, or a Labour triumph, and which sectors might benefit from either outcome.

Of the many investment company sectors that look cheap today, infrastructure and renewables must be close to the top of the list, and there are some potentially positive snippets in manifestos to confirm that.

The valuations of the assets owned by infrastructure and renewable energy investment companies are sensitive to changes in interest rates, so rates’ astonishing ascent have hit them hard.

In addition, with a return of well above 4% still available on safe assets such as UK government bonds (gilts), some may wonder why they should take on the equity risk provided by listed infrastructure or renewables trusts?

These companies were popular in a world of near-zero interest rates because their yields, which were typically in the range of between 3% and 7%, offered a big advantage over gilts, where the yield was as low as 0.25%.

The drawback was that this meant they traded very expensively, with double-digit premiums not uncommon. Those days are well and truly over. The median discount in the infrastructure sector is about 21%, and in the renewable energy sector it’s 31%, according to the Association of Investment Companies.

The big factor driving share prices over the past 12 months or so has been expectations of just how fast interest rates will fall. The European and Canadian central banks have already cut once, but the Bank of England and the US Federal Reserve are expected to hold off for at least a few months yet.

The potential for higher for much longer clearly isn’t ideal and increases the risk, so share prices have waxed and waned alongside rate cut expectations.

Yet perhaps now is the perfect time to start looking at the sector again. The yield spread over gilts is looking healthier once more, with the median infrastructure trust offering 6.3% and the median renewable energy trust offering 8.2%.

There’s clearly a political will to improve the UK’s infrastructure, as there is for pension funds and retail investors to take bigger stakes in domestic assets. Aside from UK equity funds, the infrastructure and renewables sectors provide us with an opportunity to do just that.

But deep-lying issues remain, not least the fact that the UK’s planning laws desperately need reforming. It takes four years to sign off major infrastructure projects, for instance.

Both Labour and the Conservatives are committed to reducing this, and encouraging more private investment in UK infrastructure, but this is neither going to be easy nor quick.

Not only do investment companies provide the opportunity to invest in British infrastructure, but they also offer investment opportunities in other jurisdictions. Geographical diversification is important in infrastructure assets, as well as in equities.

BBGI Global Infrastructure’s globally diversified portfolio of 100% availability-style social infrastructure assets provide it with highly predictable revenues and strong inflation linkages. It can maintain its dividend for more than a decade without having to make any new investments.

Its biggest investments include bridges in California and Ohio, Australian prisons in Northern Territory and Victoria, a health clinic in Liverpool, and motorways in the Netherlands and Germany.

On the renewables side, not only does Octopus Renewables Infrastructure invest across several different countries, including the UK, Ireland, France and Finland, but its carefully thought-out approach to diversification also means its portfolio is spread across several different proven technologies, such as onshore and offshore wind, solar and energy storage systems.

We may not be returning to zero interest rates, so perhaps big premiums for infrastructure and renewable energy companies are a thing of the past, but a shrinking in discounts seems likely.

Falling interest rates should make these trusts attractive again and while politicians’ ability to get their agendas through is questionable, there’s a positive direction of travel, so perhaps big discounts will end up being well in the rear-view mirror, too.

David Brenchley is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.

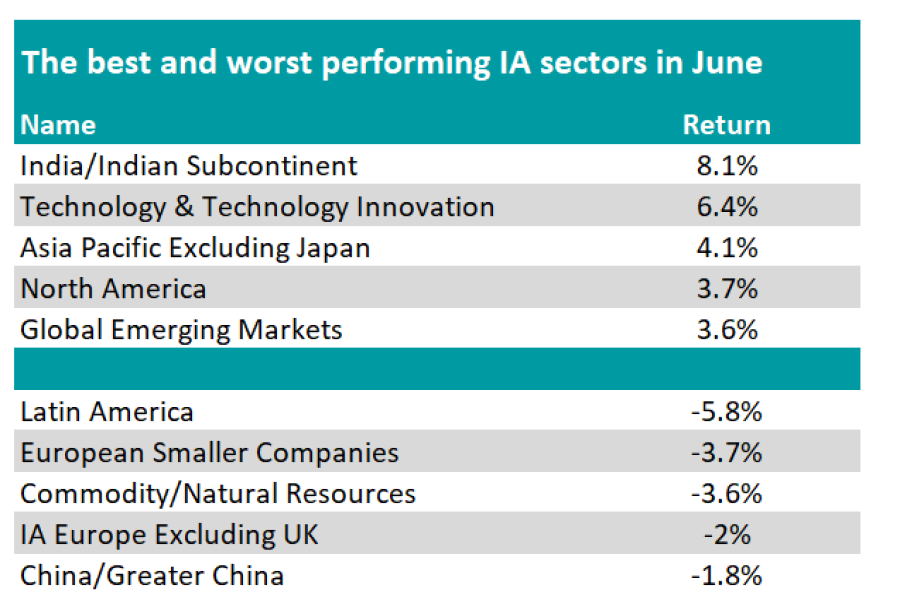

Trustnet reveals where investors should have put their cash last month.

Indian equity funds topped the performance charts last month, in spite of the disappointing election result for Narendra Modi.

While the market was expecting a landslide victory for the incumbent prime minister of the most populous country in the world, Modi failed to win an outright majority.

After an initial knee-jerk reaction at the beginning of May, Indian equities rebounded and continued their meteoric rise, with the IA India/Indian Subcontinent sector gaining 8.1% in June alone.

Ben Yearsley, director at Fairview Investing, said: “Fund managers who invest in India say the crucial aspect of the coalition is that it still has infrastructure spending as the key priority.”

Source: FE Analytics

The IA Technology & Technology Innovation sector finished second, gaining 6.4% last month.

Nvidia briefly overtook Microsoft as the world’s largest company, with both companies, along with Apple, now valued at over $3trn.

The IA Asia Pacific Excluding Japan sector secured the third position, followed by IA North America and Global Emerging Markets.

At the bottom of the tables, Latin America was the worst-performing sector in June, dropping 5.8%. Mexican equities, the second-largest component of the MSCI Latin America index, declined by 10% as the market reacted negatively to the election of Claudia Sheinbaum.

Yearsley said: “The Mexican market fell sharply on the news as Sheinbaum is seen as very left wing, [although] it has recovered slightly over the course of the month.”

European equity markets were roiled by French President Emmanuel Macron’s decision to call a snap parliamentary election. As a result, the IA European Smaller Companies, IA Europe Excluding UK and IA Europe Including UK sectors all performed poorly in June.

Although the US and UK elections are yet to play out, the French vote is causing the most concern,. Yearsley said.

“The reality is that in the US, Biden and Trump aren’t a million miles away on policy nor are the Tories and Labour in the UK. France may well be the one to watch as that could cause EU earthquakes especially if the exit polls are correct.”

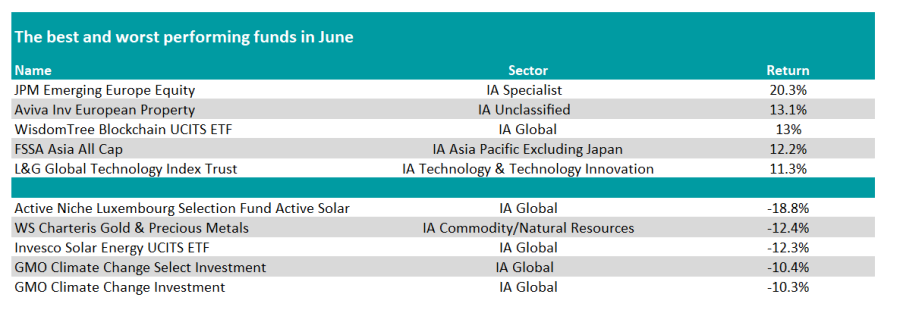

At the funds level, the top 10 was dominated by funds from the IA India/Indian Subcontinent and IA Asia Pacific Excluding Japan sectors, including Stewart Investors Indian Subcontinent Sustainability, Alquity Indian Subcontinent and FSSA Asia All Cap.

However, JPM Emerging Europe Equity took the top spot, returning 20.3% in June.

Yearsley said: “For context, this fund has lost 98.9% over five years due to Russia’s invasion of Ukraine, so the sharp rise is small comfort.”

Source: FE Analytics

Climate change was a common theme for funds at the bottom of the table, with seven out of 10 of the worst performers being climate or energy transition funds.

Active Niche Luxembourg Selection Fund Active Solar was the poorest-performing fund of the month, tanking 18.8%.

Other underperformers include Invesco Solar Energy UCITS ETF, GMO Climate Change Investment and Schroder Global Energy Transition.

Yearsley said: “Is it the lack of rate cuts that is still doing the sector down, or is it more fundamental in that the energy transition will take much longer than previously indicated by (clueless) politicians?”

