Co-manager Finn Provan explains what was learnt from not downsizing UnitedHealth Group.

No team of fund managers should ever be entirely bullish on even their highest conviction holding, according to Finn Provan, co-manager of the £6.1bn Royal London Global Equity Diversified fund.

While a high-conviction process can be praised, even talented managers can make mistakes. For Provan, the biggest example over the past year was UnitedHealth Group, a stock that “everyone in the room was bullish on” going into the year.

This meant that when the stock slid dramatically following the death of the chief executive of one of its subsidiaries in December, the team did not move to downsize it fast enough, convinced that the market would correct itself.

When UnitedHealth Group instead dropped 45%, its high allocation dragged Royal London Global Equity Diversified down. While the team would have never sold out of it entirely, not bringing it down fast enough was a mistake, she explained.

“Poor year-to-date performance is really a story of UNH,” she said.

While Provan has been on the fund as an analyst for over five years, she became co-manager when Matt Kirby and Paul Schofield officially took over Royal London Global Equity Diversified in November last year, following the departure of Peter Rutter and his team.

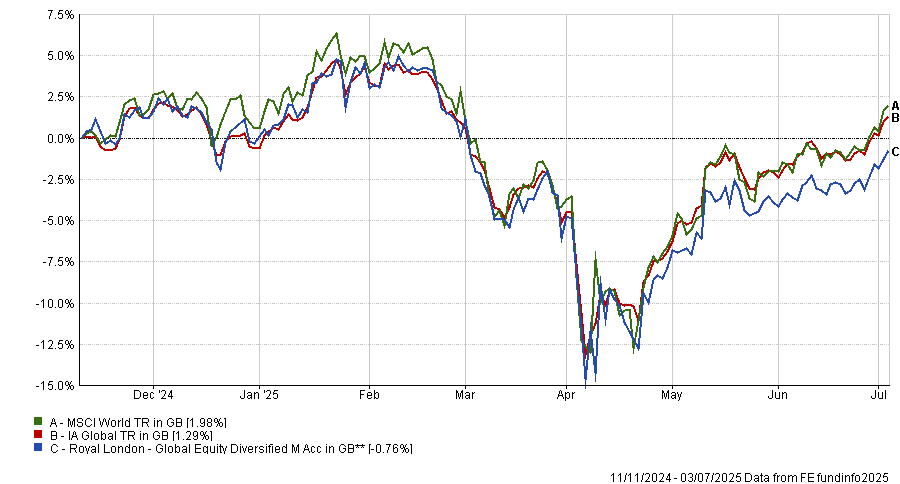

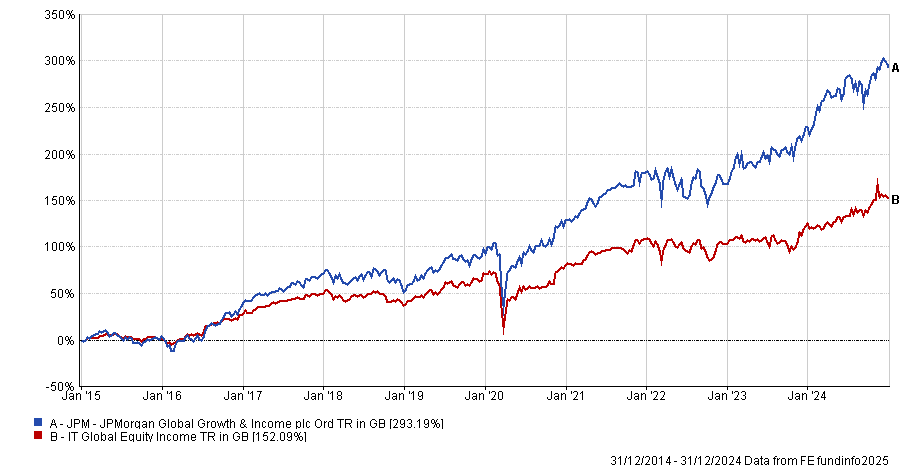

Performance of Royal London Global Equity Diversified vs the sector and benchmark under new managers

Source: FE Analytics.

Below, Provan explains why the quantitative approach makes it a suitable all-weather portfolio, how the ‘benchmark relative’ approach can still provide value in a world of passives and why some of their favourite opportunities are in areas people have never heard of.

What is Royal London Global Equity Diversified’s philosophy?

It’s a fund of data-enabled stock-picking. We’re a team of sector and regional generalists equipped with data to filter the noise and find good stocks.

We want to maximise stock-specific returns and minimise factor risk through an almost 200-stock portfolio. We believe that you can make a good investment in a company at any stage of its corporate life cycle by using data.

What differentiates the fund?

Because it’s a very balanced portfolio of stocks, we want it to function as something of an all-weather portfolio, which you don’t need to chop and change depending on macro events or whether we’re in a growth or value market.

We’re a benchmark relative approach, but we’re not narrative-driven. Because of our methodology and data tools, we have clear ideas of what makes a good company based on where it is in the corporate life cycle. We want to stick to that, instead of letting ourselves get distracted by news and narratives.

Why should investors use a benchmark relative approach instead of a passive?

The way we think about it is that we don’t want to replicate the benchmark’s performance; we want to replicate its risk profile. So, for example, we want our allocation to European banks to match the risk profile of European banks within the index.

But within that, we want to let the stocks do the talking, so if there’s a company within a sector that we think is strong from a wealth creation standpoint or a valuation perspective, we want to push that to be a slight overweight to show we have conviction in those stocks. The allocation can be similar, but we want the stocks to look quite different.

The performance target is 1-2% ahead of the benchmark and we used to get even better than that, but we’ve only got a tracking error that is also only about 1-2%. We think we manage our risk similarly to the benchmark by not taking factor risk, but can still be the active stock pickers we say we are.

What you want is to be getting active style returns, because it’s a stockpicker portfolio, with passive levels of risk.

How do you find new opportunities?

We have a few considerations: we like to look where we haven’t looked in a while, what sectors have changed since the last time we looked, what areas have momentum and what the fund needs to balance its risks.

We call it turning over rocks. We have 6,000 companies we can invest in and over three years we want to have turned over all those rocks, brushed over them to make sure we’ve not missed anything.

I think for me, the perfect situation is where we look at a certain subsector and find companies that make their cash in a similar way to bigger companies, but that aren’t even in the benchmark.

For example, we own a Japanese Pachinko machine maker that’s up 350% since we bought, but it's unlocking its balance sheet and giving cash back to shareholders. We always aim to have those idiosyncratic stocks within the portfolio.

What was your best call over the past year?

The best call was probably selling Delta Airlines in early Q4 last year. It was bought in 2022 based on the assumption that it was a turnaround company that could benefit from the post-Covid period.

We made the call that the turnaround story had happened and we sold it when it was still up over 100% for us, right before it slid massively at the start of the year.

What do you do outside of fund management?

I like reading! I’m in several book clubs and I’m a massive fan of anything written by Toni Morrison, Joan Didion or Gabriel Garcia Marquez.

Other than that, I’ve gotten into running, but I suppose that’s because everyone else on the team is always running marathons.

The government’s reported plan to lower the cash ISA limit misunderstands why people choose cash and risks pushing them into investments they’re not ready for.

You don’t create confident investors by limiting their choices. You create them by helping them understand what they’re doing.

The government wants more people to invest. That’s the motivation behind its apparent plan to slash how much individuals can save in cash ISAs, possibly cutting the current £20,000 allowance to as low as £5,000. The goal is to shift more capital into equities and other long-term assets, particularly in the UK.

But restricting access to a product that people understand and trust won’t solve this problem. Savers aren’t holding cash because they haven’t been nudged hard enough. They’re holding it because cash is simple, stable and, crucially, they understand it. Strip away that option and you create uncertainty, rather than unlock investment.

For pretty much every saver, cash isn’t a speculative asset but peace of mind. It’s what they turn to when the boiler breaks, when they lose work or when they’re saving for something real and tangible: a deposit, a car, a wedding. It’s a buffer against the unknown.

Cash doesn’t demand technical knowledge. It doesn’t fluctuate. And unlike investing, it doesn’t punish you for checking your balance. That clarity and control matters, especially to people who’ve had to fight for financial stability.

Yes, returns on cash are limited. But in today’s market, with interest rates around 5%, many see it as good value for low risk. That’s a rational, informed trade-off.

That means moving from saving to investing isn’t simply about shifting accounts. It’s about entering a system that’s inherently more complex.

Most people aren’t taught how markets work. They don’t learn about risk-adjusted returns or how to weigh volatility against time. They just know that investments can lose money and that they don’t want to make a mistake they can’t afford.

The choice paralysis is real. There are thousands of funds, platforms and portfolios. Many sound similar. Some are low-cost and diversified; others are high-fee, opaque and ill-suited to beginners. But the difference between a good choice and a poor one often only becomes clear years later.

We’ve built a system that expects people to act like investors without equipping them to think like investors. That gap – between access and understanding – is where risk becomes harm.

The vast majority of retail savers will never pay for financial advice. The cost doesn’t make sense for small portfolios. DIY platforms fill part of the space, but most can’t offer tailored recommendations without breaching regulation. So users get filters, charts and disclaimers, but no clear direction.

This leaves people trying to make investment decisions alone, without context and without confidence. They’re right to be hesitant.

When ISA rules were changed in 2014 to allow more investment flexibility, uptake didn’t surge. Most savers just kept doing what they were doing.

The impulse behind the cash ISA cap is understandable. UK companies need more domestic capital. Long-term investing can build wealth. But capital isn’t passive: it follows trust and it follows understanding.

Remove the familiar structure of cash ISAs and people won’t automatically move into markets. Some may just leave their money outside the ISA wrapper. Others might disengage entirely, afraid of making the wrong call.

But if someone is nudged into investing before they’re ready and ends up taking a loss, that lesson won’t teach them to be smarter – it’ll teach them not to come back.

If the government wants more people to invest, it needs to focus less on restricting behaviour and more on building capability. That means treating financial education as a long-term priority, not a footnote.

We need a public that understands the difference between cash and risk assets, knows how to assess basic investment options and feels confident about long-term strategy. Until that foundation is in place, changing the rules around ISAs won’t move behaviour in any meaningful or lasting way.

Because investing isn’t intuitive. It’s not the same as saving and it’s not something people fall into just because a tax rule changes.

The goal of widening participation in capital markets is a good one but – while there’s merit in nudge theory – savers deserve better than a push. They need the tools to choose for themselves and the confidence to know what they’re choosing.

Pushing people toward risk without equipping them for it is potentially ineffective and harmful. Policymakers should take note: trust in financial markets is hard-won and easily lost. If the aim is to build a nation of investors, it must begin with education, not coercion.

Gary Jackson is head of editorial at FE fundinfo. The views expressed above should not be taken as investment advice.

Experts identify UK equity funds with long-term potential for a variety of risk appetites.

UK equity funds targeting smaller companies, dividend payers and value stocks are among those that fund pickers expect to outperform if the UK market continues to perform strongly.

After years of underperformance, the domestic market is staging a comeback.

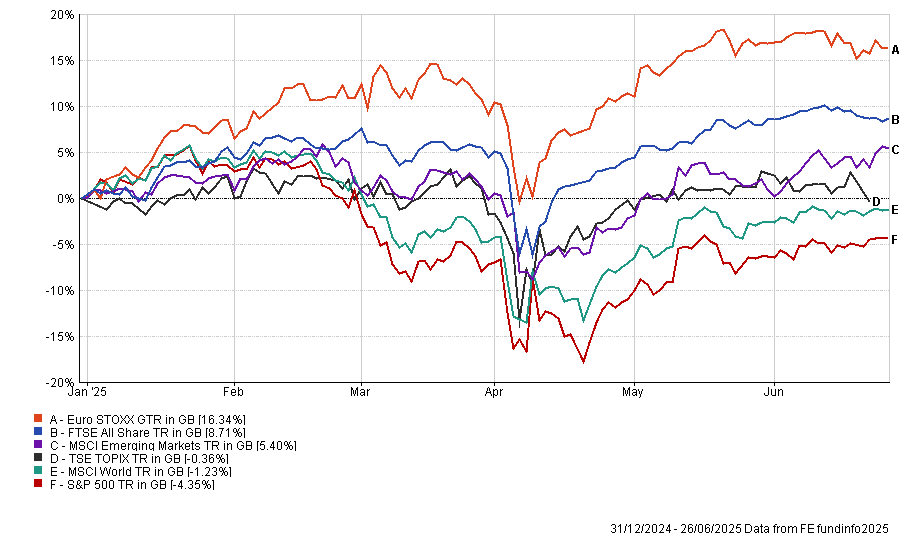

As investors have struggled to get to grips with trade volatility stemming from the White House, formerly top-performing markets such as the S&P 500 have struggled. Meanwhile, the UK has rallied as investors have pivoted out of the US, with the FTSE All Share surging by 9.4% this year, one of the better developed market results.

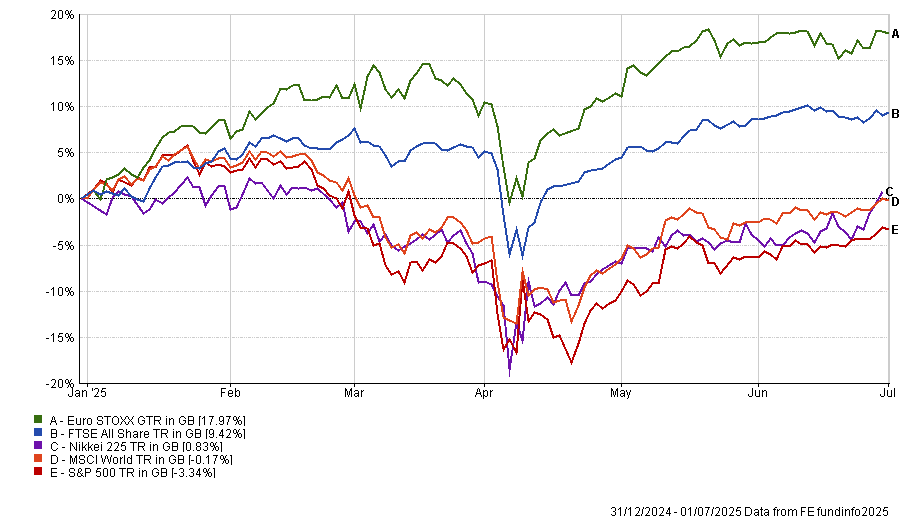

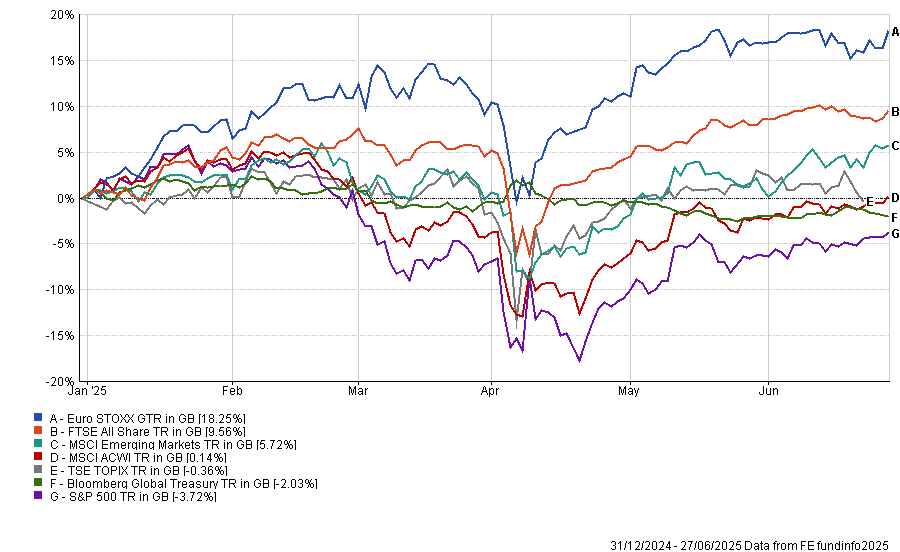

Performance of indices year to date

Source: FE Analytics. Total return in sterling.

