M&G’s Carl Vine saw his fund lag in 2025, while funds at Aberdeen Investments and Franklin Templeton staged striking short-term rebounds.

The Japanese market enjoyed a renaissance in 2025, sitting behind only the emerging markets as the top-performing major equity region last year.

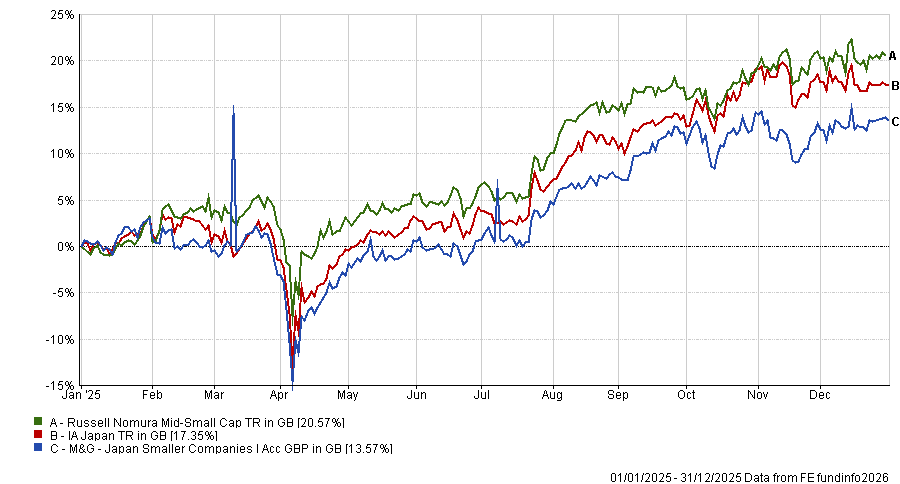

But not all funds were able to benefit from its resurgence. Indeed, FE fundinfo Alpha Manager Carl Vine’s M&G Japan Smaller Companies delivered a fourth-quartile 13.6% return over one year, lagging both its benchmark and the broader sector, with the former gaining 19.8%.

This short-term slip contrasts sharply with the strategy’s long-term credentials. Over 10 years, the fund has returned 190.6%, placing it among the sector’s first quartile winners over a period where Japanese equities performed poorly relative to other markets.

The strategy aims to beat the Russell/Nomura Mid‑Small Cap index over rolling five-year periods by running a high‑conviction, bottom-up portfolio of typically fewer than 60 holdings – picked from a core universe of over 250 Japanese companies.

The portfolio leans towards industrial goods and services and technology, with top holdings including Ichigo, Sparx Group and Infroneer Holdings.

Despite its short-term performance, FundCalibre analysts said the fund’s longer-term track record has been bolstered by the deep regional experience of the management team, reinforced by M&G’s Asia Pacific team.

They said: “Vine and his team have delivered excellent long-term performance in a very tricky and high-risk market. This is thanks to the team’s vast experience and deep knowledge of the companies they invest in and what their drivers are.

“Their strong engagement strategy with companies helps them uncover unique investment opportunities. The fund should be a strong consideration for anyone looking for Japanese smaller companies exposure.”

Performance of the fund vs sector and benchmark in 2025

Source: FE Analytics

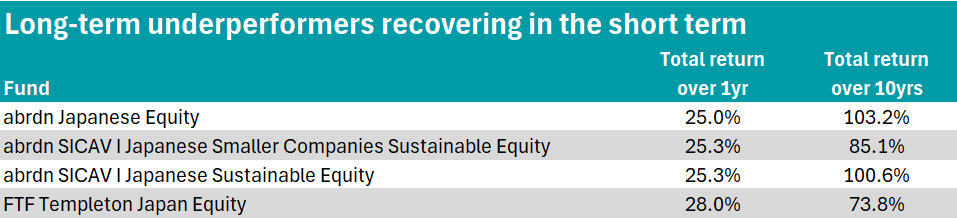

Conversely, where the M&G fund faltered, a cluster of long-term laggards enjoyed a renaissance in 2025 as the market rebounded.

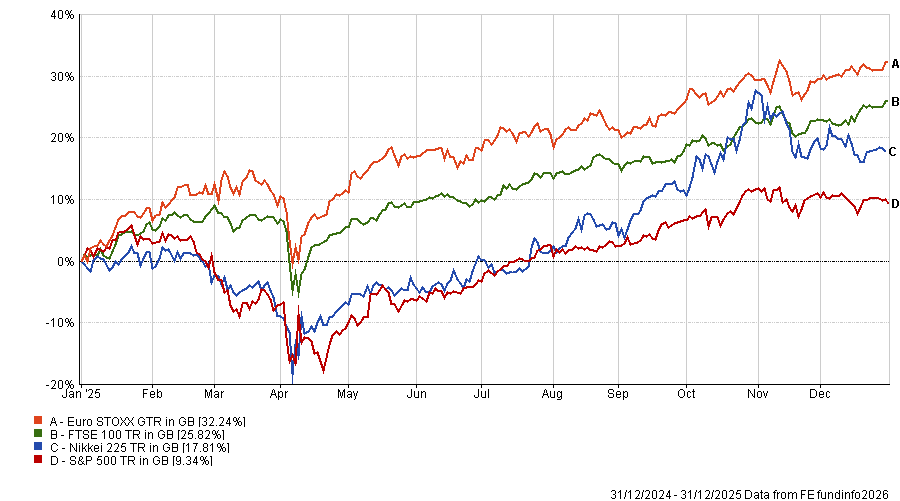

The Nikkei 225 gained 26.6% over the 12 months as a combination of global and domestic forces propelled the market higher.

While anticipation of US Federal Reserve rate cuts and an artificial intelligence (AI) build-out surge on the world stage were boons for the market, at home, Japan also benefited from rising wages, ongoing corporate governance reforms and strengthening retail participation.

Performance of the Nikkei 225 vs FTSE 100, Euro Stoxx and S&P 500 in 2025 (in sterling terms)

Source: FE Analytics

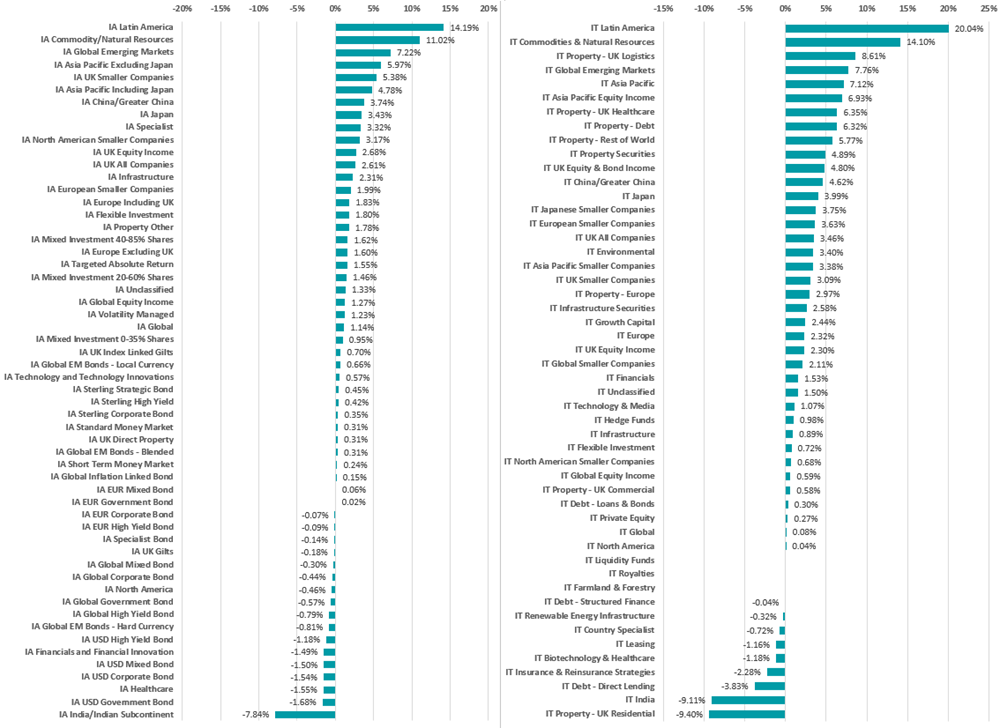

Against this backdrop, funds in the Investment Association (IA) Japan sector made an average 17.4% in 2025, making it one of the top 10 best-performing sectors for the year.

Benefitting from this shift in particular were a trio of strategies from Aberdeen Investments and FTF Templeton Japan Equity.

Source: FE Analytics

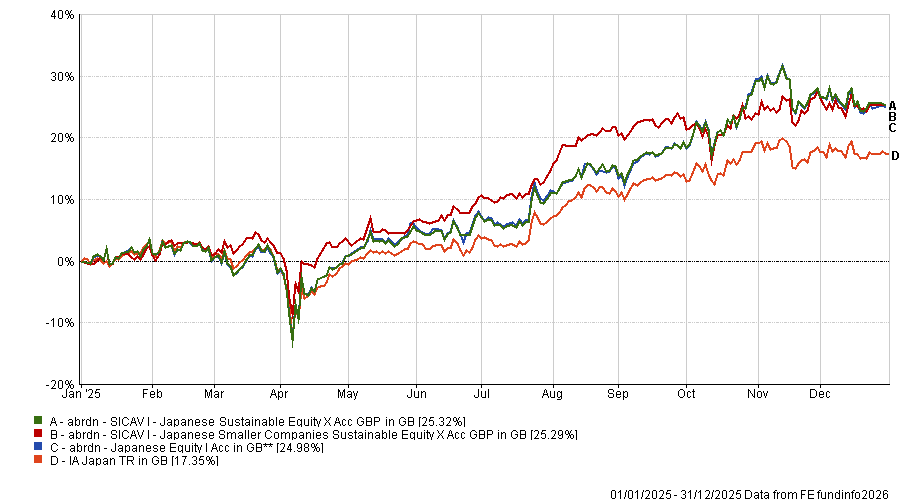

Abrdn Japanese Equity gained 25% over the year, making up a quarter of its total return over 10 years (103.2%). Led by managers Chern‑Yeh Kwok, Yuki Meyer and Zui Shiramoto, the strategy aims to outperform the MSCI Japan index via a 61-stock portfolio anchored by household names including Mitsubishi, Sony and Toyota.

Its small-cap sister strategy, Abrdn SICAV I Japanese Smaller Companies Sustainable Equity, managed an almost identical one-year return of 25.3% but has a weaker 10-year track record of 85.1%.

The fund’s sustainable investing framework – overseen by Kwok, Hisashi Arakawa and Jun Oishi – targets smaller companies considered environmental, social and governance (ESG) leaders or those showing clear potential to improve, with subsequent engagements and exclusions based on the asset manager’s ESG House Score system.

The one-year rebound also extended to Abrdn SICAV I Japanese Sustainable Equity, which matched Abrdn SICAV I Japanese Smaller Companies Sustainable Equity’s 25.3% return over one-year. It is also the best-performing fund of the three of 10 years, gaining 100.6%.

Performance of the funds vs sector in 2025

Source: FE Analytics

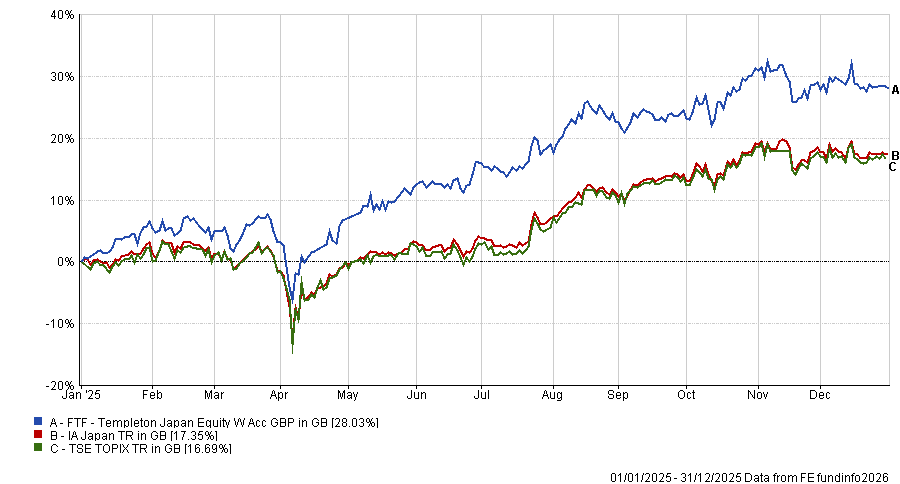

Rounding out the list of short-term standouts was FTF Templeton Japan Equity, which delivered the strongest one-year gain of the group, up 28%. It has a more modest 10-year return of 73.8%.

Managed by Chen Hsung Khoo and Ferdinand Cheuk, the £138.4m strategy aims to increase value through investment growth over periods of five years or more.

The portfolio carries a distinct tilt toward industrials and financials, with allocations of 31.1% and 24.5% respectively – higher than the benchmark weightings of 26.5% and 16%.

Performance of the fund vs sector and benchmark in 2025

Source: FE Analytics

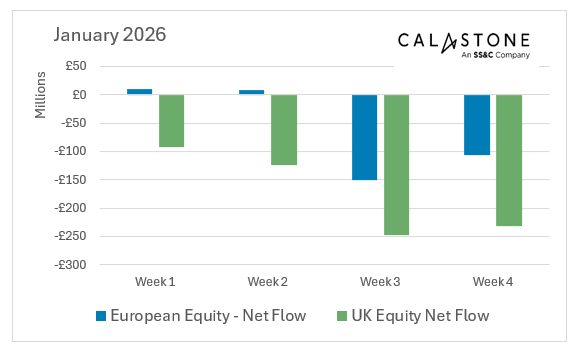

Some £931m was removed from European and UK equity funds in January.