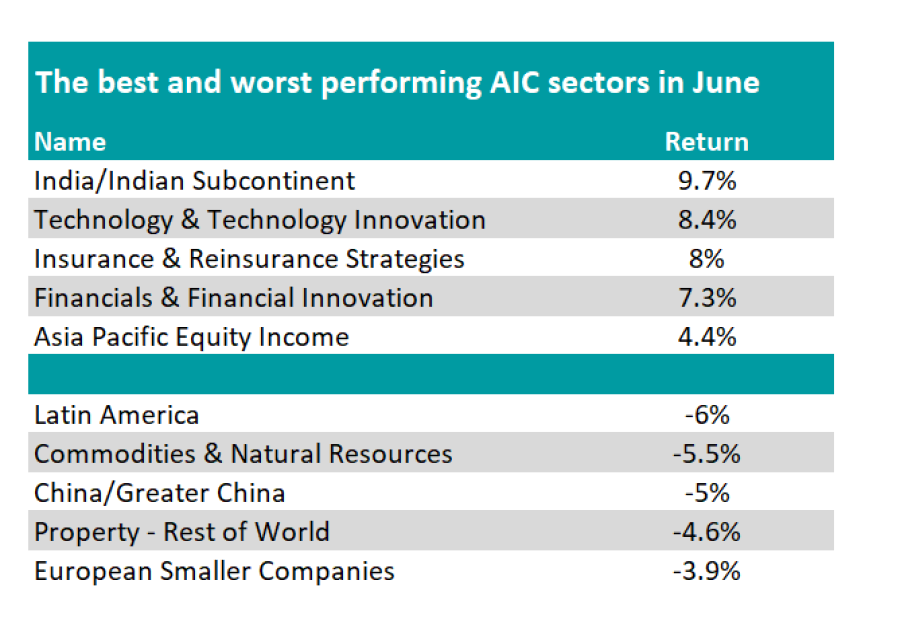

Amongst investment trusts, Indian equity and technology strategies ruled the roost, as with open-ended funds.

However, more specialist sectors came to the fore as IT Insurance & Reinsurance Strategies and IT Financials & Financial Innovation took the third and fourth spot.

IT Latin America was the worst-performing trust sector, falling 6%. It should be noted that the sector only has one constituent, BlackRock Latin American.

Source: FE Analytics

It was also a challenging month for the IT Commodities & Natural Resources and IT China/Greater China sectors, which lost 5.5% and 5%, respectively.

However, Yearsley noted that indicators are improving in China with signs of a pickup in activity driven by the service sector.

He said: “Stimulus measures have cranked up to offset the property downdraft. That appears to be paying dividends with the May PMI figure of 54 the highest since July 2023. Interestingly fund managers are starting to talk in more positive terms about China and that it might not be uninvestable after all.”

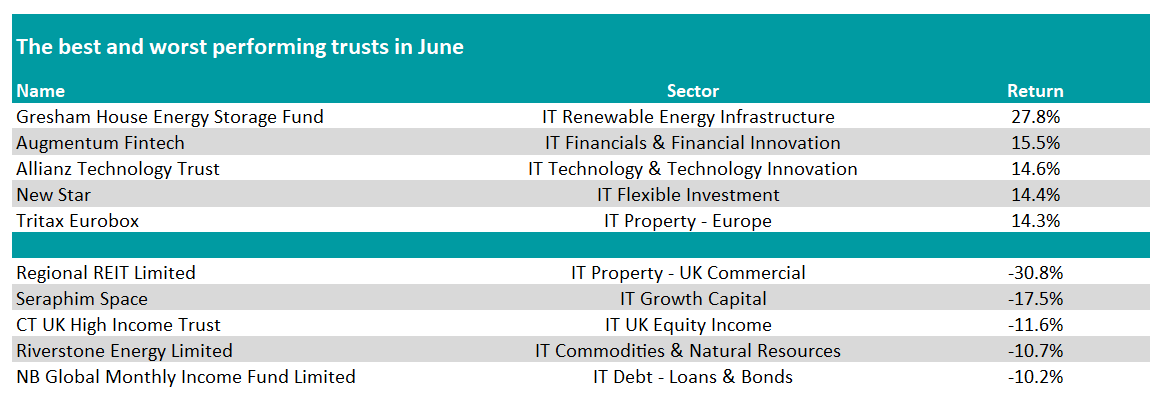

At the individual trust level, Gresham House Energy Storage Fund jumped 27.8% after announcing a battery leasing deal with Octopus.

Augmentum Fintech and Allianz Technology Trust finished second and third, after returning 15.5% and 14.6%, respectively.

Source: FE Analytics

At the bottom of the tables, Regional REIT Limited dropped 30.8% and is as such the worst-performing investment trust of the month.

Seraphim Space, the best-performing investment trust so far this year, also struggled in June, falling 17.5%.

Yearsley concluded: “Another interesting month for markets with the two most expensive areas, India and tech, leading the way. Will nothing derail these stories? In India it seems unlikely now the election is out the way, but will the lack of rate cuts eventually do for the Nasdaq?”

Market leadership may extend to cyclicals in the third quarter, according to BlackRock’s CIO of fundamental equities in Europe.

Several industries are set to flourish as we enter the third quarter of 2024, with Europe and the UK being the key beneficiaries, according to Helen Jewell, chief investment officer at BlackRock fundamental equities, EMEA.

The opportunity is so great that European shares could overtake their US counterparts in the near term. “European shares have lagged those in the US over the past decade. We now believe that, at least in the short to medium term, this dynamic could reverse,” she said.

Jewell pointed to four tailwinds set to spur Europe’s resurgence. Firstly, earnings growth momentum is likely to continue as companies have significantly reduced their debt levels and invested in future growth, while profitably remains robust despite the higher energy, materials and labour costs of recent years.

Second, the European Central Bank’s initial rate cut is already proving beneficial for companies and consumers. This “should continue to provide a boost to an economy that is already showing signs of life”, with the composite purchasing managers’ index rising in the past six months.

Further impetus should come from favourable valuations. European shares currently trade at a roughly 40% discount to US peers, versus a historical average of about 20%. She also pointed to the high quality of many European companies, which have been able to grow their earnings regardless of macroeconomic or central bank policy fluctuations.

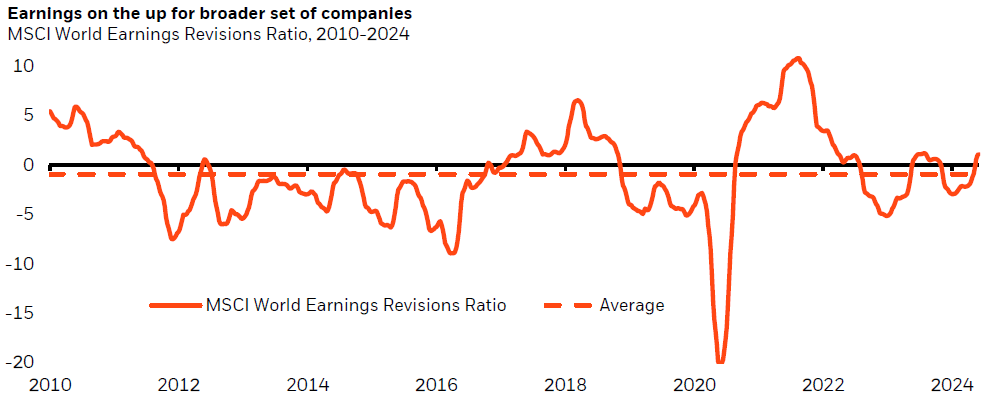

Finally, Jewell expects market leadership to broaden across several sectors, as the chart below shows.

Source: LSEG DataStream, BlackRock Investment Institute.

“The earnings revision ratio for global stocks is back above zero – which means a greater number of companies are seeing upgrades to earnings forecasts than downgrades,” she said.

“Simultaneously, rate cuts may support more cyclical areas of the market, so even as artificial intelligence (AI) remains in focus, we expect to see a broader set of winners for active managers to unearth – a ripe environment for stock selection.”

Jewell highlighted several cyclical sectors she expects to benefit from falling rates and healthier economic activity, as well as long-term structural changes such as decarbonisation, reshoring, and the rise of AI.

First, the renewable energy sector should recover as some of the headwinds that have constrained activity begin to ease. Higher rates have hindered the financing of renewable energy projects and rising inflation has put pressure on raw material costs.

Meanwhile, the secure income streams that utilities deliver will become more attractive to investors once cash savings rates drop below 4-5%.

Construction volumes are set to rebound from their 14-year lows in Europe. As the supply of some materials remains constrained, a strong pricing environment should benefit construction and construction material companies, as well as providers of energy efficiency solutions. Buildings account for 40% of global carbon emissions, Jewell explained, and as governments and businesses race to hit net-zero targets, these companies “are well placed to deliver strong earnings over the long term”.

Semiconductors should continue to flourish due to structural advantages. “Different parts of the semiconductor industry have been in different cycles. While smartphone and PC chips have seen the beginning of a post-Covid recovery, electric vehicle sales growth is slowing and there are some concerns,” she said.

“In the long term, data-centre demand will boost several companies within the semiconductor industry. Increased capital expenditures in 2024 will benefit semiconductor companies, especially those in Europe that have dominant positions in the semiconductor equipment market.”

Other sectors where BlackRock sees opportunities include: luxury goods, where pricing power for the best-managed brands remains strong; banks, which are being supported by share buyback programs, even as rates come down; and healthcare, given that some of the world’s most innovative and profitable healthcare companies are domiciled in Europe.

The managers of Evenlode Global Equity explain why there has been “a remarkable narrowing of the index”.

The US and global equity markets became even more concentrated in the second quarter of this year, with a handful of companies delivering the bulk of returns.

Apple, Microsoft and Nvidia – the three largest stocks in the US – now comprise 20.4% of the S&P 500 index, a weighting that has not been this high for at least 40 years, according to John Plassard, senior investment specialist at Mirabaud Group.

Market concentration was an issue last year when artificial intelligence (AI) propelled the Magnificent Seven to new heights but it has intensified in the past couple of months, said James Knoedler, co-manager of Evenlode Global Equity.

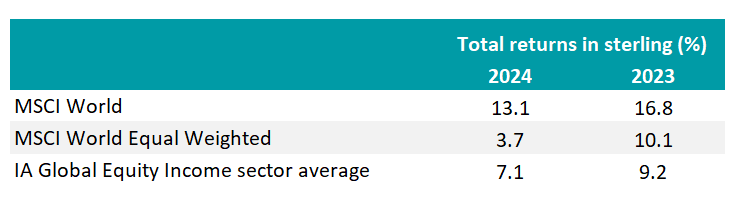

The MSCI World has risen 13.1% this year to 26 June in sterling terms. However, the MSCI World Equal Weighted index only gained 3.7%, which shows how the largest stocks have delivered a disproportionate share of performance. “It’s really unusual to see this level of dispersion,” Knoedler observed.