For some managers, this could signal the start of a genuine long-term rally for the UK market. Below, experts identify funds that have already benefited from the recent rally and might be poised to continue outperforming.

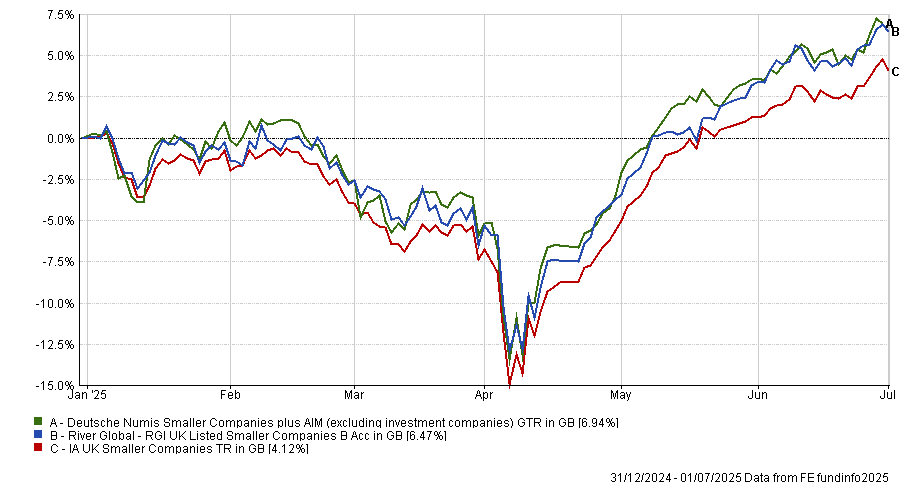

Jack Driscoll, fund analyst at FE Investments, highlighted George Ensor’s RGI UK Listed Small Companies fund, saying: “The UK market rebound has finally rippled down to smaller companies.”

This has benefitted this strategy, which invests 80% of its capital in the smallest 10% of the market. As a result, Ensor’s fund is up by 6.5% so far this year, beating the average peer in the IA UK Smaller Companies sector.

Performance of RGI UK Listed Small Companies vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling.

Driscoll added that RGI UK Listed Small Companies has a large weighting in cyclicals, which “gives direct exposure to the domestic economy”. This has been a tailwind this year as the Bank of England has entered a gradual rate-cutting cycle, benefitting the fund’s 14% allocation towards financials.

Its 70-stock book is another advantage because it “leaves headroom to top-up outperformers without adding concentration risk”. This allows Ensor to run his winners if optimism towards the UK persists.

However, because it is targeting the smallest companies at an already volatile market capitalisation, it is most suitable as a satellite holding for investors. This added volatility means the fund would be most suited for investors with a higher level of risk appetite and at least a five-year time horizon, Driscoll explained.

For an alternative that could suit both growth and income investors, Paul Angell, head of investment research at AJ Bell, identified Henry Dixon’s Man Income fund.

The fund targets UK companies across the market cap spectrum that are paying a yield in line with or better than the market average, he explained.

“Their investment process centres on identifying two types of stocks: those trading below their replacement cost (i.e. what it would cost today to replace a company's assets and operations) that are also cash-generative; and those where the market appears to be undervaluing profit streams,” Angell said.

There are plenty of undervalued and unloved companies in the UK, giving the fund a broad opportunity set, he noted.

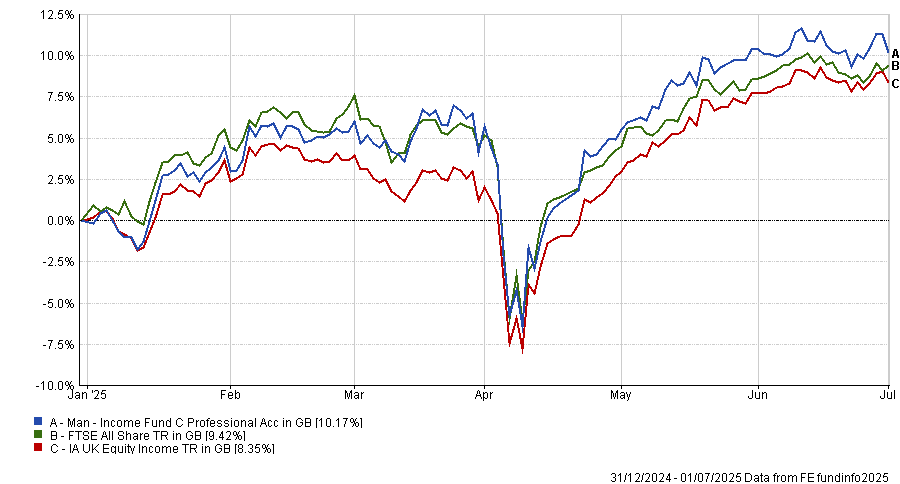

This has allowed Man Income to benefit from the recent rally, narrowly beating the FTSE All Share, as seen below. Despite strong returns, it “remains cheaper than the market on a circa 10x price-to-earnings ratio”.

Performance of Man Income vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling

Long-term returns are also strong, with the fund posting top-quartile results in the IA UK Equity Income sector over the past three-, five- and 10-year periods.

In terms of risk tolerance, Angell suggested that a low allocation would suit more cautious investors.

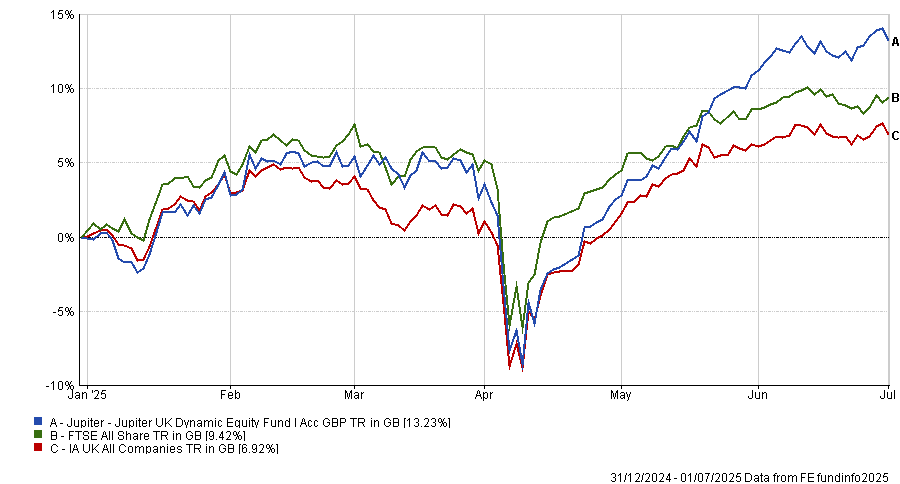

Finally, Forvis Mazars’ associate investment governance director and model portfolio manager James Rowlinson pointed to Jupiter UK Dynamic Equity.

While he accepted there was initial uncertainty about the strategy after manager Ben Whitmore departed last year, new manager Alex Savvides has “set the fund up for future success”.

Jupiter UK Dynamic Equity's value tilt has been a benefit this year as investors have pivoted away from growth towards more defensive and cautious stocks. Improving sentiment towards the UK and a rotation away from the US has naturally boosted the valuation of bargain stocks.

Additionally, Savvides has made beneficial changes to the overall approach. Instead of just taking good value stocks, he has emphasised overlooked names with improving outlooks, which have significant rerating potential.

Already, this change in strategy is paying off, with names such as Burberry and ConvaTec surging this year on the back of improved sentiment. As a result, it has made a top-quartile return in the IA UK All Companies sector, beating the UK market by around four percentage points.

Performance of Jupiter UK Dynamic Equity vs the sector and benchmark year to date

Source: FE Analytics. Total return in sterling.

While the fund can in theory go anywhere on the UK market, it has a slight tilt towards mid-caps and a beta of more than one. As a result, investors should treat it as a source of diversification in a balanced portfolio, by pairing it with another fund that has a complementary style, Rowlinson concluded.

Analysts at AJ Bell explain why private equity has not driven takeover attempts this year.

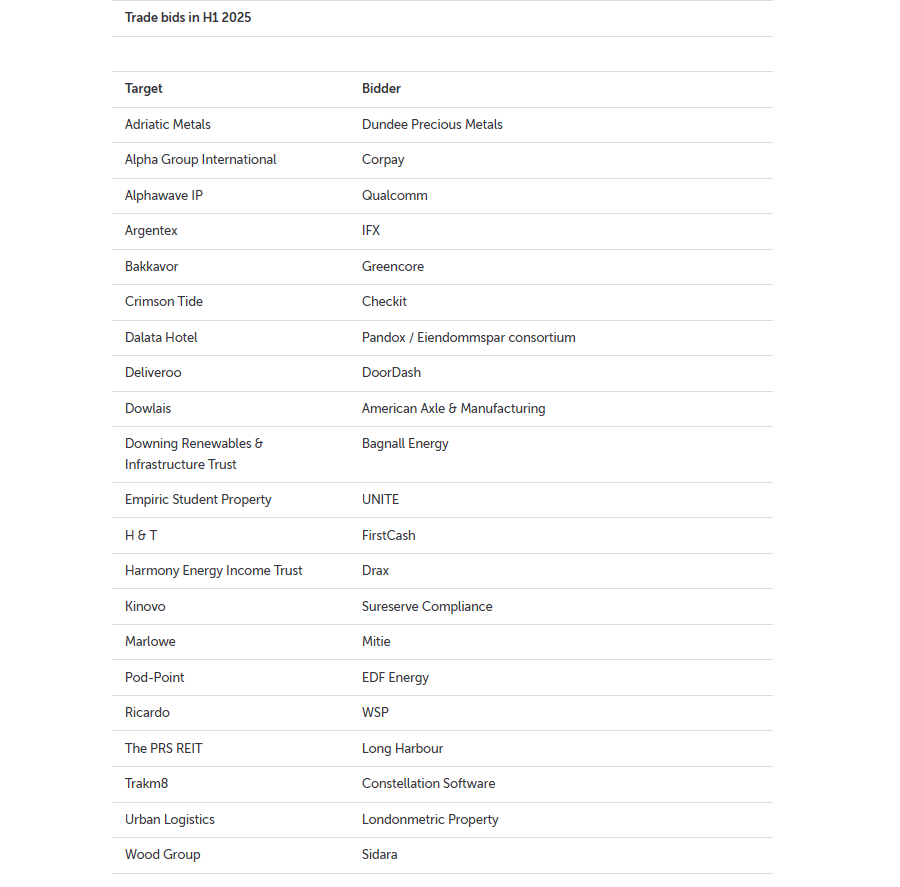

Out of nearly 50 takeover attempts involving UK-listed companies so far this year, trade buyers – typically firms operating in the same or a related sector as their targets – have accounted for almost half (21), according to data from AJ Bell.

This runs counter to the prevailing narrative that private equity is the dominant force in UK takeovers. In reality, private equity has been far less active than expected in 2025.

“Private equity companies haven’t been as prolific or successful with UK takeovers this year as their reputation implies,” said Dan Coatsworth, investment analyst at AJ Bell.

Bids this year have included high-profile names, such as food delivery group DoorDash’s successful £2.9bn bid for rival Deliveroo in May. In March, Tesco food supplier Bakkavor agreed to a £1.2bn bid from rival Greencore.

Trade bids in H1 2025

Source: AJ Bell. Company announcements

Some businesses also chose to put themselves on the market. For example, hotel business Datala put itself up for sale in March, “effectively saying it didn’t suit being a listed company because it was much smaller than quoted peers, it was undervalued, and the shareholder base was concentrated”.

The rise of trade buyers this year was attributed to their time horizon and willingness to take a long-term approach. “Trade buyers will take a long-term view of a company’s potential worth, and they are often happy to pay a fair price”.

As a result, they will try and buy a business that may remove a major competitor from the market or open the door to a new geography, as demonstrated in the deals above.

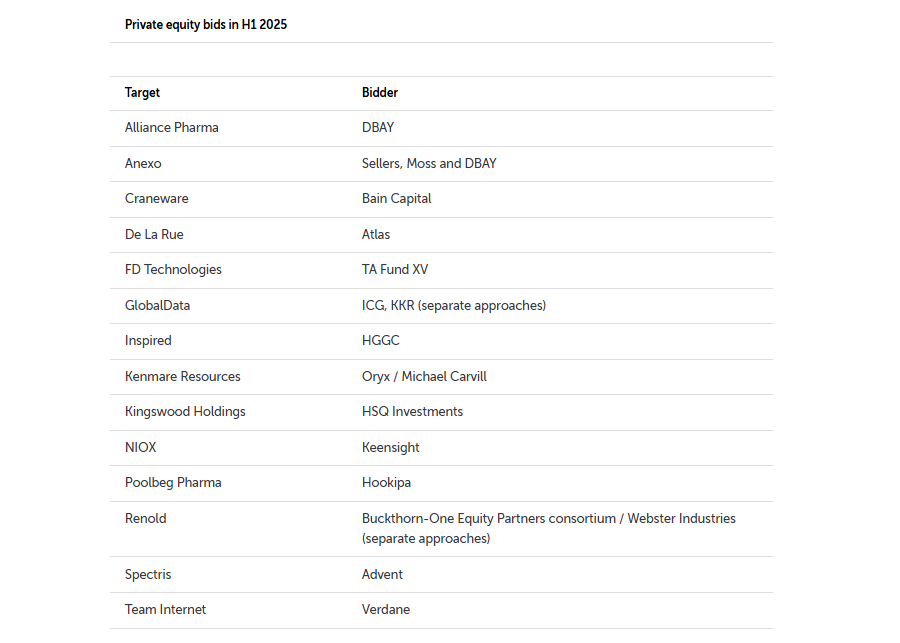

By contrast, private equity firms – while still actively bidding for high-profile companies, such as Advent’s failed £3.7bn bid for industrials group Spectris in June – had a far more limited presence int the market.

Private Equity bids in H1 2025

Source: AJ Bell. Company announcements

There are 14 private equity bids in the chart above, compared to the 21 trade bids over the same period. Of these, five ended up failing, including KKR’s earlier attempt to target analytics company GlobalData.