Investors pulled almost £700m from equity funds in January, with UK and European portfolios bearing the brunt, data from Calastone’s Fund Flows Index has shown.

In total, a net £697m was removed, marking an unprecedented eighth consecutive month in which investors withdrew their cash.

The firm credited investor concern with US president Donald Trump’s threats to hike tariffs on Europe and other NATO countries as part of his bid to take over Greenland.

Indeed, the first half of the month was relatively muted, with net sales and buys cancelling each other out. But outflows accelerated on 19 January and continued for the rest of the month, as the prospect of US tariffs and the president sending military planners to the island sent markets tumbling.

Fund flows of European and UK equity funds in January

Source: Calastone

Additionally, most of the net sales came from the two places Trump targeted: the UK and Europe. European equity funds suffered their worst month since January 2025, as investors pulled £237m from the sector, while investors withdrew £694m from UK funds over the month, mostly in the final two weeks.

Edward Glyn, head of global markets at Calastone said: “The pace of outflows in January was far slower than in the run-up to the Budget, where a record flood of selling was prompted by concerns of possible higher pension and investor taxes.

“This indicates that the risk of conflict over Greenland was more of a tail risk in investors’ minds rather than a clear and present danger. It shows, however, that it doesn’t take much to fracture fragile sentiment, especially when stock prices are riding this high.”

Elsewhere, outflows from Asia funds continued, although they remained in line with the monthly average, while investors withdrew less from Japanese equity funds in January than they had done in previous months.

Emerging markets, global and North American funds all enjoyed net inflows during the month.

“Investors now have to be more alive to geopolitical factors than in the past and they are titrating their geographical allocations accordingly,” Glyn noted.

Passives remained popular, with net inflows of £1.4bn, while active funds suffered, with £2.1bn removed last month.

Turning to other asset classes, investors flocked to bond funds, which took in £459m in new money last month. Here, corporate bond funds were more popular, while government bond portfolios were sold down. Multi-asset funds also proved popular to start 2026, with more than £1bn added in the month, right around the 10-year monthly average.

Lastly, money market funds suffered outflows for the first time since April 2024, while investors took a net £51m out of property funds.

Fund pickers choose nine strategies to get exposure to the US today.

The way people invest in the US is changing. Allocating to the region is no longer automatic but requires more careful thought than before due to political uncertainty, extreme concentration in a handful of mega-cap stocks and the dominance of the artificial intelligence theme.

Investors have been cutting their winners, introducing currency hedging or moving some exposure from pure growth strategies towards value, as discussed on Trustnet earlier this week. Below, three fund pickers reveal their new approach for the US, which focuses on small-caps, insurance and healthcare – or anything but tech.

Darius McDermott, managing director at Chelsea Financial Services, said one of the key lessons from 2025 was to be wary of cutting US exposure altogether, citing the rebound after the 'Liberation Day' sell-off.

“The US still represents the highest-quality equity market in the world and having no exposure at all would be a mistake for long-term investors,” he said.

However, while VT Chelsea’s managed funds have not been actively selling US holdings, they also “haven’t been directing new money into the market”. Instead, fresh capital has gone into emerging and frontier markets, such as India.

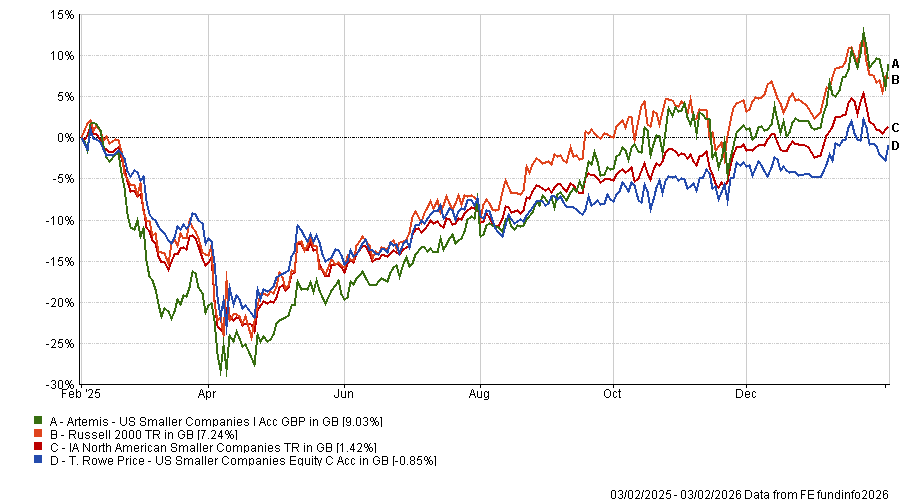

If allocating to the US today, McDermott said he would be more inclined to do so away from AI-driven hyperscalers and towards US small- and mid-caps, which he reckons are more attractively valued and more closely linked to domestic growth and company fundamentals. He highlighted T. Rowe Price US Smaller Companies and Artemis US Smaller Companies as options.

Both have limited weightings to the telecoms, media and technology sectors (11.6% and 3.6%, respectively) and focus more on basic materials (15.2% and 11.8%), financials (14.3% and 7%) and healthcare (both 16%). The Artemis fund has been in the top quartile of its peer group over the past one, three, five and 10 years.

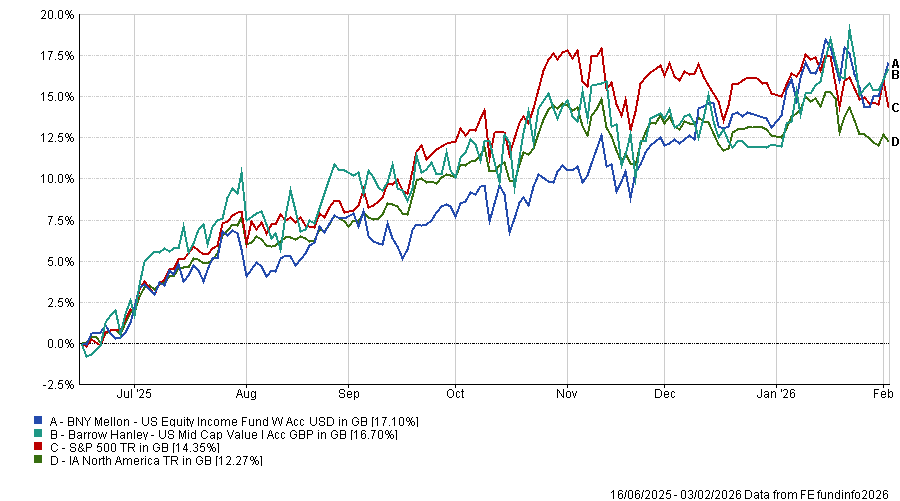

Performance of funds against index and sector over 1yr

Source: FE Analytics

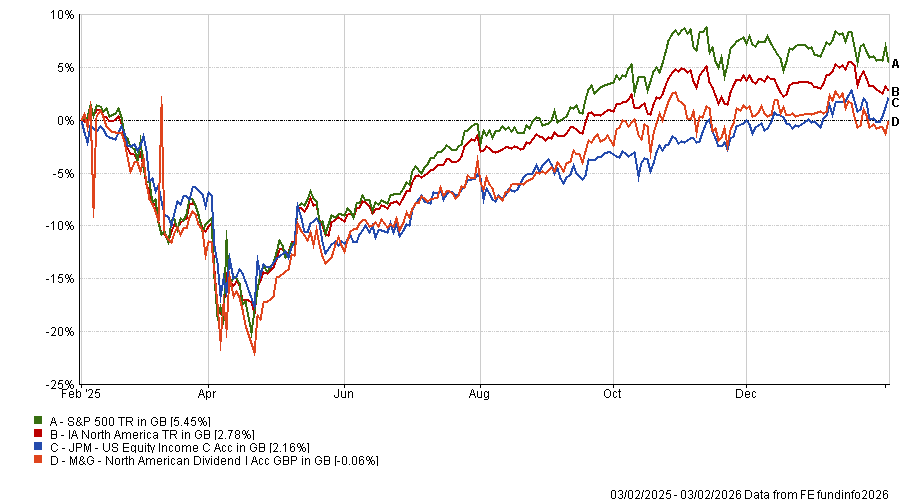

Alongside smaller companies, McDermott said he likes US equity income strategies with a value tilt, singling out JPM US Equity Income and M&G North American Dividend, which he said can provide a more balanced return profile by combining dividends with participation in long-term growth.

Performance of funds against index and sector over 1yr

Source: FE Analytics

JPM US Equity Income is income-orientated but analysts have noted how income is a residual the investment philosophy of of managers’ Andrew Brandon and David Silberman, with capital growth the primary focus. The strategy aims to soften some of the sharper moves in the wider market and produce a yield in excess of the index by favouring sensible blue-chip stocks.

M&G North American Dividend follows a dividend-growth approach, based on the belief that companies that grow dividends can add value and beat the market over the long run.

To mitigate a purely defensive bias, the portfolio is divided into three buckets: quality companies with reliable growth, asset-backed cyclical businesses and 'rapid growth' companies driven by structural themes. If a company cuts its dividend, the team treats this as a failure of capital discipline and will look to sell the holding over time.

Ben Yearsley, director at Fairview Investing, framed his approach to the US market explicitly around diversification away from mega-cap technology, saying that “it’s never wrong to take a profit”.

Many investors switched some of their market-cap trackers last year to equal-weight trackers, which he said was “a perfectly acceptable approach even though it didn’t work out last year”. Rather than relying solely on indices, Yearsley tends to use smaller or mid-cap companies or more of a value style.

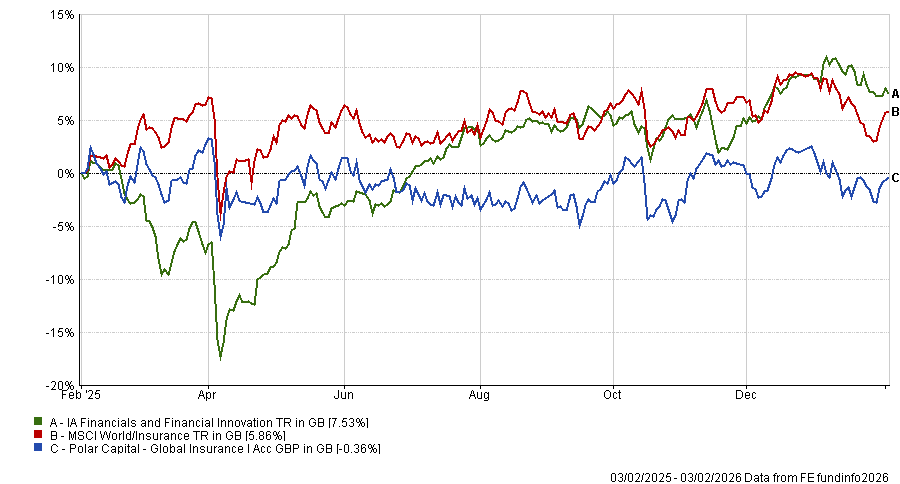

His picks in the space were Barrow Hanley Mid Cap Value and BNY US Equity Income, but he also pointed to more specialist sector funds that “have had a rougher time”, such as Polar Capital Global Insurance, which he said is about 70% US invested.

Performance of funds against index and sector over 1yr

Source: FE Analytics

The fund focuses on non-life insurance businesses around the world with a preference for medium-sized companies. The strategy many struggle during sustained falling markets when stocks are sold off indiscriminately, but the team has delivered returns in line with its stated objectives on an annualised basis.

Performance of funds against index and sector over 1yr Source: FE Analytics

Source: FE Analytics

Andrius Makin, associate portfolio director at Killik, focused on more specialist ways of accessing the US rather than revisiting broad market positioning.

His firm predominantly uses index funds to allocate to the US, but he agreed with McDermott and Yearsley that adventurous investors could look at small- and mid-cap companies, which are forecast to deliver double-digit earnings growth and should benefit from the One Big Beautiful Bill Act, he said. He also added that on price/earnings terms, small- and mid-caps trade at 26% and 34% discounts to large-caps, respectively.

That said, “smaller companies do leave you more exposed if economic conditions tighten, so in our MPS we have increased exposure only marginally”.

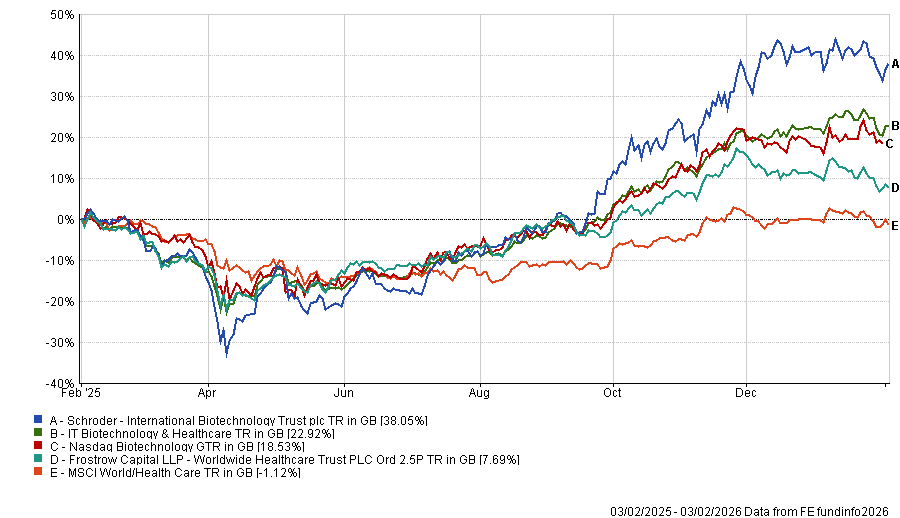

Instead, Makin is looking at specialist biotech funds, which are predominantly invested in the US and offer useful diversification. Large pharmaceutical companies face a 'patent cliff', with many sitting on large cash piles that could drive more M&A, including in UK-listed biotech trusts.