Last year, the difference between the MSCI World and its equal-weighted sibling was less stark – 4.7 percentage points over 12 months compared to 9.4 percentage points this year so far. In other words, there was a smaller gap between the best and the rest last year.

Total returns of indices last year and YTD

Source: FE Analytics

It has not always been so. During the past decade, the equal-weighted global index has lagged its market-cap sibling by about three percentage points, and over 30 years their performance is more or less the same, Knoedler said. “It’s not like Moses came down from Mount Sinai with the eleventh commandment that you’re always going to have equal-weighted underperforming.”

What this means for active managers is that their relative performance has hinged upon whether they own enough of the largest companies in their benchmarks, which is counterintuitive given that active managers are supposed to deviate from the benchmark and find even better stocks.

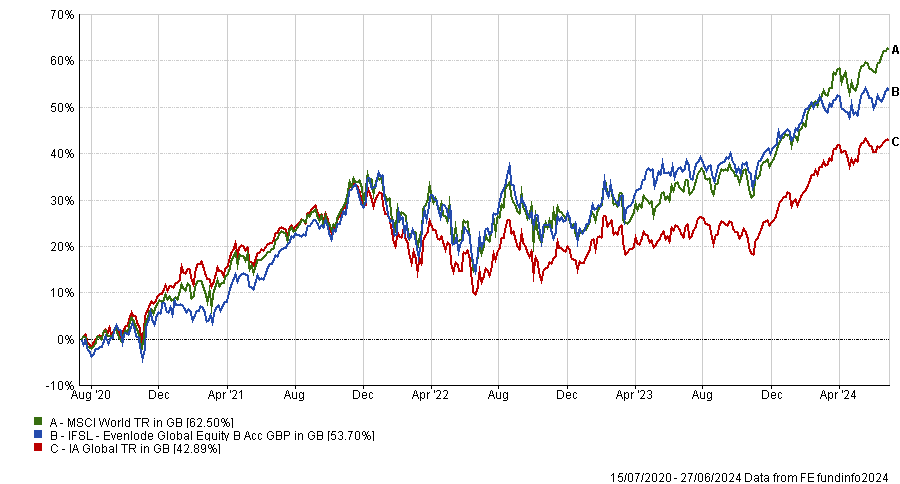

As a case in point, the fundamentals of the companies in the Evenlode Global Equity fund are solid, delivering double the earnings and revenue growth of the benchmark in the past quarter, yet the fund has underperformed on a relative basis.

“It has been a tricky year after, frankly, three and a half years when things went pretty well,” Knoedler acknowledged. “You have these moments in markets which test your conviction that your philosophy and processes are set up the right way.”

Performance of fund vs benchmark and sector since inception

Source: FE Analytics

The market has been behaving unusually due to two seismic events, Knoedler believes. “You have occasional one-off shocks that occur in the market and we've had two that've happened within a year."

One of those events was Nvidia creating $60bn of free cash flow “out of nowhere” over the past 18 months. The other was the US Federal Reserve calling the top of the hiking cycle at the end of 2023 – a major shock that drove a powerful rally in companies geared to interest rates and economic cycles.

As a result, global equity markets have cycled through three stages since late last year. “What goes bonkers initially is stuff that's very highly linked to rate policies, so the small regional banks in America and European small-caps. And they actually faded as this year has gone on because rates haven't come down as quickly as hoped,” Knoedler said.

In the first quarter of this year, those sectors passed the baton onto large banks, industrials, cyclicals and retailers – “stuff where we're not really present”.

The rally excluded the companies Evenlode favours, which have durable competitive advantages and deliver predictable cash flows.

“I think it just reflected the notion that winter was over, you could get out of the igloo and you didn't really need defensive, predictable, cash flow growth companies as much, and you could try other stuff,” he reflected.

This was followed by “a remarkable narrowing of the index” in the past few months, but Knoedler and co-manager Chris Elliott expect the short-term phenomenon of extreme concentration to dissipate eventually, making way for broader-based stock market performance and a return to fundamentals.

“It's not a bad time to be an investor. There are a lot of good quality companies out there and they're doing pretty well,” Knoedler concluded.

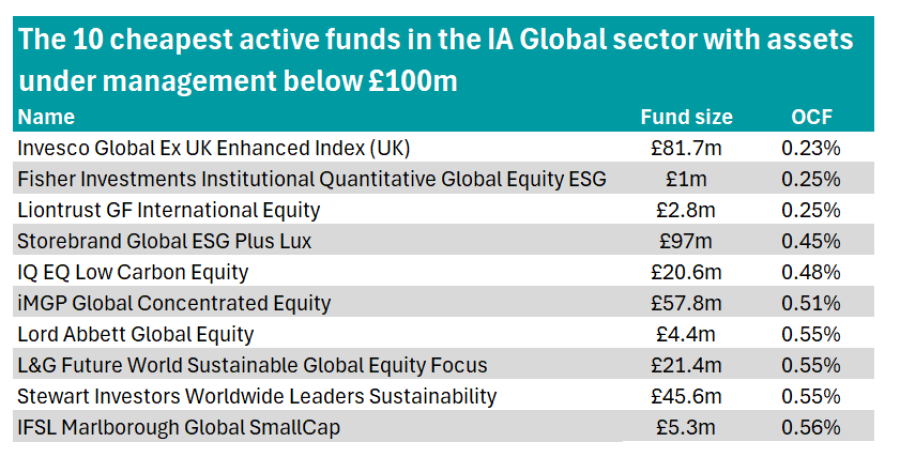

Trustnet researches the 10 cheapest active global funds with less than £100m in assets under management.

Smaller funds can afford to be more nimble and take advantage of market volatility in a way that is hard to replicate for their larger, and therefore more rigid, peers, but a big drawback is they tend to cost more.

With less money under management firms typically hike up the cost to make the portfolio profitable, while larger funds can drop their prices thanks to economies of scale.

For instance, Nick Wood, head of fund research at Quilter Cheviot, considers funds with less than £100m in assets under management (AUM) to be sub-scale.

He said funds with less than £100m in assets are “too small” for institutional investors to consider as they typically do not want to own such a large percentage of any one fund, which puts a block on these funds growing and gaining enough assets to begin lowering prices.

And this is borne out in the numbers. The average fund in the IA Global sector (including passives) charges about 0.8% in ongoing charges. For ‘sub-scale’ funds, this rises to 1%.

However, there are exceptions to the rule. As such, below, Trustnet highlights the 10 cheapest active funds in the IA Global sector with less than £100m in AUM.

Source: FE Analytics

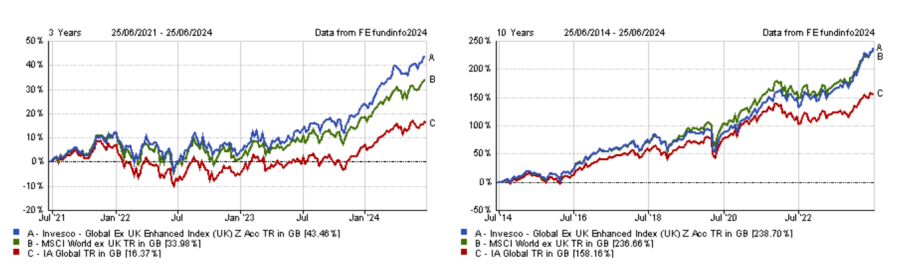

With a size of £91.4m and an ongoing charge figure (OCF) of 0.23%, Invesco Global Ex UK Enhanced Index (UK) is the cheapest ‘sub-scale’ fund in the IA Global sector.

The fund has been managed by Georg Elsäesser since 2021 and Michael Rosentritt since 2023 and is based on a systematic factor-based investment process focusing on momentum, quality and value.

Relative risk is managed using an analytical tool that recommends trades to enhance portfolio exposure to selected stocks within established risk and return parameters.

The managers also limit risk at the country, sector and industry levels when building the portfolio. For instance, the fund is slightly underweight technology and the US relative to its benchmark, but marginally overweight financials and Japan.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

The fund has outperformed both the IA Global sector and the MSCI World over one, three, five and 10 years.

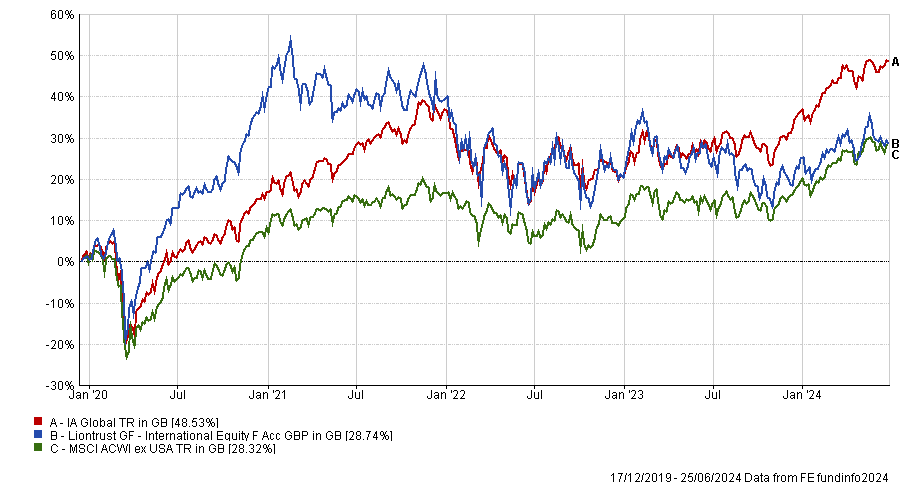

Next up is the £3.4m Liontrust GF International Equity fund, which has an OCF of 0.25%. A distinctive feature of this fund is that it excludes the US from its investment universe and seeks opportunities in Japan, the emerging markets, and Europe.