“It’s easy to suggest private companies are behind most bids, yet data tells a different story,” said Coatsworth.

This is a sharp departure from this time last year, when experts suggested ‘clever money’ from private equity bidders was behind a wave of mid-cap takeovers.

The lack of activity from private equity this year is not an issue of funding because the industry is “awash” with cash, Coatsworth noted.

Trade and tariff uncertainty could be playing a role, with private equity companies perhaps pausing investment due to the misty outlook in the same way as public companies. “If they are going to spend big bucks, they will want confidence in the geography, industry and corporate profit potential.”

Secondly, he argued private equity firms' risk appetites have dwindled. They want companies that make good money currently rather than ones that might be profitable in the future, in contrast to trade buyers. Private equity wants to be able to “flip an acquisition within three to five years at a profit” and they may be struggling opportunities that fit that bill.

Finally, “private equity firms often look for missing pieces of the puzzle”. They generally aim to acquire businesses that can be combined with other companies in their portfolio to create a larger entity they can sell on. He added: “The UK market might not have the sort of characteristics they are looking for.”

However, private equity firms and trade buyers are hardly the only people behind this year’s merger and acquisition activity.

Investment trusts were responsible for seven bids this year as part of the recent “takeover frenzy” in investment trusts. Several vehicles below £200m have been realising they need to merge or wind up, and with high-profile campaigns by activist investors such as Saba, many trusts have started making offers to “gobble up” some of their competitors.

This has included high-profile mergers such as the recent £2.1bn deal between Fidelity European and Henderson European Trust.

JP Morgan Asset Management’s Hugh Gimber explains how to put cash to work in today’s market.

Forecasting the economy and markets can be hard at the best of times, let alone when policy is changing so rapidly.

Today, however, uncertainty is not just a descriptor of predicting challenges; it is actively influencing the US economy. CEOs face a choice: make major hiring or investment decisions now or ‘wait and see’ for a few months, in the hope that greater clarity will emerge.

While sentiment has improved somewhat recently, US businesses following April’s tariff announcements highlighted hesitancy to invest as great as during the depths of the Covid-19 pandemic in April 2020. We expect this temptation to pause decision making to weigh on growth ahead.

For the Federal Reserve, life would be relatively straightforward if the only uncertainty was around downside risks to growth. Interest rates could be cut pre-emptively to guard against the risk of recession.

Yet with tariff-related price pressures likely to emerge in the coming months, the situation is clearly not that simple. Like CEOs, Fed chair Jerome Powell is quite rightly opting to be patient in planning his next policy move.

Businesses, not investors, can afford to wait and see

Investors do not have the same luxury of simply hitting pause. With inflation eroding the purchasing power of cash, there is a clear need to put cash to work. And of course, if investment decisions are only taken at times when uncertainty is low, it is likely that markets will already have efficiently priced in what is to come.

It is therefore imperative to focus on strategies that can perform well in multiple states of the world. Today we see five themes that will help investors thrive in these unstable times.

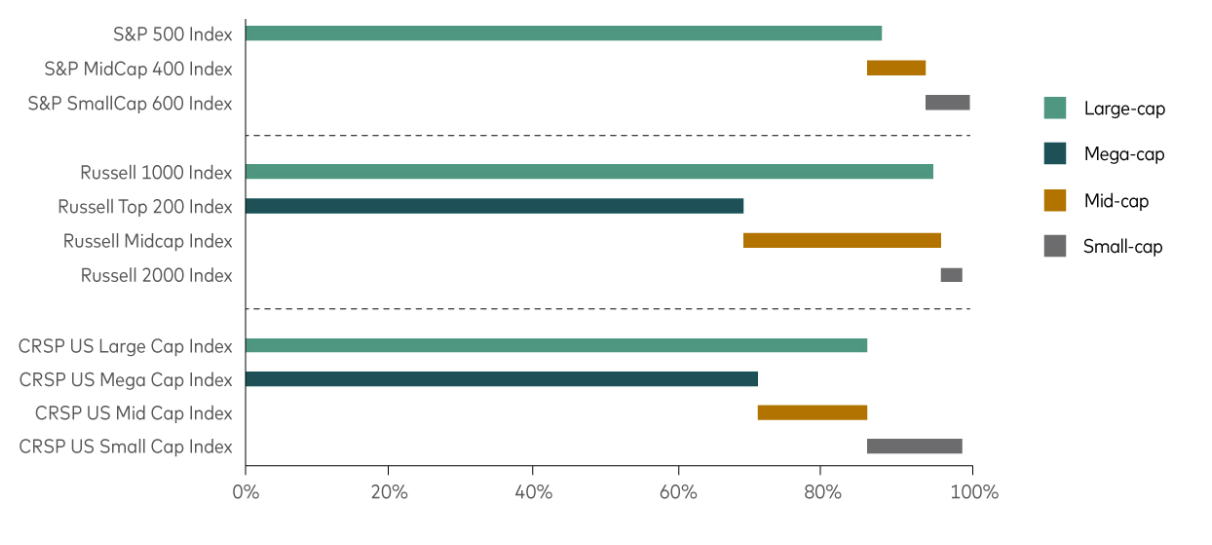

First and foremost, within equity markets, regional equity diversification is arguably more important today than at any point since the global financial crisis. After an incredibly strong run for US equity markets, we believe that, unlike the last 10-15 years, investors will see better risk-adjusted returns ahead from being well regionally diversified than from running concentrated US portfolios. With the US economy appearing somewhat less exceptional, and with new fiscal stimulus improving Europe’s medium-term growth outlook, the gap in earnings between the two regions is likely to narrow.

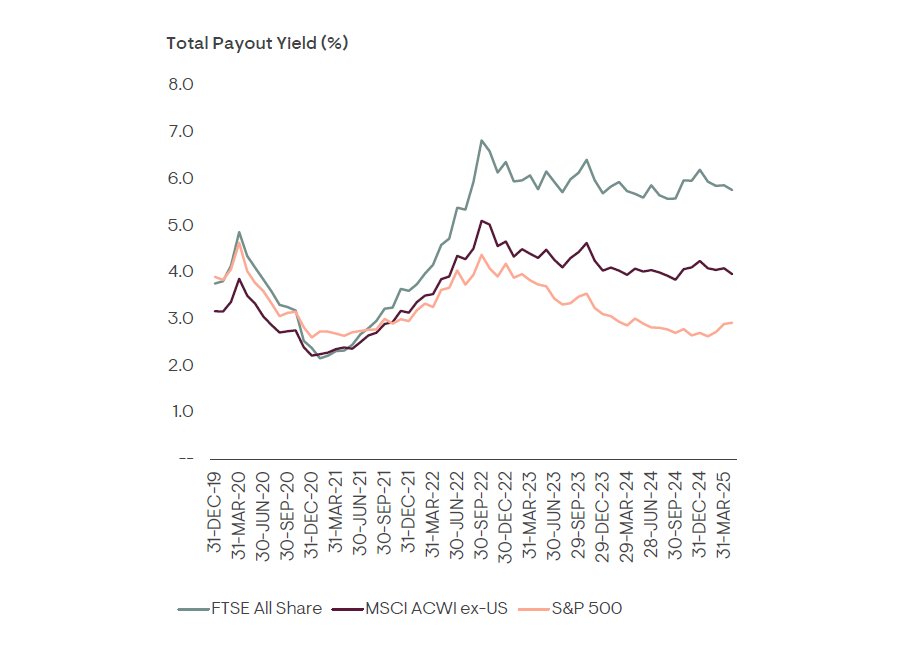

Second, we expect income-oriented strategies to prove relatively defensive if volatility picks up again. Dividend growth is typically more resilient than earnings growth, and with corporates pulling back from capex, this resilience may be even greater than usual if earnings do slow.

Diversifying the diversifiers

Third, for the more defensive aspects of a portfolio, government bond markets have been caught in a tug of war for the last two years. When growth concerns have come to the fore, bond yields have fallen in anticipation of more central bank easing ahead. Yet these rallies in bond prices have not been sustained, with the market still wary of inflation risks, and governments around the world keen to hit the fiscal accelerator.

While we expect some of this volatility in bond yields to persist, core bonds absolutely deserve their place in providing income and downside protection against a growth shock. UK gilts appear better positioned than their regional peers, given a relatively weak growth backdrop and a UK government that is much more constrained by its own fiscal rules.

Our fourth theme focuses on investors needing to consider diversification against the global economy proving too hot rather than too cold. Rising trade barriers threaten a classic negative supply shock, at a time where fiscal policy is already taking a more expansionary turn.

While 2022 may be a year that many investors are keen to forget, it also provides a helpful template for how markets may respond to an inflation shock.

Alternative assets, and core real assets in particular, provided the best places to hide in a period where stocks and bonds sold off simultaneously. For investors unable to access less liquid strategies, commodities, macro hedge funds and large cap UK equities were also relatively resilient. In a world where inflation and growth risks are more evenly balanced, these alternative tools are an increasingly essential part of a well-diversified portfolio.

Finally, currency considerations cannot be overlooked. Since 2010, the FX exposure of unhedged US assets has provided something of a ‘free lunch’. US dollar appreciation has added an additional 1.9% per annum for sterling investors, while also often providing a diversification benefit during risk-off periods. With the US dollar’s safe haven status no longer as solid, a different balance of currency risks may be required.

By focusing on strategies that perform well in various scenarios, investors can position themselves to succeed amidst the complexities of today's global economy. Establishing stable foundations for an unstable world will therefore be crucial.

Hugh Gimber is global market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.

New Junior ISA rate to also apply from mid-July.

National Savings and Investments (NS&I) has launched new issues of its two, three and five-year British Savings Bonds today, offering savers fixed interest rates across both Guaranteed Growth and Guaranteed Income Bonds.

In addition, NS&I’s Junior ISA will offer 3.55% AER tax-free to savers under the age of 18 – marking the first interest rate change since 18 August 2023 (4% AER).

The rates across growth and income for two, three and five years are illustrated in the table below.

|

Product |

Previous interest rate (from 15 April 2025) |

New interest rate from 3 July 2025 (on general sale) |

|

Guaranteed Growth Bonds 2-year (Issue 74) |

4.00% gross/AER |

3.85% gross/AER |

|

Guaranteed Income Bonds 2-year (Issue 74) |

3.93% gross/4.00% AER |

3.79% gross/3.85% AER |

|

Guaranteed Growth Bonds 3-year (Issue 76) |

4.10% gross/AER |

3.88% gross/AER |

|

Guaranteed Income Bonds 3-year (Issue 76) |

4.03% gross/4.10% AER |

3.82% gross/3.88% AER |

|

Guaranteed Growth Bonds 5-year (Issue 68) |

4.06% gross/AER |

3.84% gross/AER |

|

Guaranteed Income Bonds 5-year (Issue 68) |

3.99% gross/4.06% AER |

3.78% gross/3.84% AER |

|

Product |

Previous interest rate (from 18 August 2023) |

New interest rate from 18 July 2025 |

|

Junior ISA |

4.00% AER (tax-free) |

3.55% AER (tax-free) |

The one-year British Savings Bonds remain unchanged at 4.05% gross/AER for growth and 3.98% gross and 4.05% AER for income.

Andrew Westhead, NS&I retail director, said: “Today’s announcement is in response to changes in the wider market and will ensure we continue to offer a range of fixed-term options while balancing the interests of savers, taxpayers and the broader financial services sector.”

These bonds are fixed-term savings accounts with guaranteed returns that are available for savers with a minimum investment of £500.

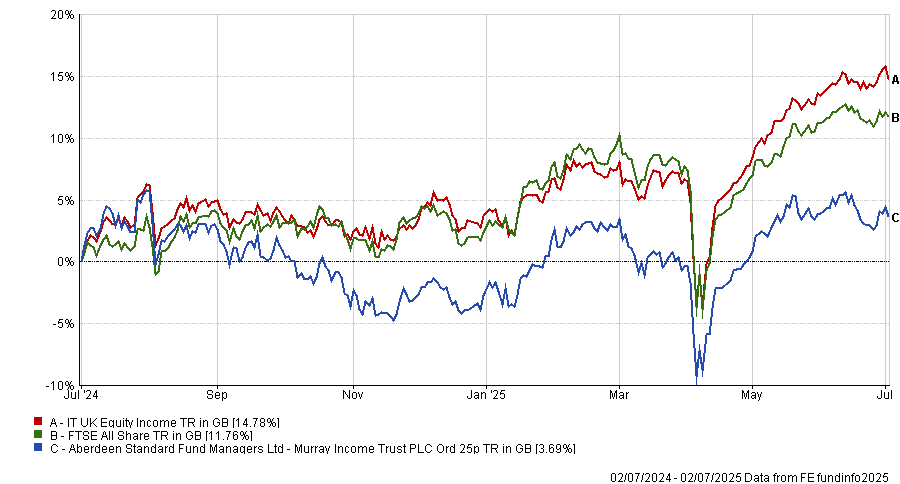

The Murray Income trust is facing a “surprise” strategic review launched to improve long-term returns and address a persistent discount.

The board of the £931m FTSE 250-listed trust managed by Aberdeen said it would examine a range of options with the aim of boosting shareholder value, while continuing to deliver an attractive yield.

This follows a “detailed evaluation of performance”, which the board said has been "below expectations for some time".

Performance of trust against index and sector over 1yr Source: FE Analytics

Source: FE Analytics

QuotedData’s James Carthew described the announcement as a surprise, noting that last year’s annual report contained no direct criticism of the trust’s performance.

He highlighted that the trust currently trades on a 10.3% discount, which is unusually wide for a large-cap income-focused vehicle. “That sort of level is bound to attract attention from discount-driven investors,” he said. Emma Bird, head of investment trust research at Winterflood, noted that Murray Income’s discount has averaged 9.3% since the start of 2023, which is currently the second-widest in its peer group.

When it comes to performance, the trust has ranked last among its 18-strong UK Equity Income peer group over the past year, underperforming the sector-leading Temple Bar Investment Trust by more than 20 percentage points. It also sits close to the bottom of the fourth quartile over both three and five years.

Bird welcomed the board’s decision to act, as strategic reviews have been increasingly prevalent in the investment trust sector in recent years, particularly among smaller, sub-scale funds.

“This is clearly not the case for Murray Income, which has a market cap of over £800m, but we commend the board for seeking to address the other issues facing the fund,” she said.

A merger could be "a plausible outcome", she added, particularly in a crowded sector where more than half of the trusts have market caps below £500m. Bird pointed to the possibility of a combination with one of Aberdeen’s other UK equity income mandates – Aberdeen Equity Income, Dunedin Income Growth or Shires Income – all of which are smaller and trade on tighter discounts or small premiums.

The board said it would make further announcements in due course.