Although biotech has been under pressure since the post-Covid highs, the portfolio director remained positive on the sector given accelerating earnings growth and the possibility of increased acquisition activity, alongside new programmes to accelerate approvals.

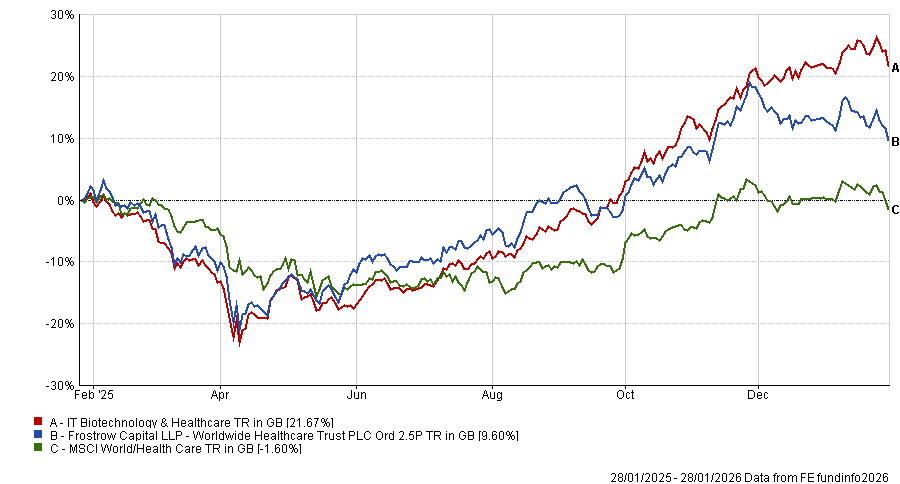

To access the area he turned to investment trusts: the International Biotechnology (81.2% US exposure) and the Worldwide Healthcare (74.2% in the US) trusts.

Both have achieved a maximum FE fundinfo Crown rating of five but differ in size (£316.1m versus £1.4bn, respectively) and risk level (with a respective FE fundinfo risk score of 275 and 165).

Worldwide Healthcare manager Trevor Polischuk has recently been quoted on Trustnet saying: “The confluence of this environment – the innovation, whether it be politics, lowering interest rates, M&A, valuation… – I've never seen it all align like this, and after four years of healthcare underperformance, I think the setup is phenomenal. This is the most bullish I’ve ever been on healthcare in my career.”

Performance of funds against index and sector over 1yr

Source: FE Analytics

Making warned he would however “be mindful of position sizing given that I expect biotech would lag healthcare and the wider market if we see any deterioration in economic conditions”.

With the 6 April deadline approaching, millions risk paying unnecessary tax by overlooking key allowances and reliefs.

Small decisions made or missed before April can have a lasting impact on tax bills, AJ Bell has warned ahead of the tax year’s end.

Laura Suter, director of personal finance at AJ Bell, said: “From savings interest and ISAs to pensions, investments and family finances, small decisions made – or missed – before April can have a lasting impact on your tax bill.”

The end of the tax year represents a hard deadline for using annual allowances. Most cannot be carried forward, meaning unused relief is permanently lost after 6 April, so below Suter highlights 10 mistakes to avoid.

1. Assuming savings interest remains tax-free

Many savers believe their interest escapes taxation, unaware that tax is eroding returns, and the government expects 2.64 million people will tax on their savings this tax year.

Basic-rate taxpayers can earn £1,000 of savings interest annually before paying tax under the tax-free Personal Savings Allowance, while higher-rate taxpayers face a £500 limit and additional-rate taxpayers receive no allowance. Rising interest rates mean millions now exceed these limits, whilst frozen thresholds push more people into higher tax bands. From April, tax on savings interest will increase further.

A saver earning 4.5% needs just £22,200 before hitting the tax-free limit as a basic-rate taxpayer, or £11,100 as a higher-rate taxpayer.

“Savers can move their money into a cash ISA and protect any interest from tax, or potentially benefit even further by moving that money into a stocks and shares ISA,” Suter said.

2. Letting ISA allowances go unused

ISA allowances operate strictly on a ‘use-it-or-lose-it’ basis. Failing to use the £20,000 allowance before 6 April means permanently forfeiting tax-free protection, potentially costing thousands in future tax on interest, dividends and gains.

Each individual can put £20,000 tax-free into an ISA, meaning couples can shelter £40,000 before April. Children receive £9,000 annually. The limit spans all account types.

3. Ignoring pension top-ups

Missing pension contributions before year-end means forfeiting immediate tax relief, which is particularly costly for higher-rate taxpayers where every £1 in a pension can cost as little as 60p.

Basic-rate taxpayers receive 20% tax relief, whilst higher and additional rate taxpayers can reclaim an extra 20% or 25% through online claims or tax returns.

“For some, a small contribution could also prevent them falling into a tax trap,” Suter said. “If you’re close to an earnings threshold that means you’ll lose some tax breaks or government support, such as for childcare, you can contribute to your pension to reduce your effective income, and once again be eligible for the tax break or perk.”

4. Forgetting to bank capital gains

The capital gains tax burden has escalated through cuts to the tax-free allowance and rate increases over the year. The allowance now stands at £3,000 per person, with basic-rate taxpayers paying 18% on gains and higher and additional rate payers facing 24%.

“If you have gains outside an ISA, you could realise the gains up to the annual £3,000 limit and move that money into your ISA – this process is known as a ‘Bed and ISA’,” Suter said.

Investors can also transfer assets to spouses or deploy investment losses to offset gains.

5. Overlooking dividend tax on modest portfolios

The dividend allowance has contracted to just £500, with tax rates set to increase from April. Rates will rise to 10.75% for basic-rate taxpayers and 35.75% for higher rate taxpayers.

“Many investors wrongly assume dividend tax only applies to large portfolios, but even relatively modest holdings can now generate a tax bill if they sit outside an ISA or pension,” Suter said.

A portfolio yielding 5% requires just £10,000 before hitting the limit but investors can use a ‘Bed and ISA’ to transfer dividend-paying investments into ISAs.

6. Falling into frozen-threshold tax traps

Pay rises can quietly push earners over key thresholds, reducing allowances or eliminating benefits such as child benefit or tax-free childcare. Failing to assess income position before April could mean losing thousands in support.

Parents face particular exposure at the £100,000 threshold, where tax-free childcare and funded hours disappear. Child benefit tapers from £60,000 and vanishes at £80,000. Moving into the higher-rate tax bracket halves the Personal Savings Allowance and triggers higher dividend tax rates.

“A small pension contribution could reduce your taxable income below these thresholds,” Suter explained.

7. Keeping assets in the higher-earning partner's name

Couples who fail to share assets often pay more tax than necessary. Not utilising a lower-earning partner’s allowances, ISA limits or tax bands results in avoidable tax on savings, dividends and capital gains.

If one partner earns less, transferring savings or investments into their name allows the couple to pay lower tax rates, Suter noted. Where one partner has not used their ISA, pension, Personal Savings Allowance or CGT exemption, moving assets can maximise available tax breaks.

8. Missing out on tax-free growth for children

Not using Junior ISAs or Junior SIPPs means forfeiting both tax-free growth and, for pensions, automatic tax relief. Over time, this can cost families tens of thousands in lost compound growth.

Junior ISAs allow savings of up to £9,000 per child annually, with funds growing tax-free until age 18. Junior SIPPs permit contributions of up to £2,880 per year, with government relief increasing this to £3,600, though funds remain locked until at least age 57.

“Someone who is able to put away the full £9,000 Junior ISA allowance each year, earning the same 5% return a year, could have £52,200 after five years or £266,000 after the full 18 years,” Suter said.

9. Forgetting to use inheritance tax gifting allowances

Failing to use annual gifting allowances means more of an estate could face inheritance tax later. Pensions will be pulled into the inheritance tax net from April 2027, bringing more estates into the charge.

Every individual can gift up to £3,000 per year free of IHT, with unused allowances carried forward one year. Couples can combine allowances to give away £6,000 tax-free annually.

Extra allowances apply for wedding gifts: £5,000 from parents, £2,500 from grandparents and £1,000 from others. Small gifts of up to £250 per person are also exempt.

“The most generous exemption is for gifts made from regular income, which can be unlimited if they don’t reduce the donor’s standard of living,”. Suter added. “If you haven’t used up your annual gifting amounts, it’s a good idea to consider it before the end of the tax year.”

10. Treating tax planning as an annual scramble

Leaving everything until the last minutes means savers are more likely to rush decision, miss allowances and make mistakes, while savers who fail to automate contributions often under-use their tax shelters year after year.

“It's a good idea to set your finances at the start of the tax year, working out what you can afford to contribute to ISAs and pensions, and then start automating it,” Suter finished.

“You can make sure you’re claiming the government allowances you’re eligible for and can work out what you want to gift, if applicable. You can then check in mid-year if you’re on track and factor in any changes to finances.”

Rathbones’ Alexandra Jackson argues that patient investors may be rewarded by unloved UK mid-caps.

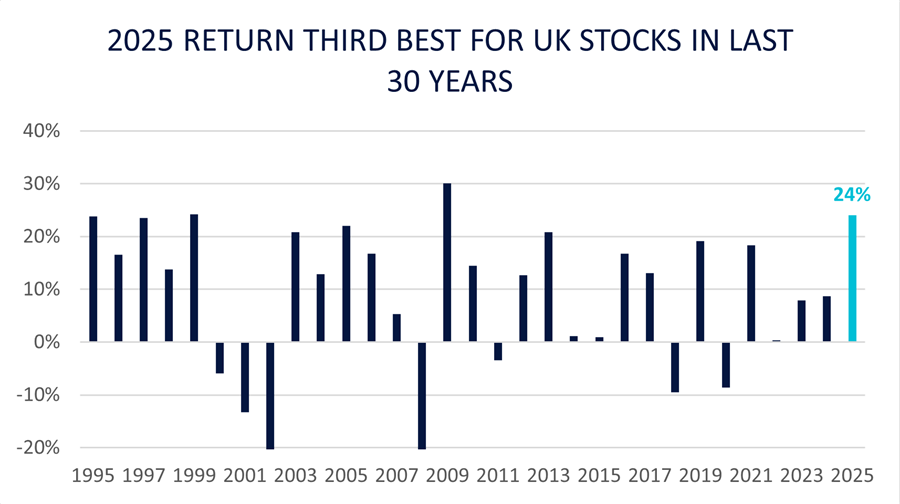

After years in the shadows, the UK stock market was the firecracker of 2025. Global equities enjoyed a strong run last year thanks to steady economic growth and falling interest rates, with the global buzz around AI adding extra fuel. Yet UK equities greatly outpaced global markets, to the surprise of many.

Growing appetite to diversify away from the Magnificent Seven stocks that dominate American and global indices, combined with concerns over unpredictable US government policy, more than offset underwhelming UK economic data that has been the norm for many years now. Attractive valuations across the FTSE All Share created favourable conditions, while tariff disputes and concentration risk served as catalysts for renewed interest.

For some time, commentators have highlighted the risks facing UK investors who adhere to a 4% global benchmark allocation in domestic equities, potentially missing opportunities in a market offering compelling valuations with scope for attractive returns. Those predictions materialised over the past year.

Source: FactSet, Rathbones; FTSE All Share index total returns by calendar year

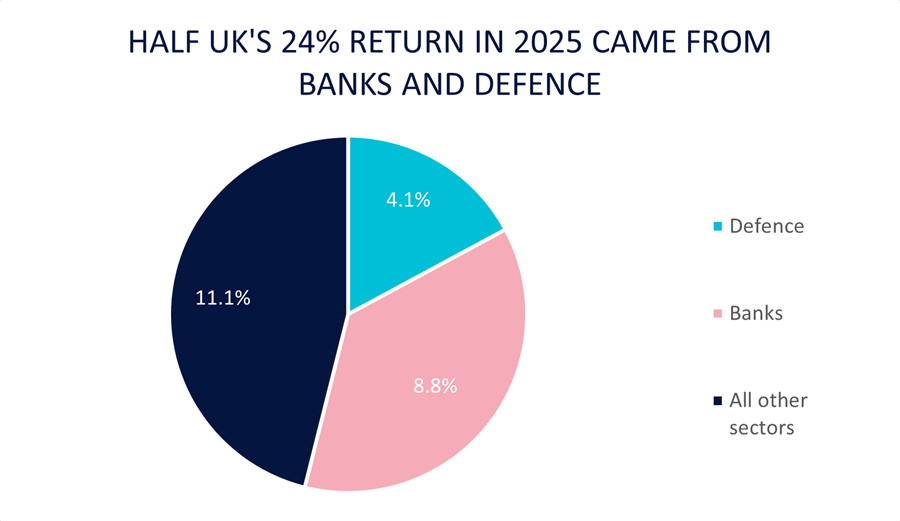

Investment flow data reveals that overseas investors have primarily driven the return to UK equities thus far. Domestic investors have yet to capitalise on these opportunities to the same extent. Passive flows from the United States gained momentum, with their impact most visible at the upper end of the index. Large-cap banks and defence stocks contributed over half of the FTSE All Share's impressive 24% annual return. In contrast, the FTSE World index of global developed companies delivered 15% by contrast.

Source: FactSet; data contribution to total return of FTSE All Share index for 2025

‘Quality’-oriented stocks, typically flourish during periods of economic stagnation, a descriptor that aptly characterises the current UK environment. Emphasising the quality factor provides a hedge against domestic economic challenges. However, the extent of outperformance from ‘cyclical’ sectors exceeded expectations.

Across Europe more broadly, 2025 marked the quality factor's worst relative performance in two decades, leaving this investment style de-rated and out of favour. This dynamic creates opportunities for when these high-quality British businesses receive appropriate recognition from the market.