While the fund lacks exposure to US tech heavyweights, it still maintains a significant allocation to the information technology sector through companies such as Taiwan Semiconductor Manufacturing Company, Keyence, and Mercadolibre.

However, consumer discretionary remains the largest sector weight in the portfolio, including holdings such as China’s Trip.com and India’s MakeMyTrip.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Since its launch, Liontrust GF International Equity has slightly outperformed its benchmark but has significantly lagged behind its peer group, primarily because its mandate restricts investments in the narrow cohort of US tech stocks that have driven the market in recent years.

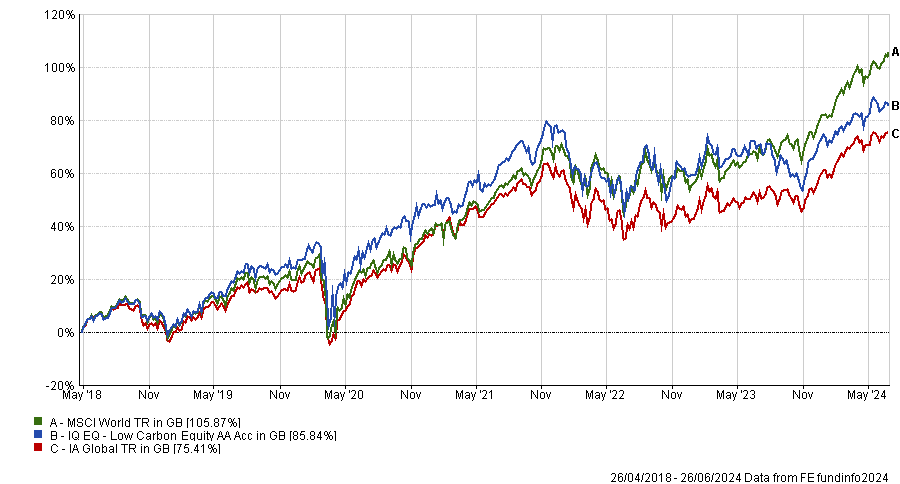

Another fund among the 10 cheapest global funds with less than £100m in AUM is IQ EQ Low Carbon Equity managed by Des Flood. The fund invests in businesses considered leaders in addressing climate change within their respective sectors, with companies such as Microsoft, Quanta Services and Siemens among its top 10 holdings.

It also excludes companies that profit from the exploration, extraction or burning of fossil fuels.

IQ EQ Low Carbon Equity was launched in 2018 and sits in the third quartile of the IA Global sector over five years. However, it has demonstrated lower levels of downside risk over the same period, as indicated by its maximum drawdown score of -14.3%, ranking 49th out of 405 in the IA Global sector. In comparison, the benchmark's maximum drawdown over the same period was -15.7%.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

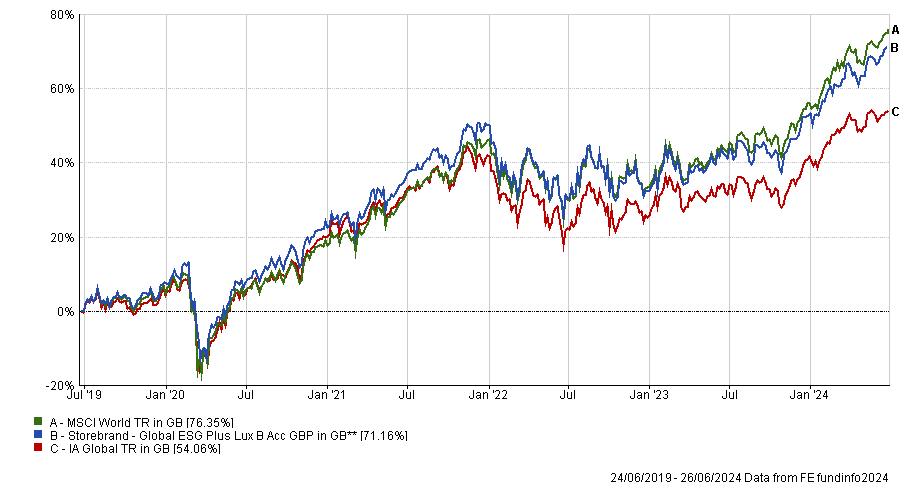

Storebrand Global ESG Plus Lux, managed by Henrik Wold Nilsen, also follows a fossil-fuel-free investment approach, but takes additional environmental, sustainable and governance (ESG) criteria and sustainability factors into consideration.

Investee companies must have a high Storebrand sustainability rating and be aligned to the UN’s sustainability goals. Moreover, the fund invests up to 10% of its assets in businesses related to clean energy, energy efficiency, recycling and low-carbon transport.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

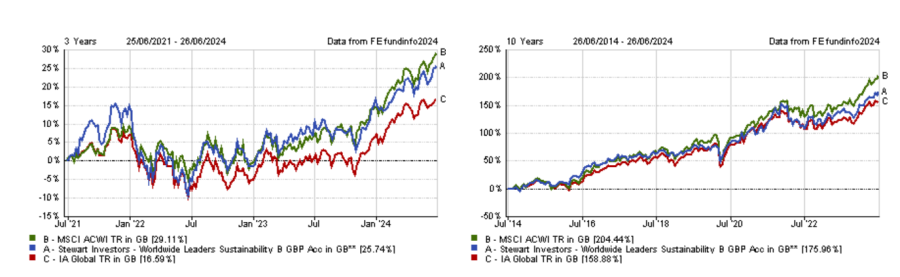

Up next, the £45.6m Stewart Investors Worldwide Leaders Sustainability fund charges investors 0.55% – one of the higher figures on the list but still far below the average IA Global fund’s costs.

Managed by FE fundinfo Alpha Manager David Gait and Sashi Reddy, the fund invests in large- and mid-caps across both developed and emerging markets. For instance, India holds the second-largest country weighting in the fund after the US, with Indian company Mahindra & Mahindra as its top holding.

Gait and Reddy aim to invest in high-quality companies positioned to both contribute to – and benefit from – sustainable development. They assess businesses on three metrics: quality of management, quality of the company and quality of the company’s finances. The fund sits in the second quartile of the IA Global sector over 10 and five years, as the below chart shows.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

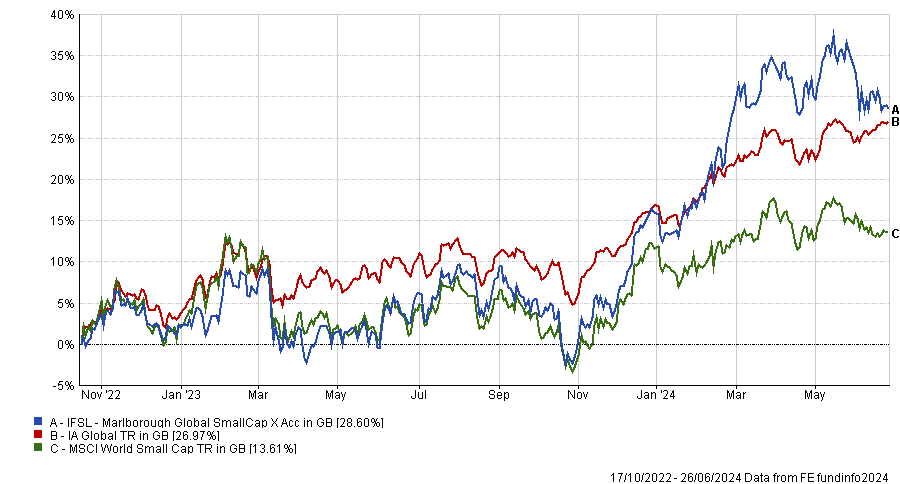

Finally, the £5.3m IFSL Marlborough Global SmallCap charges investors 0.56% to get an exposure to small- and mid-caps across the world.

A smaller fund can be advantageous when investing in small-caps, with experts previously indicating a preferred size range of £60m to £200m for small-cap funds.

However, IFSL Marlborough Global SmallCap is more tilted towards mid-caps, which constitute 60% of the portfolio.

The industrials sector represents more than 50% of the portfolio, making it the largest sector weighting, while the US accounts for 55% of the portfolio (it’s largest country exposure).

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Since launch, the fund has outperformed both the IA Global sector and its benchmark, despite a period that has favoured more liquid and resilient mega-caps.

Rory Stokes also explains why he is worried about central banks getting monetary policy wrong…again.

Sometimes it is better to be lucky than good, although it helps to be both. The latter is something that has helped propel the Janus Henderson European Smaller Companies fund to the top of the charts over the past decade.

Managed by Rory Stokes, the portfolio has returned 200.1%, over 10 years making it the best-performing portfolio in the IA European Smaller Companies sector.

Yet he admits he has not got everything right. For example, the manager failed to spot the Covid pandemic in 2020 and was also caught out by Russia’s invasion of Ukraine in 2022.

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Despite this, his fund held up well during both periods thanks to its process of investing in a range of different buckets. “The major advantage of investing across the corporate lifecycle and maintaining a balance of various styles is that different bits of the portfolio can do the heavy lifting at different times,” he said.

In 2020, his allocation to early-cycle names, including an online German pharmacy, a bike helmet safety company and computer gaming companies, all helped bolster returns.

Fast forward to 2022 and at the start of the Russia-Ukraine conflict the fund’s energy names and financials as well as exposure to more mature companies and undervalued businesses, came to the fore.