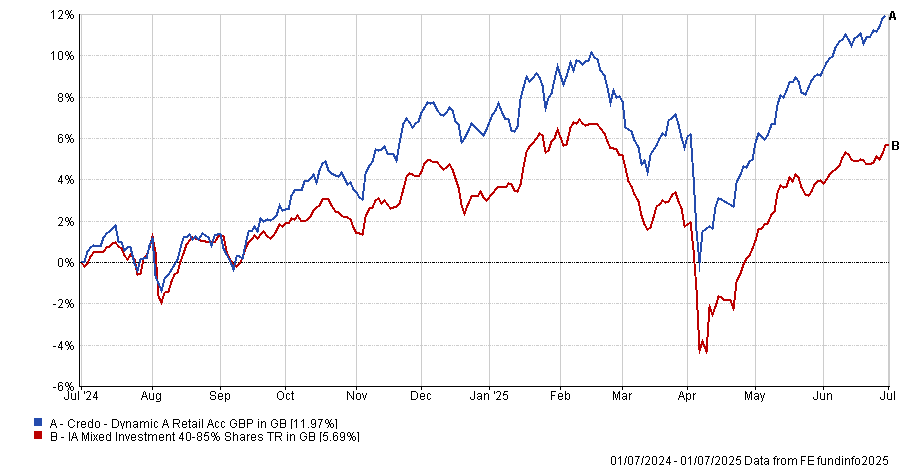

The managers of Credo Dynamic redeployed capital from REITs into hedge-fund-style strategies.

The managers of the multi-asset Credo Dynamic fund have rotated out of real estate investment trusts (REITs) and into long/short alternatives this year, as narrowing discounts and takeovers shrank the opportunity set in listed property.

A range of hedge fund-style strategies have become the main beneficiary of the shift, with three new positions added to boost diversification and improve risk-adjusted returns.

“A couple of months ago, our big bet was investment trusts and REITs. We saw big opportunities in the discounts and that was a major differentiator for us over the past year,” said fund manager Ben Newton.

“But now that’s starting to tail off. Discounts have narrowed, peers have exited, or some holdings have been taken out altogether. There have been several takeovers – Harmony, Assura and Urban Logistics REIT just to name a few. So now, we’re seeing fewer opportunities in that space.”

At their highest, REITs made up 9.5% of Credo Dynamic; now that’s closer to 4.5%.

Newton and lead manager Rupert Silver are now seeing fewer opportunities across the board, and therefore added to a set of long/short strategies (which seek to profit from stock gains in their long positions as well as price declines in short positions).

“Long/short funds have essentially no correlation to equities, a big positive for us,” said Newton.

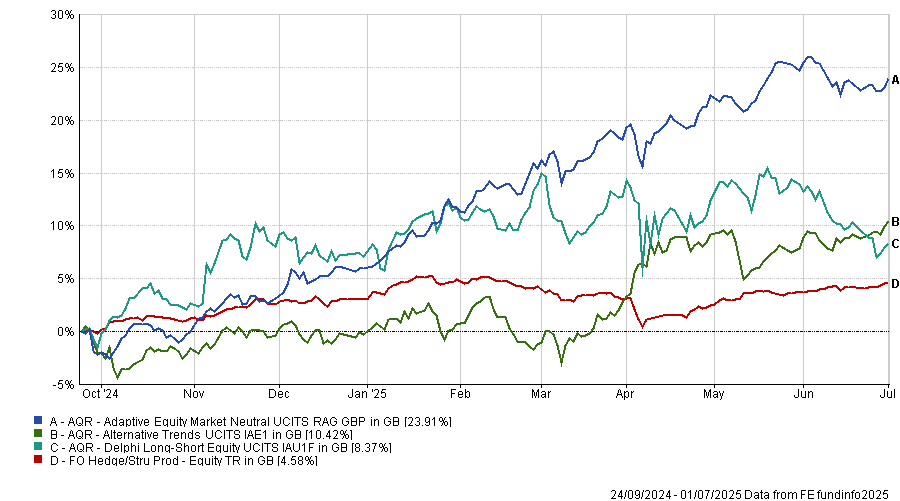

Their choice went to three strategies run by AQR Equity Market Neutral, Alternative Trends and Delphi Long/Short.

“AQR Equity Market Neutral uses 500 characteristics to screen positions – a kind of algorithm-led, AI-style approach. It’s very different from what we could do in-house, so we’re happy to allocate to a manager with strong intellectual property and a solid (albeit short) track record,” he continued.

Performance of funds against sector over 1yr

Source: FE Analytics

The managers said they want to avoid getting caught up in overly crowded trades, especially with signs of froth in areas like Bitcoin and treasuries.

“Delphi Long/Short is long value and quality, short overstretched areas of the market. That’s about diversifying the portfolio – we still hold tech and equities that would benefit in a boom, but if there’s a rotation or frothy behaviour, this helps protect against that,” said Newton.

Alternative Trends, meanwhile, focuses on momentum strategies in more esoteric asset classes. “It has low correlation and high potential returns, which makes the portfolio more robust,” he added. “These are liquid enough that we can rotate into equities or bonds if a better opportunity appears – or if discounts re-emerge.”

Silver and Newton run Credo Dynamic using a core-satellite structure. Around 50% of the portfolio is in core holdings: typically exchange-traded funds (ETFs) and corporate bonds, giving long-term exposure to global markets.

The rest, they explained, is more opportunistic, used to dial up risk when the environment justifies it through smaller companies and individual stocks or diversify through alternatives or at times aim to protect capital. They actively shift the balance based on bottom-up opportunities combined with more macro and valuation signals.

Alternatives, although a smaller allocation, have been a standout contributor in the past year, when the fund stood out against its average peer, as the chart below shows.

Performance of fund against sector over 1yr

Source: FE Analytics

“Alternatives have been especially important over the past 12 months – they’ve delivered the best returns, even though they’re a small part of the fund,” said Silver. “We like retaining that exposure when the future feels uncertain.”

That sense of uncertainty – combined with a lack of compelling opportunities – is exactly why they’ve chosen to focus on building a broad, balanced portfolio rather than making high-conviction macro calls.

“It’s a relatively uncertain environment on a number of metrics, but we’re not in risk-off mode. It’s about focusing on the type of risk you're taking. There’s no single area that stands out. It’s hard to know where to hang your hat, because we’re not seeing anything screamingly obvious,” said Newton.

That view has fed into their overall positioning, which currently sits at around 48% equity, just under 30% bonds and the remaining 20% in alternatives and cash.

While the managers are generally comfortable running a higher portfolio turnover than peers – “the satellite side of the portfolio can be highly active and opportunistic at times,” they said, noting their past focus on discounted investment trusts – recent turnover has been elevated due to the REIT unwind and rotation into alternatives. However, they expect it to fall back if no major new opportunities emerge in the coming months.

Newton summarised their outlook: “I don’t want to give the impression we’re preparing for a bearish scenario – we’re not building up a big cash buffer or waiting for a crash. We just think risks are elevated and obvious opportunities are scarce, so we’re asking: how can we still deliver strong returns from a very broad portfolio?”

Fundsmith Equity portfolio sees US drinks firm replaced by European optical powerhouse

Terry Smith has sold Fundsmith Equity’s stake in Brown-Forman, the US spirits group behind Jack Daniel’s, and started building a new position in Franco-Italian eyewear conglomerate EssilorLuxottica, according to the fund’s latest factsheet.

The disposal ends a holding that made up 1.29% of the £20bn portfolio at the start of the year and comes after a slump in Brown-Forman’s share price following disappointing quarterly results in May. The stock is down 22.8% year-to-date.

Performance of stock over the year to date

Source: Google Finance

Dan Coatsworth, investment analyst at AJ Bell, said the company had struggled with weaker demand amid rising prices and macroeconomic uncertainty. “Alcohol fans are balking at the price hikes triggered by tariffs and concerns around economic weakness have led people to seek cheaper alternatives as they watch their spending,” he said.

EssilorLuxottica, by contrast, has been gaining traction with fund managers. Daniel Avigad, who runs the TM Lansdowne European Special Situations fund, recently described it as “an industry powerhouse” and “a serious contender in Europe’s race to build a $1trn company” due to its combination of horizontal breadth and vertical integration. The firm holds a 30-40% market share across multiple levels of the eyewear value chain.

Fundsmith Equity has faced investor frustration after several years of lagging returns. Once a consistent top performer, the fund last ranked in the top quartile of the IA Global sector in 2019 but was in the third quartile for the past three full calendar years as well as 2025 to date.

Yet fund pickers told Trustnet investors in the fund should stick with it. The top contributors to performance in June included Meta, Microsoft, Nike, Texas Instruments and Alphabet; the largest detractors were Automatic Data Processing, Brown-Forman, Visa, Unilever and Procter & Gamble.

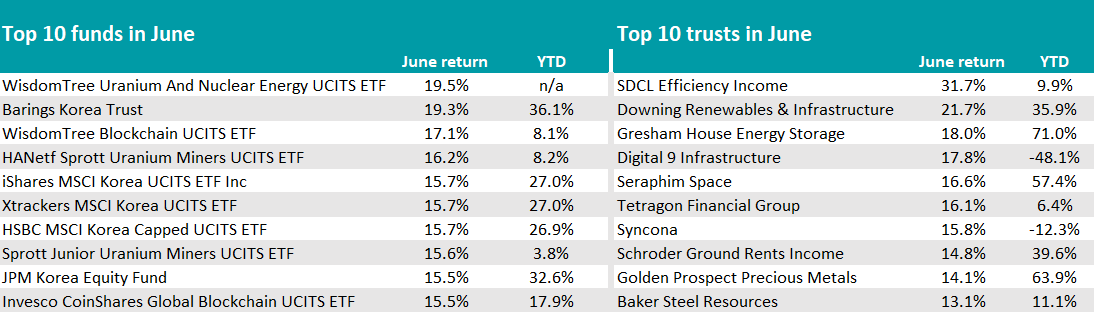

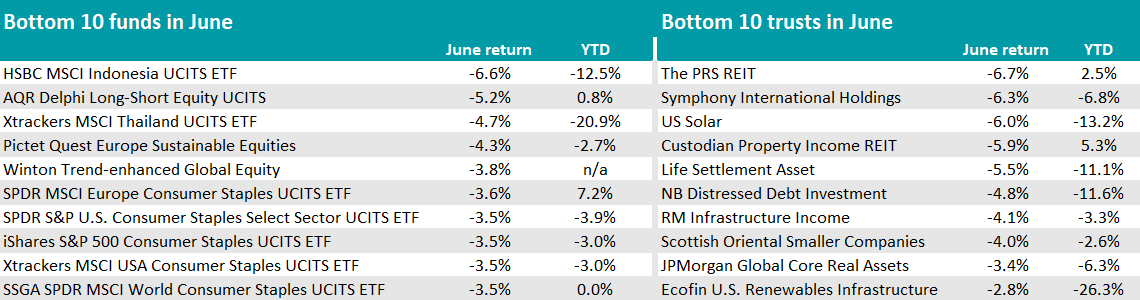

Trustnet reviews the past six months to find out the strongest parts of the market.

Investors would have been rewarded by holding European stocks, banks and funds investing in gold over the opening half of 2025, research by Trustnet shows.

The first half of the year has been more turbulent than investors would have liked, with US president Donald Trump’s new administration sparking a cycle of market sell-offs and rallies through its upheaval of the global order in areas such as trade, defence and diplomacy.

Below, we look at the market from a range of viewpoints to find out which asset classes, stocks and funds made the highest returns over the past six months.

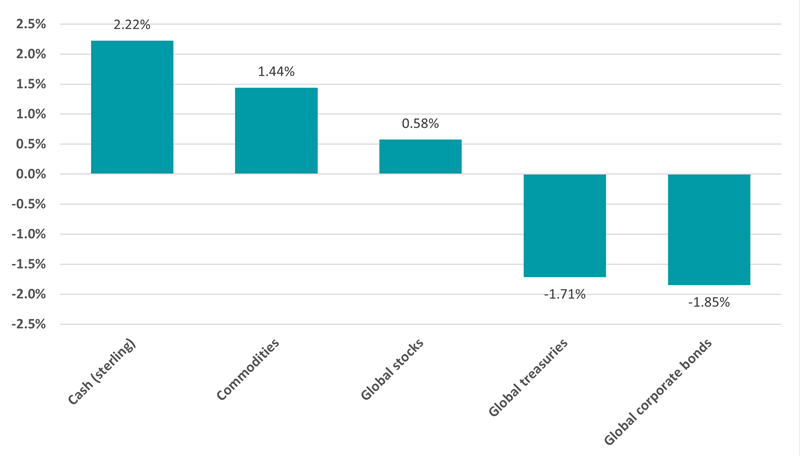

Performance of asset classes in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Cash has been the best-performing asset over the past six months, followed by commodities. Global equities, represented by the MSCI AC World index, eked out a small positive return in sterling terms.

However, this headline figure conceals the widely different performance of equities in the first and second quarters of the year: the MSCI AC World fell 4.3% in the first quarter but was up 5.1% in the second.

The opening quarter was especially weak because investors pulled back from the so-called Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla), which had led the market for several years.

But sentiment recovered in the second quarter as markets shook off the initial ‘Liberation Day’ tariff shock and rallied when Trump later paused or reduced them.

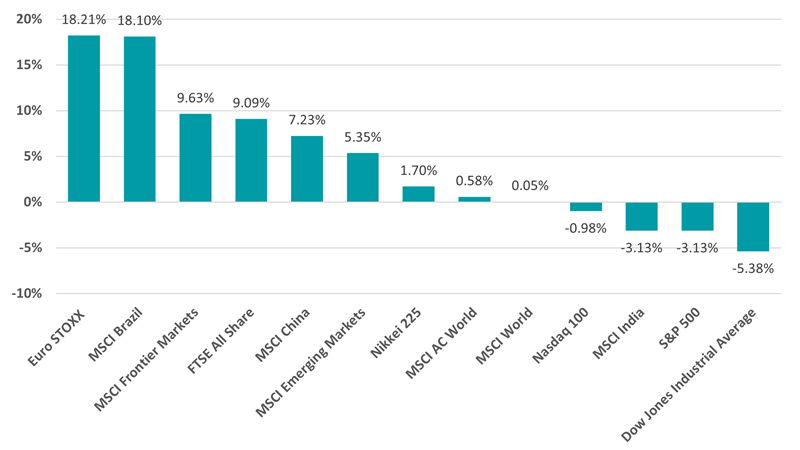

Performance by region in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Ben Yearsley, director at Fairview Investing, described the opening half of 2025 as “generally good”, pointing to the strong performance of European equities and “creditable” showing from UK stocks.

“The interesting one is the US, where despite a fresh record high for the S&P, the year-to-date gain of 5.44% has been more than wiped out by currency losses – very few investors hedge their equity exposure,” he added.