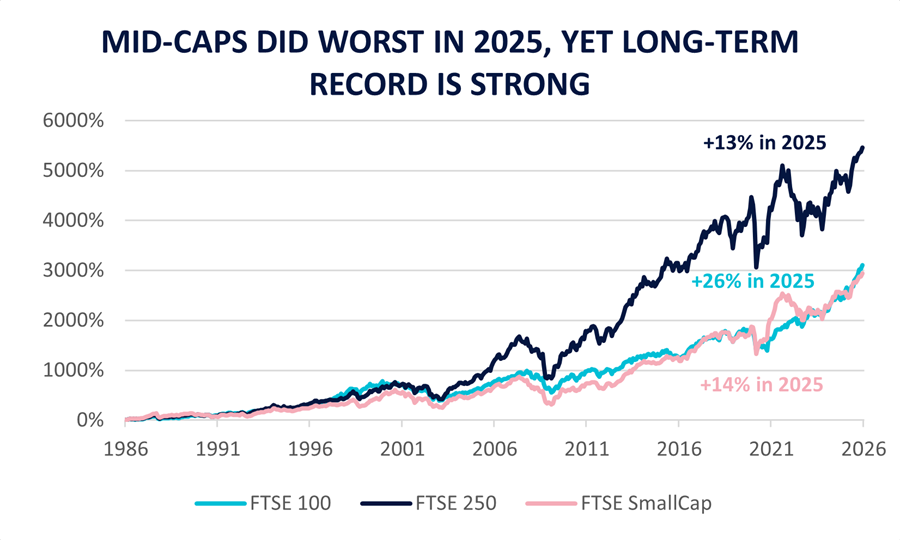

Mid-caps have endured a historically unusual period of underperformance relative to large-caps. The FTSE 250 has outpaced the FTSE 100 only once this decade, discounting a virtual dead heat in 2023. While long-term evidence demonstrates that mid-caps offer higher returns to compensate for elevated volatility compared with large-caps, passive flows have altered market dynamics. The anticipated trickle-down effect has failed to materialise and market leadership remains narrow, which pose challenges for active managers with defined investment processes.

Academic research indicates that return on invested capital serves as the strongest predictor of through-cycle returns in the UK market. This metric, measuring the profit a company generates from capital raised through equity and debt, remains fundamental to disciplined investment processes. Mid-caps have historically generated above-benchmark returns over extended periods in the UK market, supporting their continued centrality in quality-focused portfolios.

Source: FactSet; data total return 31 Dec 1985 to 31 Dec 2025

The disconnect between short-term market dynamics and long-term fundamentals presents both challenge and opportunity. While recent performance has tested conviction in quality mid-cap strategies, the underlying investment case remains compelling. Attractive valuations, strong business fundamentals and historical evidence of mid-cap outperformance suggest patient investors may be well rewarded.

The UK equity market's renaissance has begun, in our view, driven initially by international investors seeking diversification and value. As domestic investors recognise these opportunities and market leadership broadens beyond a handful of sectors, quality mid-cap businesses with strong returns on invested capital appear well positioned to deliver sustained outperformance. For long-term investors willing to look beyond recent style and size headwinds, the current environment may represent an attractive entry point into overlooked segments of a revitalised UK market.

Alexandra Jackson is manager of the Rathbone UK Opportunities fund. The views expressed above should not be taken as investment advice.

Octopus’ Chris McVey highlights the underappreciated but exceptional growth of UK small-caps.

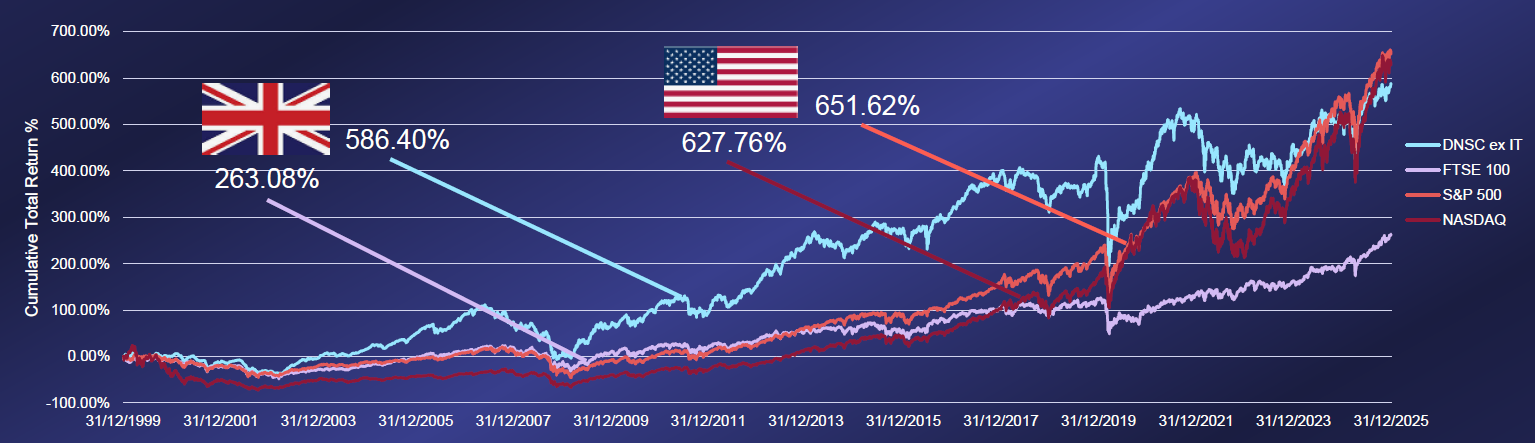

UK smaller companies have been growing at a similar pace to the tech-heavy US Nasdaq index but flows away from the asset class has meant returns have badly lagged.

As a result, Chris McVey, manager of the FP Octopus UK Multi Cap Income fund, said that over the next few years, AIM stocks and main-market listed smaller companies should be able to deliver strong double-digit gains, providing they can stem the tide of outflows.

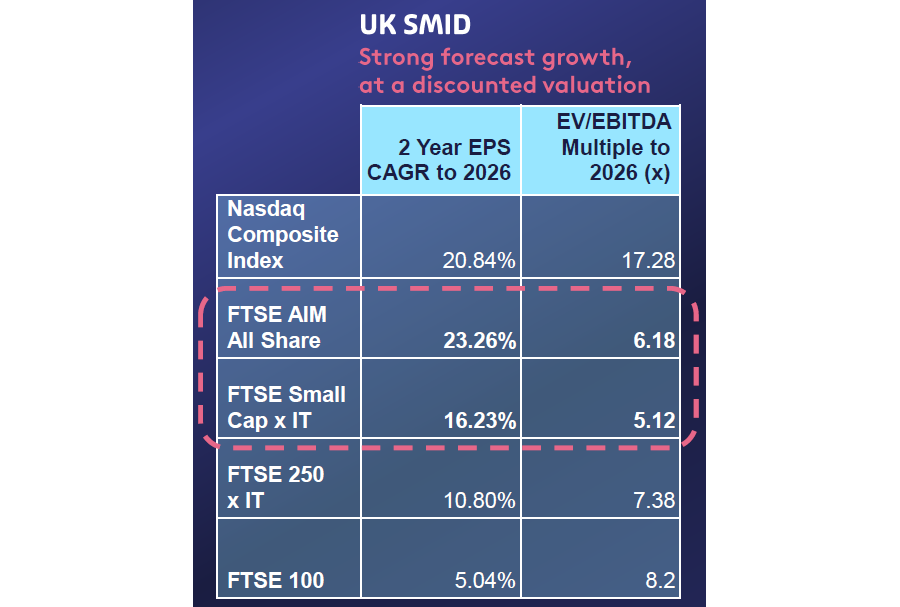

The chart below shows the underlying growth rates in earnings per share by index, against the enterprise value (EV) and earnings before interest, tax, depreciation and amortisation (EBITDA) multiples.

Source: Octopus Investments

Companies quoted on AIM lead the way with two-year cyclically-adjusted earnings growth of 23.3%. This is higher than the Nasdaq. FTSE Small Cap stocks (excluding investment trusts) are producing growth of around 16.2%.

“Even if you don't see any progression in valuation multiples, you should theoretically get between 15% and 20% per annum by investing in UK small-caps right now,” said McVey.

“If you get some semblance of re-basing of valuation, they’ll deliver significantly higher returns than that.”

The main issue, however, is “capturing people’s imaginations” and stopping the outflows. On this, McVey said government support around pension funds (forcing them to invest in domestic minnows) would be beneficial.

He noted there are many schemes being considered by the government to attract money back to the UK but admitted he did not know which, if any, would work.

Regardless, investors buying now are starting at a good price, with AIM stocks trading at 6x EV/EBITDA and small-caps on 5x. As such, McVey said he sees “limited downside from a valuation multiple perspective right now”.

“These are basically the lowest they’ve ever been. I can't see any reason for this level of valuation downside from a multiple perspective,” he said.

This is combined with strong historic long-term performance. Small-caps have broadly kept pace with the dominant US large-caps since the turn of the century, with relatively poor performance only starting in recent years.

Source: Octopus Investments

While he cannot guarantee the timeframe (McVey admitted he would have said the same thing at the start of 2025 and 2024), the FP Octopus UK Multi Cap Income manager stated that in three or four years’ time investors will be “kicking themselves for not buying at these levels”.

Alexandra Jackson, manager of the Rathbone UK Opportunities fund, agreed that UK small- and mid-caps (SMIDs) are undervalued but noted there are some external factors that could turn things around.

Firstly, SMIDs are very negatively correlated to interest rates, so falling rates should reverse the trend of recent years.

“They're also very positively correlated to sterling strength, so if your view on the dollar is informed by what you think Donald Trump is doing, then maybe think of currencies that take advantage of that. A stronger pound tends to be good for this part of the market,” she added.

Lastly, she pointed to corporate actions such as mergers and acquisitions and share buybacks, which should boost share prices.

However, having to choose between small and mid-caps, she would choose the latter, noting that it was an easy choice. While the earnings per share are lower, smaller companies tend to be more vulnerable to economic shocks or unfriendly conditions.

Higher debt costs or higher labour costs through things like higher wages or increasing energy bills tend to have an outsized impact on companies with lower revenues.

“So I want to be in that sweet spot, where the growth can really move the dial, but also with a little bit of protection,” she said.

“We have less than 6% of the fund at the moment in true small-caps. A lot of that is because the small-caps that we've owned have become mid-caps, but in the typical life cycle of this fund, you would then expect us to kind of recycle larger-cap capital into smaller companies. We just haven't found enough ‘tomorrow's winners’.”

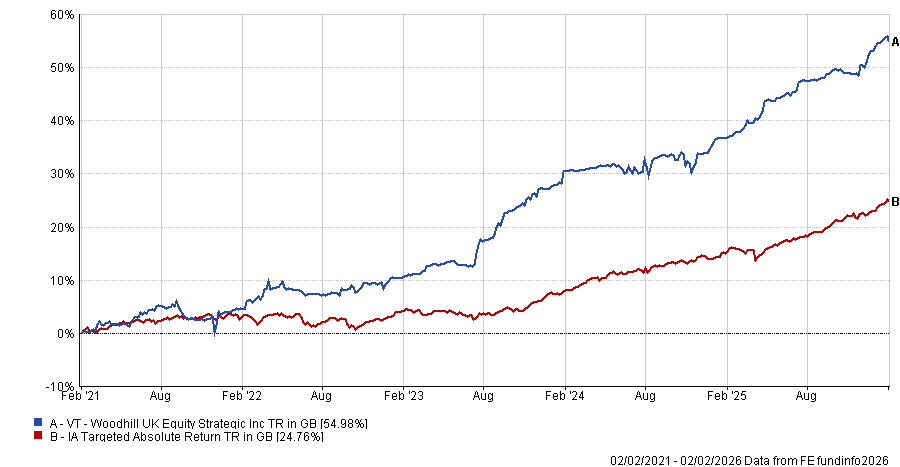

Absolute-return manager Paul Wood warns there would be nowhere to hide from a Nixon-like collapse.

Investors are underestimating the risk of a sudden market dislocation over the coming year. Paul Wood, manager of the VT Woodhill UK Equity Strategic fund, is not making a precise forecast but believes the odds of a damaging break in markets are uncomfortably high.

“There’s a 40% chance of a sharp collapse over the next 12 months,” he said.

These concerns rest on how politics, monetary policy and markets could interact. As many commentators are noting, the US is running “crisis-type stimulus” at a time when the economy is already in reasonable shape.

A combination of fiscal largesse and politicised rate cuts could recreate the conditions that produced the market turmoil of the 1970s.

Wood drew a parallel with the Nixon era, when the White House encouraged policymakers to keep borrowing cheap despite rising prices.

“Nixon leant on the Reserve Bank and you ended up with the bond- and equity-market nightmare where they were both going down at the same time.”

If rates were pushed far below inflation again, the traditional investor playbook would break down. “Should I have equity, should I have fixed income… [This question becomes irrelevant because] there’s sort of nowhere to hide really.”

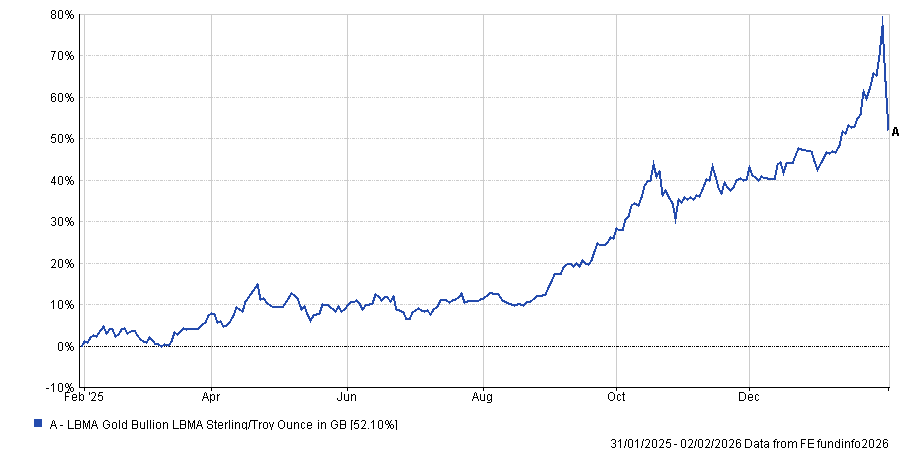

Even assets typically marketed as havens look questionable to the manager. Two years ago, he would have recommended gold as protection against geopolitical and monetary disorder.