Below, he explains discusses his issues investing in lastminute.com, how Europe is a growth market (despite investors’ preconceptions) and why he is worried about central banks getting monetary policy wrong…again.

What is your investment strategy?

We're looking to get a good balance of growth and value. We try to have exposure across the entire corporate lifecycle, whereas most of our peers just invest in quality-growth names.

Typically, about 40% to 50% of our investments could be classified as quality growth and approximately 5% to 10% of the portfolio is allocated to early-stage companies experiencing rapid growth and improving returns.

But what really differentiates us is our exposure to both mature companies where we believe management can achieve better returns and deliver solid cash flow, as well as to ‘bad’ companies that currently do not earn their cost of capital, but where we see potential catalysts for change

With that mixture, we end up with a portfolio that still has a lot of growth in it, but is as cheap as the benchmark whereas our peers typically look more expensive.

What has been your best stock over the past 12 months?

It’s been Alzchem, which is a little known specialty chemical company from Germany. It's still cheap because it's very unknown in the broader market. It is the only European producer of creatine.

Many people who like going to the gym take creatine, which helps them get an extra two or three reps out of their weight training sessions. Since the pandemic, people have embraced going to the gym and using creatine due to its physiological and mental benefits.

Alzchem also has a product called nitroguanidine, which is an accelerant used in artillery shells. The EU has given the company a big grant to boost its production and help guarantee the security of supply of NATO ammunition.

Performance of stock over 1yr

Source: Google Finance

And the worst-performing stock?

The most burdensome active position has been lastminute.com, an online travel agency. It has been through a number of challenges in recent years and the pandemic was clearly a big blow for the business.

That was then compounded by the senior management being accused of having mismanaged the equivalent of furlough payments in Switzerland. The CEO was arrested.

There's been lots of management changes and the new CEO is very good, but the company now has to navigate a conflict with Ryanair about being able to buy Ryanair flights.

Performance of stock over 1yr

Source: Google Analytics

What is the biggest misconception about European equities?

The biggest misconception is that there is no growth. To an extent, that has been true in the large-cap space, but there's a handful of names that are bucking that trend.

Within European small-caps, there is a lot of growth. Of course, there are pockets of low growth, but you don’t need to be exposed to them. It's a heterogeneous area, which means you can also find earnings growth, and since it’s a neglected part of the market, you don't have to pay very much for that at the moment.

Europe is seen as sclerotic and boring, but I think there are a lot of opportunities. There's a lot of tech, great businesses and growth and that's probably not adequately recognised by the broader investment community.

What is your main source of worry when it comes to European small-caps?

A consistent worry is policy error. Central banks’ response to the pandemic was too aggressive and they were also too slow to respond to the inflation shock. The worry now is that, in an attempt to establish credibility, they keep rates too high for too long.

I also worry about the broader geopolitical risks that everybody else talk about. But the lesson I've learned over the past 24 years in the small-cap space is that random stuff just happens and most of the time, you don't see them coming.

The important thing is to size your positions so that you can get out of them when you need to. You need a willingness to recognise that when information changes, you have to rotate the portfolio.

What do you do outside of fund management?

I like riding my bicycle. I coach my children's football and play the Nintendo Switch with them. Those things take up most of my time.

Fund managers believe the US market’s dominance can continue.

Earlier this week, reporter Jean-Baptiste Andrieux asked fund managers whether the US’ dominance over the past decade and the market’s willingness to eschew price and focus on growth potential could continue.

Their answer: yes.

There were a plethora of reasons given, such as that the US is full of tech disruptors who are of higher quality than overseas rivals, make more money and are benefiting from healthier macroeconomics.

Even on valuations the managers were unconcerned. Getting technical, Gerrit Smit, manager of Stonehage Fleming Global Best Ideas Equity, expected earnings growth for the S&P 500 to be close to 10% per year over the next three years.

As such, despite being on higher price-to-earnings ratios, future growth should more than offset this over time.

But this begs the question – why invest in an active fund? According to the latest MSCI World factsheet, the premier global equities index is 70.9% weighted to America.

Yet, if the active managers quoted in the story are correct and the US will continue to drive markets forward, then they will need to be overweight this figure to outperform.

So how can active managers hope to stand a chance against the passive titans? The most common answer is stock selection. Fund managers argue that their research and ability to uncover stocks is better than others and therefore they should have an edge.

Certainly, fund managers can outperform the index by picking good companies either in the US or in other markets, something highlighted by news editor Emma Wallis last week when she looked at the UK stocks able to beat most of the Magnificent Seven.

And there will be more examples in other markets too of individual stocks able to produce the type of returns investors have come to expect from US tech giants.

But the issue is that they are harder to find and – while all fund managers believe in their ability to spot them – few can do so consistently.

Managers often say they do not need to get everything right, they just need to be right more than 50% of the time, which is true, but even this hit rate is difficult when the passive index has been so strong.

Indeed, just 20% of the IA Global sector (52 out of 245 eligible funds) have beaten the MSCI World over the past decade after fees, a figure that drops to 18% over five years and just 13% over three years.

So by suggesting that US exceptionalism can continue over the next decade, active managers have perhaps inadvertently given justification to their greatest rivals – passives.

The most sensible option appears to be basing a portfolio around a global tracker and having other funds at the margins.

However, there are some funds that have an even higher weighting to the world’s largest market than the MSCI World. In the IA Global sector, 46 out of 564 funds are overweight the US, with passives accounting for many of them (particularly the ones that track other, even more US-heavy, indices).

But there are active funds with overweight positions including Smit’s Stonehage Fleming Global Best Ideas Equity fund, which has a 71.7% allocation to the US. The active fund does have the edge on the MSCI World over 10 years after fees, up 249.4% versus the benchmark's 225%, although it has struggled over five and three years.

Whether this is enough to justify spending 0.81% per year in ongoing charges, rather than the 0.12% charged by the cheapest trackers, is up to investors to decide.

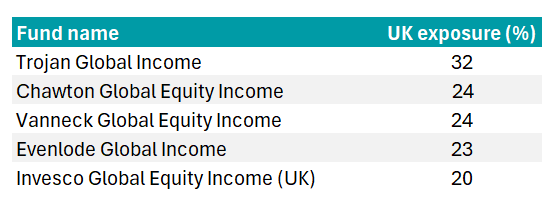

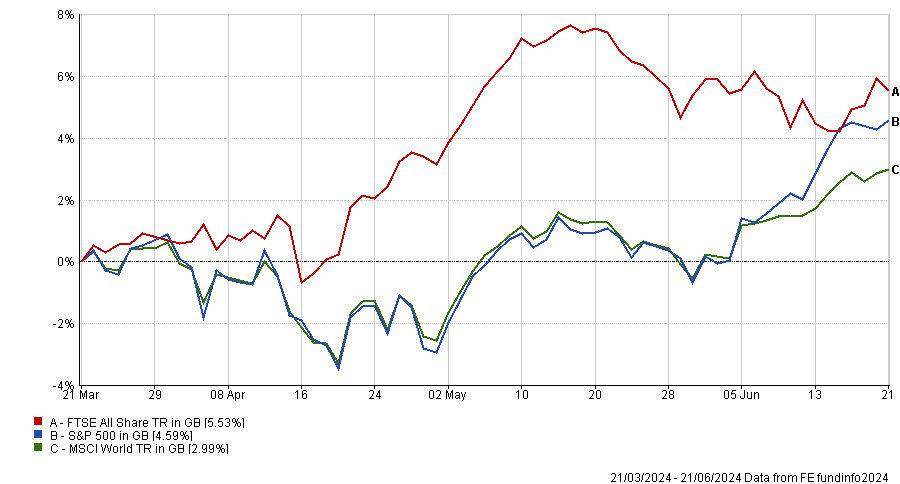

Invesco, Evenlode and Troy have all channelled more than a fifth of their global equity income strategies into UK-listed dividend payers.

The UK was one of the world’s best performing stock markets for the past three months, beating US and global equities hands down. One quarter does not atone for a decade’s underperformance but it does shine the spotlight on the UK’s nascent recovery, attractive valuations and wealth of high-quality, dividend-paying companies.

A handful of global equity income managers are well placed to profit from the UK’s turnaround, with more than a fifth of their portfolios in domestic equities.

Although income funds often favour UK and European stocks because they tend to pay higher dividends than US-listed companies, a 20% allocation is still a large bet, particularly compared with the MSCI World and the MSCI World Quality Dividend index, which have just 4% and 6% respectively in Britain.

Global equity income funds with more than 20% in the UK

Source: FE Analytics, funds’ factsheets

Why are these funds overweight the UK?

Several of the funds’ managers said they were overweight the UK for stock-specific reasons, at a time when many high-quality UK companies are cheap.

Stephen Anness, head of global equities at Invesco, said: “We have been able to find several businesses at attractive valuations in the region. Part of this is linked to the UK now being such a small part of the overall index that it does get less attention from a lot of global managers and therefore you can find some really interesting opportunities and hidden gems.”

James Harries, senior fund manager of the Troy Global Income strategy, added that despite the UK being "deeply out of favour", it has "a number of global companies that offer a compelling combination of quality and long-term income growth".

Michael Crawford, chief investment officer at Chawton Global Investors, said he looks for quality companies delivering a high return on invested capital, where capital allocation drives shareholder value, and these qualities are more evident in the UK and Europe.

As a result, the WS Chawton Global Equity Income fund has had a significant overweight to the UK since inception in April 2019. Next and Bloomsbury are its largest two holdings.

The UK stock market isn’t the British economy

The high UK allocation is a bit of a misnomer, Anness pointed out, because so many UK-listed companies are global businesses earning more of their revenues abroad.

For example, the Invesco Global Equity Income fund’s biggest position is 3i, a private equity investment trust that earns 97% of its revenues outside the UK and has a large holding in Action, Europe’s fastest-growing non-food discount retailer.