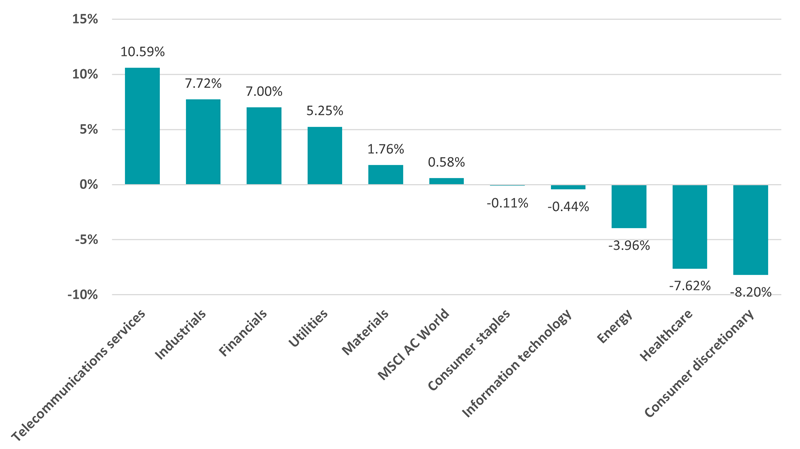

Performance of equity sectors in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Telecommunications topped the list of equity sectors, returning over 10% in sterling terms, as they benefited from resilient cash flows and growing investor appetite for stable yield. Industrials, financials and utilities also outperformed the wider global index.

Conversely, there was sharp underperformance from consumer discretionary and healthcare stocks. Discretionary companies struggled with subdued consumer demand on the back of inflation worries and real wage stagnation, while healthcare’s headwinds include regulatory uncertainty, pricing pressures and patent cliffs.

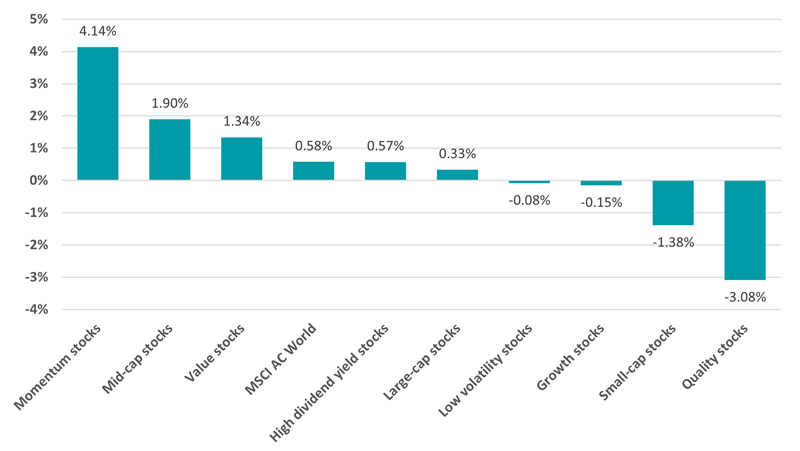

Performance of investment factor in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

This environment favoured momentum stocks as investors moved towards recent winners, while quality stocks suffered from little new upside to justify higher prices.

A look at the composition of the underlying indices – MSCI ACWI Momentum and MSCI ACWI Quality – also helps explain their performance in 2025’s first half. The momentum index has a lower allocation to areas like the US, tech stocks and healthcare than the quality index, with more in financials, industrials and utilities.

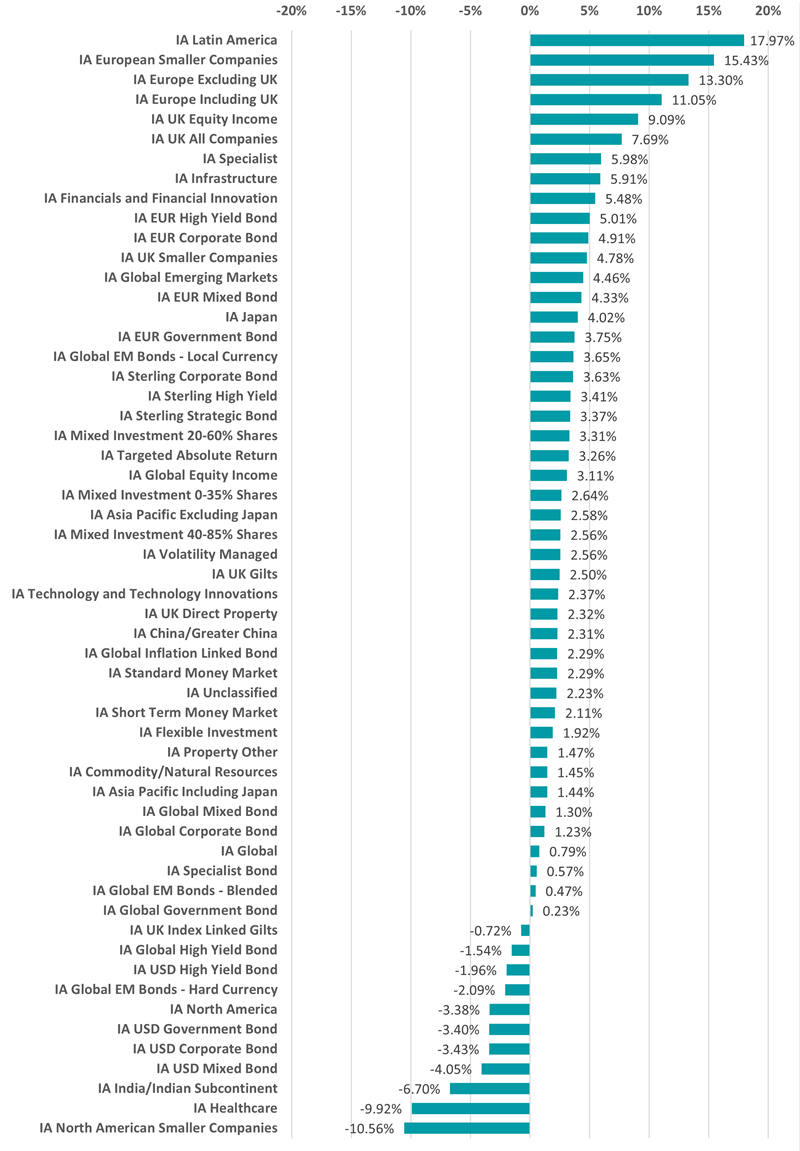

Performance of fund sectors in 2025’s first half

Source: FinxL. Total return in sterling between 1 Jan and 30 Jun 2025

Within the Investment Association sectors, IA Latin America was the best-performing peer group over the past six months with an average return of just under 18%. BlackRock GF Latin American made the highest return here, up 24.8%, followed by iShares MSCI EM Latin America UCITS ETF (18.5%) and Barings Latin America (18.5%).

As geopolitical tensions and valuations have risen elsewhere, investors turned their focus to Brazil and Mexico. Both countries’ stock indices are at record highs, yet still trade at a steep discount to developed peers.

The macro environment has been supportive, with a softer dollar lifting local currencies, rate cuts gaining traction and sovereign bond yields remaining appealing. This combination of relative political calm, favourable carry trades and historically discounted stocks has sharpened the appeal of Latin America in 2025.

The three European fund sectors followed, all making double-digit average returns. European equities have gained significant traction in 2025 as investors pivot away from the uncertainty surrounding US policy.

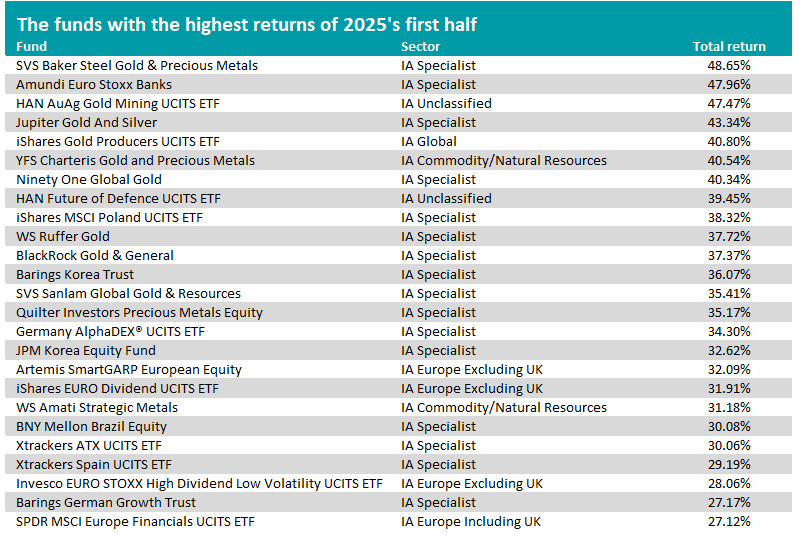

Source: FE Analytics. Total return in sterling between 1 Jan and 30 Jun 2025

When it comes to individual funds, however, gold was the main theme. As the chart above shows, seven of the 10 best-performing funds over the past six months are gold strategies, with SVS Baker Steel Gold & Precious Metals making 48.7%.

Investors have increasingly turned to gold in 2025, driven by a blend of geopolitical shocks and persistent economic uncertainty. Tensions in the Middle East, renewed US tariff threats, and ongoing trade disputes have rekindled demand for safe-haven assets like gold, contributing to its climb to record highs.

At the same time, a weakening US dollar and expectations of rate cuts from the Federal Reserve have bolstered gold’s appeal relative to non-yielding assets. Central banks, notably in China and Russia, have maintained aggressive gold buying to diversify reserve holdings, reinforcing upward pressure on prices.

Several other themes are represented in the table above, including Europe’s outperformance (Artemis SmartGARP European Equity, iShares EURO Dividend UCITS ETF), strong banks (Amundi Euro Stoxx Banks, SPDR MSCI Europe Financials UCITS ETF) and higher spending on defence (HAN Future of Defence UCITS ETF).

The trust's annual report details a focus on "adaptable holdings" and continued belief in the US healthcare sector.

Following a disappointing end to its financial year, the Monks Investment Trust managers are doubling down on building portfolio resilience to weather ongoing uncertainty.

The £2.5bn portfolio, which is managed by Spencer Adair, Malcolm MacColl and Helen Xiong, has delivered a NAV return of 163.3% over 10 years, slightly behind the FTSE World index’s 182% rise over the same period, according to the latest annual report for the year to 30 April 2025.

However, in the 12 months to April, Monks has underperformed the index by 5.2%, with a flat NAV return of 0.1% compared to FTSE World’s 5.3% gain.

The managers cited global trade tensions ignited by US president Donald Trump’s ‘Liberation Day’ tariffs and strong negative momentum within the US markets – the impact of which was more keenly felt due to the trust’s near 60% weighting to North America.

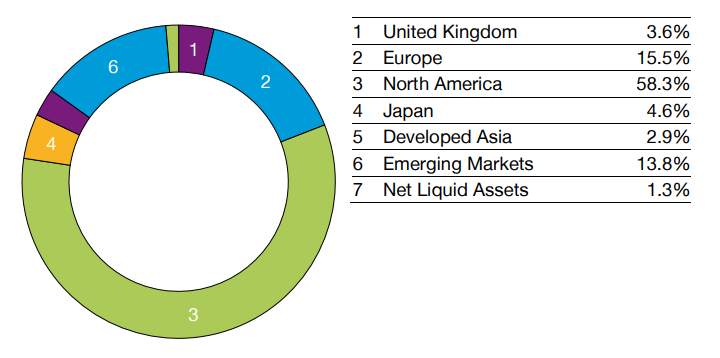

Regional allocation of Monks Investment Trust

Source: Baillie Gifford

The Monks management team said that ongoing uncertainty caused by the volatile situation in the US cannot be priced, hedged or insured against. Instead, the managers are prioritising building resilience, retaining perspective and remaining reward-seeking.

The Monks’ game plan

The managers’ focus has been on ensuring holdings are “sufficiently adaptable” so that the portfolio is “positioned to win across a wide range of scenarios”.

“Rather than attempting to predict the unpredictable, we focus on building resilience through investing in companies with robust fundamentals and a diversity of growth drivers,” they said.

As such, the trust’s portfolio companies are “conservatively financed”, with 20% net debt/equity compared to the index (50%), and structurally more profitable with 39% gross margins versus 29%, the team said.

Monks also invests more in future growth and its companies have a higher return on equity at 19% versus the index’s 15%.

Holdings are organised into three profiles: stalwart (wealth compounders), rapid (typically technological innovators and disruptors) and cyclical growth (economically sensitive businesses whose growth arrives unevenly).

“This broad and pragmatic approach to growth gives us degrees of freedom to adapt to changing conditions, seize emerging opportunities and shift emphasis as market cycles evolve,” the team said.

The annual report also provided insight into position sizing, with over 40% of the portfolio by weight in the top 15 holdings. The managers said they believe these companies’ have the highest likelihood of at least doubling in return over the next five years.

“However, we recognise the asymmetries that equity investing offers and embrace this by managing a basket of smaller, 'incubator' positions (<0.5%), where the path to growth is less clear but potentially highly rewarding for shareholders,” the team added.

The trust currently invests in 40 such companies – around 15% of the portfolio.

The overall impact of this strategy is that Monks’ shareholders are not “overly exposed to the fortunes of one company, but instead a diverse range of holdings”.

Another method of ensuring resilience is to focus on more enduring and structural trends that will “outlast political cycles”, according to the managers. Examples include artificial intelligence (AI) and the penetration of electric and autonomous vehicles.

Around 25% of Monks is invested in companies that power, build or benefit from AI. The team currently has around 3.5% invested directly in the growth of electric and autonomous vehicles but noted “the direction of travel is clear”.

“By building resilience and maintaining perspective, we create the mental space to remain reward-seeking,” the managers said.

Under the weather

Elsewhere in the report, the managers pointed to the disappointing performance of its healthcare holdings, which were among the largest detractors from relative performance for the portfolio.

“President Trump’s healthcare appointments and their combined pronouncements have impacted short-term sentiment in healthcare,” the managers said.

As demonstrated in the table below, US health insurer Elevance Health suffered a fall in share price, which the managers have put down to tightened Medicaid eligibility criteria post-pandemic.

Top five contributors and detractors to relative performance by stock for the year end 30 April 2025 (%)

|

|

Average weight in portfolio |

Average weight in Index |

Average active weight |

Total Return |

Attribution |

|

Top five |

|

|

|

|

|

|

DoorDash |

2.3 |

0.1 |

2.2 |

40.6 |

0.8 |

|

Prosus |

2.9 |

0.1 |

2.9 |

29.9 |

0.6 |

|

Alnylam Pharmaceuticals |

1.0 |

0.0 |

0.9 |

70.1 |

0.6 |

|

Sea Limited |

0.8 |

0.0 |

0.8 |

98.9 |

0.5 |

|

Shopify |

1.4 |

0.1 |

1.2 |

27.2 |

0.5 |

|

Bottom five |

|

|

|

|

|

|

Elevance Health |

3.1 |

0.1 |

3.0 |

-24.5 |

-1.0 |

|

Novo Nordisk |

1.7 |

0.5 |

1.2 |

-51.1 |

-1.0 |

|

Martin Marietta Materials |

3.0 |

0.0 |

2.9 |

-15.8 |

-0.8 |

|

Moderna |

0.4 |

0.0 |

0.4 |

-70.6 |

-0.5 |

|

Block |

1.2 |

0.1 |

1.1 |

-25.1 |

-0.5 |

Source: Revolution, FTSE. All attribution figures are calculated gross of fees, relative to the index from stock level up, based on closing prices.

Despite this, the managers remain optimistic, arguing that there is “a structural tailwind for growth in the years ahead” as the population ages, treatments become more expensive and need for health insurance coverage grows.