“You could buy a bit of gold,” he said of that earlier period. “But I couldn’t say that honestly now. Even the safe assets are looking a bit dangerous because they’ve done so well.”

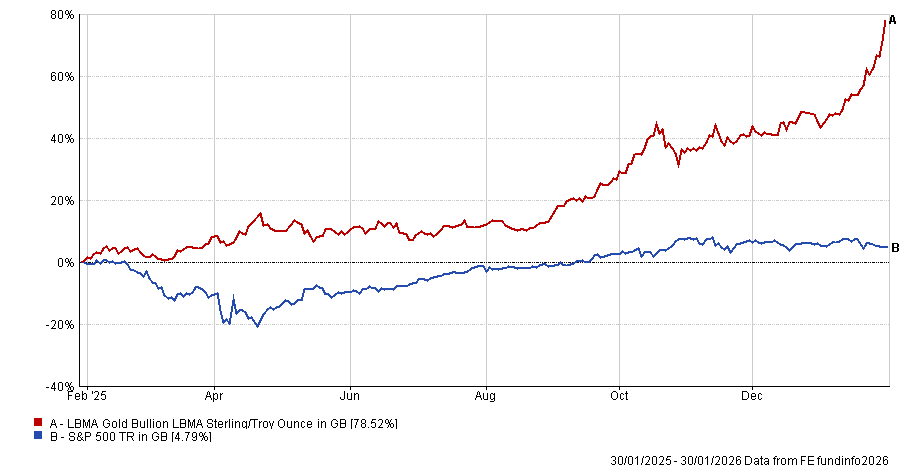

Performance of gold over 1yr

Source: FE Analytics

The scepticism about crowded trades and false safety is also evident in Wood’s broader philosophy, who has been worrying about strategies becoming fragile when too much money piles in behind the same idea.

Reflecting on the 1990s hedge fund boom, he noted that firms such as Soros Asset Management gradually outgrew many of their original opportunities. “They would get bigger and bigger, until the only thing left was currency, which was the only thing big enough to take that sort of volume of trading quickly.” The implication is that smaller vehicles can remain more flexible and selective.

At £36.5m, VT Woodhill UK Equity Strategic is small, even though many advisers instinctively prefer large, established products. Wood acknowledged that small funds can look unstable if staff leave or performance wobbles but thinks behavioural investor biases also play a role.

“It’s like the old corporate habit of buying IBM equipment simply because everyone else did,” he said. “If you buy something different and the thing you bought is a bit rubbish, then that’s a real problem. But if everybody’s IBM kit is rubbish, that’s fine.” For Wood, that herd mentality is exactly what a nimble fund can – and should – try to avoid.

Wood describes his approach as closer to credit analysis than traditional equity picking, with the aim to own high-quality companies across the market rather than making big sector bets. When they judge the balance of risks to be unfavourable, they hedge the portfolio using FTSE 100 futures.

He is keen to distinguish this from what he calls a “Texas hedge”, where a manager increases, rather than reduces, exposure to market risk by doubling down on an existing position.

Wood says his hedge tracks closely enough that, in stressed markets, his focus on quality can still generate relative gains. “When the market goes down, nearly always the high-quality firms do better than the more fragile ones,” he said, noting that the fund recently made about 1% in a month despite being fully hedged.

Wood is a critic of the idea that you must take more risk to get more return.

“Not all fund managers work to protect your money. They have goodwill but they won’t hedge, they won’t go to cash, they won’t do any of those things because it’s just too much career risk in it for them.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

VT Woodhill UK Equity Strategic achieved a maximum FE fundinfo Crown rating of five and holds about 40 to 50 large-cap UK stocks, chosen primarily for the strength of their balance sheets.

But the approach has not always worked smoothly. Covid was a painful episode because it did not fit the usual frameworks the team relies on.

Wood went into the pandemic hedged and initially protected the portfolio but removed the hedge too early as markets rebounded. The experience prompted a stricter, rules-based stop-loss policy.

Under that system, if the market falls 5% over five days, the fund now hedges fully and keeps that protection in place. If volatility is elevated, the team waits for a VIX reading of about 20 to 30 before easing off the hedge, to avoid trying to “catch a falling knife”.

Wood says the discipline is designed precisely to prevent the kind of mistimed decision that hurt them in 2020.

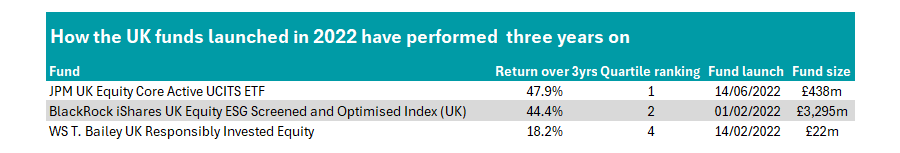

Just three funds investing in domestic equities were launched in 2022.

Three UK funds launched in 2022 crossed their pivotal three-year anniversary last year, data from FE Analytics shows, but only one was able to top its sector while establishing its track record.

In this series, Trustnet looks at the funds launched in 2022 that turned three years old during 2025. To maintain consistency, we have looked at their performance over the three years from the start of 2023 to the end of 2025. Previously we have looked at the US.

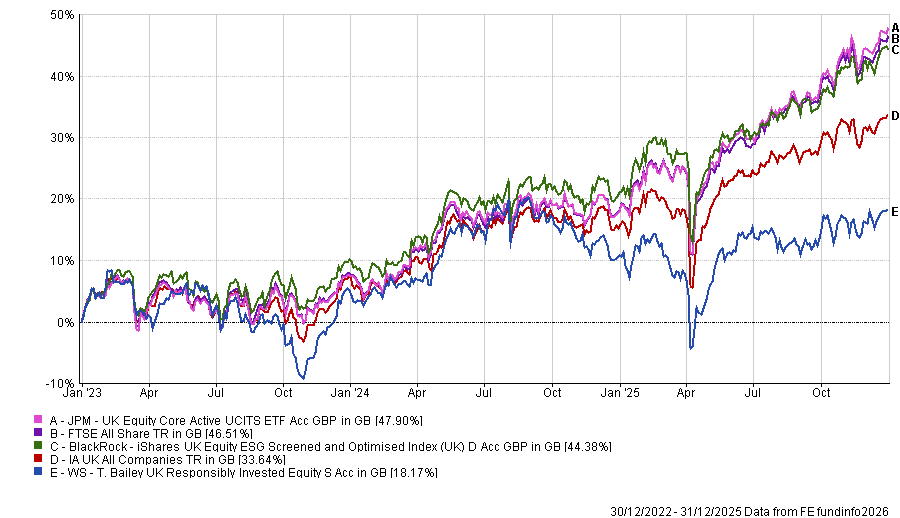

JPM UK Equity Core Active UCITS ETF was the only top-performer of the young UK funds. One of three funds on the list from the IA UK All Companies sector, it made a 47.9% return between 2023 and 2025, placing it in the top quartile of the peer group.

Managed by James Illsley, Callum Abbot, Christopher Llewelyn and Richard Morillot, the £424m fund aims to beat the FTSE All Share index by moderately overweighting stocks the managers have the most conviction in, while underweighting those they are least keen on.

This strategy means the fund will have broad sector exposure that is similar to the index and a large number of stocks. Currently it holds 145 companies, with HSBC and AstraZeneca (7.5% of the portfolio each) the largest holdings.

It is similar in nature to the JPM UK Equity Core portfolio but uses a different fund structure. Active exchange-traded funds (ETFs) are managed by investment professionals who make decisions on asset selection in real time and aim to outperform the market through stock selection.

They have gained traction in the UK and across Europe as regulatory changes and investor demand for flexibility have aligned.

Source: FE Analytics

The next-best performer launched in 2022 was the £3.3bn iShares UK Equity ESG Screened and Optimised Index (UK). This passive fund tracks the Morningstar UK ESG Enhanced index, which uses environmental, social and governance (ESG) screens to whittle down stocks, weighting the remaining constituents accordingly based on their market capitalisation.

It has the same top two holdings as the JP Morgan fund above, although it has higher weightings at 8.7% and 8.3% respectively and has made a similar return, up 44.4%. This was ahead of the sector average, but placed the fund at the top of the peer group's second quartile.

Among the three IA UK All Companies funds launched in 2022, WS T. Bailey UK Responsibly Invested Equity has the weakest performance.

The £21.8m fund run by Elliot Farley and Peter Askew since its launch has made just 1.4% since inception in February 2022.

Returns over three years to the end of 2025 are better, with the fund up 18.2%, although this remains a bottom-quartile performance in the sector.

Performance of funds vs sector and FTSE All Share over 3yrs

Source: FE Analytics. Data to 31 December 2025.

It invests in stocks that have positive environmental and social sustainability characteristics. The 30-stock portfolio particularly struggled in 2025 as large-caps dominated.

In the fund’s December factsheet, the managers said: “Whilst UK equities remain supported by comparatively high dividend yields and global revenue exposure, domestic growth has remained constrained.

“This market structure has remained a headwind to the fund throughout the year as, despite their share price trajectory, the majority of these market leaders don’t meet the metrics of sustainable financial strength to be eligible investments.”

Indeed, funds with an ESG investment approach lagged their conventional peers in 2025, particularly in the UK, where ESG-focused funds made around 3.7 percentage points less than their more traditional peers.

WS T. Bailey UK Responsibly Invested Equity has a high weighting to industrial goods and services, while just 6.7% in banks, 8.2% in construction and materials, 3.4% in basic resources and nothing in energy.

It is the first addition of the year for Hargreaves' best-buy list.

Hargreaves Lansdown has added Vanguard Global Small-Cap Index to its Wealth Shortlist.

The addition is the first of the year for Hargreaves but not the first recommendation for this particular strategy, which also made its way into interactive investor’s Super 60 list exactly a year ago, on 30 January 2025.

The analysts’ judgement is that the category’s growth potential and different return patterns justify exposure, provided investors can tolerate volatility and have a long time horizon.

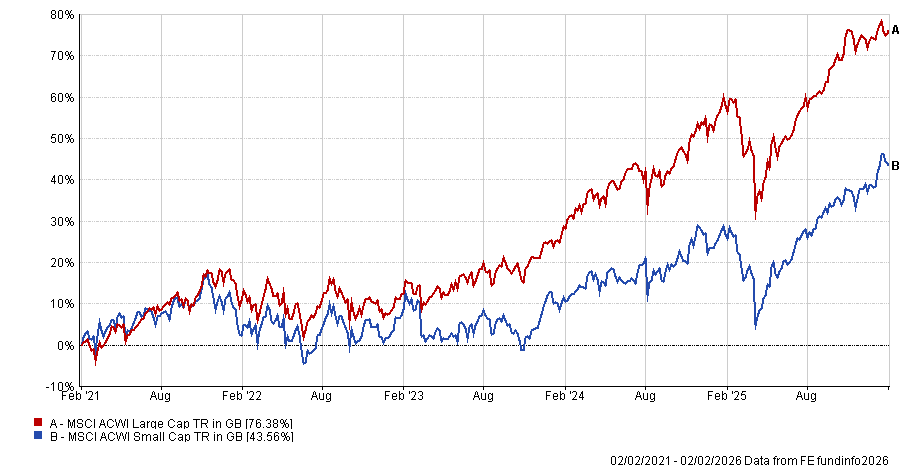

“While smaller companies have lagged their larger counterparts in recent years, they’ve performed better over the long term,” passive investment analyst Danielle Farley said.

“We think they offer strong growth potential for the future as they’re often among the most innovative businesses and have plenty of room to grow.”

Performance of indices over 5yrs

Source: FE Analytics

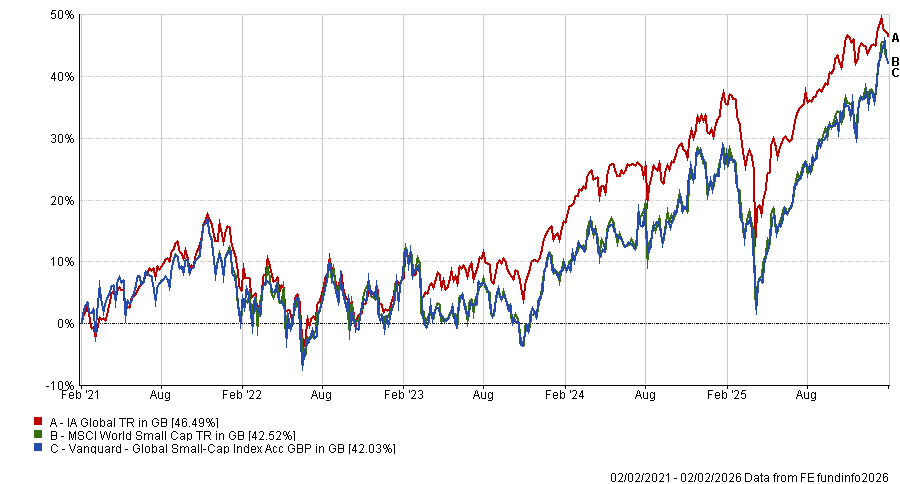

The fund tracks the MSCI World Small Cap index, which holds about 4,000 stocks. Vanguard uses full physical replication, buying every constituent at its index weight. It is a trading-heavy approach because small-cap indices change often and require frequent rebalancing, which pushes up costs, as FE Investments analysts noted.