“We see this as nothing less than one of the best businesses on the continent – hidden within a financial company. Action currently has more than 2,300 stores across Europe and plans to open 400 a year by 2026. We estimate it could take almost 20 years to saturate Europe alone so there is a very long runway for growth,” Anness said.

Invesco’s next two largest UK holdings, Rolls Royce and Coca-Cola Europacific Partners, are “multinational companies where the UK is very small component of overall revenue, they just happen to be UK listed,” he said.

Evenlode also looks at its geographical exposure through the lens of where revenues are generated, said investment analyst Rob Strachan.

Evenlode Global Income currently has 23% in UK-listed stocks, near the top of its historical range. Its UK exposure has varied between 16% and 24% since inception in 2017, but revenues from the UK have always remained below 5%.

“We are well positioned in certain high-quality, multinational, UK-listed businesses that look relatively good value compared to our wider investable universe, such as Unilever, RELX and Diageo,” Strachan explained.

“The largest position in the fund is currently Unilever, reflecting its globally diversified portfolio of brand intangible assets, distribution advantages and attractive relative valuation.”

Unilever also features within the top 10 holdings of Trojan Global Income and VT Vanneck Global Equity Income, which have almost a third (32%) and a quarter (24%) of their portfolios in the UK, respectively.

In addition, Troy holds British American Tobacco, RELX and Reckitt Benckiser, while Vanneck owns Rio Tinto and Hargreaves Lansdown. The investment platform’s share price has soared in the past couple of months after it received bids from a consortium of private equity firms led by CVC Capital Partners.

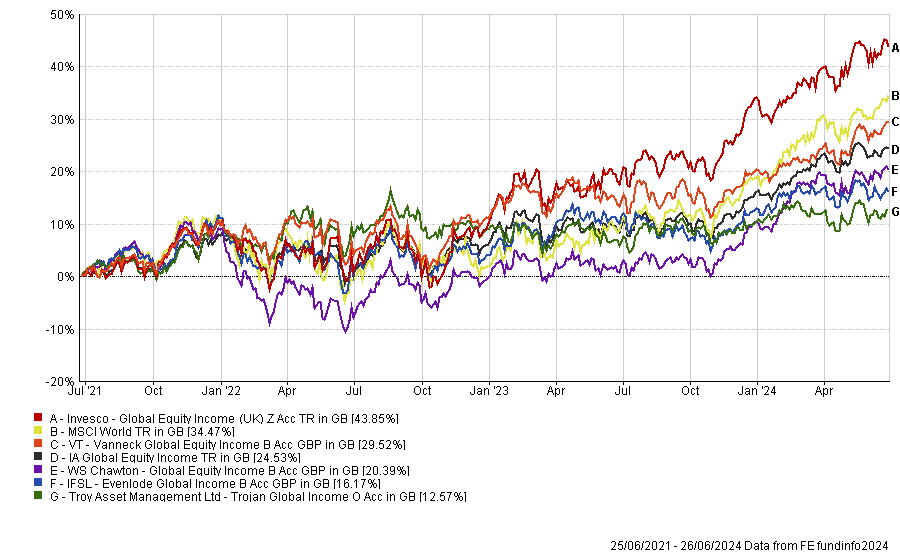

Stock selection can override asset allocation

A large UK weighting has been a drag on performance given the relative gap between the UK and US stock markets for the past decade. However, some of the funds have made up a lot of that ground through stock selection and Invesco Global Equity Income stands out as a top performer.

Performance of funds vs sector and MSCI World over 3yrs

Source: FE Analytics

Stock selection within the UK has helped the fund. Invesco owns Rolls Royce, which soared 198% in the 12 months to 26 June 2024, while 3i delivered total returns of 70.7%.

Global equity income funds in general were at a relative disadvantage last year when the Magnificent Seven contributed more than 50% of the MSCI World index’s returns, Anness pointed out.

“When seven out of over 1000 companies make up more than half of the total return of a major index, being benchmark agnostic (or underweight them) can be extremely painful. On top of that, the bedrock of our philosophy is a focus on cash flows, dividend-paying companies and a strict focus on valuation. Given that only three of the Magnificent Seven pay a dividend we tend to be underweight these companies… and yet we still beat the market.”

Top contributors last year included Broadcom, chemicals company Celanese, BE Semiconductor Industries (Besi) and private equity manager Kohlberg Kravis Roberts (KKR), in addition to Rolls Royce and 3i.

“I suspect few would have guessed that in the year of artificial intelligence, Rolls Royce would have outperformed Nvidia, or that a lesser-known chemicals company, Celanese, could outperform Apple,” Anness pointed out.

Investment-grade bonds are offering attractive yields and would provide investors with an element of protection if economic growth dips.

The opportunity set in fixed income is the greatest it’s been for more than a decade, according to Al Cattermole, co-manager of the Mirabaud Sustainable Global Strategic Bond fund.

With yields much higher compared to the past 15 years, there are now “opportunities that investors didn't have before” to make good risk-adjusted returns, he said.

His conviction is reflected in the Mirabaud Sustainable Global Strategic Bond fund’s 60% allocation to investment-grade credit and senior financials (debt that must be repaid first by a company if it goes out of business) – its highest weighting since Cattermole started managing the fund 11 years ago.

“Investment grade is yielding nearly 6% in the US and it's a similar level for global,” he said.

Investment-grade bonds also offer protection against an economic downturn. If a severe recession occurs and central banks cut rates dramatically, he thinks investment grade bonds could deliver double-digit returns.

Catrermole also believes that high-yield bonds would hold up relatively well in a recession, despite spreads being tight.

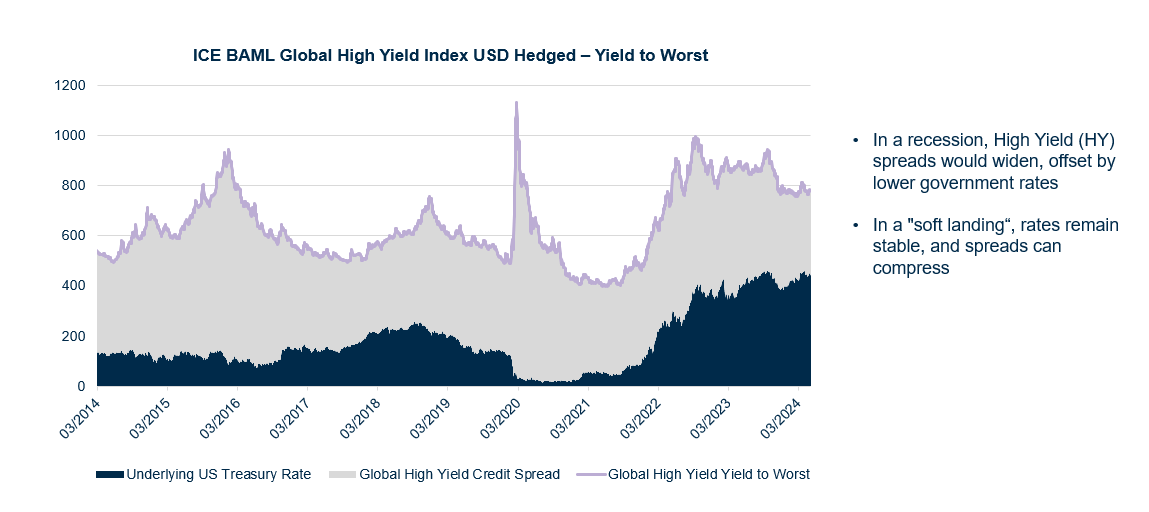

Today, global high-yield bonds are yielding 7.8%, as measured by the ICE BAML Global High Yield index. This is comprised of 350 basis points (bps) of credit spread and 432bps of underlying government rates, as the chart below shows.

High government rates provide protection in a recession scenario

Source: Mirabaud Asset Management, ICE BAML, Bloomberg, data to 31 May 2024

An 8% yield is attractive, but with credit spreads close to 10-year tights, many investors do not feel this compensates them for the risk of a slowing economy, he said.

But they are wrong to think so, according to the manager. “We agree that in a recession scenario (not our base case, but it is in the range of outcomes) credit spreads will increase (let’s say +200bps to 550bps). However – if we do move into a recession the underlying government rate will also fall as central banks cut rates quickly (on average eight cuts/200bps in the first year),” he said.

“This means over 12 months we have +200bps of credit spread but also -200bps in underlying rates movement, and the overall yield on the index is unchanged. In this situation you make the coupon return of the index (around 6.5% running yield or 7.8% yield to worst currently) – so even in a recession scenario, high yield delivers better than cash returns.”

Whether a recession occurs or not, treasury yields and credit spreads should move in opposite directions in next phase of the business cycle, allowing “a bit of a buffer no matter what happens”.

Cattermole reduced his high-yield exposure to 20% last year due to higher recession worries, but he recently increased his allocation again to approximately 30%.

As for the manager’s next move, it would “probably be to reduce credit and increase duration”, as the fund’s dynamic approach allows the managers to change duration frequently.

“The next phase would be moving into a more recessionary position, but if you do that now and the recession is not until 2026, you’ve move too early,” he noted.

Many companies do not neatly fit into a single industry or sector.

Clients often ask why we have a large exposure to the healthcare sector within our funds, and whether this poses a risk.

In principle, this is a valid question. Conventional wisdom holds that a diversified portfolio balanced across a range of sectors will reduce the impact that a downturn or shock in a particular sector has on the performance of the fund.

This is the view of ‘top-down’ allocators, who argue that managing sector exposures provides sufficient diversification to lower risk, which they equate to volatility.

Diversification is not that simple. When constructing portfolios, our belief that earnings drive share prices is what matters, and this belief is why we instead take a ‘bottom up’ approach to allocation, to ensure these earnings come from as diverse a set of sources as possible.