However, in the top five, the managers highlighted Alnylam Pharmaceuticals, which received positive results from its late-stage trial to treat a rare heart condition – an achievement that could give it wider access to the patient population.

“We took some profits on shareholders’ behalf after the share price rose by 80% but we remain excited by the company’s potential to address even larger patient populations,” the managers said.

In contrast, Monks sold its position in Moderna, citing disappointing revenue from the Covid-19 vaccine and slow speed to market with its respiratory syncytial virus vaccine.

“Though we continue to believe that they have a potentially exciting pipeline of drugs, our patience has been exhausted,” the managers said.

Kepler’s David Brenchley identifies the investment trusts to consider if the dollar continues to weaken.

Perhaps it’s the financial writer in me, but our long-awaited holiday to Japan was hastened by a currency that had moved heavily in our favour; the same may be the case for the US next year.

We decided to take in the sights of Tokyo, Kyoto, Nara and Osaka in May, to take advantage of a weak yen. The GBP/JPY exchange rate had climbed by c. 50% over the past five years, from c. 130 five years ago to c. 195.

Sterling has climbed against the US dollar, too. Perhaps that will be our next big trip.

The GBP/USD exchange rate has risen c. 30% in the past three years, from c. 1.05 to c. 1.37 at the time of writing. You’ll recall that during the Truss premiership there were fears the pound would hit parity with the dollar.

Sterling’s four-year high against the dollar may be good news for holidaymakers, but it’s not so good for those UK-based investors whose portfolio is heavily weighted to USA Inc.

During this period of dollar weakness (since 28 September 2022), the S&P 500 has generated a total return of c. 70%, yet UK (and other Europe-based) investors have not kept up with this. The iShares Core S&P 500 UCITS ETF, denominated in sterling, is up c. 33.6%, according to FE fundinfo.

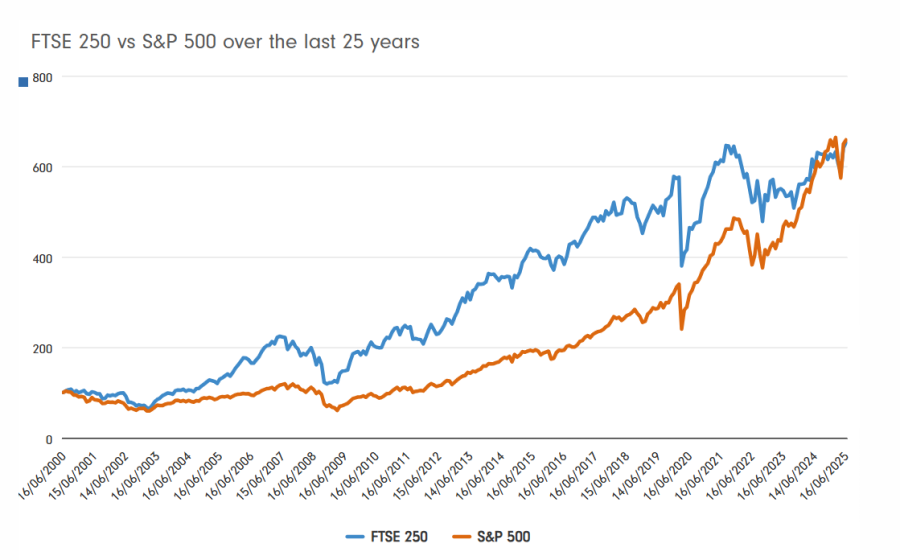

Currency movements are notoriously difficult to predict, but it’s prudent to at least consider the risk that depreciation could drag on your returns when investing overseas. The S&P 500 has powered ahead since 2022, but sterling investors would have been better off putting their cash into the iShares Core FTSE 100 UCITS ETF, which has returned 37.8%.

This is a far cry from the post-financial crisis period when a strong dollar worked in our favour. Indeed, the iShares Core S&P 500 UCITS ETF returned c. 354% in the 10 years to 28 September 2022, versus a US dollar return of c. 196% from the S&P 500.

Now, a rethink of this dollar dependence seems sensible. Bear in mind that president Trump wants a weaker dollar so that the US becomes more competitive from an export perspective as well as to shrink its trade deficit.

So, what, if anything, should a non-US dollar denominated investor do if the greenback continues to slide?

Most obviously, all things being equal, domestically oriented investments become more attractive. Broadly, this is because you don’t have to take on any currency risk – and we’ve already shown that in sterling terms the FTSE 100 has outperformed the S&P 500 recently.

The nuance here is that only c. 30% of FTSE 100 companies’ revenues come from the UK, with a large portion of that being US dollar sales. So, perhaps a more interesting place to look would be the UK small- and mid-cap segment, where companies are more geared to the UK economy. FTSE 250 companies generate c. 45% of revenues domestically and that number will be lower for small-cap firms.

Take Rockwood Strategic, which invests at the very bottom of the small-cap segment, in micro-cap companies. Rockwood Strategic’s portfolio generates roughly half of its revenue from the UK, with the other half coming from the US as well as continental Europe, Asia and Africa.

From a mid-cap perspective, consider Schroder UK Mid Cap, which has been boosted by its domestic exposure, such as housebuilders and other companies down the housebuilding supply chain including brick makers.

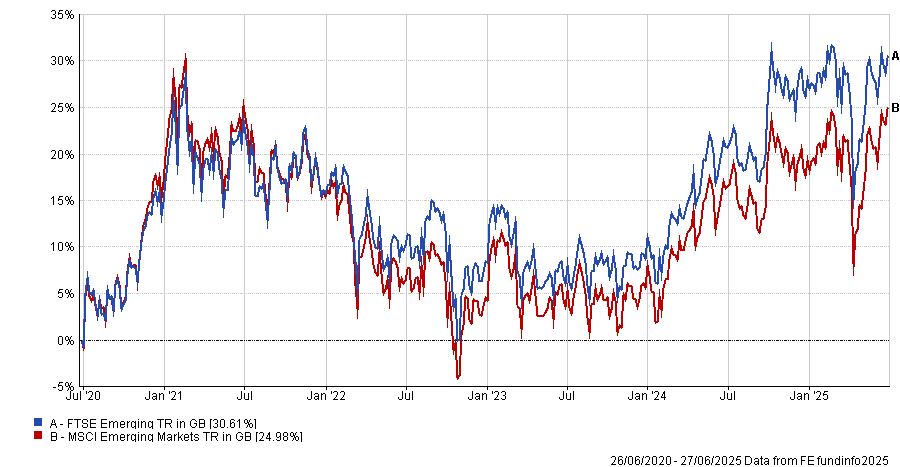

Emerging market economies have tended to be negatively correlated with the US dollar in that when the dollar rises, emerging markets generally do badly. If this is the case, it’s fair to suggest that the reverse should hold true and that as the dollar continues to weaken, emerging markets will thrive.

That’s particularly true of the countries at the smaller end of the emerging complex, which tend to have more US dollar debt, suggesting that BlackRock Frontiers could benefit.

Fidelity Emerging Markets is an interesting option here, in that it is a differentiated option in the sector. Managers Nick Price and Chris Tennant are very valuation-focused, giving them the flexibility to stray from the benchmark, which leads them into small- and mid-caps, as well as having the ability to short companies with weak balance sheets.

A further asset class that has benefited from lower dependence on the US dollar as a source of funding is gold. Aside from it doing well in an uncertain geopolitical environment, central banks in countries with big US dollar revenues have been diversifying and reducing their exposure to the currency. To do this, they’ve been buying physical gold.

One beneficiary of this trend has been Golden Prospect Precious Metals, which continues to be a standout performer with a share price total return of c. 79% over the past year. High conviction exposure to smaller-cap miners, where the managers still see compelling valuations, has contributed to this and Golden Prospect Precious Metals still trades on a discount of c. 15%.

Of course, this is not all to say that wholesale portfolio changes are merited. The US market continues to chug along and it’s possible that the dollar could perk up at some point. However, most signs suggest that an ever-strengthening dollar will no longer provide a big boon to returns from your Stateside exposure. Diversification seems more important today than ever.

David Brenchley is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.

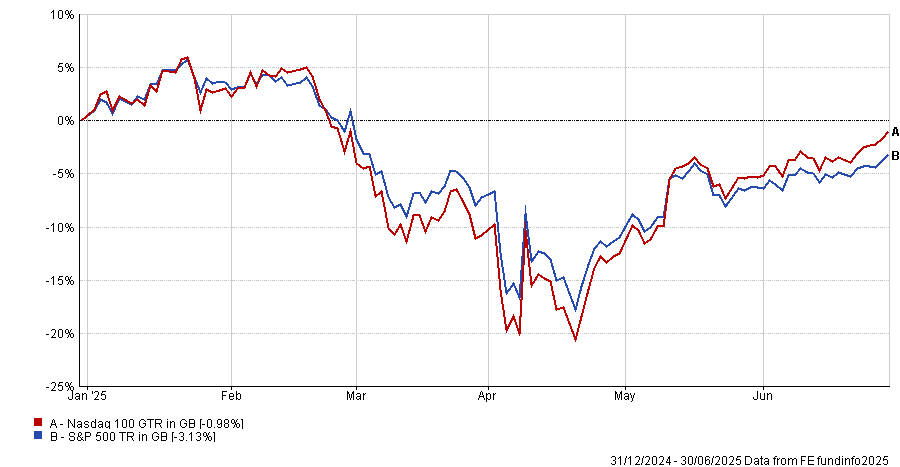

Trustnet finds out how European equities have caught investors’ eyes this year.

Investors have turned positive on European stocks with the opening months of 2025 seeing them outpace US equities, but exactly which of the region’s stocks and funds are performing the best?

The June edition of Bank of America’s closely watched Global Fund Manager Survey found a net 34% of asset allocators are overweight European equities. This is 0.8 standard deviations above the long-term average and reflects vastly improved sentiment towards the once-unloved region.

There is no doubt that 2025 is turning out to be a strong year for European equities. Since the start of the year, the Euro STOXX index has made a 18.3% total return (in sterling terms), compared with a 0.6% loss from the MSCI AC World index.

Performance of Euro STOXX vs other equity indices in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 27 Jun 2025

As the chart above shows, European stocks have outpaced all the major equity regions and government bonds by a wide margin this year. This includes US stocks – the former market darlings – as tariff threats, political uncertainty and high valuations caused investors to rotate away from the US.

Alex Holroyd-Jones, multi asset portfolio manager at Ninety One, also highlighted the positives for Europe: “A confluence of macroeconomic forces is building a more constructive case for European equities. Chief among them is the region’s cyclical upturn.

“The eurozone is showing signs of recovery after weak growth for much of the last two years. Business sentiment, measured by [purchasing managers’ indices], is climbing, led by improvement in manufacturing. Consumer confidence is also recovering, buoyed by real wage growth as inflation cools and employment remains resilient. A new credit cycle has emerged, with credit growth regaining after a period of contraction. Europe’s long-idling growth engine is finally gaining traction.”

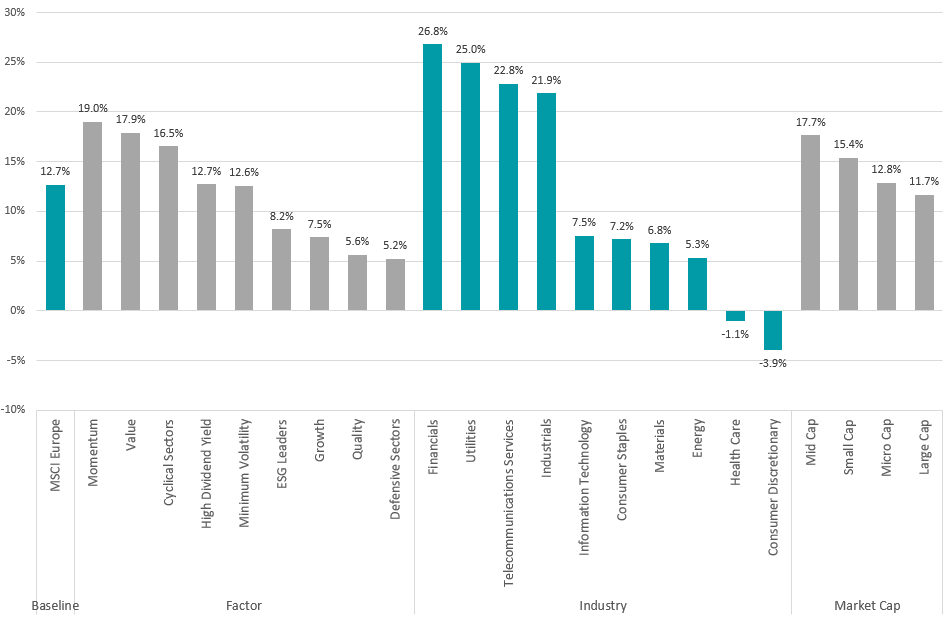

Performance of European equity sub-indices in 2025

Source: FinXL. Total return in sterling between 1 Jan and 27 Jun 2025

While European stocks have had a strong first half of 2025, the gains haven’t been evenly spread. Financials, utilities and telecoms stand out with returns well above the MSCI Europe benchmark.

These sectors are seen as stable and income-generating, especially in an environment where interest rates remain high and economic uncertainty lingers. Investors are leaning into dependable earnings and steady cash flows rather than chasing more speculative growth.

The pattern is clear in factor performance too. Momentum and value stocks are making the highest returns, while growth and quality have fallen behind, showing a clear shift toward cheaper but proven names over expensive future growth potential.

On an individual country level, the strongest returns have come from Spain (up 29.4%), Norway (24.8%), Austria (24.4%), Italy (21.6%) and Ireland (20.2%). Denmark is the only constituent of the MSCI Europe index in negative territory this year, down 9.4%.

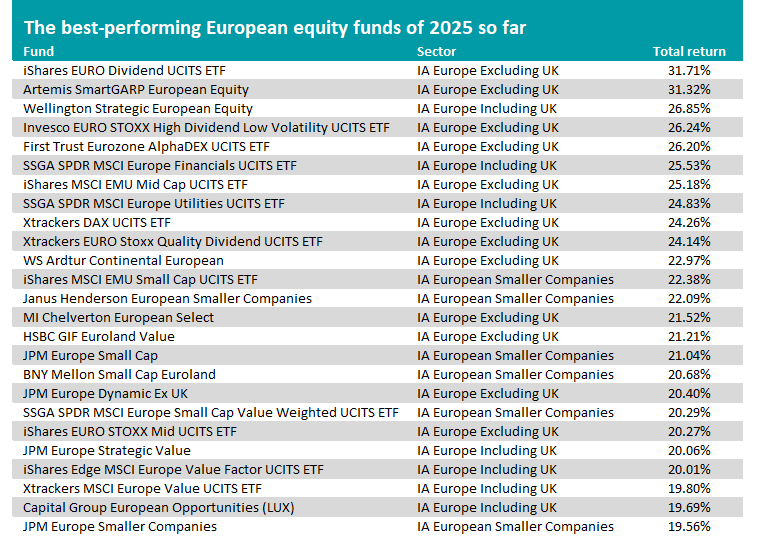

This has acted as a strong backdrop for European equity funds. Of the 250 funds in the IA Europe Excluding UK, IA Europe Including UK and IA European Smaller Companies sectors, 241 - or 96.4% - have made a positive return in 2025 so far. The 25 with the highest returns can be found in the table below.