To offset that drag, Vanguard lends some of the portfolio to approved counterparties in return for a fee. This can reduce tracking difference but adds risk.

The fund’s ongoing charge is 0.30%. FE Investments warned that if asset flows were to reverse, those economies of scale could unwind and fees could drift higher. Vanguard runs only physical trackers, so while there are no derivative counterparties, the fund still relies on brokers and securities borrowers that Vanguard must monitor internally.

On tracking, Hargreaves expects the fund to follow the index closely, given Vanguard’s scale and trading capability.

“The fund invests in all the companies in the index and in the same proportion. This should help it track the index closely,” Farley said.

“[Vanguard] has a large investment team with the expertise and resources to help its funds track indices and markets as closely as possible, while having scale to keep costs down. We rate Vanguard’s index team highly.”

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Farley also cited portfolio construction as another rationale for the addition.

“This fund could be a good way to gain broad exposure to smaller companies. It could also provide some diversification to an investment portfolio focused on shares in larger companies, as they tend to perform differently.”

Hargreaves stressed that shortlist additions are not recommendations to trade.

The challenge now is not whether to allocate, but how.

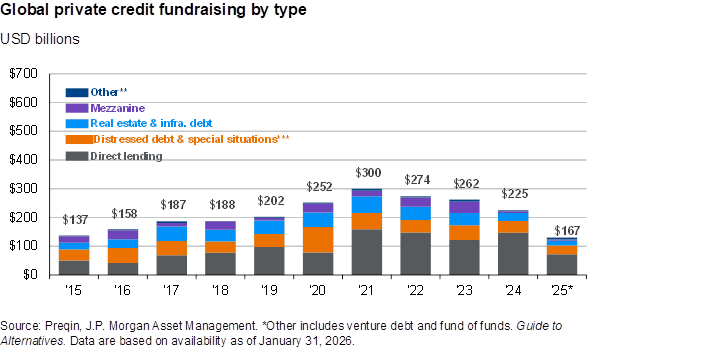

Private credit has grown remarkably over the past decade. What was once a relatively niche corner of the alternatives universe has become one of its largest and fastest-growing segments.

Fundraising has exceeded $1trn over the past five years, assets under management have grown at 14.5% per annum and private credit has become a core allocation for many institutional portfolios.

But rapid growth rarely goes unquestioned. The pace of expansion, combined with a handful of high-profile credit events over the past year, has inevitably raised concerns.

Critics have asked whether private credit has grown too large, too fast – and whether the attractive returns of the past decade can be sustained.

To answer those questions, it is worth considering why private credit grew so quickly in the first place, how the opportunity set has changed and what investors should focus on as the asset class enters a more mature phase of its cycle.

Why has private credit grown so fast?

Private credit’s rise is best understood through the lens of shifting supply and demand in corporate lending. On the supply side, the post-global financial crisis regulatory regime materially increased capital requirements for banks, making it less economical to lend to riskier small and mid-sized companies. Private credit funds stepped in to fill that gap.

Increased institutional allocations further reinforced the supply shift. Through much of the 2010s, structurally lower interest rates pushed institutional investors to private credit in the search for higher yield.

Pension funds and insurance companies found private credit’s floating‑rate coupons, stable cashflows and yield premium over public credit particularly attractive.

As allocations grew, so did the lending capacity of private credit funds, enabling the market to serve more borrowers. Strong performance then amplified this cycle: over the past decade, private credit delivered attractive risk-adjusted returns with lower volatility and smaller drawdowns than many public credit indices.

That track record supported continued fundraising, further deepening the pool of available capital.

On the demand side, private equity was pivotal. As private equity expanded globally, demand for flexible, non‑bank financing rose alongside it.

Direct lending became an integral part of the buyout toolkit, financing acquisitions, refinancings and secondary transactions. This preference increased demand for private credit relative to traditional bank loans, especially in complex or time-sensitive deals.

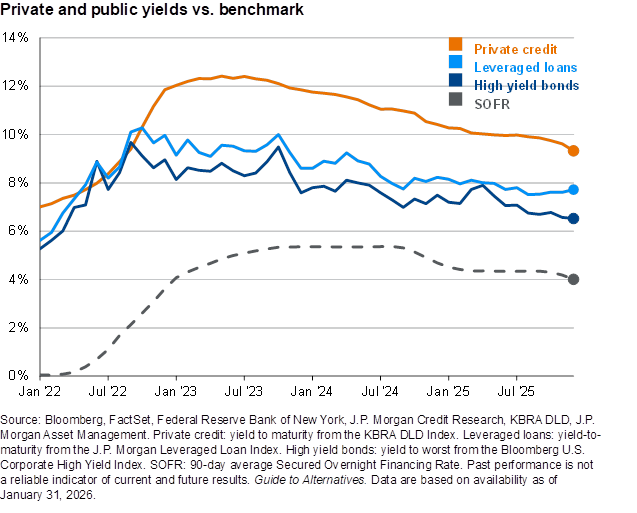

Is private credit still attractive today?

Private credit yields are lower today than they were a few years ago but remain at elevated levels. Base rates have come down, while the competition to deploy the large stock of dry powder has put downward pressure on spreads.

Even after compression, private credit yields today are 9.3%, around 160 basis points over broadly syndicated leveraged loans, and around 280 basis points over high yield bonds.

While yields are high in absolute terms, investors must focus on whether they are currently being compensated for taking additional risk in private credit today.

Two considerations make me comfortable that the answer to that question is yes.

First, a combination of high yields and seniority in capital structure creates decent protection against losses. At today’s yields, we would need to see default rates rise over three times their current levels to see negative total returns, assuming reasonable assumptions about leverage and recovery rates.

Second, to fully erode the additional yield premium that private credit offers over high yield, default rates in private credit would need to rise by roughly six percentage points above those seen in public markets, assuming relatively conservative 50% recovery rates. That is a meaningful cushion.

That’s not to say there isn’t risk in private credit. The low default rates of the past decade were supported by lower interest rates. With rates now higher, debt servicing costs are higher and when we do see an economic slowdown dispersion is likely to increase – both across managers and across vintages.

So how should investors allocate to private credit today?

First, investors need to place greater emphasis on selectivity and risk management than in the past. Reducing concentration risk, avoiding aggressive leverage structures and maintaining diversification across vintage years are increasingly important in mitigating downside risk.

Structural protections – such as strong covenants, seniority in the capital structure and conservative documentation – are also going to matter far more when we enter a challenging environment.

The gap between top-quartile and bottom-quartile managers is already wide and there is little reason to believe it will narrow. On the contrary, as weaker loans come under pressure, differences in portfolio construction and risk discipline will become more visible.

Active selection – informed by track record, team stability, sourcing capabilities and alignment – will be a key driver of alpha over the next cycle.

Second, investors should broaden beyond direct lending. Direct lending remains the core of the asset class, but it is no longer the only source of attractive risk-adjusted returns.

Many investors are increasingly looking to complement traditional direct lending with exposure to real estate debt, infrastructure debt and special situations.

These strategies can offer different risk drivers, longer duration or stronger asset backing, helping to diversify portfolios and reduce reliance on a single segment of the credit market.

In a more competitive environment, such diversification can play an important role in improving portfolio resilience.

Conclusion

Private credit has entered a more mature and demanding phase of its evolution. The era of easy growth, abundant spread and uniformly strong performance is likely behind us. But that does not mean the opportunity has disappeared.

Instead, the asset class is transitioning from rapid expansion to greater differentiation. Returns will increasingly be shaped by manager skill, structural discipline and thoughtful portfolio construction rather than market beta alone.

For investors willing to be selective, private credit still has a valuable role to play in diversified portfolios. The challenge now is not whether to allocate, but how.

Aaron Hussein is global market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.

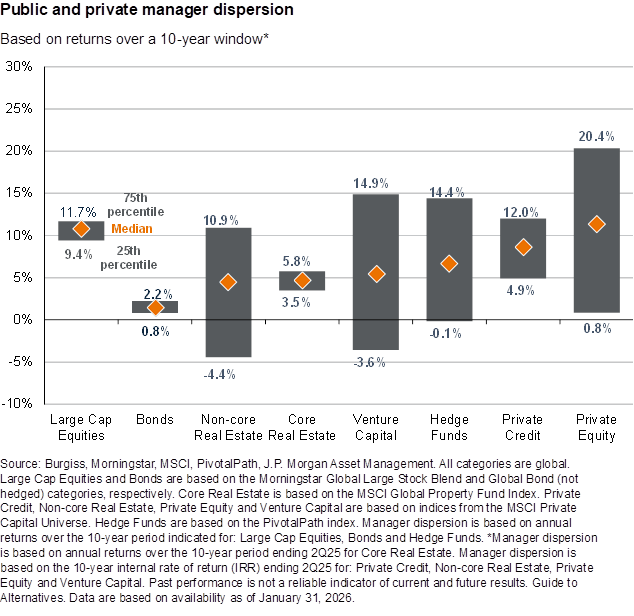

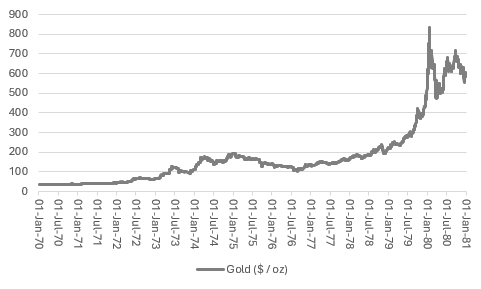

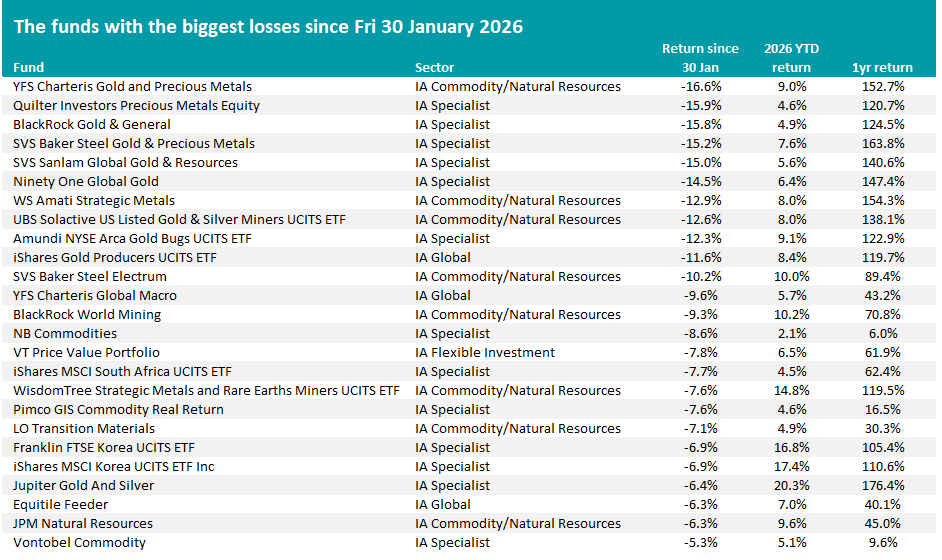

Some funds have lost up to 16% in five days as gold and silver experienced their worst volatility since the 1980s.

YFS Charteris Gold and Precious Metals, Quilter Investors Precious Metals Equity and BlackRock Gold & General have lost more than 15% in recent days after gold and silver were hit with a dramatic sell-off, FE fundinfo data shows.

On Friday 31 January, gold had its worst single day since 1983 while silver posted its worst day since March 1980. The metals continued falling on Monday.

Gold fell from an intraday peak of $5,595 per ounce on 29 January to below $4,500 by Monday morning, while silver crashed from $121.64 to below $78. However, both have rallied this morning.

Performance of gold and silver

Source: AJ Bell, LSEG Refinitiv data

Friday will likely be remembered as the most volatile day for both metals in modern history, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree. “These are price swings that would typically be expected over the course of a year - not within a single trading day,” he said.

Russ Mould, investment director at AJ Bell, outlined five competing theories for the meltdown. The first is simply that both metals had gone too far, too fast and were due a pullback.

The second theory holds that losses in Microsoft after its second-quarter results forced investors to sell other positions to cover losses. “If this is true, then the foundations of the markets may be wobblier than we thought, especially given the degree of margin and leverage which are building up within the system,” he added.

The third explanation centres on the nomination of Kevin Warsh as the next Federal Reserve chair. Some see Warsh as a monetary policy hawk whose previous criticism of quantitative easing suggests he will keep policy tighter than expected, supporting the dollar and reducing demand for alternative haven assets like gold.

However, the fourth theory is that Warsh’s previous calls for lower interest rates suggest he would aggressively loosen policy, Mould said. That could weaken the dollar, especially against the Japanese yen, forcing the closure of short yen positions and cutting off a source of cheap liquidity to global markets.

The fifth explanation points to how the COMEX commodity exchange raised its margin requirements on metal-trading positions and switched from a flat dollar fee to a percentage-based fee. This could have left the more speculative metals players needing to liquidate gold to raise cash.

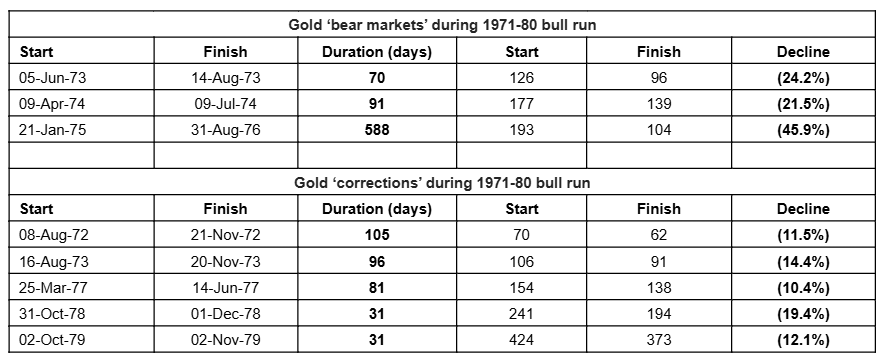

“Whatever the explanation, gold and silver are now trying to recover and both are no lower than they were in early January. Moreover, gold bugs may well be tempted to argue that both of the 1971-1980 and 2001-10 bull runs in the precious metal featured several retreats which did not ultimately nullify or prevent major gains,” Mould added.