For example, we look at how much exposure a portfolio might have to the Chinese luxury consumer, or to value-based healthcare reform in the US.

Intuitively, this sounds like the logic of the top-down sectoral approach favoured by many managers. But this similarity only holds true if the categories used to assess diversification adequately group together companies with similar earnings drivers, and therefore similar sources of risk. In our view, they do not.

Categorisation: A nuanced problem

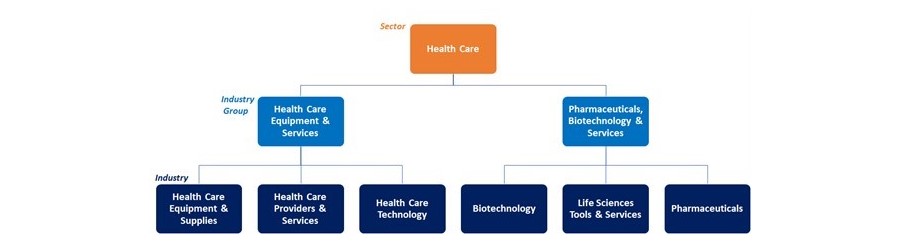

The Global Industry Classification Standard (‘GICS’), is the most widely used industry framework for sector-based portfolio management. This framework groups companies into a multi-tiered classification system according to their principal business activity, with revenues the key determining factor.

The drawback is that many companies do not neatly fit into a single industry or sector. By focusing on ‘principal business activity’, the totality of a company’s exposure, the nuances of its business model and the long-term secular growth drivers that may be spread across different industries and sectors are all lost.

This means that categories alone can tell you very little about what a company does or how it makes money, and thorough research is still non-negotiable.

In the case of massive, diversified conglomerates with earnings spread across multiple industries and markets, the challenge of categorising by principal business activity is obvious. But more importantly, even the narrowest subcategories frequently fail to distinguish between very specialised, very different businesses.

Sunglasses, pets, and sub-sub-sectors

To illustrate these points, let’s explore the healthcare sector as defined by the GICS system. As mentioned, this is the largest sector allocation across our funds. But although these companies may be classified as ‘Healthcare’ they all have different growth drivers and risks, meaning the earnings of these companies are a lot more diversified than this blunt labelling suggests.

According to the GICS framework, the healthcare sector can be broken down into two industry groups, with six industries beneath this, as the below chart shows.

Source: Seilern Investment Management

But even within one of these six industries, companies can possess markedly different growth drivers and business models. To illustrate, let’s consider two companies in our investment universe, IDEXX Laboratories and EssilorLuxottica.

These are both classified in the healthcare sector, the same industry group, ‘Healthcare Equipment & Services’ and the same industry, ‘Healthcare Equipment & Supplies’.

IDEXX is the global leader in companion animal diagnostic tests and services and provides the veterinary industry with the tools to help treat animals effectively, diagnose illnesses and to raise the standard of care.

The company’s long-term growth drivers are linked to the increasing rates of pet ownership and the ‘humanisation’ of pets whereby “pet-parents” increasingly see their pets like children, and subsequently spend more of their disposable income on their health.

EssilorLuxottica, on the other hand, is the global leader in the eyewear industry. It designs, manufactures, distributes and retails corrective prescription lenses, spectacle frames and sunglasses.

One of its main long-term growth drivers is the increasing prevalence of short-sightedness due to prolonged exposure to screens such as phone and tablets, as well as in emerging markets, where rising wealth and a large pool of people with unaddressed visual issues, are also driving growth.

Same sector, different fundamentals

A purely top-down, sectoral interpretation would hold that having both these stocks in a portfolio would provide no diversification benefits, and in theory, they should perform similarly.

But if we compare their share price performance their very different growth drivers are evidenced by their five-year correlation coefficient of just 63%. This is a seemingly low figure for two companies who, even at one of the most granular levels of the GICS categorisation, supposedly belong to the same industry.

This illustrates the limitations of using a top-down approach to manage risk. Different growth drivers mean the risks to these companies are also very different. For IDEXX, the risk to its earnings would be if the demand for animal healthcare was to falter, whereas for EssilorLuxottica it would be if rates of short-sightedness decrease.

So, if one were to be affected and the share price suffer, it would be highly unlikely that the other stock would also see its share price affected.

A bottom-up approach

Given this, a top-down sector allocation framework is not a true reflection of the concentration of risk within a portfolio. Instead, investors should look at ‘bulk risk’ – that is, how closely correlated the earnings of companies are. This approach can only be implemented by analysing each business model in detail from the bottom-up perspective of core earnings drivers, not the top-down view of which industries and sectors a company nominally operates in.

Akash Bhanot, research analyst at Seilern Investment Management. The views expressed above should not be taken as investment advice.

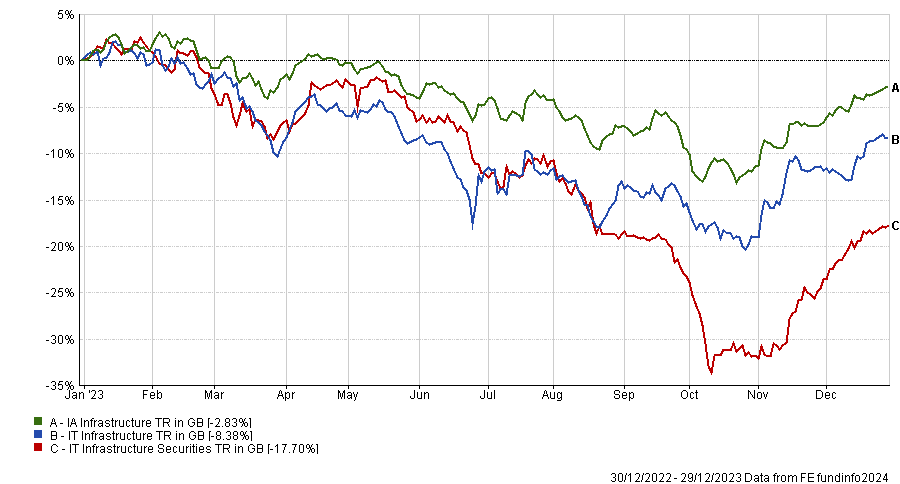

Infrastructure has plummeted over the past few years, but experts believe a resurgence is on the cards.

Infrastructure was once seen as a must-have alternative for investors who were suffering through the era of low interest rates in the 2010s, but has fallen by the wayside more recently.

This culminated in a disastrous 2023, when the asset class dropped as central banks hiked rates to deal with rampant inflation.

Indeed, looking at the main infrastructure sectors in both the Association of Investment Companies (AIC) and Investment Association (IA) universes, all made a loss last year, ranging from 2.8% (IA infrastructure) to 17.7% (IT Infrastructure Securities).

Performance of sectors in 2023

Source: FE Analytics

Returns have continued to underwhelm in 2024, with the IT Infrastructure the best of the trio, up 0.6%, while IA Infrastructure is down 1.1% and IT Infrastructure Securities has dropped 0.9%.

Thuy Quynh Dang, portfolio manager on the global listed infrastructure team at Cohen & Steers, said the main issue for the asset class has been the macroeconomic picture.

“While global economic growth continued to slow, it was generally stronger than expected over the course of 2023. This, combined with falling inflation, lessened the appeal of infrastructure’s defensive qualities,” she said.

Several factors were involved but perhaps the main one was the yields available to investors from other assets. Over the past decade, bonds have yielded very little with rates nailed to the floor, but now investors can make 5% or more from cash and low-risk government bonds – yields that were previously only achievable through alternatives such as infrastructure.

“In 2023, for the first time in years, interest rates rose to levels that made fixed income investments a viable alternative to higher-yielding equities,” she said.

Additionally, inflation caused companies’ costs to rise, while elevated rates and higher borrowing costs hurt sectors that tend to have more debt, such as utilities, she added.

Yet the impact of rate rises is now priced in, according to Dang. Even if rates remain higher for longer, she said markets expect a 7.8% total return from the infrastructure sector, with some areas such as renewable energy infrastructure in particular potentially making even more.

Jeremy Anagnos, portfolio manager of Nordea’s Global Listed Infrastructure strategy, was even more bullish, suggesting the asset class could “eclipse” the 8-10% returns it made over the past decade.

Infrastructure has historically performed well during periods of above-average inflation and high interest rates, he noted, highlighting the performance between 2000 and 2007, when the yield from 10-year US treasuries ranged from 3.8%-5.1% and infrastructure delivered a double-digit annualised return.

As such, “with low debt refinancing needs and healthy balance sheets, we think infrastructure can perform well if US risk-free rates remain in the 4%-5% range,” said Anagnos.

If this is reversed and rates start to fall – as is still expected at some point either this year or in early 2025 – the returns from infrastructure could be even stronger.

“Performance during the rate reversal trade over November and December, a period in which infrastructure delivered a 14% return, is a good indication of what investors could expect under such a soft-landing scenario. During this period, infrastructure kept pace with equities and nearly doubled the returns of fixed income,” said Anagnos.

Lastly, infrastructure should do well in a scenario where there is more market uncertainty (either through central banks wavering on rates or from geopolitical risks). After all, it has “saved investors about 30% of the downside in a negative market”, he noted.

Shannon Saccocia, chief investment officer of private wealth at Neuberger Berman, added that companies should do well regardless of the interest rate environment, as there remains a need for these assets.

Infrastructure is a broad term that includes bridges, roads, tunnels, power grids, hospitals, schools, data centres and ports, among numerous other areas.

“Whatever the great economic and investment themes of the next generation turn out to be, and however complex their nuances, without infrastructure they are not going to happen,” she said.