Source: FE Analytics. Total return in sterling between 1 Jan and 27 Jun 2025

At the top of the table, iShares EURO Dividend UCITS ETF reflects the ‘stable and income-generating’ theme mentioned above. It invests in eurozone companies with the highest dividend yields, with 50.2% of its portfolio in financials, 10.7% in utilities and 5.8% in telecoms.

Invesco EURO STOXX High Dividend Low Volatility UCITS ETF, SSGA SPDR MSCI Europe Financials UCITS ETF, iShares MSCI EMU Mid Cap UCITS ETF and SSGA SPDR MSCI Europe Utilities UCITS ETF also reflect some of the previously highlighted themes.

The £905m Artemis SmartGARP European Equity fund is the highest-ranked active fund in 2025, making a 31.3% total return. Manager Philip Wolstencroft has been running the fund since its launch in 2001 using the SmartGARP process, which seeks out companies growing faster than the market but on lower valuations.

Its biggest sector allocation is to financials (accounting for 41.6% of the portfolio), followed by industrials (11.8%) and healthcare (10.2%). Italy, Spain and France are the largest country weightings.

Analysts at Rayner Spencer Mills Research said: “This fund is suitable as a core investment or for use alongside a large-cap or passive vehicle. The mid-cap weighting is significantly higher than that of the market and introduces investments that are often not found in the fund’s peers. In this way, the fund provides diversification, particularly relative to strategies that are more growth or large-cap orientated.”

Wellington Strategic European Equity is in third place with a 26.8% total return this year. Unlike many of the funds in the table, this resides in the IA Europe Including UK sector, with the UK being its largest geographical allocation.

Manager Dirk Enderlein looks for companies with “superior structural free-cash-flow and earnings growth outlook and a strong competitive positioning combined with attractive valuation levels”. However, the fund is at capacity and currently soft closed to new investments.

Of the 25 best European funds this year, a handful were also in their sectors’ top quartile over the previous three and five years, suggesting their recent strength is not limited to the current market backdrop.

These funds are Artemis SmartGARP European Equity, Wellington Strategic European Equity, SSGA SPDR MSCI Europe Financials UCITS ETF, WS Ardtur Continental European, Janus Henderson European Smaller Companies, BNY Mellon Small Cap Euroland and SSGA SPDR MSCI Europe Small Cap Value Weighted UCITS ETF.

Looking forward, Ninety One’s Holroyd-Jones pointed out that risks remain for European equities, as the continent is reliant on external demand, particularly from China, and therefore vulnerable to US trade policies. It is also a net importer of oil, so further conflict in the Middle East could increase the risk of an oil price shock adding to inflation.

However, he finished: “For investors willing to look beyond short-term noise, Europe offers the potential alignment of improving macro fundamentals, supportive policy, attractive valuations and the prospect of renewed capital inflows away from US assets.

“The eurozone may not displace the US as the epicentre of global equity markets, but its risk assets are well positioned to outperform over the medium term as global capital rebalances.”

The manager explains why businesses such as Lloyds, Frasers Group and DFS look particularly compelling.

The recent popularity of defence stocks has made it challenging to find opportunities that still have room to run, according to Fidelity’s Alex Wright.

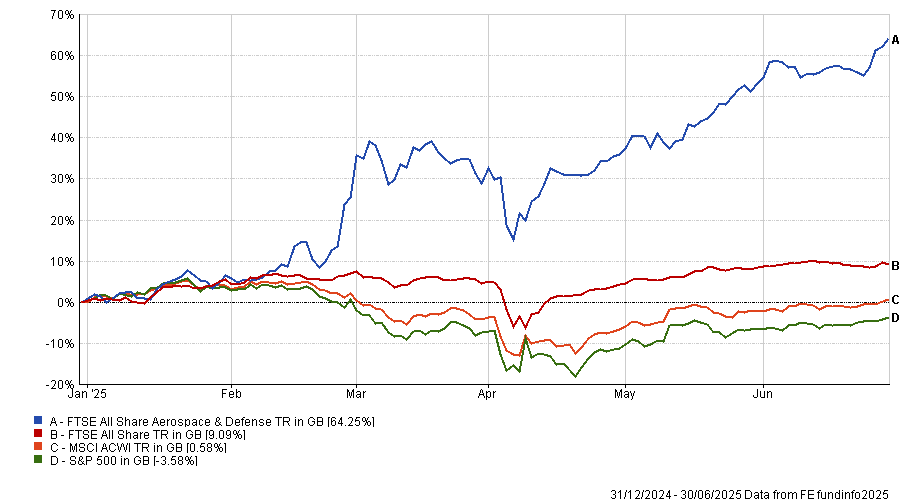

As geopolitical tensions boiled over, defence investment has been thrust into the limelight, with NATO members recently committing to spending 5% of GDP on defence. This is the latest in a string of positive developments for defence companies, causing the FTSE All Share Aerospace & Defense index to climb 64.3% so far this year.

This is significantly ahead of the wider FTSE All Share (up 9.1%), as well as the S&P 500 and the MSCI AC World, as seen in the chart below.

Performance of the indices year to date

Source: FE Analytics. Total return in sterling

Following this, defence-focused funds have surged in popularity. For example, the WisdomTree European Defence ETF has accumulated $3bn in capital in just three months.

However, Wright explained: “I think defence has become extremely fashionable and therefore valuations are too high, so we’re reducing it.”

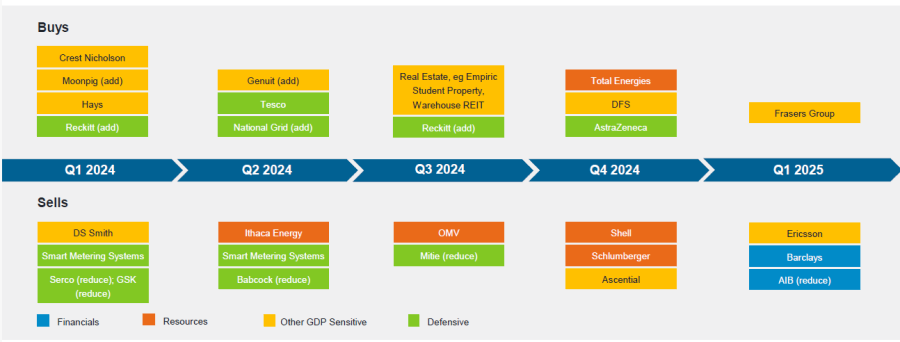

This marks a turnaround in Wright’s approach, with his Fidelity Special Values trust and Fidelity Special Situations fund typically having very high allocations to defence, he explained.

While both portfolios currently hold Babcock, Serco and Rolls-Royce, these positions were heavily reduced since 2020, due to most of the surge in defence spending being already priced in.

Recent trades in Fidelity Special Situations and Special Values

Source: Fidelity International.

While he conceded that the defence has done “a lot better than we would have expected”, other areas appeared more compelling: “Overall, I think defence has become fashionable, but I would say banks are coming back and have a lot further to go.”

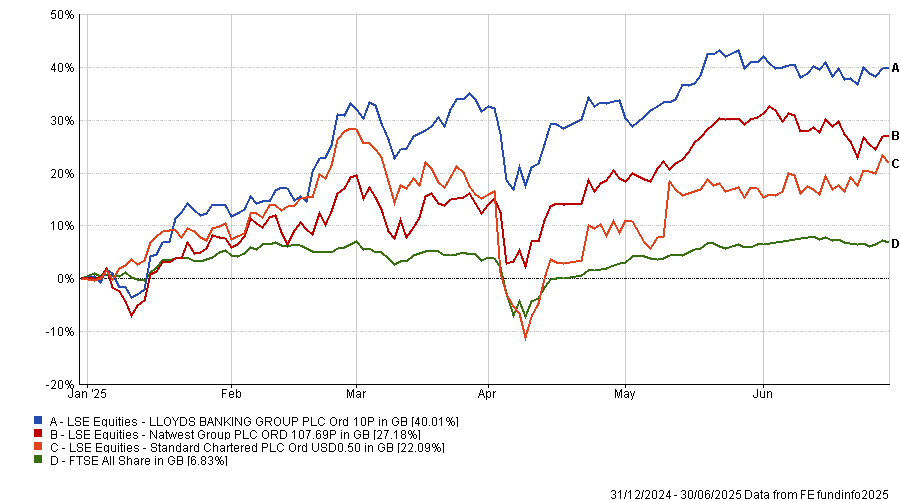

For the first time since 2016, Wright has raised his allocation towards Lloyds Bank. Restrictive regulations hit banks hard and Lloyds had particularly suffered, but the tone seems much better from here, the Fidelity manager said.

“In the UK, there’s been an easing of the regulatory burden, which had been very onerous for banks,” he said.

Partially, this is because of the need to remain globally competitive. The US is making “a lot of noise” about deregulation and if other developed markets do not follow suit, the US will continue to drain capital from the rest of the world. To prevent this, he argued that regulators have been easing up on banks.

Most UK banks are also extremely cash-generative with plenty of excess capital, he explained. Traditionally, banks used this capital to fund share buybacks, but as banks perform well, buybacks become more expensive. As a result, many UK banks are opting to grow through buying out smaller competitors.

“It makes a lot more sense for these banks to buy other banks, rather than buy your own, which is essentially what you do in share buybacks,” he said.

As a result, Wright also holds significant positions in NatWest and Standard Chartered. All three banks are up so far this year, as demonstrated on the chart below.

Share prices vs the index year to date

Source: FE Analytics. Share price in sterling

However, he noted that he is not positive on banks universally, with the increased position in Lloyds being funded by selling out of Barclays.

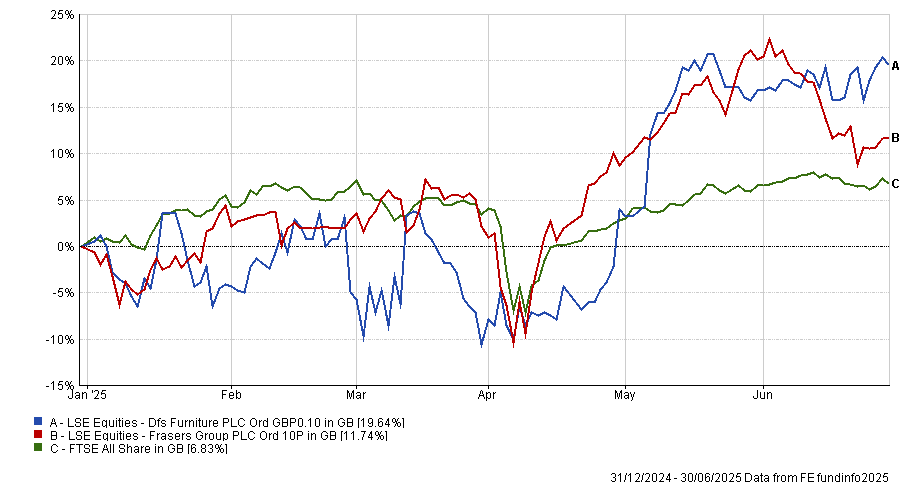

The more domestic companies in the UK index have also been appealing this year, he explained. Businesses that are sensitive to gross domestic product (GDP) are becoming more attractive in a period where dollar assets seem to be risky. Additionally, the UK consumer is in a much stronger position than the narrative suggests.

“I think the interesting thing this year is that consumers have a lot of money, with wage increases above the level of Inflation and savings at a very high level,” he said. “There has just not been that confidence to spend.”

Playing on this, one of the biggest recent additions to the portfolio is Frasers Group, formerly known as Sports Direct.

Trading at a price-to-earnings ratio of just 6x, despite a strong balance sheet, it is an “exceptional value” opportunity. Additionally, Frasers Group is “very different” to its average competitor because it has stakes in many other retail companies, such as Hugo Boss and ASOS.

Another domestic stock Wright favoured this year is sofa retailer DFS. It rallied after some very depressed market sales and is benefiting from challenges to some of its more direct competitors, such as SCS.

Share prices vs the index year to date

Source: FE Analytics. Share price in sterling

“These more UK domestic areas have been a theme for us this year,” Wright said. “It’s been out of value and out of favour and therefore has good valuations. We can buy into those.”

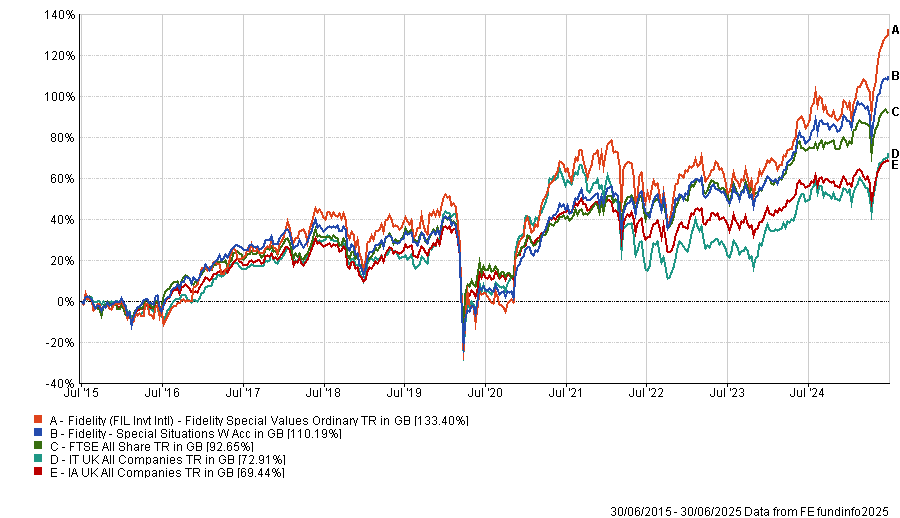

Over the past one, three, five and 10 years, Fidelity Special Situations and Fidelity Special Values have delivered top-quartile returns in the IA UK All Companies and IT UK All Companies sectors, respectively.