Source: FinXL. Total return in sterling between Friday 30 Jan and Monday 2 Feb.

The top 10 hardest-hit funds since the sell-off started are all precious metals specialists: YFS Charteris Gold and Precious Metals is down 16.6%, Quilter Investors Precious Metals Equity 15.9%, BlackRock Gold & General 15.8%, SVS Baker Steel Gold & Precious Metals 15.2% and SVS Sanlam Global Gold & Resources 15%.

But even after the sell-off, most precious metals funds retain positive year-to-date returns. YFS Charteris Gold and Precious Metals is up 9% for the year to 3 February, while Jupiter Gold and Silver has gained 20.3%.

One-year returns remain very strong, given the extended bull run both precious metals enjoyed. Jupiter Gold and Silver is up 176.4% over 12 months, SVS Baker Steel Gold & Precious Metals has returned 163.8% and YFS Charteris Gold and Precious Metals has gained 152.7%.

Looking deeper into what drove the metal’s bull run and recent falls, WisdomTree’s Shah argued that traditional institutional channels do not point to a speculative frenzy.

Net speculative positioning on the COMEX futures exchange shows neither gold nor silver at extreme levels, with silver looking “relatively bearish” by historical standards. Gold ETP buying picked up in recent weeks but not on the scale observed in 2024, while silver ETPs look to have had large net outflows in North America and Europe.

“Taken together, the traditional institutional channels of futures markets and exchange-traded products do not point to a speculative frenzy,” Shah said. “This suggests that retail investors or over-the-counter markets may have seen elevated buying – and subsequent selling – over the past month.”

John Wyn-Evans, head of market analysis at Rathbones, characterised the event as reflecting “stress among specific market participants rather than systemic weakness across precious metals”.

Shah said the sharp drawdown is likely to discourage speculative buying. “Friday's market moves may have flushed out a significant portion of speculative froth – potentially creating space for long-term strategic buyers to re-allocate,” he said.

Source: AJ Bell, LSEG Refinitiv data

Mould pointed to historical precedent showing that major precious metals bull runs regularly experience severe corrections. The 1971-1980 bull run featured three bear markets where gold fell by more than 20%.

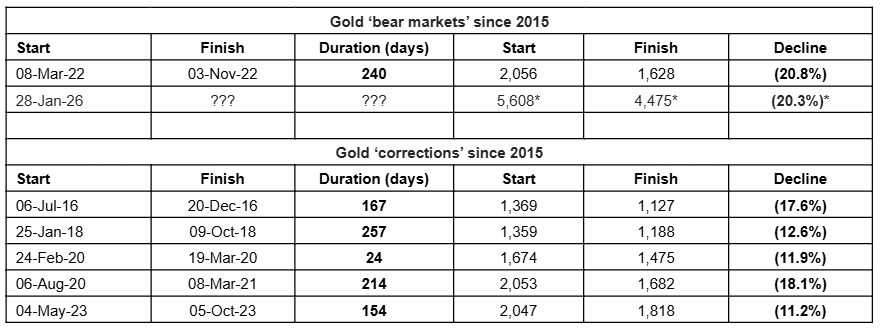

Gold’s second surge from 2001 to 2011 also endured two bear markets and five corrections of more than 10%. The current bull run since 2015 has already seen one bear market in 2022, along with corrections in 2016, 2018, 2020, 2021 and 2023.

Source: AJ Bell, LSEG Refinitiv data. *Intra-day, not closing figures.

The fundamental case for precious metals remains unchanged, according to multiple analysts. “The strategic rationale for holding gold as a diversifier – against market volatility, geopolitical risk and policy uncertainty – remains intact,” Wyn-Evans said.

Mould argued that geopolitical uncertainty, sticky inflation and galloping government debts form the bedrock of the bull case for gold. “None of those issues are any different now from the end of last week,” he added.

Shah argued that both gold and silver appear to be undergoing a structural break, catalysed by heightened geopolitical tensions, concerns around fiscal dominance and growing unease over central bank independence. This has been compounded by a broadening buyer base, including Chinese insurance companies and Indian pension funds.

“Together, these dynamics have pushed precious-metal prices into territory that traditional valuation and volatility models - which have served investors well for decades - increasingly struggle to capture,” he explained.

Wyn-Evans countered that the sharp pullback “looks more like a liquidity and positioning event than a change in the long-term case for the asset”. After a bull run driven by momentum strategies, short squeezes and leveraged buying, that same positioning unwound rapidly.

“These dynamics can be sharp but are often transient,” Wyn-Evans said.

Shah said further bouts of volatility cannot be ruled out. Mould suggested bulls may be tempted to argue that the sudden dip represents a chance to buy more, given that the underlying concerns driving precious metals higher remain unresolved.

“From a portfolio perspective, our stance is unchanged,” Wyn-Evans said. “We continue to see a role for measured exposure to precious metals within a balanced, long‑term investment strategy, while recognising that near‑term moves may be dominated by technical factors and positioning.”

Trustnet asks fund managers which areas they are closely watching this year.

The end of US exceptionalism, a plateau in the artificial intelligence (AI) rocket ship and uncertain geopolitics all make for an interesting time to be an active global fund manager.

Many have struggled in an era where US tech giants have grown to become so dominant that overweighting them has become almost impossible for a prudent, risk-aware stock picker.

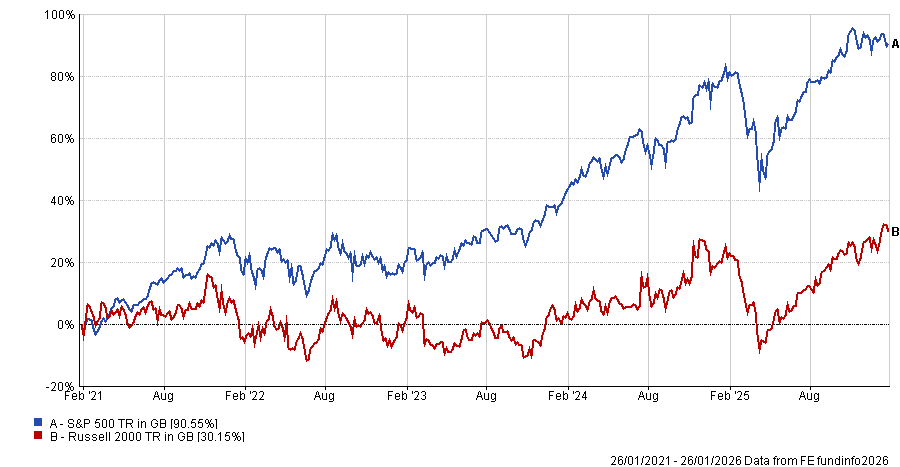

But the tide could be turning. Last year, the S&P 500 was the worst-performing major index and investors are starting to take note of the opportunities elsewhere.

Below, Trustnet asked fund managers which areas they are closely watching this year.

US smaller companies

Michael Walsh, solutions strategist and portfolio manager at T. Rowe Price, remains constructive on the American market but believes investors need to look further down the market capitalisation spectrum to the lesser-owned small-cap space.

The firm has moved overweight smaller companies in recent months, as earnings and valuations should be supported by interest rate cuts by the Federal Reserve.

“The actions of the Trump administration should also act to boost the prospects of smaller US stocks. We’d highlight the increased focus on deregulation in industries such as financial services and energy,” he said.

“The effects of the fiscal stimulus contained in the One Big Beautiful Bill should also be felt more fully by companies and consumers in 2026.”

Lastly, stronger M&A and IPO activity is picking up after “a couple of more moribund years” following the Covid pandemic, which should boost the small- and mid-cap segments in particular.

Performance of indices over 5yrs

Source: FE Analytics

“We expect equity market gains to be more broad in the coming year. Despite recent strong performance, we believe these factors, as well as potential for overlooked winners tied to the AI build-out, continue to make smaller companies in the US relatively attractive,” he concluded.

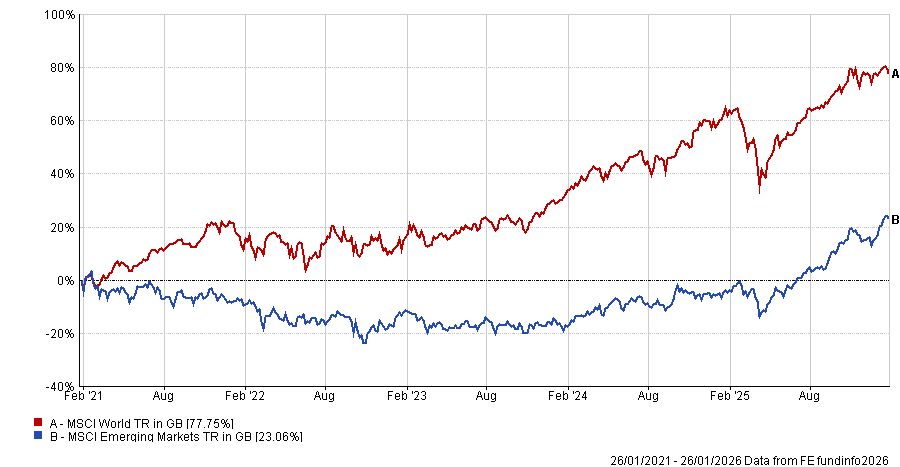

Emerging markets

Not everyone stuck to developed markets, however. While the US has outperformed most other regions significantly over past five years (largely thanks to tech), there are now signs that returns are broadening out to emerging markets, according to Paul Middleton, senior global equity portfolio manager at Mirabaud Asset Management.

“We expect the US to continue to do well, but we believe that other regions are also becoming more attractive. One of the regions that we are getting more constructive on is emerging markets, where earnings are expected to grow 22% this year (vs US 14%) and valuations are cheap,” said Middleton. Emerging market stocks sit on a price-to-earnings (P/E) ratio of 13x compared with the US at 22x.

Performance of indices over 5yrs

Source: FE Analytics

His conviction in emerging markets could grow even stronger if the dollar weakens, as any decisive move lower would drive significant flows into the asset class.

“We have had many false dawns on emerging markets, with growth expectations often disappointing and so we target very specific areas where we believe the long-term growth prospects are underrated,” he noted.

One such area is Chinese insurance, where the firm has a position in Ping An Insurance in both of its global equity funds.

“The company is seeing very attractive growth in new business, while also seeing significant productivity improvements, for example in agent productivity, where better data is yielding better results,” he said.

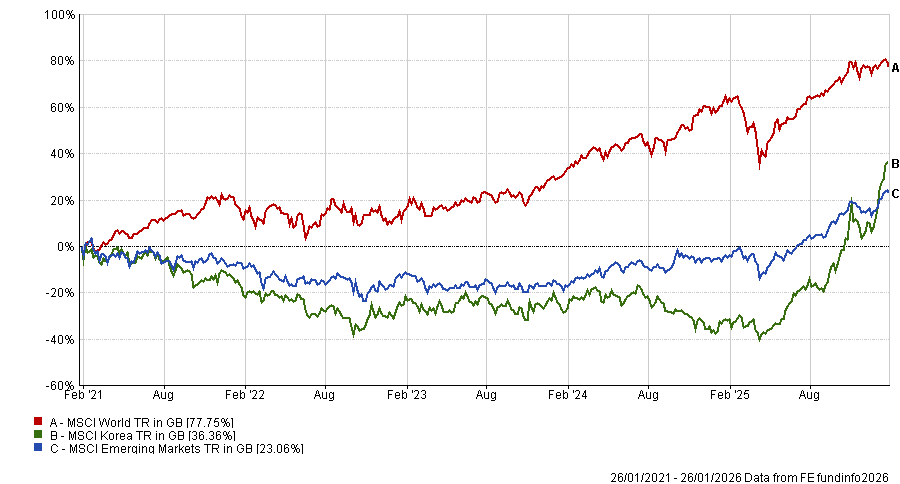

South Korea

Despite the rise of Korean television programmes and the explosion of K-pop on to the music scene, Joe Bauernfreund, portfolio manager of AVI Global Trust, said the market remains “one of the most undiscovered opportunities for global investors”.

The South Korean market houses “numerous world-leading businesses across semiconductors, advanced manufacturing and biotechnology”, yet only accounts for 1% of the MSCI ACWI.

Corporate governance reforms have helped drive the market higher and start its re-rating journey but the ‘Korea discount’ remains.

The “extreme undervaluation” is in the crosshairs of the Korean government, which is aiming to close the gap through ‘corporate value-up’ initiatives.

“Following the election in June, reform has been bold and speedy, with the newly elected government already passing two amendments to the Commercial Act, which enhance previously lacklustre shareholder rights,” said Bauernfreund.

Since then, dividend tax reform was passed in December, while the third commercial act amendment is expected to pass in the first quarter of this year.

Performance of indices over 5yrs

Source: FE Analytics

Yet even without reform, the market is cheap on valuation grounds. More than two-thirds (68%) of stocks trade below book value. For stock pickers, 60% of companies receive no coverage from brokers, 50% of all volumes are driven by retail investors and low foreign institutional ownership makes the market an interesting proposition.

“We believe the combination of structural reform, demographic necessity and wide valuation discounts will prove difficult to ignore in the years ahead,” he said.

Japan

Staying in Asia, Nikki Martin, portfolio manager of the Sarasin Global Dividend fund, highlighted Japan. The market was once “close to the US in terms of global market size” but has spent the past few decades being “shunned” by global equity investors.