Japan isn’t as cheap as it used to be, but investors can still find value if they know where to look.

Sentiment towards Japan has improved significantly of late and there has been a big pickup in overseas flows into the Japanese equity market.

This is on the back of an “extremely strong” relative performance, according to Hawksmoor portfolio manager Ben Mackie.

“Some of that performance has come from multiple expansion”, he acknowledged, meaning that “on a simple price-to-earnings basis, Japan has become more expensive”.

Nonetheless, there is still a lot of value in Japan for investors and active managers who know where to look.

“The headline index valuation has definitely increased and you can no longer say that the overall index is as massively cheap as it used to be. It’s not expensive either, but it has definitely re-rated,” he said.

“You can think about it in terms of the proportion of the Japanese equity market trading on less than 1x book value, for example. Here, there's still a significant proportion of the market that is trading on cheap valuations.”

Performance of sector over 1yr

Source: FE Analytics

Mackie believes there are three key theme driving Japan’s equity market recovery: earnings growth, multiple re-rating and the self-help story of improving corporate governance. .Companies are increasing dividends, buying back their own shares and “really thinking about shareholder returns in a different way than they previously did”.

What has happened so far, however, is that a lot of the market leadership has been in the large caps, whereas now valuation dispersion is more interesting further down the market-cap spectrum. Investors can still find “lots of value in the smaller companies area, which is where the dispersion is particularly high”, he pointed out.

For this reason, Mackie and the other co-managers at Hawksmoor have taken some profits from large caps, where the valuation argument “isn't quite as compelling as it was”, to follow the returns down the market-cap spectrum in favour of smaller companies.

Hawksmoor’s exposure to Japan is “very significant”, spanning from 7% in more cautious funds to 12% at the higher end of the risk spectrum. By comparison, the MSCI World index has 5.9% in Japan.

One of Mackie’s favourite vehicles is the Nippon Active Value trust, whose activist approach works particularly well with smaller companies.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The trust is about taking meaningful stakes in smaller companies and then engaging with management to drive change, be that at the operational, strategic or the capital-allocation level,” he explained.

“What is really nice is that it's an idiosyncratic driver of returns, with a portion of businesses being sold and realising lots of shareholder value in a way that is independent of the rest of the market.”

Because the trust’s net asset value (NAV) is only £334.9m, it can't be a massive part of Hawksmoor’s portfolio from a liquidity perspective, Mackie said, although the praised the trust’s efforts to grow its assets by merging with abrdn Japan and Atlantis Japan Growth.

“They've been very active in terms of merging with other struggling Japanese trusts. They have grown the market cap and the liquidity of the vehicle, which is pretty commendable, and have done a very good job with it.,” he said.

To achieve a blend of styles, Mackie is using the FE fundinfo five Crown-rated Arcus Japan fund for more generalist, large-cap exposure.

Performance of fund against sector and index over 1yr

Source: FE Analytics

It is run by FE fundinfo Alpha Manager Mark Pearson, who actively turns the portfolio by selling shares that have re-rated and going back into cheaper areas of the market. Mackie described him as “very much a value manager”.

The vehicle’s top 10 holdings include Panasonic, Rakuten and Mitsubishi and currently, it makes up approximately 1.9% of Hawksmoor’s portfolios.

The next fund is Alpha Manager Carl Vine’s M&G Japan Smaller Companies, in which Hawksmoor has an average 1.7% position.

Performance of fund against sector and index over 1yr

Source: FE Analytics

This is a “more pragmatic and balanced strategy”, that is looking for stock-specific risks to be the main driver of returns.

FE Investments analysts commended the fund’s managers for their in-depth bottom-up process, “which enables them to identify strong opportunities in their 250 stocks universe whilst making proactive and quick investment decisions”.

The fund has a “highly dynamic portfolio, which regularly shifts sector and small-cap exposure relative to its benchmark while exhibiting a slight value tilt and while being a small and mid-cap fund,” the analysts added.

Finally, Hawksmoor also owns Polar Capital Japan Value to re-reinforce the bias to small-caps.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The fund applies a value-based stock-picking approach, investing in a concentrated portfolio of 40 to 50 large, medium and small capitalisation companies.

Experts are mixed on whether this level of dominance can continue, however.

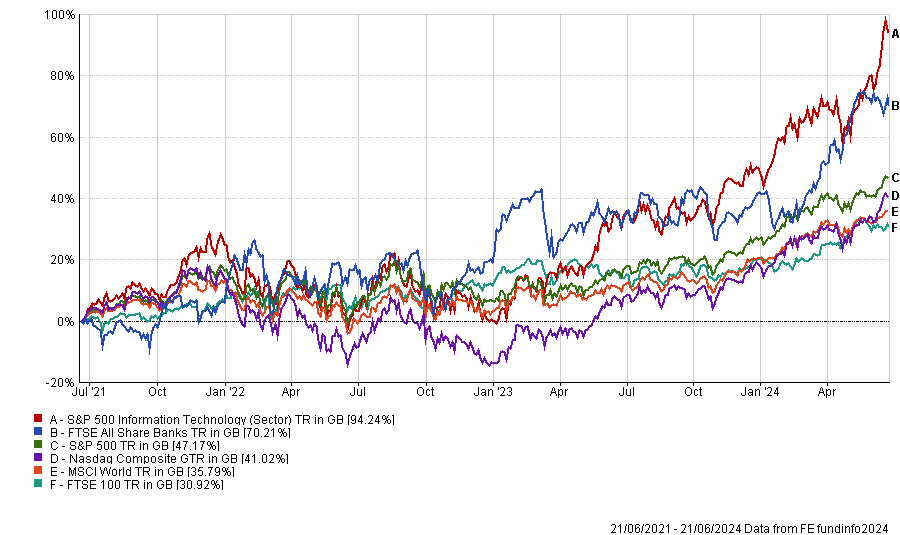

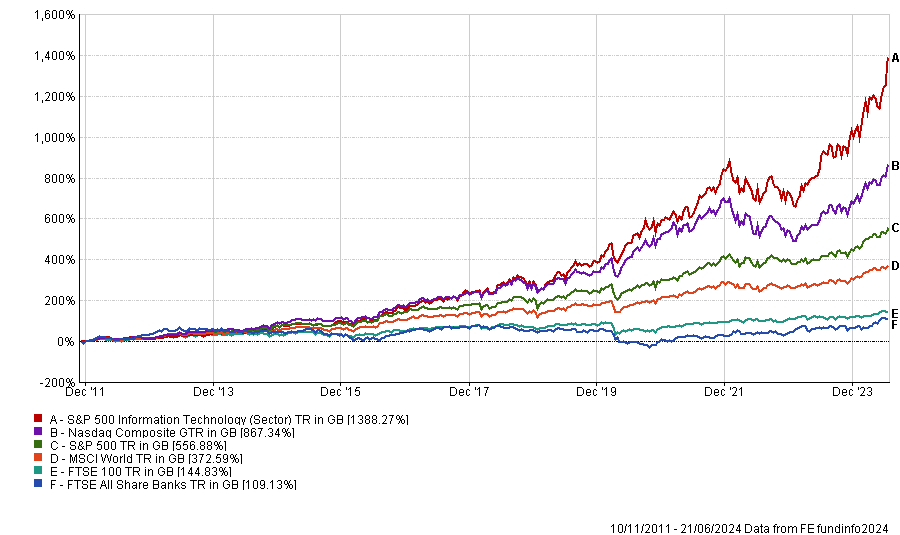

UK banks may not garner as much attention as the mighty Nasdaq or the mainstream S&P 500 index but they have proven to be a more rewarding investment than the US tech-heavy markets over the past three years.

This may come as a surprise, especially given the recent strong returns of the so-called Magnificent Seven stocks (Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia and Tesla) and the powerful narrative surrounding artificial intelligence (AI).

Yet, the FTSE All Share Banks index has returned 70.2% over the past three years, while the Nasdaq Composite and the S&P 500 have ‘only’ made 41% and 41.2% respectively over the same period. The S&P 500 Information Technology, which is a pure technology index, was the exception to the rule as it slightly outperformed domestic financials.

Performance of indices over 3yrs

Source: FE Analytics

UK banks were arguably not the most obvious candidates to outperform the two popular US indices, as they have faced the double whammy of being listed on the unloved UK stock market and belonging to a sector that has faced numerous regulatory headwinds across developed markets since the global financial crisis (GFC).

Graeme Forster, portfolio manager at Orbis Investments, said: “This prolonged water torture peaked in 2020 as UK short and long yields collapsed to zero in the wake of Covid. Bank shares collapsed with them, hitting historically low valuations.”

While the post-GFC era has been torturous for UK banks, tech-dominated indices have thrived in this environment, reaching new highs amid Covid lockdowns.

Julian Bishop, co-lead portfolio manager of the Brunner Investment Trust, said: “This was due to a combination of excitement around the pace of digitalisation around Covid and low interest rates, which theoretically increase the present value of longer-duration growth stocks.

“The Nasdaq subsequently saw a correction in 2022, but has since recovered and is now enjoying new highs once again as the narrative around AI continues to build.”

However, the rapid rise in interest rates has been a turning point for UK banks, as their profitability is highly sensitive to interest rates.

Bishop added: “As interest rates have risen, banks have been able to charge customers a higher interest rate.

“They have also received far more interest income on their deposits at central banks. As depositors will have noticed, these higher interest rates have not been passed on to current accounts which still pay a meagre amount.

“The net result is a significant increase in net interest income at the banks, most of which is pure profit. Given the much improved balance sheets at most European banks, this has allowed large dividend payments and buybacks.”

Performance of indices over 15yrs

Source: FE Analytics

Although the explosive gains we’ve seen over the past three years are not likely to be repeated, Forster believes that UK banks could continue to deliver above-normal performance.