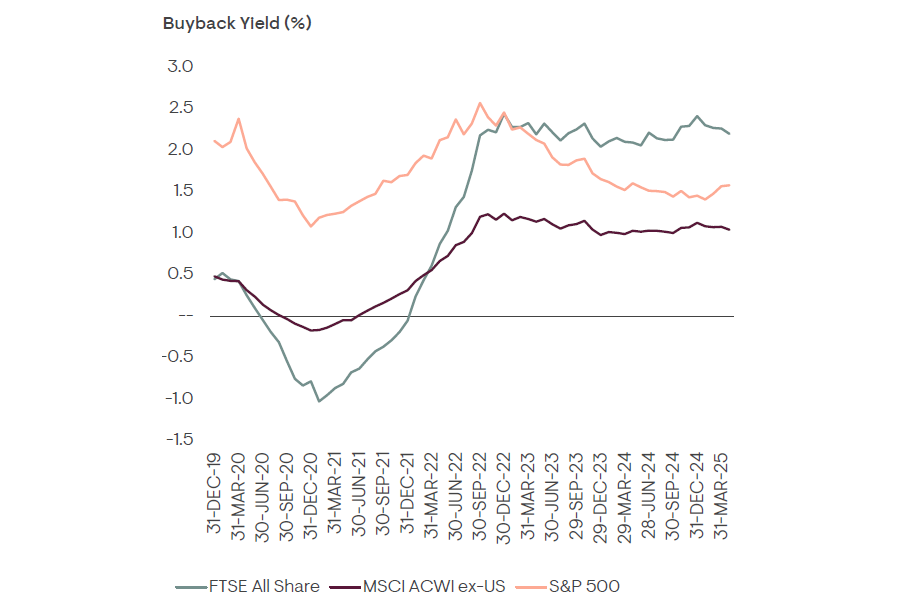

Performance of strategies vs sectors and index over the past 10yrs

Source: FE Analytics

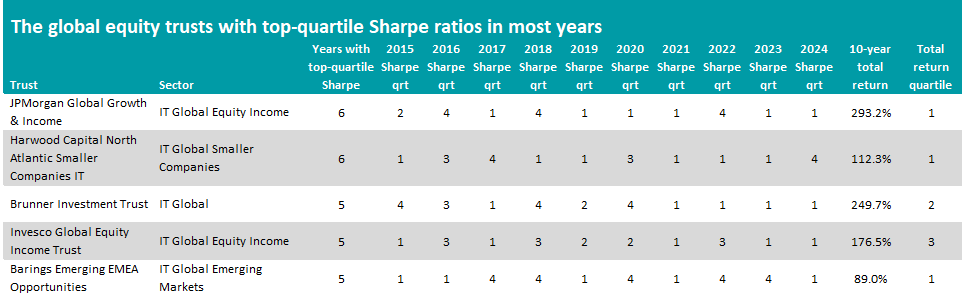

Fund selectors reveal which investment companies on a premium are attractive and which are not.

The number of investment trusts trading at a premium has risen since 2024, with 24 vehicles now above net asset value compared with 19 last year, according to data from AJ Bell and the Association of Investment Companies (AIC) published last week.

However, experts warned that premiums and discounts should be assessed individually, rather than seen as evidence of a broader sentiment shift or market-wide repricing. In fact, the numbers are still too small to be talking about any broad-based shift, with most premiums confined to a small list of outliers.

The outliers

The most expensive trusts right now are JPMorgan Emerging Europe, Middle East & Africa and British & American, trading at 310.8% and 72.3% premium to net asset value (NAV), respectively.

The price of the former, previously known as JP Morgan Russian Securities, is based on its NAV with the once-significant Russian exposure rebalanced to zero. According to analysts, the market is counting on those assets being written up quite heavily if or when the war in Ukraine and subsequent sanctions on Russia end.

“Whether that deserves a 300% premium is another thing,” said Daniel Lockyer, senior fund manager at Hawksmoor.

British & American is another exception: with just under £4m of assets under management, a high level of internal ownership and a 30% allocation in one underlying asset (healthcare company Geron), it remains well off the radars of most investors.

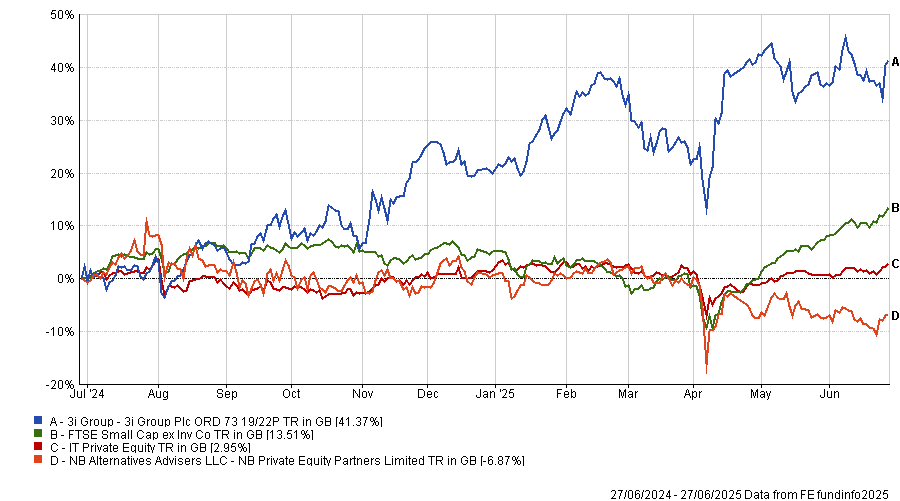

Only two other trusts have a double-digit premium. One is 3i Group (61% premium to NAV), whose premium is driven by the high demand for Action, a European supermarket chain that makes up 60% of its portfolio.

“3i is pretty much the only way to get access to Action and a lot of managers are interested in the stock right now,” Lockyer said.

However, he would prefer “a less binary exposure” through another trust, NB Private Equity.

“It has a 5% stake in Action and lots of other things as well, plus and it's trading on a 31% discount.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

Finally, Doric Nimrod Air Three (19.2% premium), an aircraft leasing special-situation portfolio, is another peculiar case, linked to the opportunity of selling airplanes to the leasing company at an appraised valuation.

But Lockyer said “it's not really worth dwelling too much on this first group” as they are all extreme cases.

Darius McDermott, managing director at Chelsea Financial Services, also preferred trusts trading on discounts.

“The risk with buying at a premium is that underperformance can hit twice – through weak NAV and a reversion to discount – which can be painful. We're generally more comfortable backing quality names trading below NAV, where the margin of safety is greater,” he said.

Jim Harrison, investment director at Chancery Lane, was even blunter, saying that he “would not go anywhere near any of them”, as premiums above 5% are “almost never worth it”.

With the exception of the four above, all the remaining trusts have a premium of 4% or below.

Trusts worth paying for

There are certainly occasions where it makes sense to pay a premium, according to McDermott.

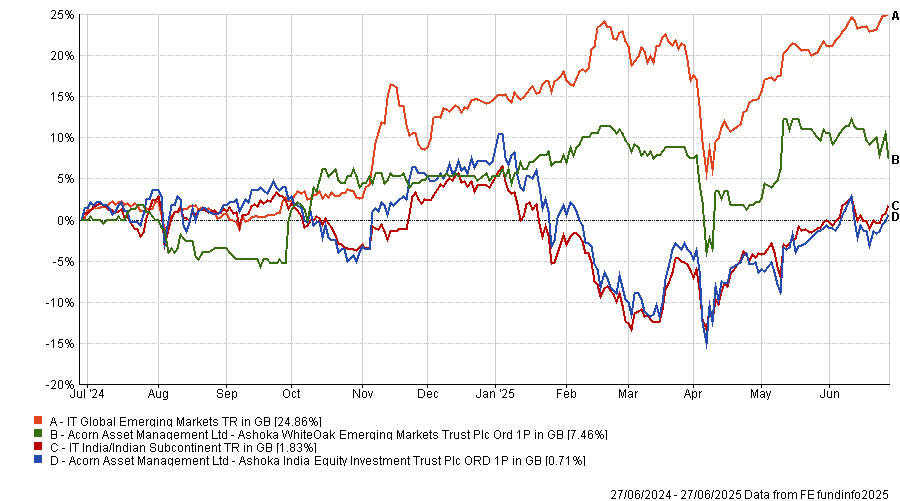

A good example are the Ashoka trusts India Equity (2% premium) and WhiteOak Emerging Markets (0.4% premium), both of which have delivered “standout performance” to justify the small premiums.

He particularly liked Ashoka India as it has “comfortably led its sector since launch” and the performance fee is tied to alpha generation, which “helps align the manager’s incentives with investors”.

Lockyer noted both vehicles have a “very good, shareholder-friendly structure” in the form of an annual redemption facility, which allows investors to exit at NAV every year and keeps their price from oscillating too much.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Rockwood Strategic (3.1% premium) has “defied the gloom around UK smaller companies to deliver outstanding performance” through a high-conviction, hands-on approach making “smart” use of the investment trust structure, McDermott said.

Lockyer agreed and added Law Debenture to the trusts he would currently own: “It has been around forever and everyone loves it”.

It has a “unique nature”, with a professional services company that “enhances the yield pays a lot of expenses as well”. “That's definitely one reason why that one's trading on premium, and it's very good,” he said.

Lockyer finished his list with the Achilles Investment Company (0.7% premium) and Onward Opportunities (0.4% premium).

Premiums not worth paying

The 24 trusts currently on a premium include many income strategies, but investors often overpay for income, according to McDermott, who noted “there are plenty of high-yielding trusts available at a discount”.

“That said, it’s easy to see why income investors gravitate toward trusts with a long history of dividend consistency,” he added.

The City of London Investment Trust (which trades at 1.3% premium to NAV) is a prime example of that, he said, having increased its dividend every year since 1966 and consistently outperformed the FTSE All Share and its sector over one, three, five and 10 years while charging just 0.37%.

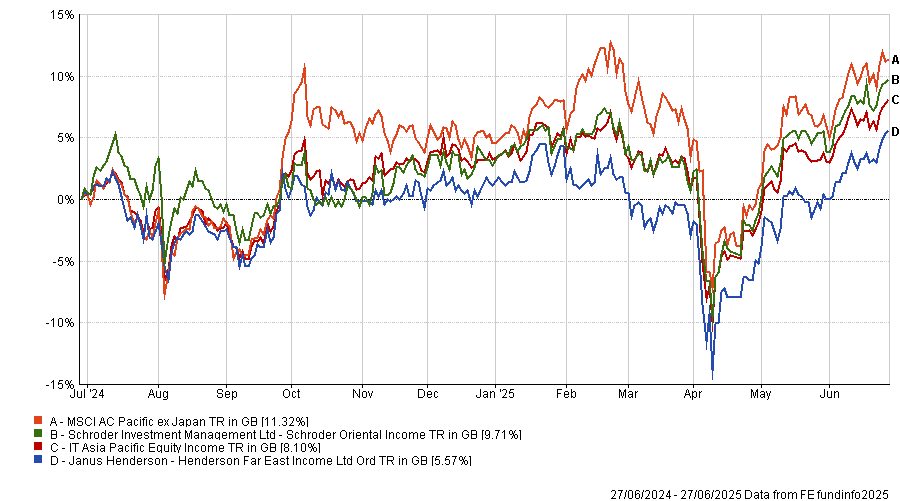

Lockyer also mentioned Henderson Far East Income, which people love because of the high yield (currently 11%), “but the total return has been lower than other Asian income investment trusts that pay a lower, more sensible yield”, such as Schroder Oriental Income, he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“You must think on a total return basis, whether you're an income manager or growth manager,” he said. “You can't sacrifice the capital at the expense of pushing for yield.”

Harrison, who uses the Henderson fund, disagreed and argued it is “very useful for people who need instant high income thanks to the sustained double-digit yield”.

However, he recognised that dividend growth is going to be “negligible” and suggested people might want to pair it with another trusts with better dividend growth potential, such as JPMorgan Claverhouse, Murray International or Law Debenture.

Artemis’ William Tamworth teaches some investment lessons from ‘Hollywood accounting’.

What do the following films have in common: Spider-Man (2002), Men in Black (1997) and Return of the Jedi (1983)?

I’ll give you a clue. Spider-Man took in $826m at the box office against a budget of $139m. Men in Black took in $589m against a budget of $90m. And Return of the Jedi took in $483m against a budget of $33m.

Have you worked it out yet? Yes, that’s right: none of these films ever made a profit. Anyway, moving on…

Royalty payments

Hang on! What’s that you say? How can I claim that none of these films ever made a profit when in each case their box-office takings dwarfed their production costs?

Well, if you don’t believe me, let’s ask some of the people whose royalty payments were dependent on these profits. In 2002, Spider-Man creator Stan Lee sued Marvel after the company claimed it received no profits from the film as defined by the terms in his contract.

In 2019, Men in Black screenwriter Ed Solomon referred to the film’s profit statement as “the greatest work of science fiction I have ever been involved with” after it claimed it was still in the red, 22 years after it was released.

And in 2009, the actor David Prowse – Darth Vader himself – told Equity magazine: “I get these occasional letters from Lucasfilm saying ‘we regret to inform you that as Return of the Jedi has never gone into profit, we've got nothing to send you’.”

So what is going on?

Welcome to the world of ‘Hollywood accounting’, where the lawyers and bookkeepers at the major studios and production companies use every trick at their disposal to avoid paying out royalties to the people involved in making their films.

But rather than go into detail about how profits can be understated to confuse actors, writers and directors, we’d rather talk about how profits can be overstated to confuse investors. Because we see it all the time.

Profits are not a statement of fact

Profits are often considered to be a statement of fact rather than a matter of opinion. This is not the case. When something is quantified, people tend to give it more credence. Compare the statements “it was 27oC” to “it was a warm day”. Most people are inclined to give greater weight to the former than the latter (clearly an opinion). Although profits are presented as a specific number, in reality they are a culmination of many opinions.

For example, if a customer has yet to pay for a service it has received, the company that provided this service is allowed to recognise the debt in its profits by reflecting the difference in working capital. When times are tough, customers may be encouraged to ‘buy now, pay later’ (which does not affect profits) rather than demand a discount (which does). Again, the difference is reflected in working capital.

Alternatively, imagine you’re a technology company employing developers to work on a new software release. As they are employees of the company, you would expect their salaries to be a ‘cost’ that hits profits. However, companies have the option to ‘capitalise’ some of these costs – put them onto the balance sheet. Then, when the software is released, they can amortise (gradually write off) the cost of these salaries against sales of the product over its lifetime, thereby deferring the hit to profits.

This can make a substantial difference to adjusted earnings and therefore P/E ratios. For advocates of EBITDA (which we are not) it’s even better – these costs never hit this metric.

Another issue is the use of ‘adjusting items’, which allow companies to ignore ‘non-recurring’ costs when reporting profits. The problem here lies with the definition of ‘non-recurring’ and often sees the day-to-day costs of running a business treated as one-offs and removed from the profit-and-loss statement. A large redundancy may be a legitimate one-off, but what if redundancies happen every year?

A focus on cashflows

So, what can investors do to protect themselves? One method of identifying the sort of practices mentioned above is to focus on cashflows – the amount of money coming in and going out of a business.

While not an exact comparison, think of the Hollywood films mentioned at the start of the article and how the difference between box-office takings and production costs didn’t translate into profits – when a company’s cashflow statement looks substantially different from its reported earnings, that immediately makes us suspicious.

Not foolproof

This technique doesn’t always work. Often there’s a credible explanation for why the numbers are different (and it’s worth noting that all the practices mentioned above are completely legitimate). In the past, focusing too heavily on cashflows has caused us to sell out of some companies we should have kept hold of and to miss other opportunities entirely.

And while it can help us steer clear of frauds, it isn’t foolproof: we didn’t pick up on what was going on at Patisserie Valerie, for example, as its profits and cashflows looked immaculate. In that case we were plain lucky – the shares looked too expensive for us, so we never invested.