“This could now be its greatest advantage. Unlike much of the developed world, Japan is emerging from deflation rather than battling inflation, allowing earnings growth to be supported by improving pricing power, rising wages and firmer domestic demand,” she said.

Like Korea, the main story in recent years has been corporate reforms, which started with ‘Abenomics’ in 2012.

“Corporate behaviour is changing in meaningful ways. Governance reforms, balance-sheet optimisation and a growing focus on shareholder returns are translating into higher dividends, increased buybacks and more disciplined capital allocation,” Martin said, although she noted that there is still a lot further to run as many companies continue to hold significant excess cash on under-levered balance sheets.

However, expectations remain low and valuations are “reasonable”, in particular beyond the most crowded stocks in the market.

A weaker yen has benefited exporters for some time but this opportunity is now being spread beyond the simple export trade to areas such as automation, industrial technology, precision manufacturing and services.

“Japan also offers breadth, something that is fast becoming scarce in global equity markets. Beneath the headline indices lies a deep pool of mid-cap companies with strong niche positions, global relevance and improving governance standards,” she said.

“As investors look to diversify away from highly concentrated US markets, Japan’s quietly evolving equity story could prove to be one of the most compelling, under-appreciated opportunities in 2026.”

Ignore the headlines but adjust your portfolio where needed, say US-focused investors.

Rising political unpredictability in Washington, record market concentration and an increasingly dominant artificial-intelligence trade have left many investors uneasy about their US exposure.

As a result, North American equities have cooled while gold prices pushed to record highs, as the chart below shows, even if the latter half of that move has started to come off the boil in recent days.

Performance of indices over 1yr

Source: FE Analytics

While investing in the US used to be a no-brainer, it now comes with a ‘wall of worry’.

The wall of worry

Managers describe a set of problems that make owning the US feel trickier than in the past. Tom Kynge, portfolio manager for multi-asset strategies at Sarasin and Partners, said the core issue is that policy has become harder to predict.

“Probably the most significant issue is the unpredictability of the administration’s actions, which is unhelpful for businesses making long-term capital-allocation decisions,” he said.

He pointed to episodes of direct government involvement in listed companies, such as Intel, as a departure from historical norms that could chill investment behaviour over time.

There is also unease about the market’s reliance on a single theme. Kynge said he is not bearish on artificial intelligence (AI) in the near term, but warned that the eventual unwinding of the AI trade “could be materially challenging for many investors” if the rest of the economy fails to pick up enough momentum to cushion the blow.

At a macro level, Hugh Gimber, strategist at JP Morgan Asset Management, highlighted a more unusual risk. “The US is running crisis-type stimulus at a time when the economy is already in reasonable shape”, he said.

While this is currently supportive for growth and markets, it leaves less room for manoeuvre if the economy were to slow sharply and ties equity performance more closely to political incentives ahead of the midterms.

Finally, valuation concerns are becoming harder to ignore. After years of outperformance, parts of the US market look stretched relative to other regions, making it uncomfortable to hold ever-larger US weightings simply by default.

The case for staying invested

Despite the above, most professionals still see powerful reasons to keep America at the core of portfolios, the first being: The foundations of US exceptionalism remain largely intact.

Its market structure is far more skewed towards technology than any other major region, a bias that has historically delivered higher growth and profitability. There are also hard data points that make it difficult to abandon the market.

Jack Caffrey, manager of the JPM America Equity fund, pointed to a run of positive economic surprises, with GDP forecasts suggesting real growth above 5% and a steady stream of earnings beats, especially outside of the Magnificent Seven stocks.

For growth investors, the argument goes beyond the cycle. Dave Bujnowski, investment manager on Baillie Gifford’s US Equity Growth team, said amid “dizzying news flow” the most reliable guide remains fundamentals.

Trade tensions, fears of irrational exuberance around AI and bouts of volatility have come and gone, but the companies that have endured are those with resilient earnings. Within the Russell 3000 Growth index, firms with rising earnings per share forecasts held up materially better during the 2022 drawdown when valuation multiples compressed.

Today, his portfolios are still seeing revenue growth of around 20%, improving operating leverage and higher EBIT (earnings before interest and tax) margins.

“Our job is to keep asking a simpler question: what is most likely to drive growth and compounding over the next five to 10 years?” he said, pointing to structural themes such as digitisation, cloud computing and America’s enduring AI advantage.

But investors are changing how they own the US

If the US still looks compelling, the way managers are investing in it has somewhat shifted. At Baillie Gifford, Bujnowski said recent activity has all been about portfolio construction.

“[We have been] taking profits from some larger and volatile winners, increasing our ‘enduring growth’ exposures and recycling capital into higher-conviction ideas, helping reduce volatility and tracking error while keeping the portfolio anchored to long-term engines of growth that appear intact and, in places, accelerating.”

At Sarasin, the adjustments have been more defensive. Given the unpredictability of policy, Kynge said his team has been gradually reducing exposure to companies with direct links to the US government, such as contractors.

At the same time, it has been increasing exposure to emerging markets, which it expects to benefit from a structurally weaker US dollar.

“The key thing to keep in mind for UK investors with US exposure is currency risk,” he said. With the dollar potentially under pressure from fiscal policy, Sarasin has been trimming dollar exposure through hedging. It has also looked to store-of-value assets, such as gold and silver, as a way to monetise that view.

From a fund-picker’s perspective, valuations are also prompting shifts. Sheridan Admans, executive officer of Infundly, said many investors have ended up with far more US exposure than they realised simply by owning global, tech, healthcare and infrastructure funds.

That was not a terrible outcome in recent years, but it is harder to justify now. “You look at valuations out there, it’s hard to feel comfortable,” he said.

Within the US, he has been moving some exposure from pure growth strategies towards value. More broadly, he has been encouraging clients to lean a little more into the UK, Europe and China, where valuations look more attractive and diversification benefits are clearer. “Holding big chunks of portfolios based in the US is a lot more challenging,” he said.

From app-driven coffee chains in China to AI-supported diagnosis in healthcare, investors are backing a wave of automation.

Artificial intelligence (AI) has already crept into people’s lives and not just through the use of large language models like ChatGPT. In some parts of the market, it is shaping what consumers buy, how companies operate and where capital is flowing.

That is most visible in places where AI has moved from a supporting role to the centre of the business model. China is one such place. One of the most digitised consumer economies in the world, many of its most successful companies use data and algorithms not simply to optimise pricing or marketing, but to shape behaviour at scale.

Sophie Elsworth, manager of the Baillie Gifford China Growth trust, said AI is already “driving revenue, margins and returns” at companies such as Tencent and Alibaba. But her favourite example of an AI adopter is coffee chain Luckin Coffee.

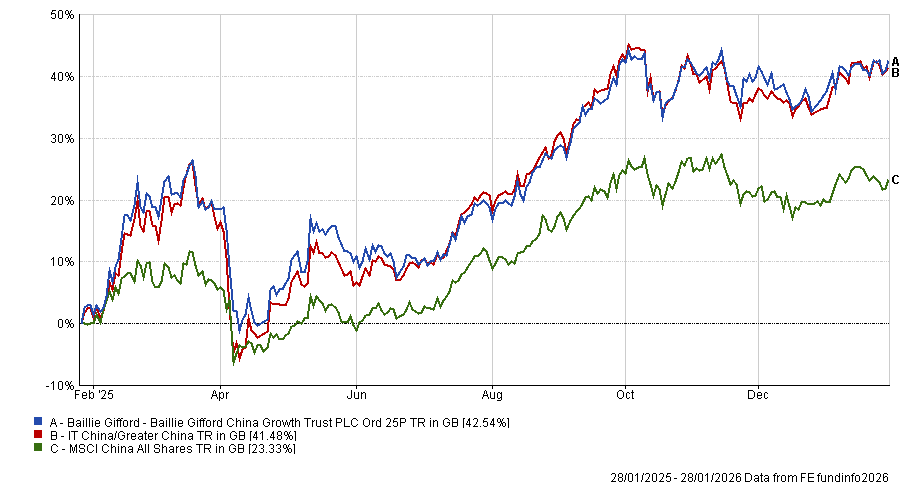

Performance of fund against index and sector over 1yr

Source: FE Analytics

Rather than competing on branding alone, this company has built its business around an app. “Luckin Coffee operates more like an internet platform than a coffee brand, with its app as the operating system,” she said. “Data drives product development and habit formation.”

Ordering, payment, pricing and product design are all mediated by software, allowing the company to analyse and exploit demand patterns with minimal human intervention, allowing customers to order ‘the usual’ without the need for a barista to remember their face (and their order).

AI systems are being trusted to manage decisions in consumer markets, but a similar approach is taking place in services, especially in sectors that rely on pattern recognition and standardised judgement, such as healthcare.

Healthcare faces mounting pressure from ageing populations, workforce shortages and rising costs. Trevor Polischuk, co-manager of the Worldwide Healthcare trust, argued that these conditions make it particularly exposed to automation. “Every part of the healthcare ecosystem is being influenced and accelerated by artificial intelligence,” he said.

In practice, AI’s role in healthcare is already extending beyond efficiency. Advances in diagnostics, personalised medicine and data analysis are changing how diseases are identified and treated. Polischuk said the result was likely to be a fundamental shift in how care is delivered.

“At the patient level, healthcare is increasingly coming home. Telemedicine is just the beginning,” he said. “We believe primary care and diagnosis will increasingly be supported or replaced by AI interfaces.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

Many of the tasks performed in primary care – triage, pattern recognition, monitoring and routine diagnoses – are well suited to systems trained on vast datasets. The attraction for healthcare providers is not only cost reduction but also consistency and scale, particularly in overstretched systems.

AI is also accelerating progress further upstream, in drug discovery and treatment design. Polischuk said innovation in medicines is now moving faster than at any point in his career, driven in part by advances in diagnostics and data processing.

“We expect innovation in medicines and cures at a pace never seen before, in part due to the revolution in diagnostics and personalised medicine,” he said. That speed has implications for patient outcomes as well as for how capital is allocated across the sector.

The same dynamic is evident in medical technology, where robotic surgery systems already incorporate machine learning and data feedback, allowing procedures to be refined continuously. While human surgeons remain central, the balance of responsibility may shift over time.

“Systems today have vastly greater computing power and embedded AI learning, with some autonomous functions already built in,” Polischuk said, suggesting that the active role of clinicians could diminish as technology matures.

AI does not need to outperform humans in every dimension to be disruptive; it simply needs to be good enough, cheap enough and scalable enough to alter behaviour, he said. That is the same logic that allowed data-driven platforms to dominate consumer markets long before most users recognised the trade-offs involved.

While some sectors are still struggling to find use cases for AI, its effects may emerge in unglamorous areas where efficiency, volume and repetition matter more than visibility. In healthcare, Polischuk sees this as an unusually compelling moment.

“The confluence of this environment – the innovation, whether it be politics, lowering interest rates, M&A, valuation… – I've never seen it all align like this, and after four years of healthcare underperformance, I think the setup is phenomenal.”

He concluded: “This is the most bullish I’ve ever been on healthcare in my career”.

Despite the strong returns already seen, there is plenty of optimism around.

What would you traditionally think of when it comes to Korean equities? For me it is a value-driven market with low valuations courtesy of the ‘Korean discount’ caused by weak governance, opacity and poor shareholder returns. But things have been changing in this often scoffed at emerging market.

At the back end of January, the South Korean (KOSPI) index broke through the 5,000 barrier for the first time. The index has been on a tear, returning 80% in the past 12 months, compared with 31% for MSCI Emerging Markets as a whole.

Those low valuations have also been tackled to a degree. The market is trading at a price-to-earnings (P/E) ratio of 24.7x, which is higher than its three-year average P/E of 18.5x – that’s despite earnings remaining mostly flat over this time.

Rationale for the renaissance can be attributed to a number of factors, but two clear ones stand out and, interestingly, they are at polar opposite ends of the market; diversification gives investors optimism that further growth may follow.

The first of these is the role of Korea as a hub (alongside Taiwan) for semiconductor and hardware component production, both of which are integral to the artificial intelligence (AI) boom. Korea specialises in the dynamic random-access memory (DRAM) market.

High Bandwidth Memory (HBM) chips, one of the most advanced types of DRAM, is now essential to the rollout of AI infrastructure, with SK Hynix and Samsung Electronics leading the market in terms of technology and scale.

Matthews Asia portfolio manager Sojung Park said that as the graphics processing unit (GPU) chips of Nvidia, the market leader in GPUs for AI, advance, they require much more bandwidth and capacity from HBM chips.

She said: “Amid the structural supply shortage in the HBM market, together with its growing strategic importance to global AI buildout, Korean companies in the field are seeing more opportunities to establish customer loyalty, longer-term contracts and greater pricing power.

“The memory sector has traditionally been highly cyclical and we still expect expansion and contraction in the area. However, over the long term, we believe Korea’s advanced memory chip makers will further build and expand on their solid market positions.”

This growthier play is being supported at the other end of the market by the ‘Value-Up Program’, a move by the Korean government to fix the aforementioned Korea discount – which reflects those historically low valuations despite strong fundamentals.

The government-led reform was introduced in 2024 to improve corporate governance, encourage shareholder returns and generally make Korean companies more transparent and, ultimately, investor-friendly.

Unlike Japan, where corporate governance changes have been enforced, Korea’s implementation has been a voluntary initiative thus far to encourage listed companies to independently create and disclose plans to improve their corporate value and shareholder returns.

JPMorgan Emerging Markets Growth & Income investment specialist Emily Whiting said while the rationale behind these corporate governance changes in Japan was due to cross-shareholdings, Korea’s motivation is tied up in family ownership (chaebols). At this stage it is heavily focused on areas such as the banks.

She said: “If you went back to Covid, I would have laughed about owning Korean banks, but we now own three of them. A good example is Hana Financial; in 2017 buybacks and dividends combined accounted for total shareholder returns of 16% – they are now in the mid-forties – a threefold increase.